Bitcoin is at present consolidating between $115,000 and its all-time excessive of $123,000, forming a decent vary that has saved each bulls and bears on edge. Regardless of the latest surge, value motion has slowed, and whereas bulls are holding robust above key ranges, market contributors are rising cautious in regards to the potential for a correction.

Associated Studying

Including to the uncertainty is the resurfacing of a Satoshi-era whale. Prime analyst Darkfost has been monitoring this long-dormant pockets, which not too long ago transferred 80,000 BTC to Galaxy Digital, a significant participant in digital property and AI infrastructure. The transfer instantly triggered hypothesis throughout the crypto house, as such massive transfers are sometimes related to upcoming gross sales.

The timing of this switch is essential. It coincides with elevated change inflows and rising discussions of institutional profit-taking. With the market already in a fragile place, the likelihood {that a} portion of this large BTC stack might be bought has analysts and traders bracing for elevated volatility.

Whale Begins Promoting: 1,500 BTC Despatched To Binance

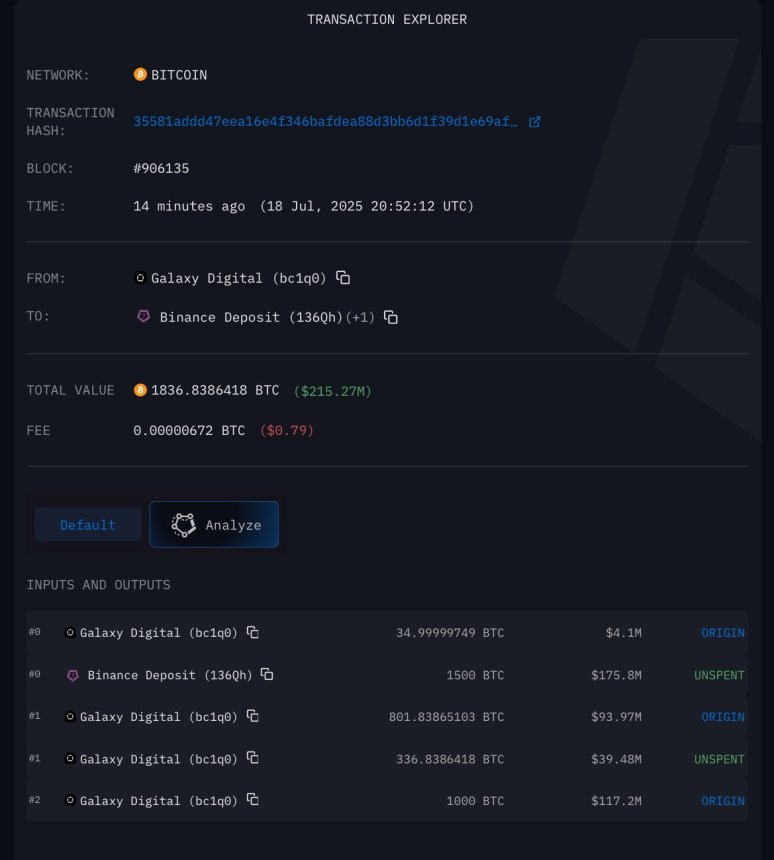

Darkfost has confirmed that Galaxy Digital has simply moved 1,500 BTC to a Binance deposit tackle. These cash have been beforehand a part of the huge 80,000 BTC linked to a Satoshi-era whale who not too long ago reactivated their pockets. The most recent switch suggests {that a} portion of this historic stash is formally up on the market.

At present costs, the 1,500 BTC represents round $180 million in market worth. Extra importantly, it marks one of many quickest and most vital offloads ever recorded from a single pockets, with the overall 80K BTC valued at roughly $9.54 billion. Whereas they’ve solely moved a small fraction to exchanges to date, the sale may sign bigger intentions.

Some view this switch as a possible warning signal, particularly given the present consolidation above $115K. Of their view, such high-volume exercise from a long-term holder may precede additional profit-taking or perhaps a broader correction. Others, nevertheless, see it as a sensible and well-timed transfer from an investor who has held since Bitcoin’s earliest days and is lastly realizing some good points.

Associated Studying

BTC Worth Holds Tight Vary After ATH

Bitcoin is at present buying and selling at $118,000, consolidating inside a decent vary between $115,730 and $123,230, as proven within the 12-hour chart. This comes after a powerful breakout earlier this month that pushed BTC to a brand new all-time excessive of $123,230. Since then, value motion has proven indicators of cooling and not using a main pullback, suggesting bulls stay in management, however short-term momentum is slowing.

The chart shows a wholesome construction, with BTC buying and selling effectively above its 50-day, 100-day, and 200-day easy shifting averages, that are at present at $111,819, $108,563, and $102,963. This confirms robust development assist from long-term holders and momentum traders.

Associated Studying

Quantity has elevated through the transfer greater, indicating conviction behind the breakout, however the previous few candles present decrease follow-through quantity, in line with a consolidation section. If BTC holds above $115,730, the construction stays bullish and will result in one other breakout towards $130,000 and past. A break under this stage, nevertheless, may open the door for a deeper retracement, with the $112K–$111K zone performing as key shifting common assist.

Featured picture from Dall-E, chart from TradingView