Bitcoin’s current incapacity to flee a decent buying and selling vary could have much less to do with spot Bitcoin ETF flows than many headlines recommend, and extra to do with the derivatives advanced nonetheless doing a lot of the heavy lifting, whilst futures exercise cools.

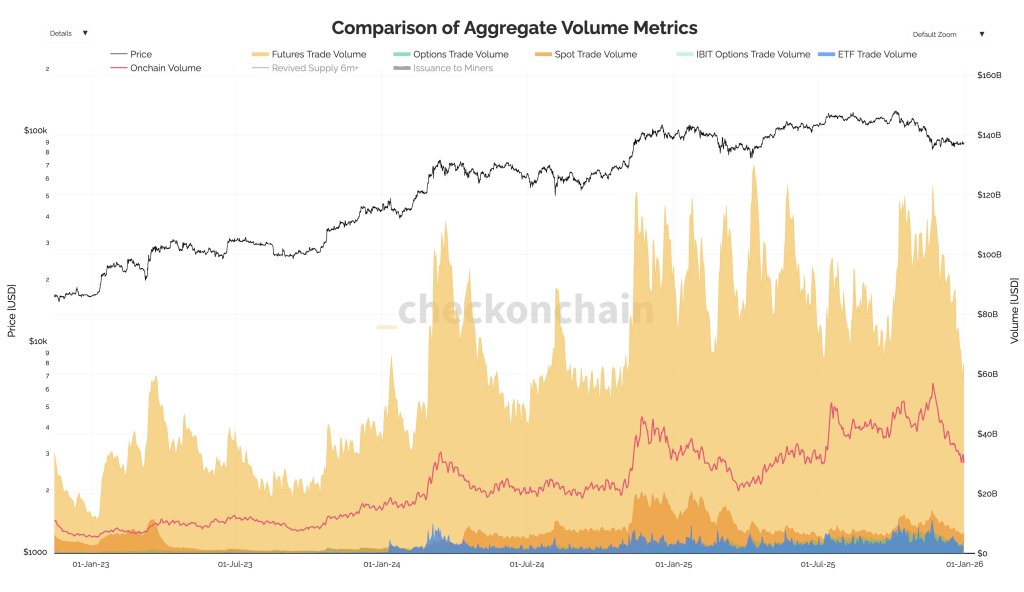

That’s the core argument from CryptoQuant analyst Darkfost (@Darkfost_Coc), who stated Bitcoin futures volumes have been “minimize in half since November 22,” dropping from $123 billion in every day quantity to $63 billion.

Futures, Not ETFs, Are Holding Bitcoin In Place

The slowdown, he added, “partly explains the low volatility noticed on BTC in current weeks.” However the larger level is relative scale: at $63 billion per day, futures nonetheless symbolize “almost 20 occasions the quantity of spot Bitcoin ETFs ($3.4B) and about 10 occasions spot market volumes ($6B),” based on the analyst.

In different phrases, even when ETF outflows are actual and visual, they will not be the dominant marginal power setting the tone. “Many proceed to level to ETFs, which have skilled important outflows in current weeks,” Darkfost wrote. “Whereas these outflows do contribute to promoting stress, futures markets clearly stay the dominant power in total volumes.”

Associated Studying

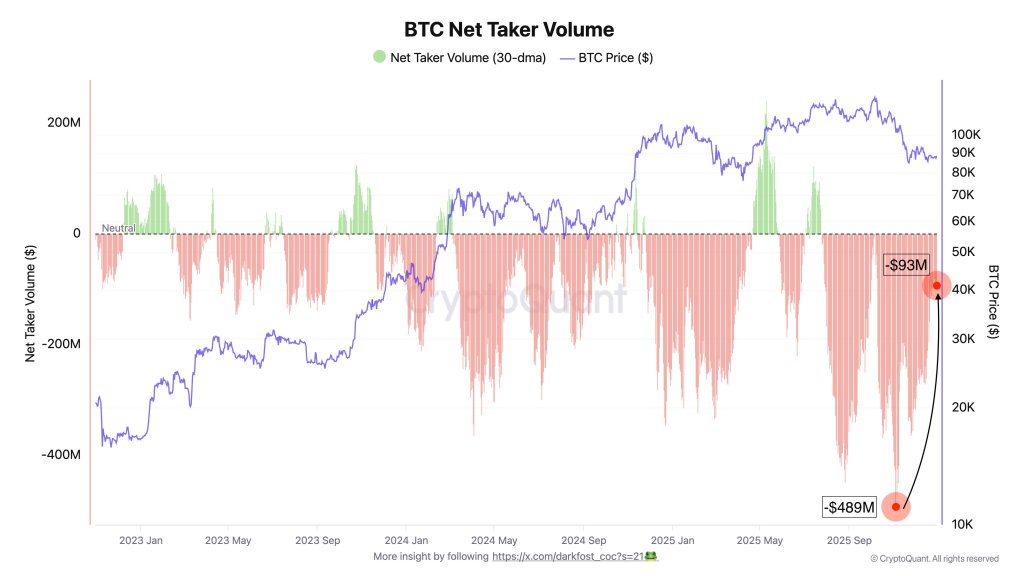

Darkfost pointed to internet taker quantity, a derivatives metric used to deduce whether or not aggressive shopping for or promoting is dominating, as a cleaner learn on why value has struggled to development. He framed it in conditional phrases based mostly on prior market habits: “Every time internet taker quantity has turned destructive, Bitcoin has entered a corrective part. When this indicator strikes into destructive territory, promoting quantity dominates.”

In his telling, the market has been residing with that bias for months. Since July, internet taker quantity has “usually remained destructive,” he stated, with one notable interruption: “A noticeable slowdown occurred in early October, permitting Bitcoin to set a brand new all time excessive, however promoting stress rapidly regained management. At this time, promoting volumes proceed to dominate and have saved Bitcoin trapped in a spread for a couple of month.”

There may be, nevertheless, a tentative enchancment in the identical dataset. Darkfost stated futures-driven promoting stress has declined since early November, with internet taker quantity bettering from round -$489 million to -$93 million. He described that as “a optimistic sign,” however not but sufficient to alter the regime. “Liquidity stays weak,” he wrote, including that ETF and spot volumes are “nonetheless too restricted to permit BTC to interrupt out of its present consolidation part.”

Demand Is Key

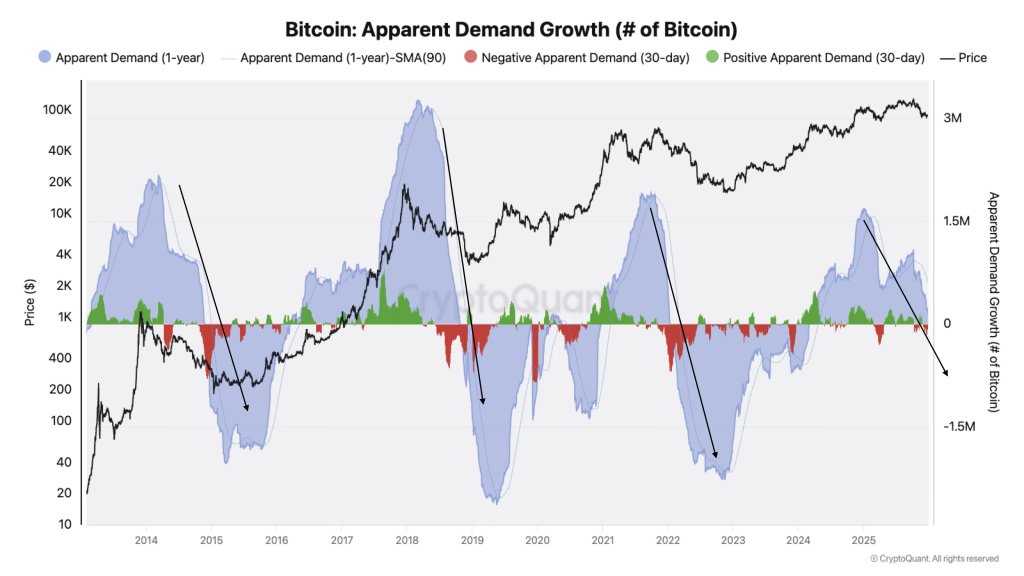

In a separate X submit, CryptoQuant’s Head of Analysis Julio Moreno added a broader framing that shifts consideration away from chart-based cycle narratives and towards demand dynamics. “Most are specializing in value efficiency to outline a cycle, when it’s demand what they need to be trying to,” Moreno wrote. “Bitcoin demand is contracting on month-to-month phrases and slowing down considerably on an annual foundation (and about to get into destructive territory).”

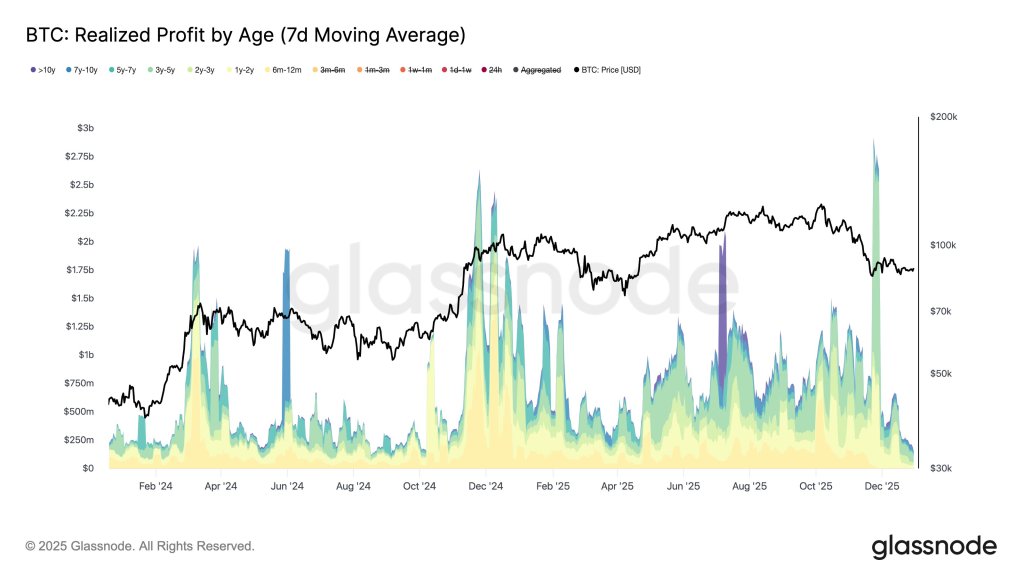

Alongside the futures-driven rationalization for Bitcoin’s stall, the promoting stress from long-term holders (LTHs) emerged in current weeks as the principle driver for Bitcoin lagging efficiency in opposition to the inventory market and gold. As reported yesterday, the long-term holder promoting appeared to have stopped, based on a number of on-chain commentators, with round 10,700 BTC transitioning into long run held cash.

Associated Studying

In his newest submit, main Glassnode analyst CryptoVizArt argued the change is extra about tempo than path. “LTHs didn’t cease promoting,” the analyst wrote, claiming LTHs “are nonetheless spending ~7.3k BTC/day (7D SMA) and nonetheless realizing <$200M/day in revenue. What modified is the speed, not the habits. This can be a cooldown after months of heavy distribution, not a flip to pure accumulation.”

Darkfost didn’t dispute that LTHs might be persistent sellers, however he emphasised a special lens. “LTHs by no means actually cease promoting in actuality, however once we have a look at provide change, it provides a special image,” he wrote. “It seems that their distribution has come to an finish for now, that means the quantity of BTC maturing and transitioning into LTH standing equals the BTC being offered by LTHs (STH shopping for).”

At press time, BTC traded at $87,972.

Featured picture created with DALL.E, chart from TradingView.com