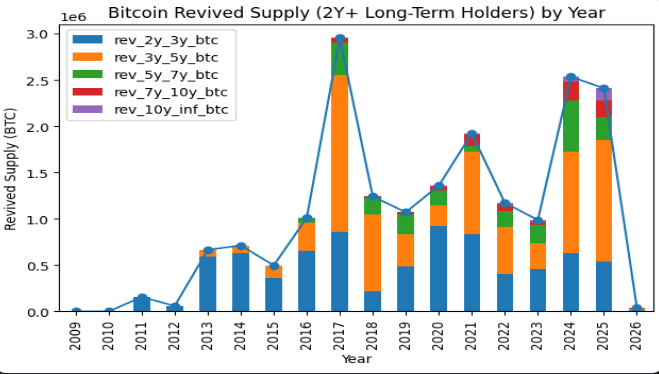

Based on on-chain trackers, an enormous wave of outdated Bitcoin has began transferring after lengthy dormancy. Cash that sat untouched for greater than two years have been transferred in numbers bigger than what was seen throughout previous peaks in 2017 and 2021.

Associated Studying

CryptoQuant analyst Kripto Mevsimi stated on-chain information exhibits that 2024 and 2025 marked the largest launch of long-held Bitcoin provide ever recorded. He tracks “revived provide,” or cash that stayed dormant for greater than two years earlier than being moved.

That form of motion often means deep-pocketed holders are altering their plans, not small merchants chasing a fast acquire.

A Shift With out A Occasion

Experiences say this launch of long-held provide arrived with little fanfare. There was no mass retail mania. Costs didn’t spike in a frenzy. As an alternative, the transfers got here throughout a stretch when the market has been beneath regular strain from broader monetary stress.

A few of these older cash had been possible offered for revenue. Some could have been moved for different causes — custody upgrades, non-public trades, or to again monetary merchandise. On-chain alerts present the cash moved, however they don’t write the explanations on the blockchain.

Lengthy-Time period Holders Change Course

Primarily based on stories from analysts monitoring these flows, the sample suggests a altering of the guard. Early adopters who held by means of a number of cycles and pointed to shortage and self-control have been trimming positions.

New consumers are showing who watch value swings and macro headlines. Establishments, recent giant accounts, and price-driven merchants at the moment are shaping a lot of the market’s short-term exercise.

International Threat Pressures Threat Property

Experiences have linked latest weak spot in Bitcoin to rising international threat. Analysis ties a part of the pullback to tariff strikes by US President Donald Trump, which have pushed buyers away from dangerous belongings.

Tariffs can dent company income, fire up inflation uncertainty, and alter how the market views future charges — all of which hits sentiment. When huge markets wobble, crypto typically follows. That strain helps clarify why long-held cash moved with out the same old hype.

New Consumers Step Ahead

In accordance To on-chain and value information, establishments and new “whales” are getting into the gaps left by sellers. Bitcoin has been buying and selling close to the excessive $80k vary, with latest figures round $89,140 as markets take a look at demand. The outdated holders could have taken positive aspects, however the market didn’t collapse. That exhibits there may be nonetheless urge for food, even whether it is totally different from the previous.

Associated Studying

This cycle feels totally different as a result of promoting got here with out euphoria, and shopping for appears to be like extra tactical. That doesn’t imply the story is over. The market could be shifting towards price-sensitive individuals and out of doors monetary forces.

Or the latest calm may very well be a pause earlier than recent shopping for. Both manner, these on-chain strikes matter. They modify the place the cash sit, and that adjustments how future value swings could play out.

Featured picture from Unsplash, chart from TradingView