Ethereum is buying and selling at a pivotal stage after a robust bullish rally pushed its value above the $3,650 mark. This surge has positioned ETH as one of many strongest performers within the present crypto market cycle, igniting optimism amongst buyers and analysts alike. With bulls in management, many are pointing to rising momentum throughout altcoins as an indication that the long-anticipated altseason might lastly be underway.

Associated Studying

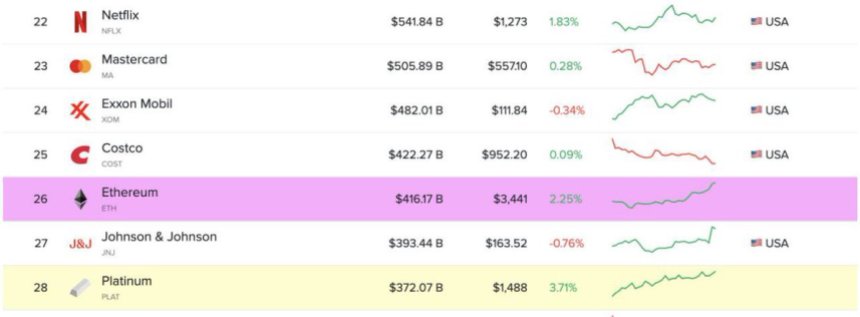

Including to this narrative, Ethereum has now entered the record of the highest 30 international property by market capitalization, reaching a $416.17 billion market cap. This achievement displays not solely value appreciation but additionally a rising wave of worldwide recognition and adoption. Institutional demand is climbing, spot ETF inflows are surging, and technical indicators stay firmly in bullish territory.

As Bitcoin consolidates after reaching new all-time highs, Ethereum’s relative energy is drawing consideration. The approaching days can be key in confirming whether or not ETH can maintain this momentum and push towards new highs, or if it would face resistance at this psychological stage. For now, market sentiment stays optimistic, and Ethereum’s positioning among the many world’s prime property hints at a maturing digital economic system with ETH at its heart.

International Adoption Will increase For Ethereum

Ethereum has formally develop into the twenty sixth most useful asset globally by market capitalization, in response to knowledge shared by prime analyst Ted Pillows. With a market cap of over $416 billion, Ethereum now sits among the many world’s monetary giants—a formidable milestone that underscores the asset’s rising legitimacy and investor curiosity. Pillows added that this positioning might mark the start of Ethereum FOMO, as each retail and institutional buyers react to rising momentum and market construction.

This surge in valuation comes on the heels of a serious legislative breakthrough. The US Home of Representatives handed three essential crypto payments yesterday, together with the GENIUS Act and the Readability Act. These legal guidelines intention to convey much-needed regulatory transparency to the crypto sector, additional reinforcing investor confidence. The passage of those payments is considered as a turning level in US crypto coverage, setting the stage for broader institutional adoption and innovation.

In the meantime, establishments are ramping up ETH accumulation. On-chain knowledge reveals regular inflows into Ethereum spot ETFs, whereas a noticeable premium on Coinbase suggests robust demand from US-based whales. Mixed with a bullish value construction and bettering macro circumstances, Ethereum seems to be getting into an expansive section, not solely in value but additionally in community utilization and adoption.

Associated Studying

ETH Surges To New Highs After Breaking Main Resistance

Ethereum has continued its bullish advance, now buying and selling at $3,619 following a clear breakout above the important thing resistance stage at $2,852. The chart reveals a transparent shift in momentum, with ETH surging greater than 25% over the previous week, backed by robust quantity and bullish construction. This marks the best value since early 2024, and it comes as Ethereum decisively clears all main transferring averages on the 3-day chart—the 50, 100, and 200 SMAs.

The 200-day SMA at $2,815 had acted as a long-standing ceiling through the previous yr of consolidation and correction. Now that value has reclaimed it with energy, the earlier resistance might flip into robust assist within the close to time period. The latest value motion additionally resembles the breakout sample seen earlier than ETH’s final main rally towards all-time highs.

Associated Studying

Quantity has considerably elevated, additional validating the breakout and suggesting that institutional participation could also be rising once more, particularly as spot Ethereum ETFs proceed seeing document inflows. If ETH holds above the $3,400–$3,500 area over the approaching days, a continuation towards the $4,000 psychological stage might be subsequent.

Featured picture from Dall-E, chart from TradingView