Hello. I’m Andy Baehr with the CoinDesk Indices crew.

Query: Bitcoin is caught in a variety. Is {that a} unhealthy factor or a superb factor?

Even informal BTC watchers could have famous the ten p.c channel that has held for greater than a month. As of at present, in truth, it has been 40 days since we entered the ~$101K – ~$111K vary, with no catalyst forcing a breakout via both boundary. Good or unhealthy factor?

The macro muddle helps range-trading. Our anchor bitcoin macro issue stays expectations for future actual curiosity rates–nominal charges minus inflation. Latest cross-currents create an unclear image: inflation expectations from surveys have been elevated (although latest releases appear much less regarding), whereas hopes for Fed aid had been dim till the market started pricing in two 2025 cuts extra assertively. Too muddled for a breakout. Bitcoin is doing what it ought to.

For the store-of-value thesis, range-trading is definitely high-quality. As bitcoin accumulates extra days of “not sudden” habits, it helps the narrative of relative independence from different threat belongings and improved stability. (The S&P 500 has additionally stored an 8% vary via the identical 39 days, so bitcoin isn't alone on this holding sample, though latest information flows might need knocked a youthful bitcoin off the observe.)

However merchants are getting stressed. Bitcoin's basement-level thirty-day realized volatility under 30% crimps alternative. Implied vols are additionally down as possibility patrons develop fatigued and sellers seize yield extra confidently. Like all market, a variety that holds too lengthy creates complacency—making the eventual exit extra “thrilling” than it might in any other case be.

The stalled temper is hurting breadth. With out bitcoin offering management, different digital belongings are wilting. The CoinDesk 20 Index has trailed bitcoin by about 5% over the previous month, as the shortage of sentiment has stalled the late-April rally, even in ETH, which had bounced strongly.

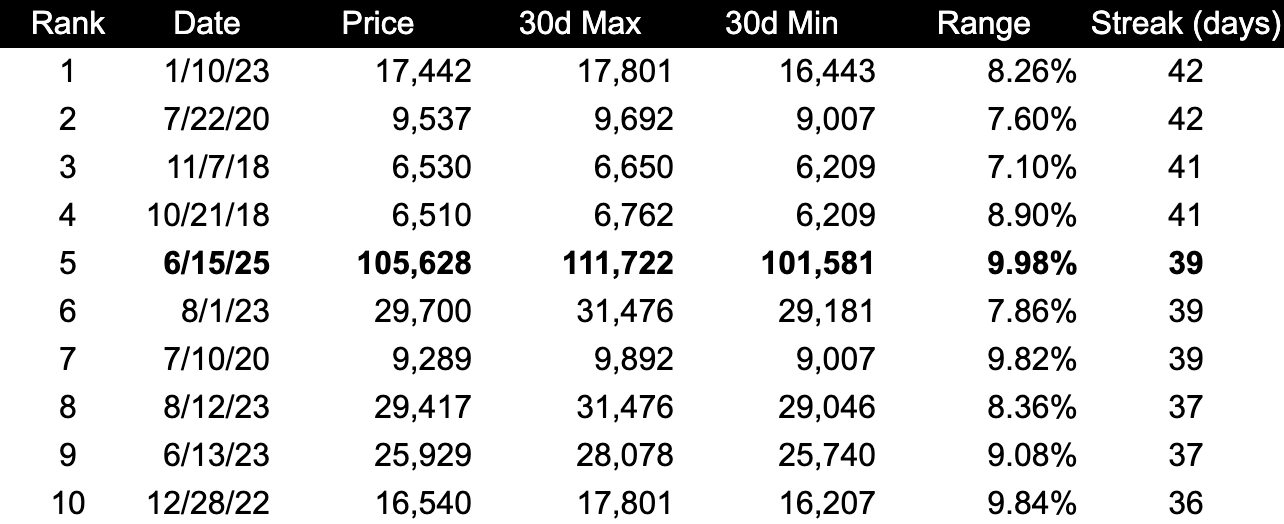

How does this examine traditionally? With some really unattractive vibe coding (I take the blame), we studied bitcoin's longest streaks of holding 10% ranges. The present 40-day stretch isn't the longest—that was 42 days—nevertheless it's shut. Related streaks occurred in 2018, 2020, and 2023. Given bitcoin's developed possession construction (ETFs, MSTR) and extra accessible spot and derivatives markets, would a 50-day streak shock anybody? Unsure.