- $BTC close to $66K and $ETH close to $1.9k spotlight a fragile tape the place volatility dictates positioning.

- ‘It’ll worsen’ warnings resonate as a result of liquidity stress amplifies dangers like wider spreads and better cross-chain prices.

- Bitcoin DeFi competitors is heating up, inserting a premium on platforms that appeal to actual liquidity somewhat than simply headlines.

- LiquidChain’s unified liquidity narrative aligns with a risk-off market that’s actively punishing complexity.

Crypto’s newest downdraft feels much less like a short lived shakeout and extra like a regime change. Bitcoin is buying and selling round $66K and Ethereum is hovering close to $1.9K, with each belongings posting sharp 24-hour swings. Volatility is again within the driver’s seat.

That backdrop is exactly why Cardano founder Charles Hoskinson’s warning that the hunch might ‘worsen’ is hitting dwelling. Talking throughout a livestream from Tokyo he famous that additional issues might lie forward, and that’s on high of the present circumstances.

In a market the place liquidity thins out, narratives don’t prevent; execution does. The second-order results are the place the harm compounds: as soon as spot costs flip uneven, leverage resets, spreads widen, and cross-chain capital turns into extremely choosy about the place it sits. A ‘risk-off’ tape doesn’t simply hit costs; it stresses the plumbing.

Some might see this as a 2026 ‘crypto winter,’ citing steep drawdowns from 2025 highs and fading threat urge for food. However the actual structural weak point is fragmented liquidity throughout Bitcoin, Ethereum, and Solana. When customers are pressured into multi-step bridging and wrapped-asset dependency simply to place capital to work, the system cracks.

Right here, the ‘fluidity’ angle turns into vital. When markets bleed pink, the winners are typically programs that cut back friction, collapse steps, and make liquidity composable, particularly for builders who can’t afford operational complications.

Fragmented Liquidity Is the Bear Market Tax: $LIQUID is Right here to Pay

In bull markets, fragmented liquidity is annoying. In bear markets, it’s costly.

Liquidity fractures throughout ecosystems as a result of execution environments don’t naturally discuss to one another. The trade has traditionally papered over this with wrapped belongings and bridges. The chance is clear: bridge belief assumptions and wrapped collateral buildings change into the weakest hyperlink proper when stress is highest. Sound acquainted? Spreads hole out, redemptions get crowded, and that ‘one additional hop’ immediately turns into a significant legal responsibility.

The following leg of crypto adoption, significantly institutional, received’t be powered by one more remoted app chain. It’ll be powered by liquidity that strikes cleanly. Frankly, the market is asking a blunt query: why ought to capital settle for additional steps and further threat simply to entry primary DeFi primitives? That’s the opening LiquidChain is making an attempt to use.

LEARN WHAT LIQUIDCHAIN IS BUILDING

LiquidChain ($LIQUID) Pitches Single-Step Cross-Chain Execution

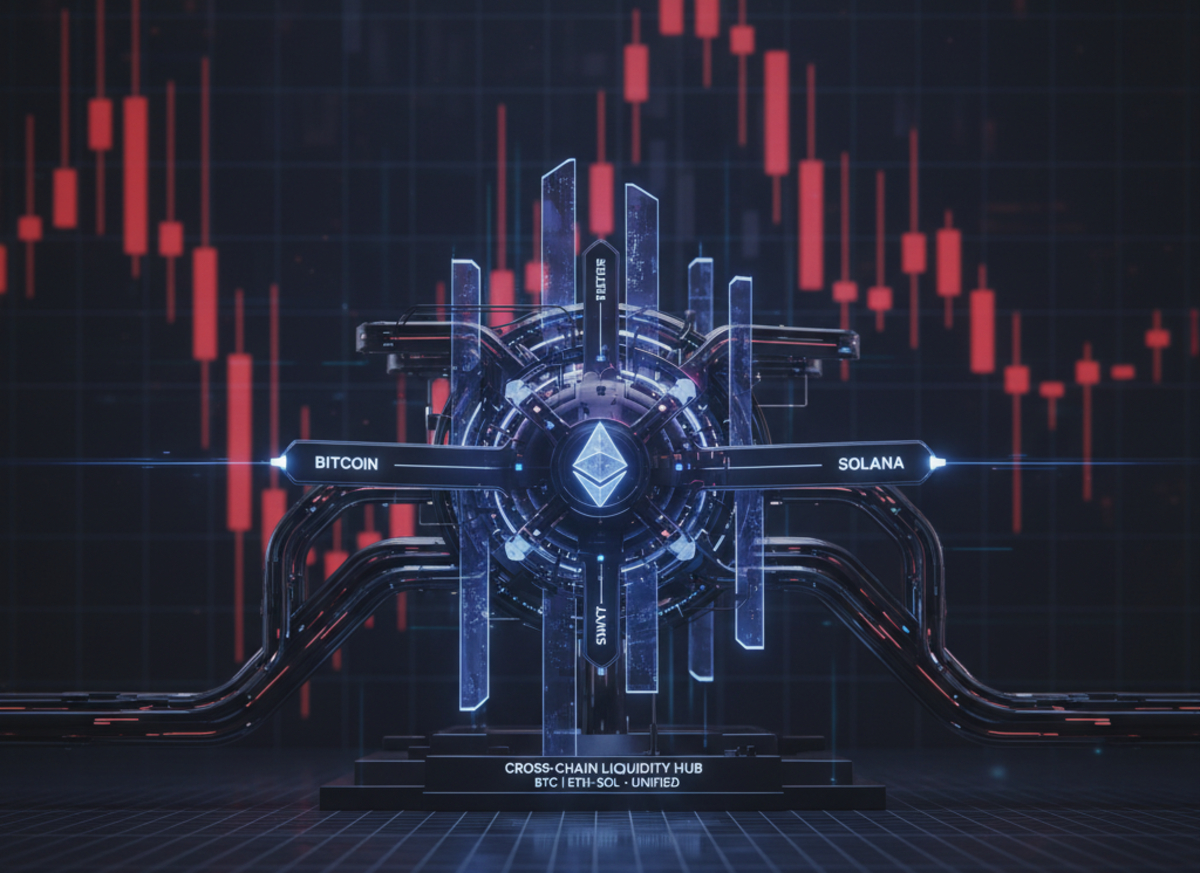

LiquidChain positions itself as ‘The Cross-Chain Liquidity Layer’, an L3 infrastructure protocol designed to fuse Bitcoin, Ethereum, and Solana liquidity right into a single execution surroundings. The core pitch is simple: fragmented liquidity and complicated consumer flows aren’t options; they’re failure factors.

Its function set addresses that thesis instantly:

- Unified Liquidity Layer to merge $BTC, $ETH, and $SOL ecosystems

- Single-Step Execution to chop down multi-transaction consumer journeys

- Verifiable Settlement to strengthen belief assumptions versus ad-hoc routing

- Deploy-As soon as Structure, letting builders entry liquidity throughout networks from one deployment

LiquidChain targets the unglamorous however vital plumbing of crypto: the transaction choreography that customers usually don’t see, till it breaks. For builders, the ‘deploy as soon as’ narrative issues as a result of it’s successfully a wager on effectivity: ship to at least one surroundings, faucet a number of swimming pools of capital, and keep away from rebuilding the identical app stack thrice.

Merchants watching this setup know that cross-chain layers stay or die by safety design and adoption. With out clear traction from builders and sustained liquidity depth, even good structure stays theoretical.

BUY $LIQUIDCHAIN ON ITS OFFICIAL PRESALE PAGE

LiquidChain Presale Costs Within the Danger-Off Actuality

Bearish sentiment doesn’t essentially kill early-stage demand; it filters it. When ‘number-go-up’ euphoria vanishes, the market begins pricing protocols on whether or not they cut back threat, steps, and failure modes.

On that entrance, LiquidChain’s presale metrics sign early curiosity: it has raised over $529K, with tokens at present priced at $0.01355. These figures matter for monitoring momentum, as they replicate stay demand on the level of sale.

Proper now, the market backdrop is punishing complexity. With $BTC and $ETH swinging arduous, mainstream protection is brazenly discussing deeper drawdowns.

The chance is clear. If the macro tape stays hostile, ETF outflows persist, and regulation headlines tighten, presales broadly can sluggish as consumers hoard dry powder. But, if historical past serves, infrastructure that improves mobility tends to re-rate rapidly as soon as stability returns, just because it turns into the route capital takes again into DeFi.

This text just isn’t monetary recommendation; crypto is risky, presales are dangerous, and cross-chain programs carry smart-contract and bridge-related dangers.