Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin is navigating a extremely unstable surroundings, as escalating Center East conflicts and intensifying macroeconomic dangers dominate international headlines. Regardless of mounting uncertainty, BTC continues to carry agency above the $104K degree, signaling sturdy purchaser curiosity at key help zones. Bulls stay in management for now, however hawkish macro circumstances—similar to elevated US Treasury yields, persistent inflation issues, and geopolitical turmoil—pose critical dangers that would drive BTC beneath the vital $100K mark.

Associated Studying

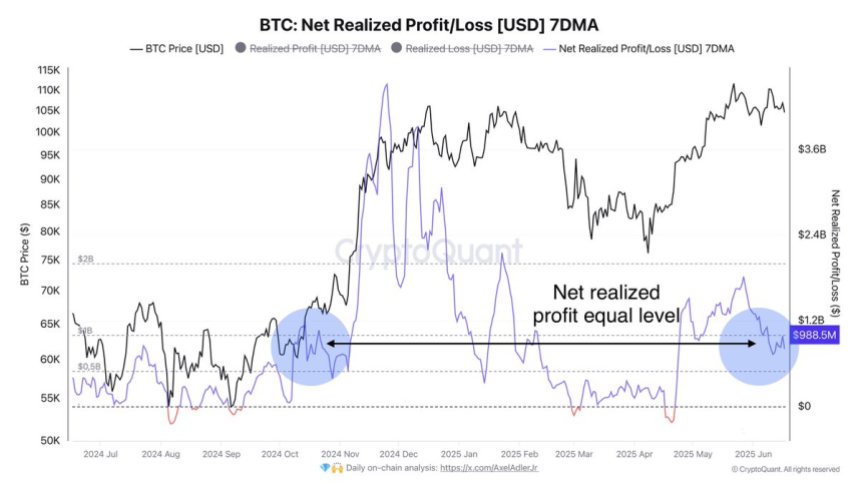

The market is split on what comes subsequent. Some analysts level to sturdy fundamentals and institutional adoption as gasoline for a large bull run, whereas others warn of a deeper correction earlier than any upward continuation. Prime analyst Darkfost emphasised the significance of monitoring on-chain habits throughout such durations of uncertainty. In accordance with CryptoQuant information, realized income on Bitcoin (7-day shifting common) present no main warning indicators. Present profit-taking exercise stays beneath $1 billion—just like ranges seen following the October 2024 correction—indicating that traders are neither panicking nor overly euphoric.

This muted revenue realization may very well be an indication that long-term holders are nonetheless assured within the broader development, setting the stage for an eventual breakout as soon as macro circumstances stabilize.

On-Chain Metrics Sign Calm Bitcoin Consolidates

Because the battle between Israel and Iran escalates, fears of a broader battle—and the potential for US intervention—proceed to weigh closely on international markets. Traders stay on edge, with rising oil costs and weakening financial confidence feeding into macro uncertainty. But, Bitcoin appears largely unfazed. Regardless of the heightened geopolitical rigidity, BTC continues to consolidate slightly below its all-time excessive, displaying resilience that has each bulls and bears second-guessing their subsequent transfer.

Basically, Bitcoin stays sturdy. Institutional adoption is steadily rising, and change provide continues to say no, reflecting a development towards long-term holding and off-exchange accumulation. In some ways, BTC seems to thrive on this surroundings of volatility and uncertainty.

In accordance with on-chain information shared by Darkfost, realized income on Bitcoin—measured by the 7-day shifting common (7DMA)—present no main warning indicators. Present revenue ranges stay below $1 billion, a spread not seen because the finish of the October 2024 correction. Even through the latest ATH surge, realized income stayed properly beneath the January 2025 peak. This lack of aggressive profit-taking suggests that the majority traders are nonetheless holding sturdy, neither panicking nor dashing to promote.

That restrained habits is enjoying a key function in Bitcoin’s ongoing consolidation. With out a wave of revenue realization, there’s little stress to pressure the market down—but no catalyst sturdy sufficient to push it decisively greater both. Monitoring these on-chain indicators will likely be vital within the coming days. If realized income spike or change inflows surge, it could mark the start of a brand new section.

Associated Studying

BTC Technical Evaluation: Key Help Being Examined

The 12-hour chart of Bitcoin (BTC/USD) reveals the asset at the moment buying and selling at $104,292, simply above a vital help degree at $103,600. This space, which corresponds to the earlier all-time excessive set in late 2024, has turn into a key battleground for bulls and bears. BTC has repeatedly bounced from this degree in latest weeks, and its capacity to carry may decide the route of the subsequent main transfer.

BTC failed to interrupt by the $109,300 resistance, forming a collection of decrease highs since tapping the $112,000 degree. This implies a weakening bullish momentum and highlights the significance of present value motion across the 50-period SMA, which is now appearing as short-term dynamic resistance.

Quantity has remained comparatively secure however confirmed slight upticks throughout latest pullbacks, hinting at cautious promoting moderately than full-blown capitulation. The 100-period and 200-period SMAs, at the moment sitting at $104,065 and $94,617, respectively, provide extra help beneath the present vary, with the 100-SMA now straight aligned with the horizontal $103,600 degree.

Associated Studying

If BTC breaks and closes beneath this demand zone with quantity affirmation, it may set off a transfer towards the $100K psychological help. Conversely, a robust bounce from right here would reinforce the continued consolidation and hold the trail open for one more take a look at of $109,300.

Featured picture from Dall-E, chart from TradingView