Bitcoin is now buying and selling greater than 9% under its $124,500 all-time excessive, reflecting the load of latest promoting stress. Regardless of the pullback, bears have struggled to push the value under the $105,000 assist zone, a degree that has thus far acted as a agency flooring for the market. The controversy amongst analysts is intensifying—some are calling for a deeper correction that might reset overheated sentiment, whereas others see present worth motion as a prelude to a different take a look at of all-time highs.

Associated Studying

Prime analyst Maartunn shared recent insights, describing the present setting as a “main Bitcoin reshuffle.” Based on him, outdated cash are more and more flowing into ETF wallets, a phenomenon marked by three vital waves: summer season 2024, fall 2024, and summer season 2025. In contrast to previous cycles, the place such redistribution occasions usually occurred as soon as earlier than fading, this cycle has proven a repeated sample of provide rotation.

This uncommon development highlights a structural shift in Bitcoin’s market dynamics. Lengthy-term holders look like lowering publicity, whereas ETFs and institutional automobiles proceed to soak up provide. Whether or not this redistribution stabilizes the market or fuels additional volatility can be a defining issue for Bitcoin’s trajectory within the coming months.

Outdated Bitcoin Provide Unlocks: Market Dynamics In Focus

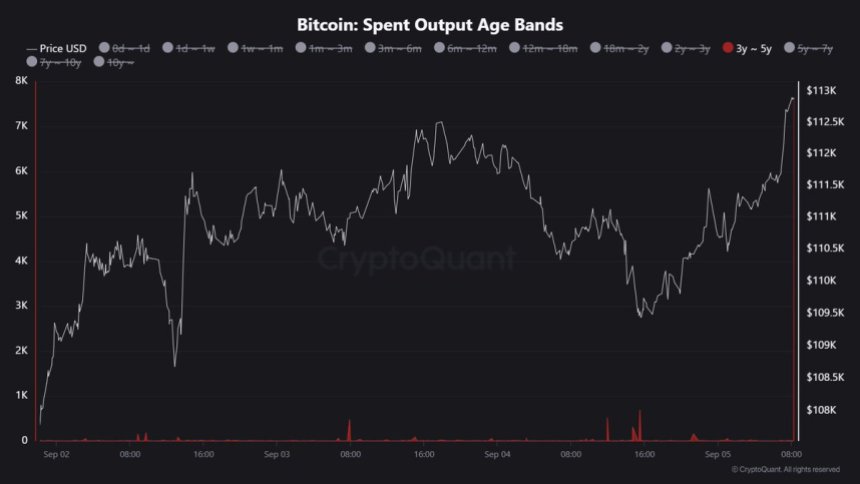

Based on Maartunn, a big motion of seven,626 BTC aged between three to 5 years has just lately taken place. The sort of exercise is notable as a result of it indicators long-term holders deciding to launch dormant cash again into circulation. Traditionally, such occasions typically coincide with heightened market uncertainty and shifts in investor conduct, reinforcing the narrative that outdated provide continues to play a decisive function in shaping Bitcoin’s trajectory.

Regardless of this promoting stress, Bitcoin has managed to carry above the $110,000 degree, exhibiting resilience within the face of profit-taking from long-term holders. This stability is encouraging, because it demonstrates that patrons are stepping in to soak up provide, although the power of that demand stays in query. Some market individuals are pointing to ETF inflows as the first cause Bitcoin has averted a sharper correction. ETFs, by nature, act as a constant demand sink, channeling institutional capital into Bitcoin by means of regulated frameworks.

Nevertheless, the danger stays that with out strong new demand, the promoting stress from newly unlocked cash might start to outweigh shopping for curiosity. If this occurs, latest holders could face the brunt of volatility. For now, the market seems to be balancing between long-term holders’ profit-taking and institutional accumulation.

This rising dynamic highlights how Bitcoin’s present cycle differs from earlier ones—ETF participation and repeated redistribution of outdated cash are reshaping the market construction. The approaching weeks can be essential in figuring out whether or not ETF inflows are robust sufficient to offset the elevated exercise of older provide and preserve Bitcoin on a bullish path.

Associated Studying

Testing Mid-Vary Resistance Ranges

Bitcoin is at present buying and selling at $112,409, exhibiting a modest restoration after latest volatility. The chart highlights a rebound from the $109K–$110K demand zone, which has acted as short-term assist in the course of the previous week. Nevertheless, BTC now faces resistance because it assessments the 50-day shifting common (blue line at $111,661) and the 100-day shifting common (inexperienced line at $114,382). These ranges characterize key limitations for bulls trying to reclaim greater floor.

The broader image exhibits BTC nonetheless lagging behind its all-time excessive close to $124,500, marked by the yellow resistance line. Regardless of a number of makes an attempt, Bitcoin has struggled to generate sufficient momentum to retest this degree, largely resulting from persistent promoting stress and cautious sentiment amongst merchants. The pink 200-day shifting common at $114,746 sits simply above present worth motion, making a cluster of resistance ranges that might restrict upside within the close to time period.

Associated Studying

If Bitcoin manages to shut above $114K, it could verify bullish continuation and doubtlessly set the stage for a retest of the $120K–$124K zone. Conversely, failure to maintain above $110K might see BTC revisiting decrease helps round $106K–$108K. For now, consolidation dominates, with bulls needing recent demand to push past resistance.

Featured picture from Dall-E, chart from TradingView