Are you in search of a fee processor for your corporation? In that case, it’s possible you’ll be questioning which fee processor to pick on your wants. PayPal and Stripe are some of the well-liked fee processors.

To resolve which fee processor is finest for your corporation, you will want to contemplate your particular wants and necessities. Should you want a processor that gives a variety of options, PayPal could also be a great possibility. Should you want a processor that’s straightforward to make use of and integrates with many software program platforms, Stripe could also be a greater possibility. On this article, we’ll examine PayPal and Stripe, and assist you perceive the important thing variations so that you could make one of the best choice for your corporation.

How does a Fee Processor Work?

A fee processor is an organization that gives the expertise and infrastructure wanted to just accept and course of bank card funds. When a buyer makes a purchase order utilizing a bank card, the fee processor forwards the transaction info to the buying financial institution, which then deposits the funds into the service provider’s account.

The fee processor additionally handles chargebacks and fraud prevention on behalf of the service provider. Chargebacks happen when a buyer disputes a cost with their bank card issuer. The fee processor will examine the declare and, if it finds in favor of the client, will refund the client’s cash and deduct the quantity from the service provider’s account.

Now that we’ve defined how fee processors work, let’s take a extra detailed have a look at PayPal and Stripe to see which one is finest for your corporation.

What’s PayPal?

PayPal is among the largest on-line fee processors and POS supplier on the earth. Based in 1998, PayPal permits clients to make on-line purchases utilizing their bank cards, debit playing cards, or financial institution accounts. PayPal additionally provides a cellular app that permits clients to make in-store purchases utilizing their telephones.

Along with processing funds, PayPal additionally provides different monetary providers, similar to peer-to-peer funds, enterprise loans, and credit score merchandise. PayPal has over 277 million lively customers and handles $251 billion in funds per yr.

What’s Stripe?

Stripe is a relative newcomer to the world of on-line funds, however it has rapidly develop into a preferred selection for companies of all sizes. Stripe was based in 2010 with the objective of constructing it straightforward for anybody to just accept funds on-line. Stripe now powers funds for over 100,000 companies in over 25 nations.

One of many key options that units Stripe other than its opponents is its easy-to-use software program growth package (SDK). This enables companies to combine Stripe’s fee processing capabilities into their present web sites and apps with only a few strains of code. Stripe additionally provides quite a lot of plugins for well-liked eCommerce platforms, similar to Shopify and WooCommerce.

Key Variations

1. Ease of Use:

Stripe is trickier to arrange and should be built-in together with your website. It requires technical information to setup, however supplies an in-app popup. Stripe is developer-focused, providing a sturdy set of APIs that can be utilized to combine into your web site.

Paypal has customizable gateways which is a simple option to arrange and combine into web sites and apps.

- Charges:

Stripe provides an easier and low cost price construction when in comparison with Paypal.

Stripe expenses 2.9% + 30c flat charges for transactions. Their could possibly be some extra Fee Methodology or foreign money conversion charges.

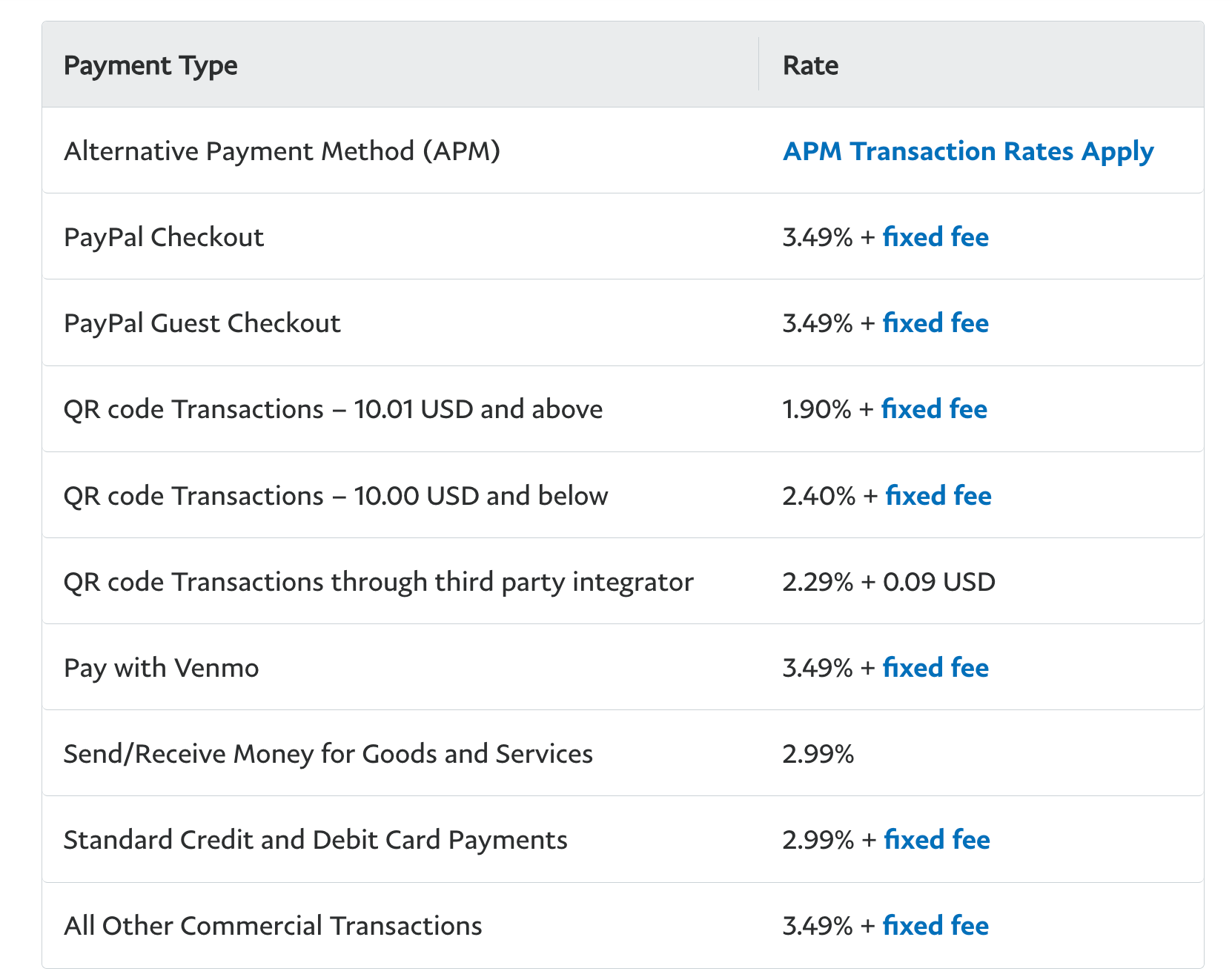

PayPal’s particular price construction can range relying on elements similar to methodology, transaction quantity, foreign money, and placement. Listed here are the charges:

- Worldwide Help:

Stripe has a low price for worldwide transactions. It’s majorly accessible throughout all areas however availability could range. Funds may be made by means of bank cards, ACH, and wire switch.

PayPal has the next transaction price however is extensively accessible throughout all main areas of the world. Funds may be made by means of bank cards, ACH, and wire switch.

- Pay Later Possibility:

Stripe does not have a local Pay Later possibility however can combine with third social gathering choices like Klarna. Klarna charges can range between 3.3% to six% + 30c flat price.

PayPal permits particular person clients to defer their funds and make purchases with the pliability to pay at a later date. PayPal Pay Later sometimes does not cost extra charges to clients, and it provides the comfort of interest-free funds inside a specified interval.

- Model Recognition:

Stripe does not have the identical model recognition as PayPal. Nonetheless, it is extensively well-liked today and in-app popups make it a straightforward option to do funds.

PayPal is an ordinary title the world over. It has very excessive belief as a fee supplier.

When to make use of Stripe?

Stripe has a flexible and developer-friendly fee processing resolution that gives customizable checkout experiences, helps worldwide funds, and supplies a simple price construction. Stripe is usually thought-about extra versatile and strong than PayPal for companies in search of superior fee capabilities and a seamless person expertise.

Usecases like ecommerce depend upon totally customizable, feature-rich fee processing, and requires strong fraud prevention instruments.

When to make use of PayPal?

PayPal is a straightforward device for invoicing, and its considerably much less advanced than Stripe. It has excessive price related to it, nevertheless it nonetheless is sensible to make use of it:

• In case you are accustomed to PayPal already.

• Low transaction quantity and prioritize simplicity

• Requires On-line and in-person gross sales

What to decide on – Stripe Vs PayPal?

Selecting between Stripe and PayPal relies on your particular wants and priorities:

• Should you worth a well known model with a easy setup and trustworthiness, even with larger charges and complicated pricing, PayPal is the really helpful selection.

• Should you choose decrease charges at scale, are snug with primary coding or outsourcing implementation, and do not thoughts lesser model recognition, Stripe is the higher possibility.

For companies making just a few month-to-month gross sales, the price distinction between Stripe and PayPal is manageable. Nonetheless, at scale, PayPal will probably price extra, making Stripe the cost-effective selection.

Enterprise Insights and Analytics

Stripe and PayPal each supply enterprise analytics instruments that can assist you monitor and analyze your gross sales and fee information, however they cater to completely different wants.

Stripe supplies a robust resolution by means of Stripe Sigma, permitting for extremely customizable experiences and deep insights into fee information. It provides real-time information and is understood for its developer-friendly strategy, making it perfect for companies with advanced reporting necessities or people who have to create customized analytics options.

Then again, PayPal provides extra primary reporting instruments, centered on offering insights into PayPal transactions and account exercise. It is simple to make use of and appropriate for companies that want simple analytics with out in depth customization.

Your selection between Stripe and PayPal for enterprise analytics ought to depend upon the extent of customization and complexity you require. Stripe is a greater match for superior and customised analytics, whereas PayPal is an easier possibility for primary reporting and account exercise monitoring. Many companies use each in conjunction to offer a number of fee choices and handle analytics accordingly.

Fee Automation

Automation can considerably streamline your corporation operations, and each Stripe and PayPal supply numerous instruments that can assist you obtain this. With Stripe, you may automate subscription billing and recurring funds, due to its strong subscription administration options. It additionally provides an API for integration into your web site or software, and webhooks for real-time occasion notifications, which can be utilized to set off automated actions. Stripe’s customized checkout workflows mean you can automate your checkout course of for a tailor-made person expertise. Moreover, you may join Stripe with different apps utilizing third-party integration instruments like Zapier to automate numerous workflows.

PayPal additionally supplies automation capabilities, significantly within the realm of recurring funds by means of its subscription providers and automatic invoicing for providers or merchandise. You’ll be able to add PayPal buttons to your web site for straightforward, one-click funds, and use PayPal’s REST API for extra superior automation wants. For e-commerce companies, PayPal typically integrates seamlessly with well-liked e-commerce platforms, making it simpler to automate funds in a web-based retailer setting. Your selection between Stripe and PayPal for automation ought to align together with your particular enterprise necessities, degree of automation wanted, and your most popular fee processing platform. In some instances, you would possibly even choose to make use of each platforms concurrently, as every provides distinct options and integration choices.

Automation is straightforward with software program like Circulate Nanonets which might deal with the end-to-end accounts payable course of and assist you 10x your effectivity. You’ll be able to automate your invoices, approval, and fee course of. Sync information in real-time together with your ERP like Quickbooks for reconcilliation, monitoring and performing analytics in your AP course of.

With Fee choices like ACH & Wire switch, you may automate your funds with out a trouble. To be taught extra, schedule a name with us.