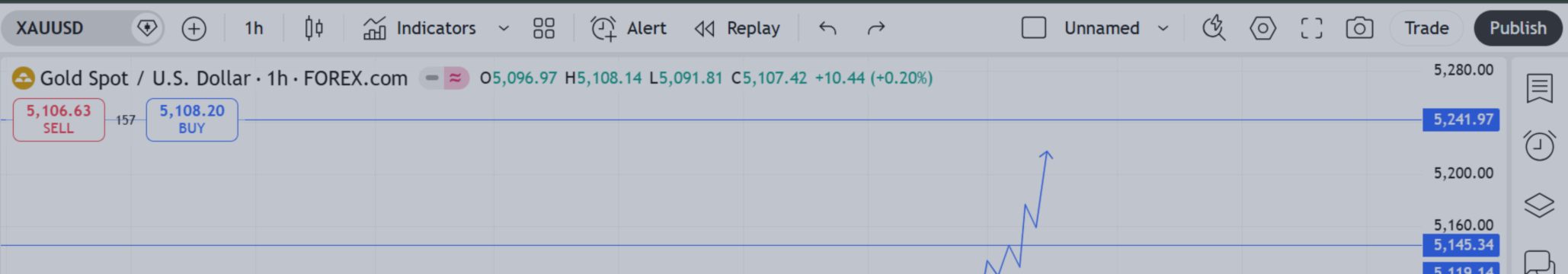

As we head into Monday’s session, Gold stays in a robust intraday bullish construction on the 1-hour timeframe.

After consolidating across the 5,000 area, worth has damaged into enlargement mode and is now buying and selling close to 5,107–5,120 resistance.

This isn’t random volatility — that is structured momentum.

🔎 Present Market Construction (1H)

Clear sequence of upper highs and better lows

Sturdy impulsive leg from 5,020 area

Clear breakout above prior consolidation

No confirmed bearish structural shift

The market has transitioned from accumulation to enlargement.

🔑 Key Ranges for Monday

🔹 Resistance: 5,119

This degree has already been examined.

If Monday opens above 5,110 and holds:

→ Anticipate continuation towards 5,145.

🔹 Main Goal: 5,145

If worth breaks and sustains above 5,145:

→ Subsequent projected enlargement: 5,180–5,200.

🔹 Essential Assist: 5,090

That is the “line within the sand.”

So long as hourly candles shut above 5,090:

→ Bias stays bullish.

A powerful shut under 5,090:

→ Opens corrective transfer towards 5,060 liquidity zone.

🔥 Monday Eventualities

🟢 Bullish Continuation

Maintain above 5,100

Sturdy hourly shut above 5,119

Momentum candles with out heavy wicks

Targets:

5,145 → 5,180

🔴 Managed Pullback

Failure to carry 5,100

Break under 5,090

Targets:

5,060 → 5,030

This may be a wholesome retracement, not a full pattern reversal.

📊 Skilled Perception

There is no such thing as a confirmed distribution but.

No decrease highs.

No structural breakdown.

No heavy rejection.

Pattern is powerful however barely prolonged.

Monday will seemingly begin with:

• Liquidity sweep → continuation

or

• Direct breakout continuation

Keep away from chasing impulsive candles.

📊 Detailed chart rationalization is shared in my channel.

Observe the channel for every day skilled evaluation and structured market updates.

Channel: https://www.mql5.com/en/channels/learning-forex-gold