Development shares have the potential to develop their financials at a tempo properly above the business common, providing traders the chance for outsized returns. Given this sturdy progress potential, these corporations usually commerce at a premium valuation. Nonetheless, their evolving enterprise fashions and comparatively costly valuations can add volatility, making them higher fitted to traders with the next threat tolerance.

Towards this backdrop, let’s discover two high-growth shares you could possibly think about shopping for with $500 to generate superior long-term returns.

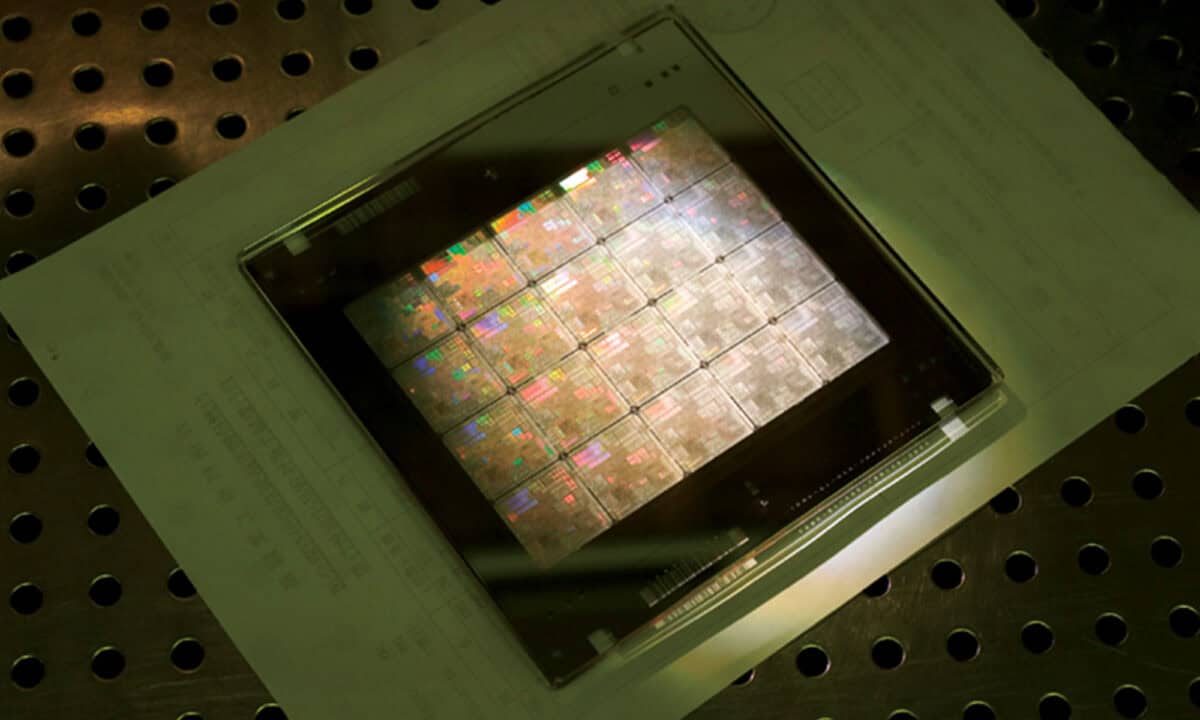

Supply: Taiwan Semiconductor

5N Plus

Given its publicity to high-growth finish markets reminiscent of semiconductors, terrestrial renewable vitality, and space-based solar energy, I’ve chosen 5N Plus (TSX:VNP) as my first choose. The semiconductor business has been experiencing strong progress amid the synthetic intelligence (AI) increase, increasing the corporate’s addressable market and strengthening demand for its specialty supplies.

Furthermore, the corporate just lately secured a US$18.1 million grant from the U.S. authorities to reinforce its germanium recycling and refining capabilities at its St. George, Utah, facility. This funding ought to assist its efforts to get well germanium from industrial residues and mining by-products, serving to reinforce vital provide chains for optics and photo voltaic germanium crystals.

As well as, 5N Plus has introduced plans to develop the photo voltaic cell manufacturing capability of its subsidiary, AZUR SPACE Photo voltaic Energy GmbH, by 25%. Supported by its international sourcing community, established manufacturing footprint, and ongoing product improvement initiatives, the corporate seems well-positioned to capitalize on beneficial business traits. Given beneficial business dynamics and its ongoing enlargement initiatives, I anticipate the constructive momentum in 5N Plus’s monetary efficiency to proceed.

Amid sturdy shopping for curiosity over the previous few months, 5N Plus now trades at a next-12-month price-to-sales a number of of 4.1 and a price-to-earnings a number of of 31.7, reflecting a richer valuation. Nonetheless, contemplating its stable progress prospects and increasing presence in high-demand finish markets, I imagine traders with a long-term funding horizon of greater than three years may think about accumulating the inventory at present ranges to generate superior returns.

Celestica

One other progress inventory I’m bullish on is Celestica (TSX:CLS), which delivered a powerful fourth-quarter efficiency final month and raised its 2026 outlook. Within the fourth quarter, income surged 44% 12 months over 12 months to $3.7 billion, pushed by a 64% improve in its Connectivity & Cloud Options (CCS) section to $2.9 billion. Inside CCS, the {Hardware} Platform Options (HPS) enterprise generated $1.4 billion in income, reflecting sturdy 72% year-over-year progress and highlighting accelerating demand from cloud and hyperscale clients. Nonetheless, income from the Superior Know-how Options (ATS) section declined 1% to $0.8 billion, partially offsetting the general progress.

Alongside strong top-line enlargement, Celestica’s adjusted working margin improved from 6.8% to 7.7%, supporting sturdy bottom-line progress. Adjusted earnings per share (EPS) got here in at $1.89 for the quarter, representing a 70.3% improve from the prior-year interval.

Buoyed by its stable 2025 efficiency and bettering momentum heading into 2026, administration raised its full-year 2026 steering. The corporate now expects income of $17 billion, implying 37.2% year-over-year progress. Moreover, projected adjusted EPS of $8.75 displays a 44.6% annual improve.

Wanting forward, rising investments in AI-ready knowledge centres to assist rising synthetic intelligence adoption create important long-term alternatives for Celestica. The corporate additionally focuses on launching modern merchandise to deal with evolving buyer wants and develop its market share. Contemplating the beneficial business backdrop, margin enlargement, and robust progress initiatives, I anticipate Celestica’s monetary momentum to proceed, doubtlessly delivering outsized returns over the long run.