‘Set and Overlook Foreign exchange Buying and selling’ is so simple as its identify implies; you merely “set” the commerce up after which “neglect” about it for a time frame. This has two main advantages: it makes it far simpler to remain emotionally disciplined and it additionally permits you to go about your life as you usually would, as a result of you’ll not be spending hours in entrance of your laptop over-analyzing the markets…

‘Set and Overlook Foreign exchange Buying and selling’ is so simple as its identify implies; you merely “set” the commerce up after which “neglect” about it for a time frame. This has two main advantages: it makes it far simpler to remain emotionally disciplined and it additionally permits you to go about your life as you usually would, as a result of you’ll not be spending hours in entrance of your laptop over-analyzing the markets…

Typically, aspiring Foreign exchange merchants change into misplaced in an internet of confusion with the quantity of information that the varied monetary media retailers plaster everywhere in the web and tv. This can be very simple to expertise “evaluation paralysis” whereas attempting to commerce foreign exchange or any marketplace for that matter. There are such a lot of competing concepts and buying and selling strategies together with extra basic knowledge popping out day-after-day than you can ever hope to digest, it may be overwhelming to even try to make sense of all of it and develop a foreign currency trading plan based mostly off this quantity of knowledge. One of many greatest psychological errors that nearly each aspiring dealer makes on their journey to success is firmly believing that the quantity of financial knowledge analyzed and (or) having a technically sophisticated or costly buying and selling methodology will assist them revenue out there. In actuality, as {most professional} merchants will attest to, these components often have the alternative impact on buying and selling earnings, no less than after sure level. This primarily signifies that when you do a certain quantity of analyzing market knowledge, any additional time spent analyzing this knowledge is more likely to have a unfavorable impact in your buying and selling; it causes you to lose cash.

Why it’s Counter Productive to Analyze too A lot Market Knowledge

It could appear complicated or counter intuitive to the aspiring Foreign exchange dealer once they first hear the truth that analyzing an excessive amount of market knowledge can really trigger you to lose cash quicker than you different smart would. The consider that “extra is healthier”, is a psychological entice that always retains aspiring merchants from persistently profiting in Forex which explains why a lot of them blow out their buying and selling accounts and ultimately surrender all collectively.

The principle motive why this happens is as a result of human beings have an innate must really feel in command of their life and of their environment, it’s an evolutionary trait that has allowed our species to perpetuate its existence and finally arrive at our present modern-day degree of civilization. Sadly, for the aspiring Foreign exchange dealer, this genetic trait of all human beings works towards these attempting to succeed at Foreign currency trading. In actual fact, most of our regular emotions of eager to work more durable than the following man or spend further time finding out and researching for our jobs or for varsity are emotions which can be actually not useful to success in Forex.

The issue with attempting to use the concept of “exhausting work” to Foreign currency trading, is that past a sure degree of technical chart studying potential and consciousness, there actually is not any useful facet to spending extra time on tweaking a buying and selling system or analyzing extra financial studies. The underside line right here is that there are actually thousands and thousands of variables concerned in buying and selling Forex; every particular person buying and selling the market is a variable and each considered one of their ideas in regards to the market is a variable as a result of these are all issues that may trigger worth to maneuver. So, except you might be by some means capable of maintain observe of each dealer out there and all of their ideas, along with the lots of of stories and financial studies that come out every day, you primarily haven’t any management over worth motion. Making an attempt to research quite a few items of financial knowledge every day or attempting to give you an excessively sophisticated buying and selling methodology is actually only a futile try to manage one thing that merely can’t be managed; the market.

Thus, the underlying reason behind Foreign currency trading failure begins with the concept that merchants really feel a psychological want to manage their environment and when this emotional state meets the uncontrollable world of Foreign currency trading it nearly all the time has unfavorable penalties. This downside works to snow-ball itself as nicely as a result of as soon as a dealer loses a couple of trades she or he begins to get indignant and desires to “get again” on the market. The way in which they do that is by studying one other buying and selling guide or shopping for a special buying and selling system that appears extra “more likely to work” or by analyzing the interior workings of each financial report they’ll discover and attempting to foretell the way it will have an effect on the market’s worth motion. As soon as this course of has begun it is rather troublesome to cease as a result of it makes logical sense to us that if we put extra time in and do extra work we are going to ultimately work out how to make more cash quicker in Forex. The troublesome fact to all of that is that, as said earlier, after you attain a sure diploma of technical and basic understanding, any additional analysis or system “tweaking” past that time will really work towards you and the speed at which you research extra and do extra analysis might be in regards to the charge at which you’ll lose your cash out there.

Much less is extra in Foreign exchange: ‘Set it and Overlook it’

So how does the aspiring dealer obtain constant profitability buying and selling Forex if we’re genetically primed to over-complicate it? The very first step on this course of is simply accepting the truth that you can not management the uncontrollable Foreign exchange market and checking your ego on the door. Forex doesn’t care what you have got completed in your life earlier than; it has no emotion and isn’t a residing entity. It’s an area the place human beings act out their beliefs in regards to the alternate charge of a sure forex pair. These beliefs are a results of feelings, and human emotion could be very predictable on the subject of cash. The purpose right here is that the individuals talked about within the earlier part who’re doing in depth quantities of analysis and looking for the “holy grail” buying and selling system are those who’re attempting to manage the market and thus buying and selling based mostly off emotion. These persons are offering the predictability for the professionals to benefit from.

The paradox right here is that skilled merchants may very well do much less technical and basic “homework” than newbie / struggling merchants; professional merchants have mastered their buying and selling technique and so they merely keep on with their day by day buying and selling routine and see if their edge is there. If there edge shouldn’t be current, then they only stroll away for some time as a result of they know that the Foreign exchange market is a steady stream of self-generating alternatives, thus they don’t really feel pressured or anxious to commerce. If their edge does present up then they set their orders and stroll away, accepting the truth that any additional motion will in all probability work towards them as a result of it is going to be a useless try to manage the uncontrollable and wouldn’t be an goal motion.

The logic of set and neglect foreign currency trading is that this; in case your buying and selling edge is current then you definately execute your edge and don’t contain your self additional within the course of except you have got a legitimate worth action-based motive to take action. Merchants that resolve to mess with or tweak their commerce as soon as they enter it nearly all the time kick begin an emotional curler coaster that results in over-trading, growing place dimension, shifting their cease loss farther from their entry, or shifting their revenue goal additional out for no logical motive. These actions nearly all the time trigger the dealer to lose cash as a result of they weren’t objectively thought out, however had been as a substitute influenced by an emotional response that was brought on by attempting to manage the uncontrollable.

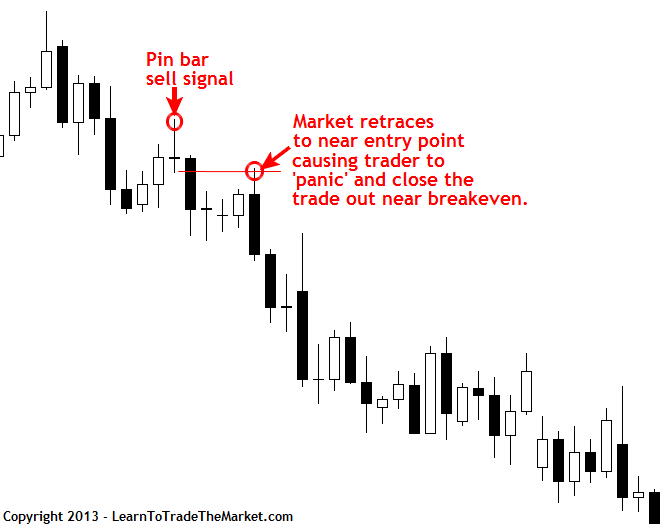

Within the chart under, we see an instance of what number of merchants get into hassle by being too concerned with their trades. Because the market retraced again towards the entry level of the pin bar promote sign, emotional merchants would have in all probability exited for a really small revenue or close to breakeven as a result of they felt “scared” or “nervous” that they may lose cash on the commerce.

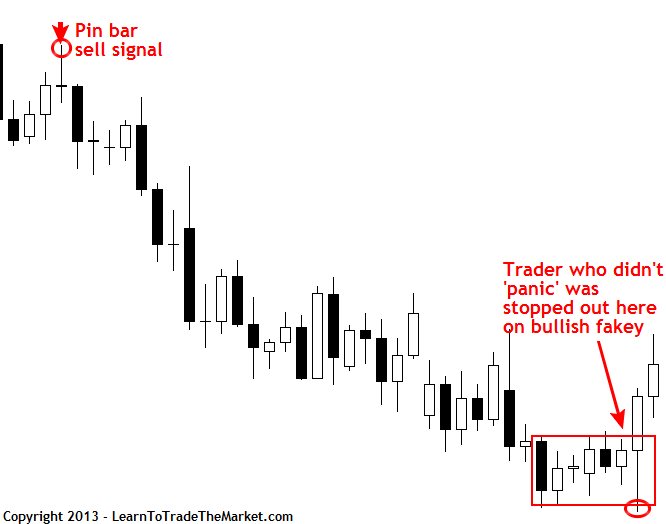

Within the chart under, we will see that simply because the market obtained to in regards to the low of the pin bar promote sign the place most merchants would have entered, it stalled after which fell considerably decrease again in-line with the downtrend. Disciplined merchants who don’t “meddle” of their trades for no motive would in all probability have nonetheless been quick and would have clearly made a really good acquire. Notice how a merchants may have waited for an opposing apparent worth motion purchase sign to exit the commerce…that is exiting on logic and worth motion quite than feelings like worry or greed.

Make Cash and Save Time by Doing…Much less?

It’s a well-studied proven fact that merchants who commerce off increased time frames similar to 4 hour, day by day, and weekly charts and maintain their positions for a number of days, earn more money in the long term that merchants who “day commerce” off intra-day charts. The rationale many individuals are drawn to day buying and selling is as a result of they really feel extra in command of the market by taking a look at smaller time frames and leaping out and in of positions ceaselessly. Sadly for them, they haven’t discovered that they’ve the identical quantity of management because the swing dealer who holds positions for every week or extra and solely appears to be like at the marketplace for twenty minutes a day and even much less. That’s to say, neither dealer has any management over the market, however day-trading and scalping provides merchants the phantasm of extra management. The one factor we actually have management over in buying and selling, is ourselves.

The ironic reality about Foreign currency trading is that spending much less time analyzing knowledge and discovering the “excellent buying and selling system” will really trigger you to make more cash quicker as a result of you may be extra relaxed, much less emotional, and thus much less more likely to over-trade or over-leverage your buying and selling account. Many individuals are drawn to speculative buying and selling as a result of they need a method to make cash that’s “more easy” than their present job, however they quickly neglect about that and begin spending numerous hours digging themselves into an enormous psychological entice that almost all of them by no means dig out of. All you principally must do to persistently make cash in Foreign exchange is grasp an effecting buying and selling methodology, develop a written out buying and selling plan based mostly on this methodology and have a strong danger administration technique, you’ll be able to then test the market one to 3 instances a day for ten to twenty minutes every time. In case your edge (worth motion methods) is exhibiting up than you arrange your entry, cease loss, and goal and stroll away till the following scheduled time to test your trades.

The ironic reality about Foreign currency trading is that spending much less time analyzing knowledge and discovering the “excellent buying and selling system” will really trigger you to make more cash quicker as a result of you may be extra relaxed, much less emotional, and thus much less more likely to over-trade or over-leverage your buying and selling account. Many individuals are drawn to speculative buying and selling as a result of they need a method to make cash that’s “more easy” than their present job, however they quickly neglect about that and begin spending numerous hours digging themselves into an enormous psychological entice that almost all of them by no means dig out of. All you principally must do to persistently make cash in Foreign exchange is grasp an effecting buying and selling methodology, develop a written out buying and selling plan based mostly on this methodology and have a strong danger administration technique, you’ll be able to then test the market one to 3 instances a day for ten to twenty minutes every time. In case your edge (worth motion methods) is exhibiting up than you arrange your entry, cease loss, and goal and stroll away till the following scheduled time to test your trades.

Buying and selling on this method really elicits a snowball of constructive habits that work to additional perpetuate your buying and selling success. This whole article may be summarized by the next two sentenes: Individuals who spend extra time analyzing market knowledge and attempting to excellent their buying and selling system inevitably induce a cycle of emotional errors that work to extend their buying and selling failures and ultimately lead to misplaced cash and misplaced time. Individuals who notice that the market is uncontrollable and construct their buying and selling plan round this reality will inevitably arrive at a “set and neglect” sort mentality that induces an emotional state that’s conducive to on-going market success and constant profitability. The buying and selling methodology used shouldn’t be as vital because the psychological or danger administration features of buying and selling, however usually talking, a technique that provides a easy high-probability edge such because the worth motion buying and selling methodology that I educate in my worth motion buying and selling course, is one of the best methodology to make use of to keep up your “set and neglect” mindset.