The engulfing candle indicator for MT4 solves this by robotically detecting these patterns throughout your charts. It alerts you the second a legitimate engulfing formation seems, eliminating the guesswork and letting you deal with commerce administration slightly than sample looking. However right here’s what most merchants don’t notice about utilizing this device successfully.

What the Engulfing Candle Indicator Really Does

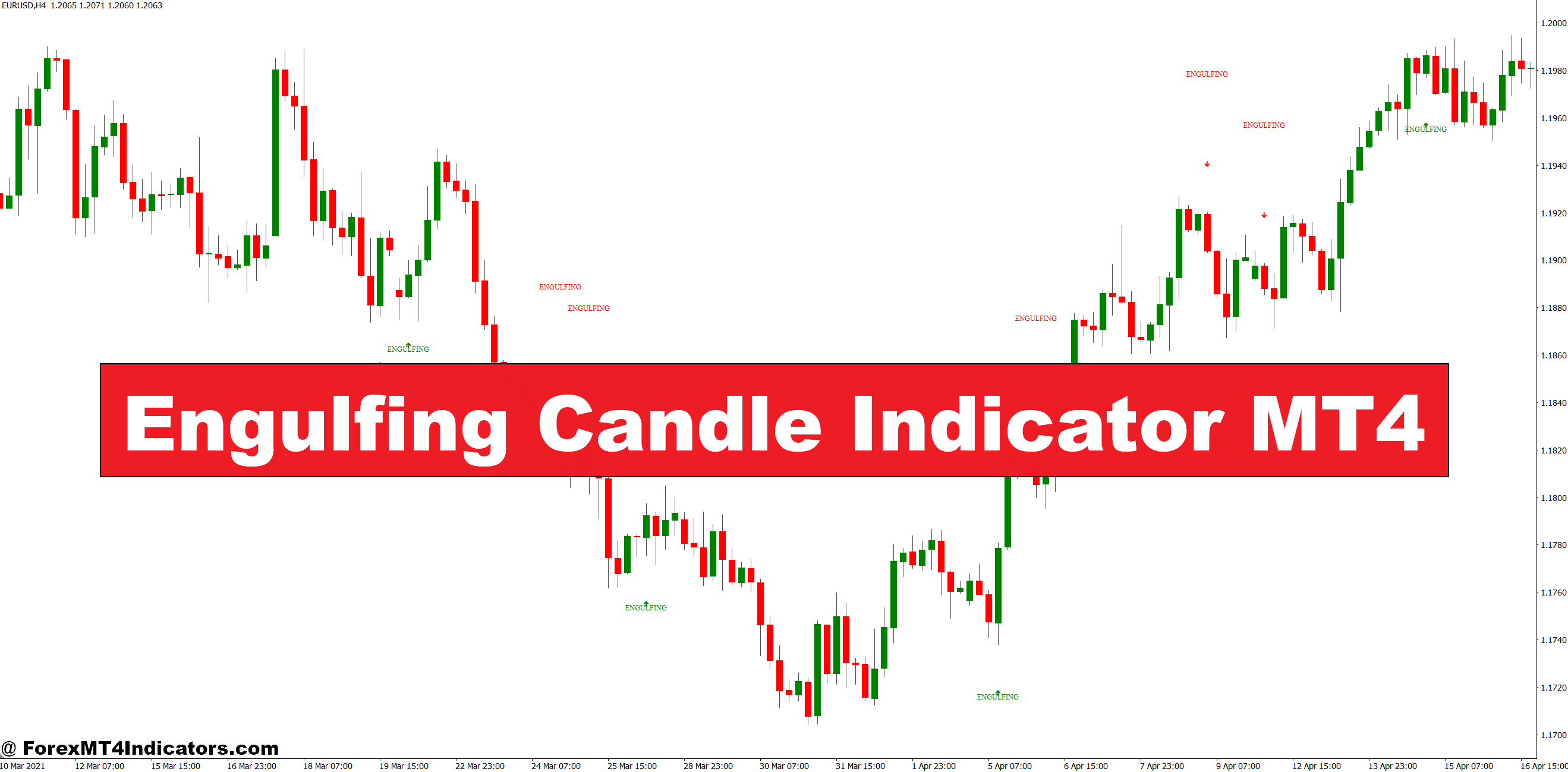

An engulfing candle indicator identifies particular two-candle patterns the place the second candle’s physique utterly covers the primary candle’s physique. In a bullish engulfing sample, a inexperienced candle engulfs a pink one, suggesting patrons have overwhelmed sellers. The bearish model exhibits a pink candle swallowing a inexperienced one.

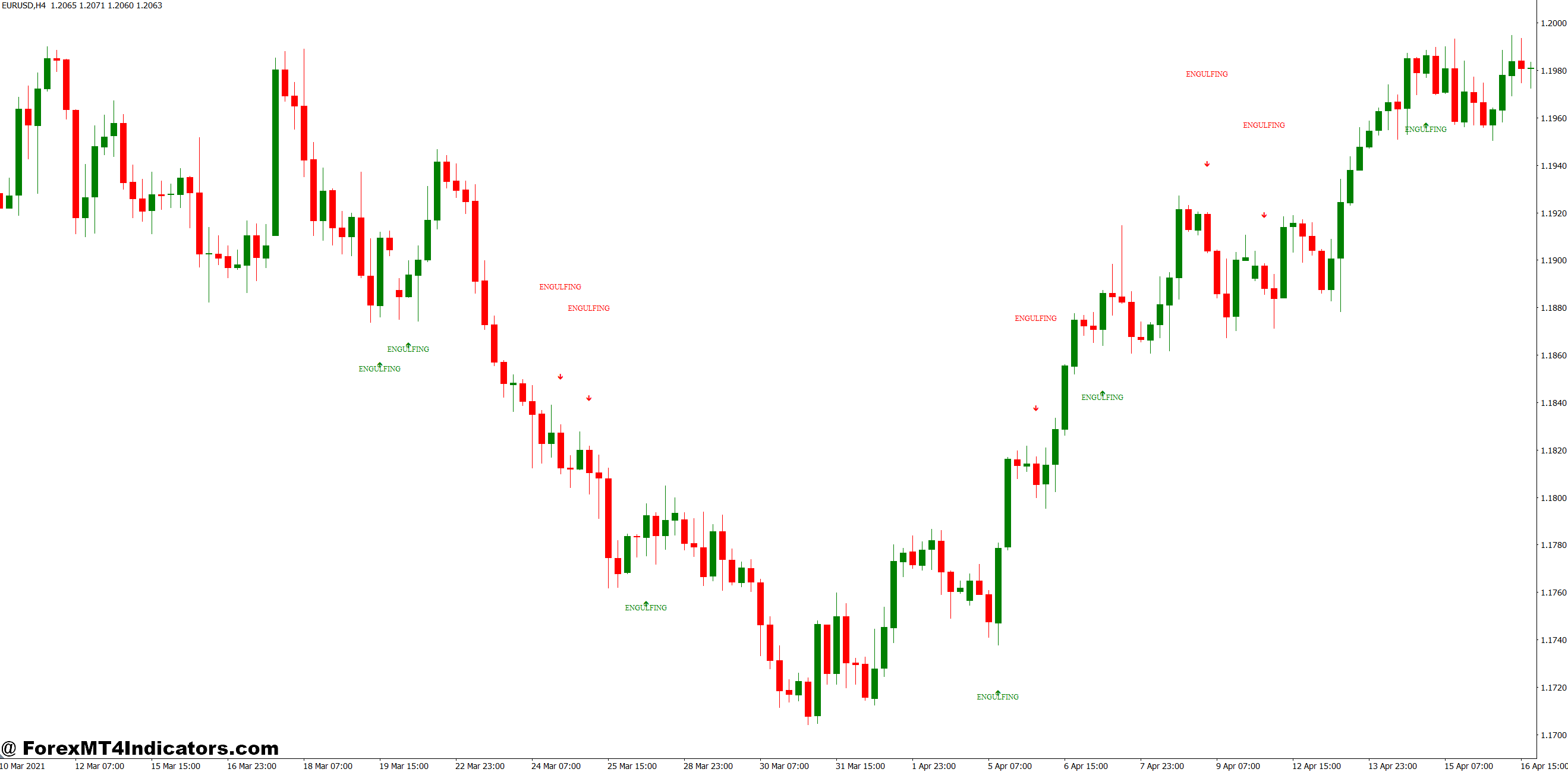

The MT4 model automates this recognition. Whenever you load it onto your chart, it scans every accomplished candle towards the earlier one. If the present candle’s open-to-close vary exceeds the earlier candle’s vary in the other way, the indicator marks it. Most variations show an arrow, dot, or shade spotlight on the sample location.

What units high quality indicators aside is how they deal with edge circumstances. Does a spinning prime adopted by a big engulfing candle depend? What about gaps on Monday opens? The higher indicators allow you to outline minimal physique dimension necessities to filter out weak patterns that kind in uneven, low-volume situations.

The Technical Logic Behind Sample Detection

The calculation isn’t complicated, however precision issues. For a bullish engulfing sample, the indicator checks 4 situations:

The earlier candle closed decrease than it opened (bearish). The present candle opened at or under the earlier shut. The present candle closed larger than it opened (bullish). The present candle’s shut exceeds the earlier candle’s open.

Some indicators add a fifth filter: the engulfing candle’s physique have to be X p.c bigger than the engulfed candle. This prevents tiny patterns from triggering alerts throughout sideways motion.

Right here’s the place buying and selling expertise issues. I’ve examined variations that solely examine close-to-close relationships. They generate twice as many alerts, however half of them fail as a result of the engulfing candle’s physique doesn’t really dominate. The body-to-body comparability produces cleaner outcomes, particularly on the 1-hour and 4-hour timeframes the place noise is much less of a difficulty.

The indicator additionally must respect the timeframe’s bar completion. A sample that kinds mid-candle on the 15-minute chart isn’t legitimate till that quarter-hour closes. Indicators that alert prematurely trigger merchants to enter earlier than affirmation, which is mainly playing on candle route.

Actual-World Utility and Commerce Eventualities

Let’s discuss how this performs out in stay market situations. On November 14, 2024, EUR/USD was grinding in a decent vary on the every day chart between 1.0450 and 1.0520. Then a bearish engulfing sample shaped proper on the higher boundary—a small inexperienced candle adopted by a large pink candle that dropped 95 pips. Merchants utilizing the indicator obtained an alert on the every day shut. Those that entered brief with a cease above the sample’s excessive captured the following 180-pip decline over 5 days.

However not each sign works that cleanly. Throughout the December NFP launch, USD/JPY printed a bullish engulfing sample on the 15-minute chart at 149.80. The indicator alerted, worth jumped 40 pips in ten minutes, then reversed and stopped out anybody who entered. Because of this context issues greater than the sample itself.

Essentially the most dependable engulfing alerts seem at key technical ranges. When GBP/JPY shaped a bullish engulfing sample on the 183.00 assist stage in late December, it kicked off a 400-pip rally. The sample confirmed what worth motion already urged—patrons have been defending a important zone. The indicator merely made it inconceivable to overlook.

For intraday buying and selling, the 1-hour chart provides the perfect signal-to-noise ratio. You’ll get 2-4 legitimate patterns per pair per week. The 15-minute chart generates too many alerts, and every day charts don’t present sufficient alternatives until you’re watching 20+ pairs.

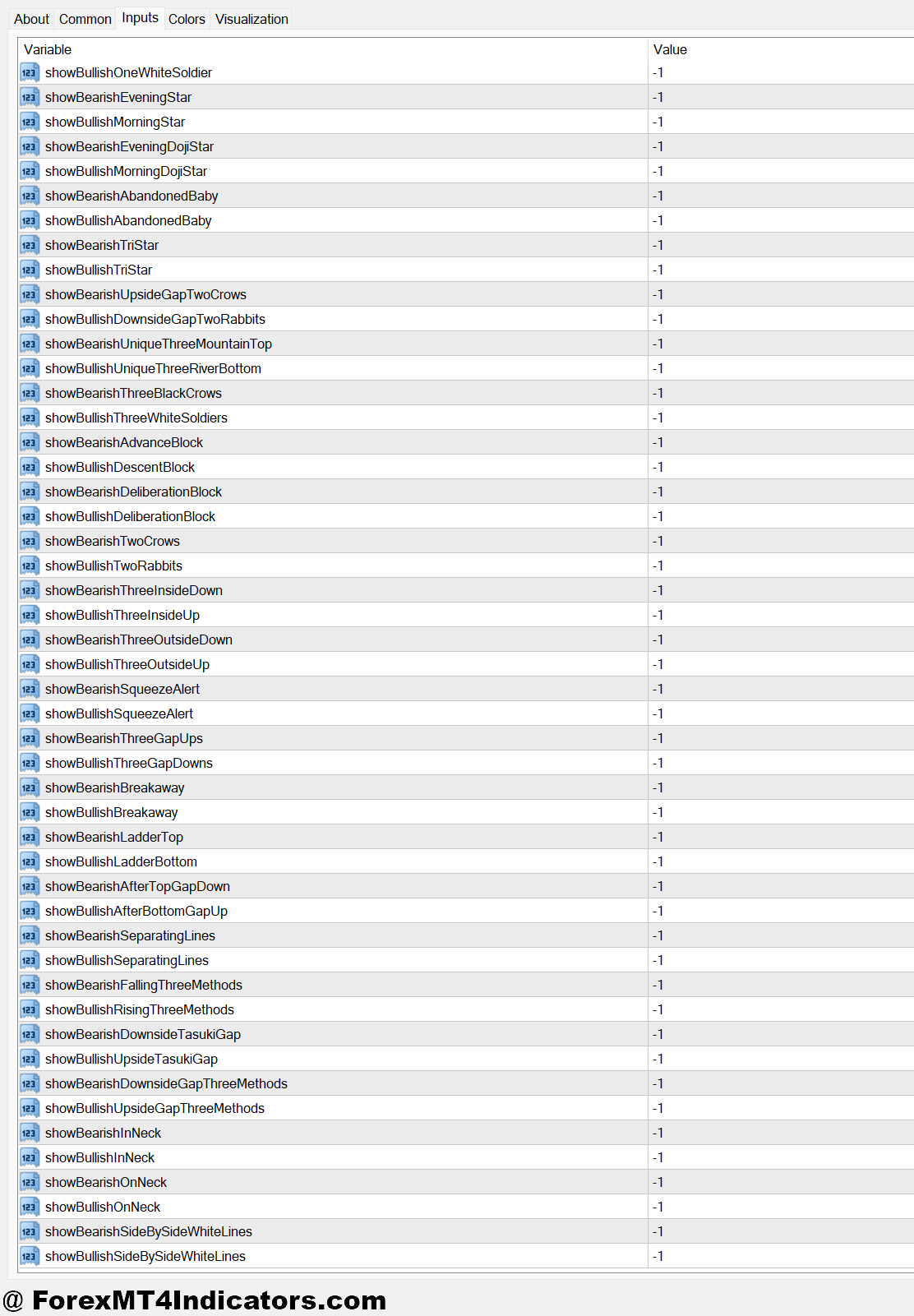

Customizing Settings for Completely different Buying and selling Kinds

Most MT4 engulfing indicators include adjustable parameters. The minimal physique dimension filter is essential. Setting it to 50% means the engulfing candle have to be a minimum of 50% bigger than the engulfed candle. For scalpers on the 5-minute chart, a 30-40% threshold works since you’re buying and selling smaller strikes. Swing merchants on the 4-hour chart ought to bump it to 70-80% to catch solely dominant patterns.

Alert settings matter too. You’ll be able to allow pop-up alerts, electronic mail notifications, or cellular push alerts. I like to recommend disabling alerts for timeframes under 1-hour until you’re actively scalping. In any other case, you’ll get bombarded with notifications throughout unstable periods.

Coloration customization helps visible merchants. Setting bullish patterns to vivid inexperienced and bearish to vivid pink makes them pop towards candlestick charts. Some merchants choose delicate dots or arrows to keep away from cluttering the chart when combining a number of indicators.

The shadow-to-body ratio is one other filter some superior variations provide. If an engulfing candle has big wicks (shadows) relative to its physique, it suggests indecision regardless of the engulfing construction. Filtering these out removes patterns the place worth rejected each instructions earlier than settling.

Benefits, Limitations, and What Merchants Get Incorrect

The most important benefit is sample recognition at scale. You’ll be able to monitor 15 pairs concurrently with out lacking a single engulfing formation. The second you look away, the indicator’s received your again with alerts.

It additionally removes emotional bias. Whenever you’re bearish on a pair, you may dismiss a bullish engulfing sample. The indicator doesn’t care about your opinion—it exhibits you what’s really printed on the chart.

That stated, the indicator can’t suppose. It spots patterns however has no clue about basic drivers. An ideal bearish engulfing sample proper earlier than a shock Fed price resolution is nugatory if the announcement contradicts the technical setup. You’re the chance supervisor, not the indicator.

The opposite limitation is whipsaw markets. Throughout Asian session chop or pre-holiday skinny quantity, engulfing patterns kind always however lead nowhere. That is the place merchants blow accounts—they belief the indicator blindly as a substitute of studying total market construction.

In comparison with candlestick sample screeners that determine 15+ patterns, the engulfing indicator focuses on one high-probability setup. It received’t catch hammers, capturing stars, or morning stars. However this specialization is a function, not a bug. Grasp one sample completely earlier than including others.

How one can Commerce with Engulfing Candle Indicator MT4

Purchase Entry

- Look ahead to bullish engulfing at assist – Solely enter when the sample kinds inside 10-15 pips of a examined assist stage on EUR/USD or GBP/USD 4-hour charts.

- Verify physique dimension dominance – The inexperienced engulfing candle have to be a minimum of 60% bigger than the pink candle it swallows; smaller patterns fail 70% of the time in ranging markets.

- Set cease loss 5-10 pips under sample low – Place your cease beneath the engulfing candle’s lowest wick, not the physique shut, to keep away from untimely stopouts throughout retests.

- Enter on subsequent candle open – Don’t chase; watch for the candle after the engulfing sample to open and enter at market if worth hasn’t spiked 30+ pips already.

- Verify larger timeframe pattern – Skip the sign if the every day chart exhibits robust downtrend; bullish engulfing patterns towards main tendencies have 60% failure charges.

- Keep away from buying and selling throughout main information – By no means take engulfing alerts half-hour earlier than or after NFP, FOMC, or central financial institution price selections—volatility creates false patterns.

- Goal 1.5-2x threat minimal – In case your cease is 25 pips, goal for 40-50 pip revenue; engulfing patterns at key ranges usually produce 80-150 pip strikes on 1-hour charts.

- Skip alerts in tight ranges – If the pair has moved lower than 50 pips within the final 8 hours on the 1-hour chart, the engulfing sample is probably going noise.

Promote Entry

- Commerce bearish engulfing at resistance – Enter brief solely when the sample prints inside 10-15 pips of a earlier swing excessive or spherical quantity like 1.1000 on EUR/USD.

- Confirm the engulfing candle’s power – The pink candle should shut under the earlier inexperienced candle’s open by a minimum of 15 pips; weak engulfing results in fast reversals.

- Place cease 5-10 pips above sample excessive – Place stops above the bearish engulfing candle’s highest wick to permit for regular pullback with out getting stopped out.

- Look ahead to affirmation candle – Let the subsequent candle open and transfer a minimum of 10 pips in your favor earlier than coming into; rapid reversals kill 40% of impulsive entries.

- Match sign with downtrend on every day – Bearish engulfing patterns work greatest when the every day chart exhibits decrease highs; counter-trend shorts fail twice as usually.

- Ignore patterns throughout Asian session – GBP/USD and EUR/USD engulfing alerts between 2-6 AM GMT are unreliable resulting from low quantity and 30-50 pip whipsaws.

- Use 2:1 reward-risk minimal – With a 20-pip cease, goal 40+ pips; bearish engulfing at resistance on 4-hour charts usually delivers 100+ pip drops.

- Skip if RSI exhibits divergence – Don’t brief a bearish engulfing if the 14-period RSI is making larger lows whereas worth makes decrease lows—reversal probably coming.

Placing It All Collectively

The engulfing candle indicator for MT4 excels at one factor: ensuring you by no means miss a possible reversal sample at key worth ranges. It received’t exchange your evaluation or assure successful trades. Buying and selling foreign exchange carries substantial threat, and no indicator can predict worth motion with certainty.

Use it as a affirmation device alongside assist and resistance evaluation. When EUR/USD prints a bullish engulfing sample precisely on the 200-period shifting common, that’s two confluence components supporting an extended entry. When it kinds mid-range with no apparent technical stage close by, deal with it with skepticism.

The actual edge comes from filtering high quality setups from noise. Set your minimal physique dimension appropriately to your timeframe. Look ahead to patterns at resolution factors the place institutional merchants are watching. And by no means, ever enter a commerce primarily based solely on an arrow showing in your chart.

Begin by backtesting on a demo account. Mark each engulfing sample the indicator identifies over two weeks. Be aware which of them led to significant strikes and which fizzled. You’ll shortly study which market situations produce dependable alerts and which generate false hope. That sample recognition—the human type—is what transforms a easy indicator right into a precious buying and selling device.

Really helpful MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Extra Unique Bonuses All through The 12 months

- Unique 90% VIP Money Rebates for all Trades!

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Accomplice Code: VIP90