The Owl Sensible Ranges Indicator relies on the buying and selling system Owl – Sensible Ranges. This buying and selling system makes use of information of two indicators, Full Fractals and Valable ZigZag, that are included into the Owl Sensible Ranges Indicator within the modified kind in comparison with their classical model.

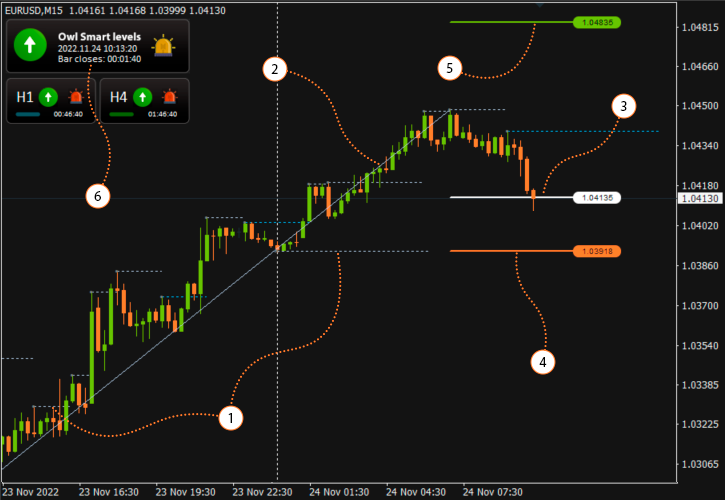

The Owl Sensible Ranges Indicator is a full-fledged indicator and it contains all of the plots based mostly on the buying and selling system with the identical title. The indicator plots ranges for opening an order on the chart as quickly as a gap sign seems and on the similar second it sends a notification to the dealer concerning the look of a brand new sign. That is why Owl Sensible Ranges could be very simple to make use of. Solely the mandatory plottings are proven:

- the fundamental ranges, in relation to which the worth of order opening worth, StopLoss and TakeProfit indexes are calculated, are plotted utilizing the Full Fractals indicator. Hint ranges on the display are auxiliary, so you’ll be able to disable their show within the settings relying in your preferences;

- the Valable ZigZag Indicator determines the buying and selling path for the instrument. If the acute ZigZag is directed upwards, it signifies that the pattern in the meanwhile is ascending, and solely purchase trades are allowed. If ZigZag is directed downwards, offers are solely allowed to promote on a downtrend;

- the road units the extent of inserting the order Purchase Restrict or Promote Restrict;

- the road units the StopLoss degree for the order;

- the road units the TakeProfit degree for the order;

- the information panel will be enabled or disabled within the indicator settings for comfort.

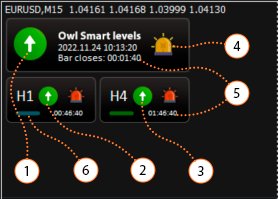

Handy data panel

The buying and selling system Owl Sensible Ranges relies on the Triple Display methodology which is beneficial in buying and selling by the well-known dealer Alexander Elder. The precept of triple display consists in simultaneous statement of charts of various durations. Particularly, defining the buying and selling path – on the upper timeframe, whereas coming into a commerce – on the decrease one. For consumer comfort the information panel shows information of the Valable ZigZag Indicator:

- the pattern path on the primary (intermediate) timeframe;

- the pattern path on the upper timeframe;

- the pattern path on the second increased timeframe;

- sign indicators: pink – no sign, yellow – there’s a sign for putting Purchase Restrict or Promote Restrict orders, inexperienced – you’ll be able to enter the market on the present worth;

- time earlier than the present candle shut;

- the colour of the pattern reversal ranges on increased timeframes.

Advisable settings and instruments

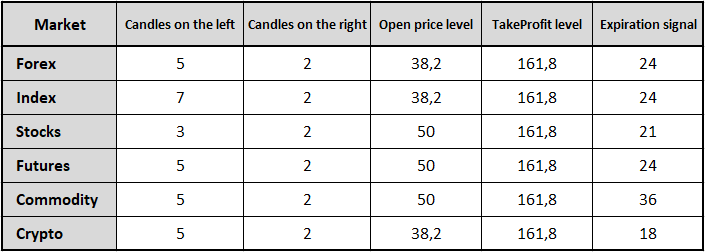

On account of using basic indicators the buying and selling system Owl works equally properly in all markets. You’ll be able to commerce on Foreign exchange, Indexes, Shares, Futures, Commodity, Crypto by barely adjusting the indicator settings.

There are 5 primary settings within the Owl Sensible Ranges Indicator:

- Candles on the left – the variety of candle to the left of the sign candle, the Excessive of which must be decrease than the Excessive of the sign candle to construct a fractal Up;

- Candles on the proper – the variety of candle to the proper of the sign candle, the Excessive of which have to be decrease than the Excessive of the sign candle to construct a fractal Up;

- Expiration sign – the variety of candle throughout which the sign is energetic;

- Open worth degree – Fibonacci degree for putting a pending order for Purchase Restrict or Promote Restrict;

- TakeProfit degree – Fibonacci degree for putting a TakeProfit order.

Desk of beneficial settings for every market

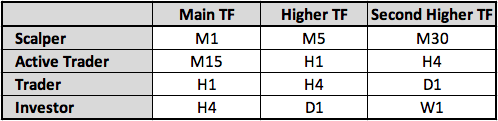

Relying on buying and selling exercise, there are beneficial settings for the triple display system:

Situations for putting orders

A Purchase Restrict order must be positioned when the next circumstances are matched:

- the Valable ZigZag Indicator on all three timeframes reveals upward path (arrows within the data panel present upward path);

- there’s a new UP fractal (the dotted line on high of the candle);

- there’s a minimum of one DOWN fractal on the proper aspect of the chart (dotted line on the backside of the candle) earlier than the swing level of the Valable ZigZag Indicator;

- IGNORE the sign if the colour of the dotted line is blue (the brand new UP degree is decrease than the earlier one);

- IGNORE the sign if in the meanwhile of its look the value is behind the order opening degree or was already there.

If these circumstances coincide, the Owl Sensible Ranges Indicator plots on the chart the degrees for putting a Purchase Restrict order (OpenPrice – white degree, StopLoss – pink degree, TakeProfit – inexperienced degree).

A Promote Restrict order must be positioned when the next circumstances are matched:

- the Valable ZigZag Indicator on all three timeframes reveals a downward path (the arrows within the data panel present the downward path);

- there’s a new DOWN fractal (the dotted line on the backside of the candle);

- there’s a minimum of one UP fractal on the chart on the proper (the dotted line on the high of the candle) earlier than the swing level of the Valable ZigZag Indicator;

- IGNORE the sign if the colour of the dotted line is blue (the brand new degree DOWN increased than the earlier one);

- IGNORE the sign if in the meanwhile of its look the value is behind the order opening degree or was already there.

If these circumstances coincide, the Owl Sensible Ranges Indicator plots on the chart the degrees for putting a Promote Restrict order (OpenPrice – white degree, StopLoss – pink degree, TakeProfit – inexperienced degree).

All pending orders must be deleted in the event that they haven’t been triggered inside 24 candle from the sign one (Expiration Bar). If the value has reached the TakeProfit degree with out catching the pending order, this order must be deleted.

All circumstances listed above are already considered by the indicator when plotting sign ranges, and extra filters, moments of closing and deleting orders must be checked by the dealer himself.

Further filters:

- a brand new commerce shouldn’t be opened if there’s already one place available in the market for the present image;

- trades from 23:00 to eight:00 must be skipped, as a result of presently the market is inactive, and pullbacks will be false;

- start buying and selling at 8:00 GMT on Monday; indicators acquired earlier than 8:00 on Monday morning must be ignored;

- end buying and selling at 16:00 GMT on Friday; the indicators acquired after 16:00 must be ignored;

- ignore indicators acquired in the course of the first 10 candle after the commerce was closed;

- don’t bear in mind indicators on the trades, if the StopLoss measurement is lower than 50 pips on 5-digit quotes.

Closing a place and deleting a pending order

Open positions must be closed earlier within the following instances:

- if a minimum of as soon as the Valable ZigZag Indicator has modified its path (one of many arrows on the knowledge panel started to point out the other way);

- on Friday, at 16:00 GMT, it’s endorsed to shut all positions on the present worth.

Pending orders must be deleted within the following instances:

- if a brand new degree Down of the Full Fractals Indicator appeared above the opening worth degree of a commerce, in case of a BUY sign, the BUY LIMIT order must be deleted. The identical applies to the SELL LIMIT order: if there’s a new degree Up of the Full Fractals Indicator under the opening worth, the order must be deleted;

- if new ranges seem on the chart it’s essential to delete the pending order and set a brand new one in response to the brand new ranges.

Advice

When the Fibonacci degree reaches 100% (Sign Fractal degree) you’ll be able to transfer your place to Breakeven (transfer the StopLoss degree to the order opening degree +1 level to compensate of the dealer’s fee).

Capital administration

The buying and selling system has a really excessive profitability issue (TakeProfit / StopLoss = 3.24), so even making 30% of worthwhile trades you’ll keep within the revenue.

The order quantity must be calculated in such a means that the utmost loss doesn’t exceed 1.5% of your deposit.

If there’s a loss on the present buying and selling instrument then the danger of the subsequent order must be elevated by 0.25%.

As soon as a commerce has been closed with a revenue, the subsequent commerce must be opened with an preliminary danger of 1.5%. In case you obtain a big sequence of shedding trades you shouldn’t exceed the danger per one commerce of three%.

If a commerce was closed as breakeven, the subsequent commerce must be opened with the identical danger because the earlier one.

I am Sergei Ermolov, observe me and do not miss extra helpful instruments for worthwhile buying and selling on Forex.