If somebody requested me to explain my buying and selling technique in as few phrases as attainable, it will be this; horizontal ranges and value action. Certainly, buying and selling value motion setups from horizontal ranges is the “core” part of my buying and selling idea and technique, and should you had been to remove just one factor from my web site it will be which you can study to commerce the market successfully by merely drawing the core ranges in your charts and ready for apparent value motion alerts to kind round them.

If somebody requested me to explain my buying and selling technique in as few phrases as attainable, it will be this; horizontal ranges and value action. Certainly, buying and selling value motion setups from horizontal ranges is the “core” part of my buying and selling idea and technique, and should you had been to remove just one factor from my web site it will be which you can study to commerce the market successfully by merely drawing the core ranges in your charts and ready for apparent value motion alerts to kind round them.

After you end studying this lesson, go away a remark, prefer it on fb, tweet it on twitter and share it with others. 🙂

Why are horizontal ranges so essential?

If you wish to study to commerce a “bare” value chart, you’ll have to study two issues at minimal; value motion and horizontal ranges. The whole lot available in the market begins with a horizontal line; that is the back-bone of my buying and selling strategy in addition to the buying and selling strategy of many different nice merchants. Certainly, merchants like George Soros, Warren Buffet, Jesse Livermore and others, all pay (paid) shut consideration to the important thing ranges available in the market, as a result of they know that these ranges are important and might thus have a powerful affect on the course of value.

Horizontal ranges assist with timing they usually present “worth areas” that may assist you outline your threat by providing you with a value stage to put your cease loss past. I’ve been a disciplined dealer of ranges mixed with value motion for years; most likely about 80% of my trades contain an apparent “core” horizontal stage mixed with a value motion sign. Horizontal ranges present us with a confluent space to commerce from, however they aren’t the one issue of confluence that I search for; the extra components of confluence you have got lining up with a value motion sign the higher. Nonetheless, I do think about horizontal ranges to be the “core” piece of confluence in my buying and selling technique and I need to present you guys some examples of how I take advantage of horizontal traces and value motion to commerce the markets. Prepared? Let’s go…

Examples of buying and selling with horizontal traces and value motion alerts:

I educate a plethora of value motion buying and selling affirmation alerts in my course that I mix with ranges and the pattern, right here’s a number of examples of how I commerce value motion alerts with apparent horizontal ranges available in the market.

• Buying and selling horizontal traces in trending markets with value motion from “swing factors”

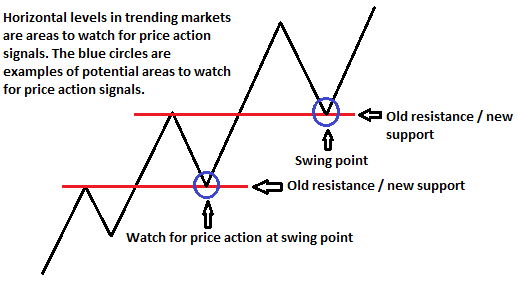

My favourite technique to commerce with horizontal traces is to commerce them in trending markets from swing factors. As markets pattern, they create horizontal ranges as they ebb and movement, these ranges are what I name “swing factors”, and we will discover very high-probability commerce setups by looking ahead to value motion forming from these swing factors available in the market.

Have a look at the illustration under, notice how the market is trending larger and because it makes new highs it additionally creates resistance when it falls away from these highs, then because it pulls again the earlier excessive / resistance really turns into help (swing level). Thus, previous resistance turns into new help in an uptrend, and in a down pattern previous help turns into new resistance, also called swing factors.

The best way that we reap the benefits of these horizontal stage swing factors, is to observe for value motion methods forming close to them because the market pulls again. Have a look at the blue circles within the illustration above, these are the swing factors at which you need to look ahead to apparent value motion alerts forming, then you’re buying and selling from a confluent level of “worth” inside a trending market.

• Buying and selling horizontal traces in range-bound markets with value motion

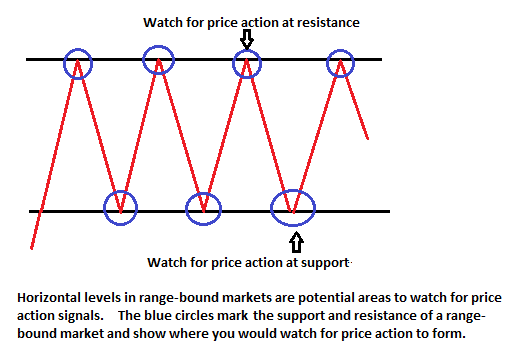

One other glorious technique to commerce horizontal traces available in the market is to easily look ahead to value motion setups forming close to the boundaries of a range-bound market. Sadly, markets don’t at all times pattern like we would like them to, as an alternative, they typically swing between help and resistance in a buying and selling vary. Fortuitously, buying and selling with easy value motion setups permits us to commerce in any market situation, so we will nonetheless discover high-probability commerce setups even in range-bound market circumstances.

Within the illustration under we will see an instance of what a range-bound market may seem like. When value is clearly bouncing forwards and backwards between a horizontal help and resistance stage, we will anticipate value to hit one of many boundaries of the vary after which look ahead to value motion alerts forming there. This supplies us with a really high-probability entry state of affairs and a quite simple buying and selling technique. It additionally provides us apparent ranges to outline our threat and reward. Threat is outlined simply past the buying and selling vary excessive or low from the boundary you’re getting into close to, and reward is outlined close to the other finish of the buying and selling vary.

• Buying and selling “occasion space” horizontal traces with value motion

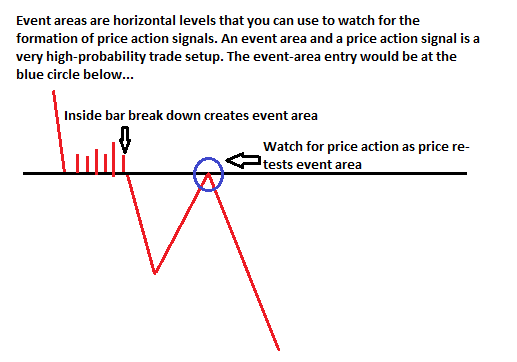

Occasion areas are horizontal traces that may be very high-probability areas to observe for value motion setups forming close to. Primarily, when a serious value occasion happens in a market, like an inside bar breakout or a pin bar reversal, value creates an “occasion space” at this horizontal stage. You’ll discover that these occasion areas are important more often than not as a result of value will typically stall or reverse because it re-tests them.

Within the illustration under we will see an instance of the creation of an occasion space in addition to the way it may subsequently be traded. Primarily, any value motion sign can create an occasion space if it units off a considerable transfer from the occasion space / horizontal stage. Within the instance under we will see an inside bar breakdown occurred after which value got here again and re-tested this event-area / horizontal stage. As value re-tests the occasion space we’d watch carefully for value motion alerts, because the formation of a value motion sign at an occasion space is a really high-probability occasion.

Nonetheless, occasion areas additionally present us with the flexibility to enter with out affirmation from value motion. It is a extra superior technique that I educate in my value motion buying and selling course, however it’s attainable to enter “blindly” on the occasion space as value comes again to re-test it, that’s to say with out affirmation from value motion.

• Actual-life examples of buying and selling value motion at horizontal ranges

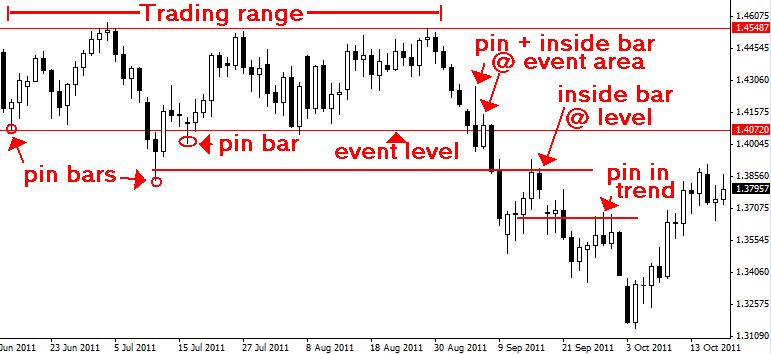

Lastly, I wished to point out you guys an actual chart of the EURUSD and analyze its latest value motion and horizontal ranges to point out how you may have used easy horizontal ranges with value motion to commerce the market.

1) Notice the buying and selling vary that the EURUSD was in for about 3 months earlier this yr. Worth was bouncing forwards and backwards between resistance close to 1.4550 and help close to 1.4100 – 1.4000. We didn’t get lots of alerts on this vary, however there have been at the least three good pin bars that shaped off the help of the vary that merchants may have made some excellent cash on.

2) Subsequent, because the buying and selling vary shaped and the pin bars developed alongside help, we obtained an occasion space forming round 1.4100 – 1.4000. As value started to maneuver decrease from the highest of the buying and selling vary earlier than it broke out, it shaped a long-tailed pin bar after which an inside bar proper at this occasion space. Thus, a break of the pin bar low meant a break of the occasion space and we will see a major transfer adopted.

3) Subsequent, we will see an inside bar and a pin bar setup that shaped because the market trended decrease. These setups each shaped at horizontal ranges and we will see they resulted in massive strikes to the draw back that offered good threat reward ratios for savvy value motion merchants

In closing, buying and selling horizontal ranges with value motion alerts is the first method that I take advantage of to research and commerce the market. It’s basically the “basis” of my buying and selling technique and I consider it actually is the “easiest buying and selling technique on this planet”, in addition to the best. It’s apparent that horizontal ranges are crucial available in the market, and by combining them with my value motion methods you have got a really efficient and easy buying and selling technique. If you wish to study extra about how I take advantage of horizontal traces and value motion, in addition to my different buying and selling methods, take a look at my value motion buying and selling course right here.