One factor I’ve realized over years of serving to folks discover ways to commerce, is that almost all merchants are likely to try to deal with too many variables at one time, particularly merchants to start with phases of studying commerce. They usually need to commerce 10 or 20 totally different setups with quite a few indicators on their charts while taking a look at each time-frame obtainable on their buying and selling platform in 30 totally different markets. That is in a phrase, ineffective. Merchants usually come into the markets with good intentions however their focus is just too broad, this causes over-analysis, confusion and normally frustration.

One factor I’ve realized over years of serving to folks discover ways to commerce, is that almost all merchants are likely to try to deal with too many variables at one time, particularly merchants to start with phases of studying commerce. They usually need to commerce 10 or 20 totally different setups with quite a few indicators on their charts while taking a look at each time-frame obtainable on their buying and selling platform in 30 totally different markets. That is in a phrase, ineffective. Merchants usually come into the markets with good intentions however their focus is just too broad, this causes over-analysis, confusion and normally frustration.

The idea I’m going to introduce in at present’s lesson that may enable you to grow to be a worthwhile worth motion dealer is “specializing”. Your new objective is to consider your self as a “specialist” dealer, and to really grow to be one. If you happen to go searching at most professions, it’s probably the most specialised those that take advantage of cash. For instance, a household physician makes a superb revenue, however a neurosurgeon most actually instructions extra money as a result of she or he is a specialised physician who has “mastered” the talent of performing difficult mind surgical procedures, amongst different issues.

There’s an outdated saying that you will have heard: “Jack of all trades, grasp of none” and in accordance with Wikipedia it’s “…utilized in reference to an individual that’s competent with many expertise however just isn’t essentially excellent in any explicit one.” As specialist worth motion merchants, we need to take the alternative strategy, our goal is to grow to be “excellent” at one explicit worth motion setup at a time; that is maybe probably the most highly effective factor you are able to do to start out profiting as a worth motion dealer. What I’m going to share with you guys at present is one thing that’s as near a “secret” to buying and selling success as you can find, and I hope after studying at present’s lesson you guys have a way of confidence and path about how finest to proceed in changing into a “grasp worth motion dealer”…

The “secret” to profiting as a worth motion dealer

As worth motion merchants, we now have a definite benefit over merchants who would possibly use indicators or buying and selling software program, that benefit lies within the simplicity of worth motion buying and selling methods. The truth that we are able to merely concentrate on a market’s uncooked worth motion and its assist and resistance is one thing that simply permits us to concentrate on mastering one setup at a time. That is in direct distinction to many different buying and selling methods or techniques on the market which may require a dealer to commerce with quite a few totally different indicators whereas making an attempt to commerce the information on the similar time…it’s fairly exhausting to grow to be a “specialist” of such a messy and haphazard buying and selling type.

Principally, what I need to actually drive-home at present is the purpose that specializing in one worth motion setup on one time-frame and in a single market, will mean you can grow to be a grasp of that “technique”. For instance, if we select to commerce the pin bar technique from key ranges on the 4 hour chart and within the EURUSD market…that will be thought of “one technique”…the objective is to essentially MASTER that technique…commerce solely that technique till you are feeling like you’re ‘Jedi grasp’ of it…(sure I made a tacky Star Wars reference there).

Nevertheless, I would like you to go even additional, I would like you to grasp one setup at a time, on one time-frame, and in a single market and with one very particular set of entry parameters. For instance, you would possibly resolve you need to look just for inside bars on the every day chart time-frame of the GBPUSD that happen within the context of a development….that will be one technique and you’d keep it up till you’re profitable with it, which might take 1 month, 3 months or much more…the purpose of this train is that when you actually persist with this technique of buying and selling, after a yr goes by you can be one potent “badass” of a worth motion dealer. These emotions of taking a look at a chart and being afraid to drag the set off can be utterly gone, and with mastery of such a sniper-like buying and selling strategy, your success within the markets will solely be a matter of time.

An instance of “specialist” worth motion buying and selling:

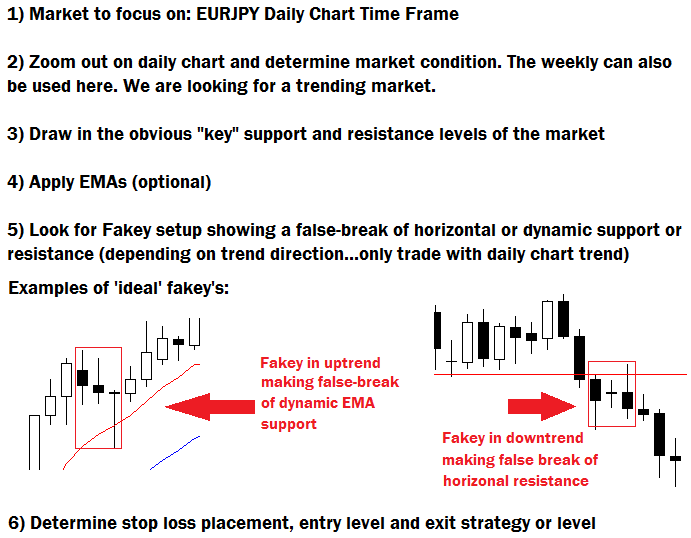

Now let’s go over an instance of what can be thought of one particular worth motion buying and selling technique that you can concentrate on till you’ve mastered it. Take note, that is simply an instance and you’ll provide you with your individual technique in order for you, that is to get you considering and to get you on the monitor to changing into a “specialist” worth motion dealer…

Discover your market first: The very first thing to do is choose the market you need to commerce. I recommend sticking with one of many main forex pairs or one of many extra common crosses as they’re probably the most liquid, have the tightest spreads and can typically behave extra “predictably” than the extra unique pairs. We’re choosing the EURJPY for at present’s lesson.

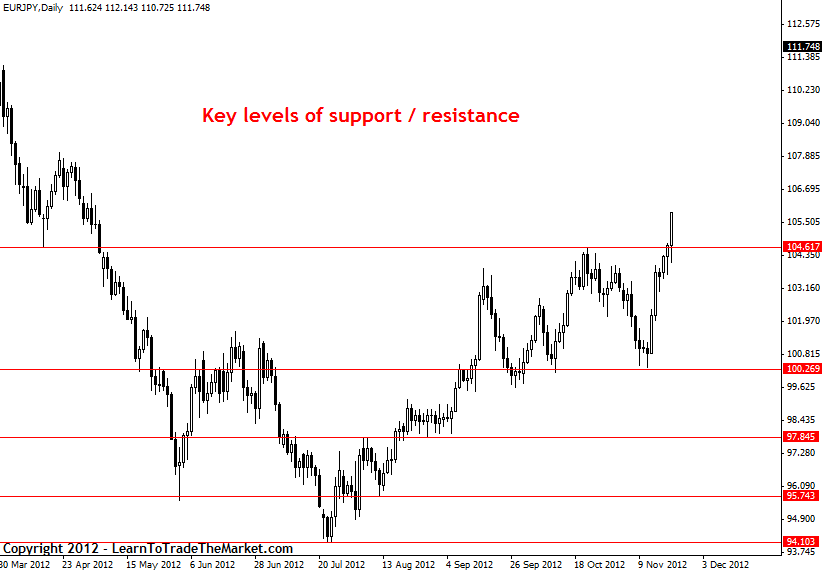

Subsequent, zoom out in your chart to get an total view of longer-term development and draw the degrees on the every day chart, it’s also possible to do that on the weekly chart too in order for you. Under we see a zoomed out every day EURJPY chart and we are able to clearly see that an uptrend was in place as marked by the upper highs and better lows which we are able to see by the crimson circles. So, the primary two elements of our “specialist” buying and selling technique are in place: we’re trying on the every day chart EURJPY and we’re searching for an apparent directional bias to be in place, on this case the bias is up:

After figuring out development and total market situation, we attract the important thing “apparent” ranges:

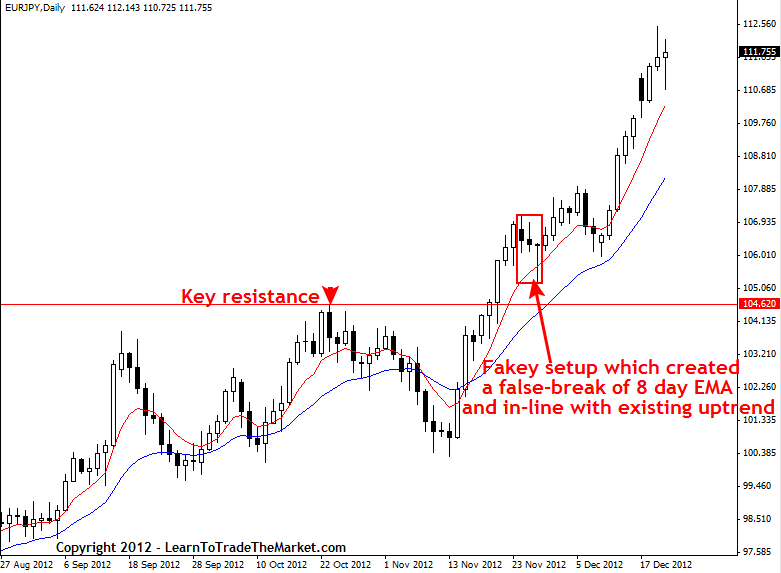

You’ll then choose the actual worth motion setup you need to commerce. You may study all my setups in my buying and selling course, however for at present’s lesson we’re going to concentrate on only one, the fakey setup. That is additionally what you’ll do once you do that strategy for your self; persist with ONE setup at a time…it’s important to ignore the temptations so as to add setups proper now, you may add setups to your toolbox in a while as you grasp one by one. Now, after about 4 days glided by, a really apparent fakey / pin bar combo setup fashioned displaying rejection of the 8 day EMA assist degree and implying that worth would possibly proceed pushing increased in-line with the uptrend. We now have the following two elements of our “specialist” buying and selling technique: we’re searching for a fakey setup which creates a false-break of both a dynamic EMA assist or resistance degree or a horizontal assist or resistance degree inside a trending market:

The particular components of confluence supporting our worth motion setup are literally a part of the setup itself and are essential for us to contemplate the setup as being legitimate. Many merchants make the error of buying and selling any outdated fakey or pin bar, and so on, when in actuality the situation and placement of the value bar throughout the broader market construction is simply as essential as the value bar itself.

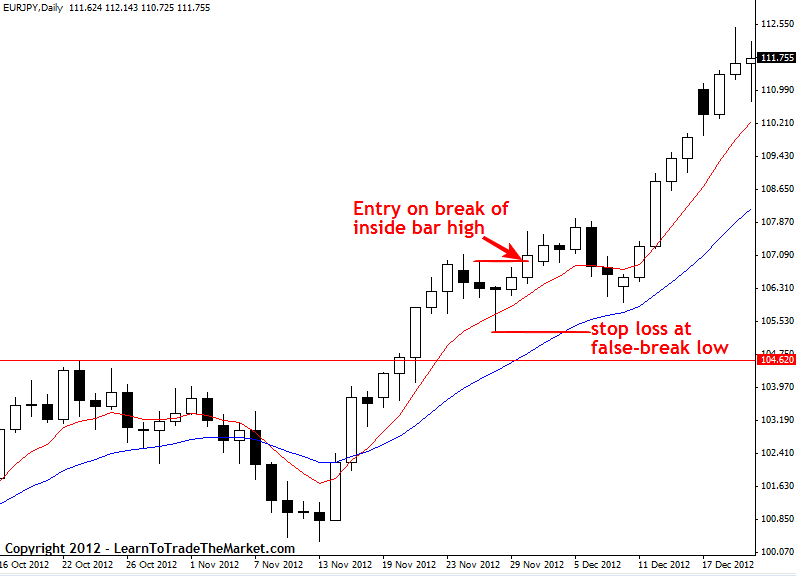

Now, the following a part of our specialist buying and selling technique is how we are going to enter and exit it. Let’s say we select to stay to an entry above or under the within bar excessive or low after the false-break of the mom bar has occurred. Let’s additionally say for this technique we are going to place our cease at or close to the excessive or low of the false-break bar. So, we are going to enter on a buy-stop entry 1 pip above the within bar excessive and our cease loss is a sell-stop positioned 1 pip under the false-break low, now let’s see what that appears like:

Subsequent, you’ll resolve your danger reward and cash administration eventualities. We aren’t going to get into cash administration very a lot on this article however I’ve mentioned it extensively in different articles, particularly my danger reward ‘Holy Grail’ article and danger reward and cash administration article, so make sure to verify these out.

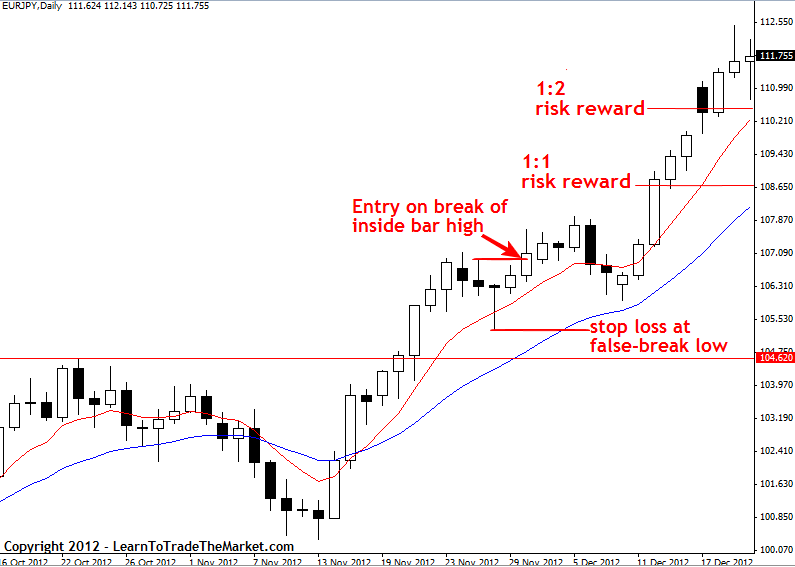

For this explicit “specialist” technique we’re merely aiming for a danger reward of 1:2 on each commerce with little to no interference. Let’s check out our commerce now and see what that 1:2 danger reward appears to be like like:

Be aware: When first implementing this “specialist” buying and selling strategy it may be finest to simply goal for a strict 1:1 danger reward ratio simply to construct a bit of confidence and construct your buying and selling account up a bit of. Then, after you’ve gained some confidence buying and selling your technique and beefed up your account a bit, you can begin to goal for 1:1.5 after which 1:2. Doing this gives you ample time to achieve display time and over time you’re going to get higher at managing your exits, finally you may attempt trailing cease strategies in trending markets and searching for bigger danger rewards like 1:3, 1:4 and so on.

Now it’s time to tie this all collectively and make a visible “verify checklist” out of the above components that you’ll use to verify in your buying and selling technique every day and to assist preserve you on monitor. It’s one factor to have your buying and selling technique in your head, however it’s finest to have it tangible and visual so that you’re reminded of what you are attempting to do…

Right here is an instance of the above “specialist” buying and selling technique summed up very concisely in a visible verify checklist:

In closing:

You need to have the endurance and self-discipline to make this work. I can nearly promise you this “specialist” strategy will enhance your buying and selling outcomes, however it’s important to give it time and it’s important to study to be OK with not buying and selling. If you happen to’re solely buying and selling one market at a time and one time-frame / one setup…you aren’t going to have a number of setups every week. However that’s a part of the purpose of this, it’s to indicate you that when you simply actually study when to commerce and when to not commerce, you is usually a worthwhile dealer. Bear in mind, as you grasp one explicit technique you may then transfer on to a different, then after a whilst you may need 3 or 4 totally different however very particular buying and selling methods which you can shortly search for on the charts every day. In my view, that is the quickest path to worthwhile worth motion buying and selling.

If you wish to study extra in regards to the worth motion setups and methods mentioned on this lesson, plus extra “specialist” buying and selling methods, checkout my worth motion buying and selling course right here.