Prop Agency Hedging Defined: The Easy Technique Behind $500K in Payouts

I’ll clarify the precise technique I’ve used to cross 300+ prop agency challenges and acquire over $500K in verified payouts.

It isn’t a secret indicator. It isn’t a magic timeframe. It isn’t some complicated algorithm that solely works in backtests.

It is hedging. And it is less complicated than you suppose.

What Is Hedging? (The Plain English Model)

Hedging means putting two reverse trades on the identical time on two completely different accounts.

That is it. That is the core idea.

When your problem account opens a purchase, your private reside account opens a promote. Similar pair. Similar time. Wrong way.

A kind of trades will win. One will lose. That is assured — as a result of they’re pointing in reverse instructions.

The bottom line is understanding what occurs on every account when one aspect wins and the opposite loses. That is the place the technique lives.

Why Two Accounts?

You want two accounts for this to work:

Account 1: Prop agency problem account

That is the place you are making an attempt to cross the problem. It has guidelines — drawdown limits, revenue targets, cut-off dates. You paid a charge to entry it.

Account 2: Your private reside account

That is your individual account, with your individual cash. No guidelines. No limits. Nobody watching. You management it fully.

The problem account runs the buying and selling technique. The reside account runs the hedge — reverse trades that mirror every part the problem does, however in reverse.

Vital: These two accounts must be at two completely different brokers. In the event that they’re on the identical dealer — or if the problem agency and your reside dealer share the identical liquidity supplier — there is a threat of the trades being linked and flagged. Completely different brokers, completely different infrastructure.

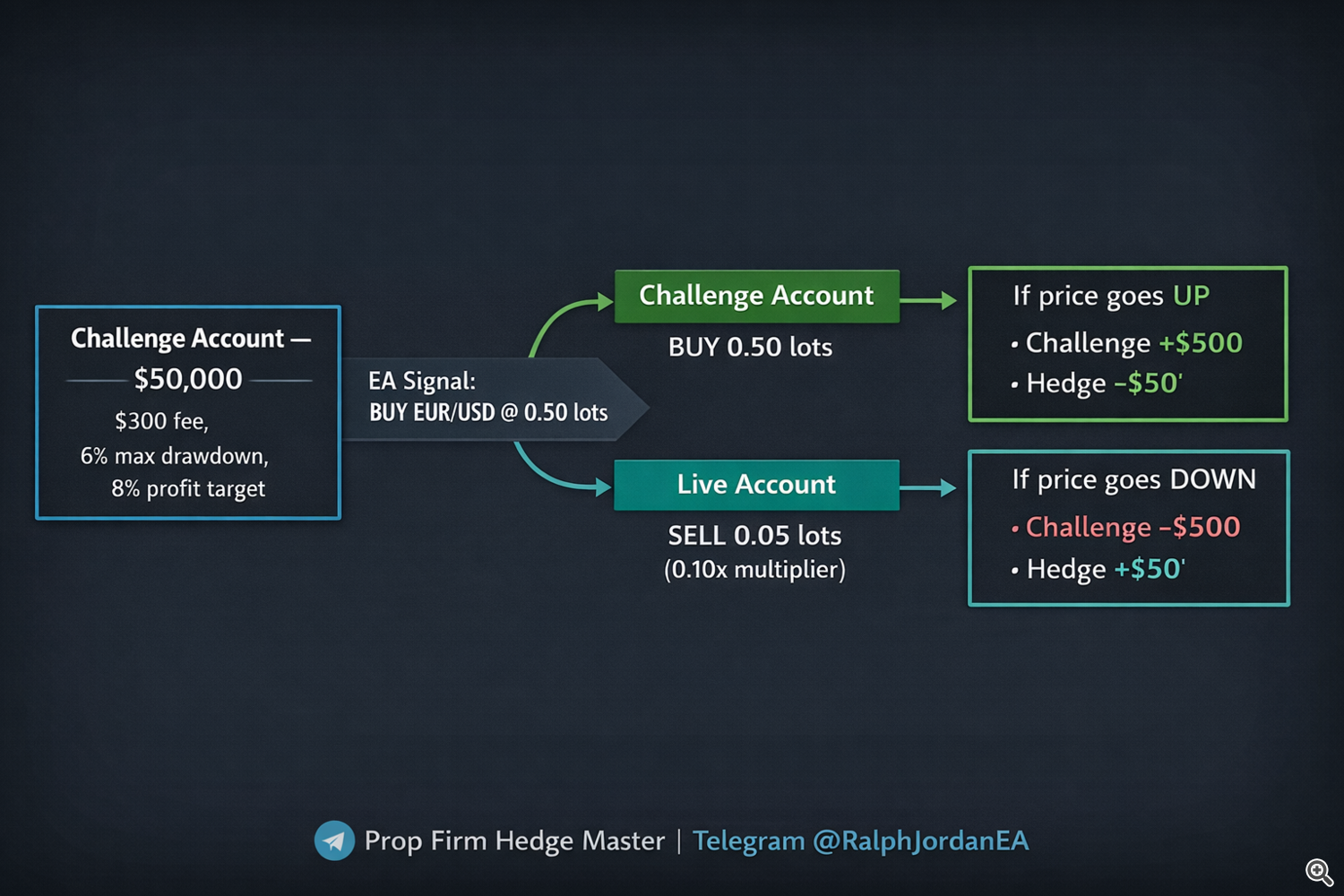

A Step-by-Step Instance With Actual Numbers

Let’s stroll by an entire instance. No concept — simply numbers.

Setup:

- Prop agency problem: $50,000 account (1-step/section)

- Problem charge: $300

- Max drawdown: 6% ($3,000)

- Revenue goal: 8% ($4,000)

- Your reside account steadiness: $2,000

- Hedge restoration mode: Break even (recuperate the $300 charge)

The commerce:

The EA identifies a setup on EUR/USD and opens a BUY on the problem account at 0.50 tons.

Concurrently, the hedge EA opens a SELL in your reside account. The lot dimension is calculated primarily based in your restoration settings — as an instance 0.05 tons for this instance.

Now we wait.

Situation 1: The Problem Commerce Wins

EUR/USD goes up. The problem commerce hits take revenue.

- Problem account: +$500 revenue. You are 12.5% of the best way to your revenue goal.

- Reside account: -$50 loss on the hedge. That is the price of insurance coverage.

Your problem is progressing towards passing. The $50 loss on the reside account is a small, managed value — a lot lower than the $300 charge you’d lose if the problem failed and not using a hedge.

Over many profitable trades: The problem account builds towards the revenue goal. The reside account takes small hedge losses alongside the best way. If you cross the problem, these hedge losses are the “value” you paid for the security web. And also you now have a funded account value way over what the hedge value you.

Situation 2: The Problem Commerce Loses

EUR/USD goes down. The problem commerce hits cease loss.

- Problem account: -$500 loss. Drawdown will increase.

- Reside account: +$50 revenue on the hedge (adjusted by the lot multiplier).

The problem took a success. However your reside account profited from the identical transfer.

If the problem ultimately fails (hits max drawdown):

For example the problem account slowly attracts down and ultimately breaches the 6% max drawdown restrict. The problem is terminated. Your $300 charge is gone.

However over the course of all these dropping trades on the problem, your reside account was making the most of the hedge. Relying in your restoration settings, your reside account gained sufficient to cowl that $300 charge — or extra.

Web outcome: You misplaced the problem however recovered your charge. The failure value you nothing.

The Lot Multiplier: How one can Calculate Your Hedge Measurement

That is an important quantity in all the system.

The lot multiplier determines how massive the hedge trades are in your reside account relative to the problem trades. It solutions the query: “How a lot do I must make on the hedge to recuperate my charge if the problem fails?”

This is the mathematics:

- Problem charge: $300

- Problem max drawdown: 6% of $50,000 = $3,000

If the problem fails, it should have misplaced as much as $3,000 earlier than being terminated. Your hedge — buying and selling reverse — may have gained near $3,000 (minus unfold and execution variations).

However you do not want $3,000 in hedge revenue. You solely want $300 to interrupt even on the charge.

So the hedge solely must seize 10% of the problem’s motion to recuperate the charge.

Lot multiplier: 0.10x (10% of the problem lot dimension)

If the problem trades 0.50 tons, the hedge trades 0.05 tons.

That is the break-even multiplier. It retains your reside account threat small whereas nonetheless recovering the total charge if the problem fails.

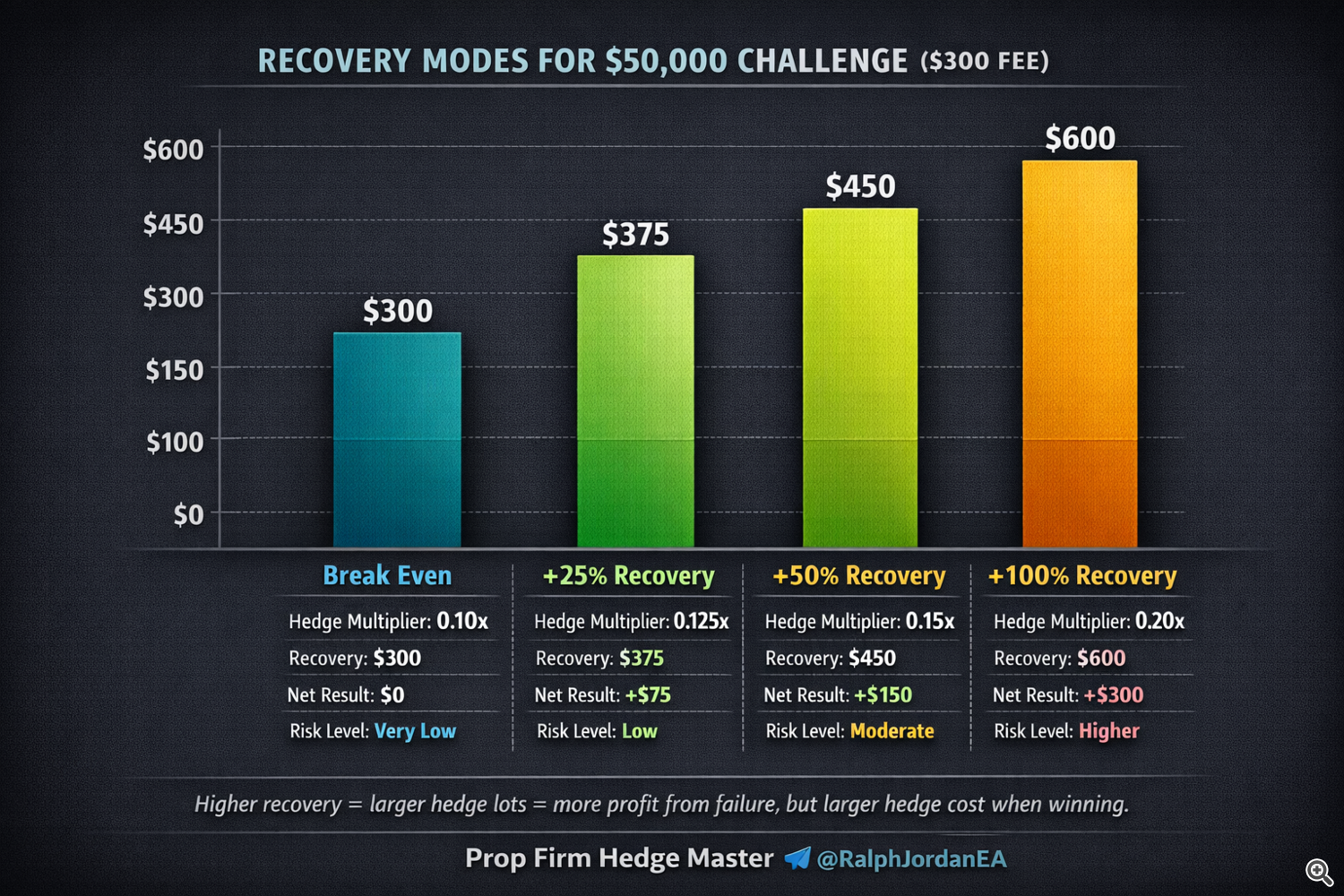

Restoration Modes: Selecting How A lot You Need Again

Break even is only one choice. You possibly can regulate the multiplier to recuperate extra:

Break Even (1x charge restoration)

- Hedge multiplier: ~0.10x

- If problem fails, you recuperate the $300 charge

- Web outcome: $0 (charge absolutely lined)

- Reside account threat: Very low

+25% Restoration

- Hedge multiplier: ~0.125x

- If problem fails, you recuperate $375

- Web outcome: +$75 revenue from failing

- Reside account threat: Low

+50% Restoration

- Hedge multiplier: ~0.15x

- If problem fails, you recuperate $450

- Web outcome: +$150 revenue from failing

- Reside account threat: Average

+100% Restoration (Double Charge)

- Hedge multiplier: ~0.20x

- If problem fails, you recuperate $600

- Web outcome: +$300 revenue from failing (you made again double the charge)

- Reside account threat: Increased

The tradeoff is easy: larger restoration = bigger hedge tons = extra revenue when the problem fails, but additionally bigger losses on the hedge when the problem is profitable.

Most merchants begin with break even or +25%. It retains the hedge value low throughout profitable intervals whereas absolutely defending the charge.

The Full Image: Cross vs. Fail

Let’s put all of it along with an entire state of affairs.

$50,000 problem. $300 charge. Break-even hedge.

In case you cross:

- Problem account: Hit 8% goal = $4,000 in revenue

- You obtain a funded $50,000 account (typical 80/20 break up on earnings)

- Reside account hedge losses through the problem: ~$300

- Web: Funded account minus $300 in hedge prices. Huge win.

Why that is nonetheless an enormous win — even with the hedge value.

For example you are taking 2 challenges and cross 1.

- Problem 1: Failed. Charge was $300, however the hedge recovered it. Value: $0.

- Problem 2: Handed. Charge was $300 + ~$300 hedge insurance coverage. Value: $600.

Whole value to accumulate a funded $50,000 account: $600.

Your usable capital is the max drawdown — 6% of $50,000 = $3,000. You simply turned $600 into $3,000 in buying and selling capital. That is 5:1.

Now evaluate that to the business commonplace — a ten% cross price. The typical dealer wants 10 makes an attempt at $300 every. That is $3,000 in charges to get the identical $3,000 in usable capital. 1:1.

| With out Hedge | With Hedge (1 cross out of two) | |

|---|---|---|

| Whole charges spent | $3,000 (10 makes an attempt) | $600 (2 makes an attempt) |

| Charges misplaced on failures | $2,700 | $0 (recovered) |

| Usable capital (6% DD) | $3,000 | $3,000 |

| Value-to-capital ratio | 1:1 | 1:5 |

In case you fail:

- Problem account: Breached drawdown. Charge misplaced ($300).

- Reside account hedge earnings: ~$300

- Web: $0. Charge recovered. You attempt once more with no monetary loss.

Examine this to buying and selling and not using a hedge:

- In case you cross: Funded account. Similar outcome.

- In case you fail: -$300. Gone. Nothing to point out for it.

Cross the problem and the hedge value turns into multiplied capital. Fail, and it saves you every part.

Widespread Misconceptions About Hedging

Let me clear up the questions I hear most frequently.

“Would not the hedge cancel out all of your earnings?”

No. The hedge tons are a lot smaller than the problem tons. When the problem wins a commerce, the hedge loss is a fraction of the win. Over a profitable problem, the whole hedge value is roughly equal to the problem charge — which is all the level. You are buying and selling the charge for certainty.

“Is not this simply breaking even on every part?”

No. If you cross the problem, you get a funded account value tens of hundreds in potential payouts. The hedge solely prices you through the problem interval. When you’re funded, you commerce usually and not using a hedge.

“Cannot I simply do that manually?”

Technically, sure. Virtually, no. Guide hedging means watching two platforms concurrently, opening trades at the very same time, calculating lot sizes on the fly, and by no means lacking a single commerce. One missed hedge — one commerce that goes unprotected — and the mathematics falls aside. I attempted handbook hedging early on. It was exhausting, error-prone, and unsustainable. That is why I automated it.

“Will not the prop agency detect it?”

It is a actual concern, and it is why the system must be designed rigorously. In case your problem trades look equivalent to hundreds of different accounts — identical entries, identical exits, identical timing — you may get flagged. The system wants randomization: random technique choice from a big pool, different entry timing, completely different magic numbers, distinctive commerce patterns per account. That is one thing I spent a very long time getting proper.

“Do I would like an enormous account for the hedge?”

By no means. As a result of the hedge tons are a lot smaller than the problem tons, you do not want a lot capital. For a $50,000 problem with break-even hedging, a reside account with $1,000-$2,000 is usually ample. The precise quantity will depend on your restoration mode and the lot multiplier.

“What in regards to the unfold value on either side?”

Sure, you are paying unfold twice — as soon as on the problem, as soon as on the hedge. However the whole unfold value throughout a problem is usually just a few {dollars} to some tens of {dollars}. In comparison with dropping a $300 charge completely, the unfold value is negligible.

Why You Want Two Completely different Brokers

This comes up each time, so let me be direct:

Your problem account and your hedge account should be at completely different brokers.

In the event that they’re on the identical dealer, the dealer can see each accounts. They’ll see that your trades are mirrored. They’ll flag it, examine it, and doubtlessly void your problem.

Even when they’re at completely different brokers however these brokers share the identical liquidity supplier or back-end platform, there is a threat. The nearer the infrastructure relationship between the 2 brokers, the upper the possibility of detection.

Greatest observe:

- Problem account: on the prop agency’s designated dealer

- Hedge account: at a totally unbiased retail dealer with no relationship to the prop agency

That is non-negotiable. Slicing corners right here places every part in danger.

Why Automation Issues

I wish to be sincere about one thing: hedging works with out automation. The maths is the mathematics. In case you can efficiently place reverse trades on two accounts on the identical time, each time, with the right lot sizes, you may get the identical outcome whether or not a robotic does it otherwise you do.

However in observe, handbook hedging fails for 3 causes:

1. Pace

The hedge commerce must open inside seconds of the problem commerce. Any delay means a unique value, which adjustments the mathematics. Markets transfer quick. Your fingers do not.

2. Consistency

It’s essential hedge each single commerce. Not most trades. Each commerce. Miss one, and if that is the one the place the problem takes an enormous loss, you are unprotected when it issues most. It is simple to hedge whenever you’re at your desk. It is inconceivable whenever you’re sleeping, working, or simply residing your life.

3. Precision

The lot sizes have to be calculated appropriately each time. The multiplier must account for various pip values throughout completely different pairs. Psychological math beneath time stress results in errors. One miscalculated lot dimension can imply the distinction between full restoration and partial restoration.

Automation solves all three issues. The EA opens the hedge commerce in milliseconds, by no means misses a sign, calculates lot sizes exactly, and runs 24/5 while not having you on the display screen.

Are you able to hedge manually? Sure. Do you have to? Not if you wish to do that persistently throughout a number of challenges.

How I’ve Used This System

I’ll maintain this straightforward as a result of the numbers converse for themselves.

I have been operating this hedging system for years. I’ve accomplished over 300 prop agency challenges. I’ve collected greater than $500,000 in verified payouts from funded accounts.

Not each problem handed. That is the purpose — they do not all must.

After I cross, I get a funded account and begin incomes payouts. After I fail, the hedge recovers my charge. Typically I set restoration larger and truly revenue from failing.

The result’s a system the place I can take problem after problem, with zero monetary threat on the charge, and each cross provides a brand new funded account to my portfolio.

It took years to refine. Getting the technique pool proper. Getting the anti-detection options working. Getting the hedge timing exact. Getting the restoration math correct throughout completely different account sizes and prop agency guidelines.

Ultimately I packaged the entire thing into two EAs and launched them so different merchants may use the identical system with out spending years constructing it themselves.

The Backside Line

Prop agency hedging is not difficult. It is two accounts, reverse trades, and primary math.

- If you win the problem, you pay a small hedge value and get a funded account

- If you lose the problem, the hedge recovers your charge

- The lot multiplier controls precisely how a lot you recuperate

- Restoration modes allow you to select: break even, +25%, +50%, or +100%

- Automation makes it constant, exact, and hands-free

- Completely different brokers maintain it clear

That is how I turned prop agency challenges from a chance right into a enterprise. And it is out there to anybody keen to study the system.

The 2 EAs that run this technique — Prop Agency Hedge Grasp (for the problem account) and Prop Agency Hedge Reside (for the hedge account) — can be found on MQL5 Market. Hedge Grasp runs over 1,000 technique mixtures with built-in anti-detection options. Hedge Reside routinely mirrors the alternative trades in your private account with exact lot calculation.

You probably have questions in regards to the setup or wish to see how the mathematics works on your particular problem dimension, be happy to succeed in out.