I’ve actually needed to put in writing an article on why I hate day-trading for a while now…as a result of I truly do HATE it…Day-trading is one thing that everybody is aware of about; you would stroll as much as any stranger and say “what do you consider day-trading?”, and they might in all probability say one thing like “dangerous, however it may well make you wealthy actually quick”. Day-trading is without doubt one of the primary concepts that lures folks into the buying and selling world; they assume they’ll make some quick cash and stay the “dream” if they only discover ways to “day-trade”. Nonetheless, as soon as they fight it, most individuals rapidly notice that it’s time intensive, traumatic, and very tough to make constant cash at.

I’ve actually needed to put in writing an article on why I hate day-trading for a while now…as a result of I truly do HATE it…Day-trading is one thing that everybody is aware of about; you would stroll as much as any stranger and say “what do you consider day-trading?”, and they might in all probability say one thing like “dangerous, however it may well make you wealthy actually quick”. Day-trading is without doubt one of the primary concepts that lures folks into the buying and selling world; they assume they’ll make some quick cash and stay the “dream” if they only discover ways to “day-trade”. Nonetheless, as soon as they fight it, most individuals rapidly notice that it’s time intensive, traumatic, and very tough to make constant cash at.

In case you get hooked on day-trading you’ll enter right into a sport of ‘amount over high quality’ of trades, and that’s not what we imagine in right here at Study To Commerce The Market. Our aim is to assist merchants ‘protect capital’ and wait patiently for less than the ‘excessive likelihood trades’. Hopefully this text offers you some perception into why day buying and selling is usually a freeway to catastrophe for many merchants.

I hate the façade of the stereotypical “day-trader”…

There appears to be an impression among the many basic public that in case you’re a monetary market speculator of any sort you’re a “day-trader” sitting at dwelling in entrance of a number of displays making tons of frantic keystrokes and cellphone calls all day. Certainly, it appears extra prestigious for us to inform our buddies and acquaintances that we’re “day-traders” throughout a lunch or dinner dialog…as a result of whenever you inform somebody you’re a day-trader they instantly get a sure picture of their head. In case you say “I’m a every day chart swing-trader and I commerce 4 to 10 occasions per thirty days”….effectively that simply sounds so much much less glamorous doesn’t it?

This Phantasm of the “day-trader” is one thing that appeals to many individuals just because they wish to say they’re “day-traders”…there’s a sure notion of being some younger and wealthy “day-trader” making hundreds of thousands and having a Ferrari…it ain’t actuality although…

The fact of a day-trader is a man who acquired 2 hours of sleep final evening as a result of he was attempting to commerce the in a single day session, now he’s up at 6am attempting to day-trade the subsequent session. Many merchants get sucked into attempting to change into a wealthy day-trader largely as a result of that’s what they assume is socially acceptable or “cool”, and it turns into them being glued to the charts each probability they get and possibly not making a lot cash (if any). This isn’t a wholesome approach to commerce and it’s undoubtedly not a wholesome approach to discover ways to commerce.

High down strategy

As a buying and selling educator, it makes me HATE day-trading much more once I take into consideration all of the buying and selling web sites on the market selling it and the way a number of them are geared in direction of newbie merchants, to not point out how closely day-trading and scalping are mentioned in nearly each public buying and selling dialogue discussion board on the web. Day-trading is one thing that ought to solely be tried by a really skilled dealer, and possibly ought to simply not be tried in any respect.

You’ll want to consider buying and selling like constructing a home; first you want a basis to construct the home on, then as the home progresses you get all the way down to finer and finer particulars till lastly you might be discussing the best way to embellish the inside and what sort of TV to purchase. As a dealer, you NEED to grasp how the greater timeframe charts work and better timeframe worth dynamics earlier than you try buying and selling the decrease time frames. Buying and selling ought to ALWAYS be taught and discovered in a top-down technical strategy, so that you just perceive what the upper time frames are doing earlier than you strive decrease timeframe buying and selling or day-trading. That is how I educate my college students in my buying and selling programs and it’s how I’ve personally traded for over a decade..

Most Brokers CA$H in on day-traders (not all, however most)

One more reason why I hate day-trading is that there’s undoubtedly a monetary incentive for brokers to get folks to commerce extra ceaselessly. It’s quite simple, extra trades equals more cash from spreads or commissions and that equals more cash for the dealer. So, there’s an underlying bias by many brokers and the higher Foreign exchange trade to get merchants hooked on buying and selling as ceaselessly as attainable. Brokers who’ve wider spreads earn more money off you each time you commerce, so they need you to commerce. Thus…day-traders make some huge cash for a lot of brokers; this is the reason you aren’t going to see any details about the perils of day-trading on most brokers’ web sites.

It’s value noting that not all brokers do that; some brokers have very tight spreads and don’t emphasize day-trading, and that is fairer on the dealer, however most easily don’t. A Foreign exchange dealer is ready of “authority” to the unsuspecting beginner retail dealer who assumes the dealer effectively all the time do what’s in the very best curiosity of their shopper. The purpose is that this; make certain you select your dealer correctly.

I’ve been buying and selling for over 10 years and I nonetheless don’t “day-trade”…that ought to let you know one thing proper there. Once more…it comes again to preserving your individual capital…whenever you commerce extra ceaselessly you give more cash to your dealer in spreads or commissions, leaving you with much less cash to commerce with whenever you get high-probability indicators available in the market.

Cease-hunters love day-traders

Day merchants naturally have cease losses nearer to the market worth since they’re usually buying and selling intra-day charts and attempting to get fast beneficial properties with tight stops. The “huge boys” and institutional merchants love the typical retail day-trader as a result of they offer them loads of stops to “hunt”. Being a day dealer and getting into a number of trades every week means it’s so much tougher to have a excessive profitable proportion, largely since you get stopped out a lot. Institutional merchants have entry to info on order circulate and the place stops are positioned; it’s not solely brokers who go “cease searching” however the larger institutional merchants who can “sniff out” the place the smaller intra-day merchants are putting their stops. Have you ever ever seen how in case you attempt to commerce intra-day the market tends to hit your cease after which reverse again within the course of your preliminary place? The extra day-trades you enter the higher threat you run of getting “stop-hunted” by the massive boys.

Instance Of Cease Looking In Motion

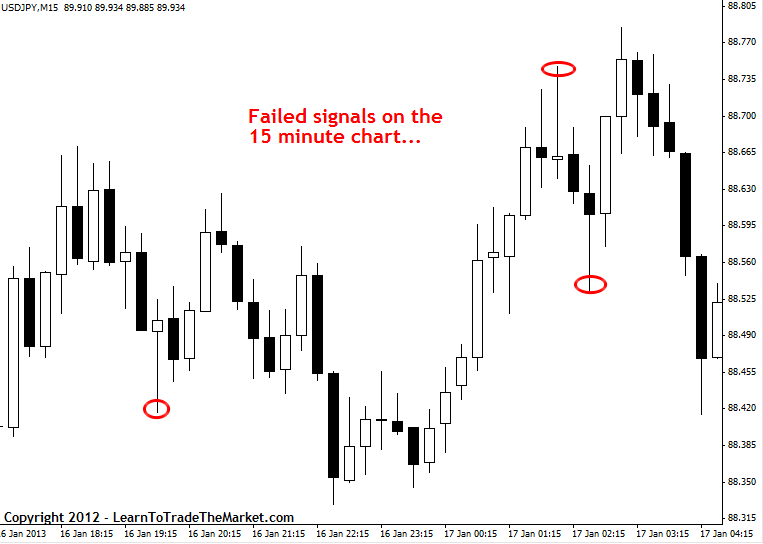

Within the chart instance beneath, we’re a 15minute USDJPY chart from earlier this week. Now, had you been attempting to day-trade this 15 minute chart you in all probability would have talked your self into buying and selling all three of the pin bar setups beneath…

Instance of How To Keep away from Cease-Looking

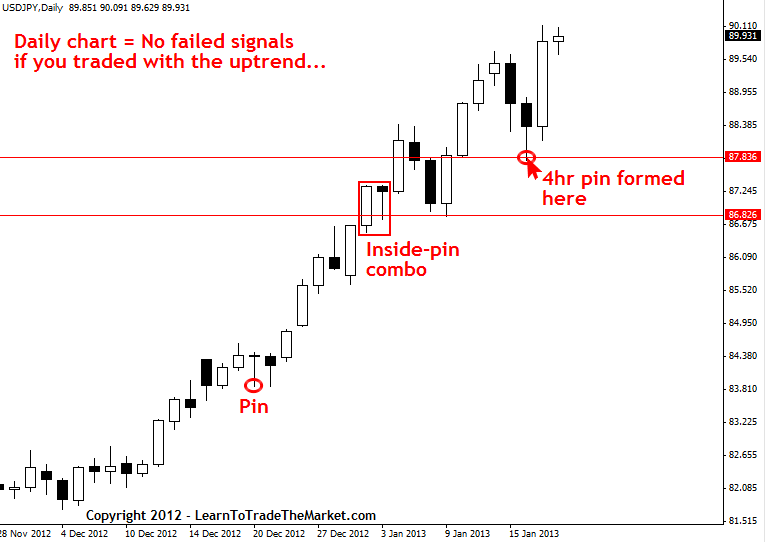

Now check out the every day USDJPY chart beneath…none of these 15 minute failed pin bar setups are even seen…by specializing in the every day chart you give the “stop-hunters” much less prey, and also you save your self cash, time and stress:

Market Noise: Excessive-frequency and quant algorithm merchants harm retail day-traders

With the appearance of high-frequency and quantitative algorithmic buying and selling, we have now intra-day charts which are filled with false-signals and what I prefer to name “market noise”. A retail day-trader in at the moment’s markets has a a lot harder time attempting to show a revenue than they did even about 10 years in the past earlier than all this high-frequency pc buying and selling was so prevalent. These high-frequency merchants have what is basically an “unfair” edge as a result of they see the info that we see however so much sooner. (you’ll be able to learn an article later about excessive frequency buying and selling right here). This sort of buying and selling has actually modified the “nature” of intra-day charts from what they was, making them extra erratic and fewer predictable, which clearly makes it so much tougher for the typical retail day-trader to learn the chart…

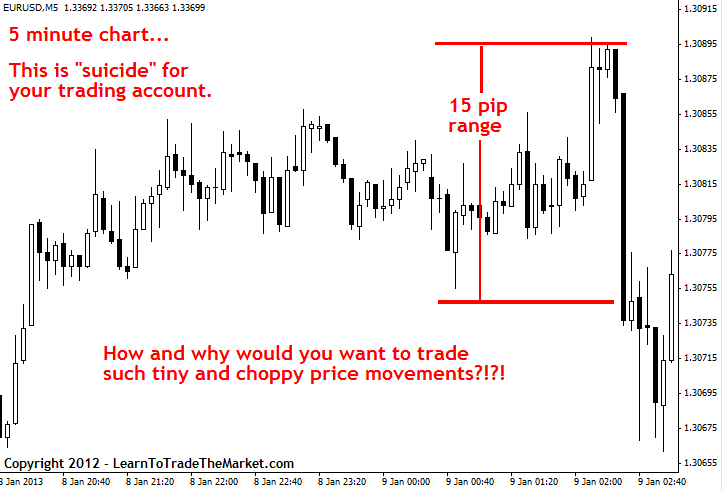

Word all of the “noise” on this chart…it’s a 5 minute chart and is barely displaying a couple of 15 pip vary…it is a very messy and tough chart to try to commerce…discover all of the failed indicators and “shake outs” that occurred…one of these buying and selling will chop your account to items very quick

That is another excuse I actually hate day-trading; who desires to attempt to sift via a sea of false-signals and market noise when you’ll be able to so simply “easy” all of it out by wanting on the greater timeframe charts? As a few of you realize, I solely educate and commerce on time frames above the 1 hour, and even the 1 hour shouldn’t be a timeframe I personally commerce fairly often. The 4 hour and every day time frames are my favourite, and I actually take into account something beneath the 1 hour to be buying and selling account “suicide”.

Filter out the “B.S.”

Day-trading ingrains and reinforces the “extra is healthier” mindset which is mainly playing, as an alternative of the “much less is extra” strategy of swing buying and selling the upper time frames. As we have now seen, at the moment’s retail day-trader is up towards some fairly stiff competitors within the type of tremendous computer systems and algorithms which are programmed by math “wizards”. Why waste your time and fry your nerves attempting to compete towards such gamers with one of these unfair benefit when there’s a a lot simpler and extra profitable approach to commerce?

This is the reason I commerce the 4 hour and every day charts; they filter out all of the “B.S.” that occurs on the small time frames on account of all these super-computer-math-wiz-algorithms. I assume if I actually needed to clarify the distinction between day-trading and better timeframe swing buying and selling it will be this; work smarter, not tougher. Buying and selling on the upper time frames and ignoring all of the chop and “B.S” that day-traders attempt to take care of is absolutely the way you commerce smarter. If you need extra coaching and instruction on the best way to commerce “smarter” on the upper time frames, checkout my Foreign currency trading course and members group for more information.

Good buying and selling, Nial Fuller

I WOULD LOVE TO HEAR YOUR THOUGHTS, PLEASE LEAVE A COMMENT BELOW 🙂

Any questions or suggestions? Contact me right here.