As merchants, it may possibly typically appear as if we’re in a relentless battle in opposition to an invisible enemy who all the time appears to have the higher hand on our subsequent transfer available in the market. It may possibly appear as if there’s a “thief” stealing our treasure each time we’re sooo near securing it. In the long run, we all know that we now have nobody in charge for our buying and selling failures however ourselves. Nonetheless, it may be onerous to grasp why you appear to constantly defeat your self available in the market…it may possibly really feel like you’re taking pictures your self within the foot many times, with an invisible gun.

As merchants, it may possibly typically appear as if we’re in a relentless battle in opposition to an invisible enemy who all the time appears to have the higher hand on our subsequent transfer available in the market. It may possibly appear as if there’s a “thief” stealing our treasure each time we’re sooo near securing it. In the long run, we all know that we now have nobody in charge for our buying and selling failures however ourselves. Nonetheless, it may be onerous to grasp why you appear to constantly defeat your self available in the market…it may possibly really feel like you’re taking pictures your self within the foot many times, with an invisible gun.

In at the moment’s lesson, we’re going to attempt to get to the foundation of why merchants are inclined to sabotage their very own efforts available in the market and what they will do to cease it. In spite of everything, if you happen to don’t perceive an issue you haven’t any probability of fixing it; so step one to enhancing your poor buying and selling efficiency is to grasp what’s inflicting you to fail within the first place. Then, you’ll be able to devise a plan to counteract the explanations you’re failing so as to get on the street to profitable Foreign currency trading.

Two sides of the identical mind

As Jason Zweig discusses in his guide Your Cash & Your Mind: How the brand new science of neuroeconomics might help make you wealthy, our brains can mainly be categorized into two primary sections; the “reflexive system” and the “reflective system”. As Zweig factors out, our reflexive mind system is the one which controls our emotions and feelings, and it tends to be interested in what feels good whereas avoiding what feels unhealthy, whereas the reflective mind system is extra analytical and used extra for advanced pondering and planning. For 1000’s of years our reflexive mind system served us very effectively; serving to us to keep away from battle with giant predators and search meals and reproductive companions. Nonetheless, as people and societies have developed, the flexibility to take a position and commerce cash developed…and on this new setting these older reflexive mind techniques are inclined to trigger numerous issues.

As merchants, we’re continually making selections in our minds which are influenced by each emotion and logical reasoning. Being too emotional is clearly unhealthy for a dealer as a result of it may possibly trigger her or him to tackle an excessive amount of threat, commerce too ceaselessly, develop into offended, unhappy, over-confident, annoyed, revengeful and extra. Nonetheless, being too analytical and inflexible in our market evaluation and buying and selling will also be detrimental to our progress within the markets. What is required is the best mixture of each “intestine” buying and selling really feel (emotion/instinct) and goal determination making and evaluation…

Most merchants fall into two classes; they’re both too analytical and inflexible or they’re too intuitive and emotional. Skilled merchants have discovered a stability between their “intestine” buying and selling instincts and their extra inflexible / analytical mind areas; and that is why they’re execs.

Your mind is sort of a muscle

The mind is sort of a muscle; the extra it does one thing the higher it will get at it. Research present that once you use the identical mind pathways time and again, as in taking part in an instrument or studying another ability, these neurological pathways and connections develop into stronger and extra environment friendly. While that’s nice for studying one thing optimistic and constructive, it’s additionally true that our brains get higher at doing unfavourable and damaging issues if we proceed to do them. For instance, if you happen to continually take into consideration being afraid to fly in airplanes and watch movies of airplane crashes, you’re coaching your mind to be extra petrified of flying than you in any other case could be. Everybody is aware of driving is statistically much more harmful than flying, however as a result of most of us affiliate flying extra with “hazard”…we really feel as if flying is extra harmful.

The mind is sort of a muscle; the extra it does one thing the higher it will get at it. Research present that once you use the identical mind pathways time and again, as in taking part in an instrument or studying another ability, these neurological pathways and connections develop into stronger and extra environment friendly. While that’s nice for studying one thing optimistic and constructive, it’s additionally true that our brains get higher at doing unfavourable and damaging issues if we proceed to do them. For instance, if you happen to continually take into consideration being afraid to fly in airplanes and watch movies of airplane crashes, you’re coaching your mind to be extra petrified of flying than you in any other case could be. Everybody is aware of driving is statistically much more harmful than flying, however as a result of most of us affiliate flying extra with “hazard”…we really feel as if flying is extra harmful.

The purpose is that this: the extra you do one thing; something, the extra environment friendly your mind will get at it and also you develop into extra routine at it. For buying and selling, this implies, if you’re caught in a cycle of over buying and selling and risking an excessive amount of or of being afraid of the market, you will proceed to do these issues increasingly more till you one way or the other break away from them.

Merchants can dig themselves very deep psychological holes if they begin buying and selling with out an efficient buying and selling technique or buying and selling plan and with poor threat administration expertise. What occurs to many merchants is that they begin out buying and selling poorly like this after which they get fortunate and perhaps hit just a few massive winners, then their account goes optimistic they usually’ve simply begun a really harmful strategy of reinforcing poor buying and selling habits of their mind. When you get just a few random rewards (giant profitable trades) available in the market, your mind tries to get you to recreate no matter you probably did to get these rewards; whether or not they got here from optimistic or unfavourable buying and selling habits. Sadly, if a dealer is behaving like a gambler available in the market and hits just a few massive winners, she or he has simply began down a really slippery slope as a result of this playing habits will get entrenched into their neurological pathways deeper and deeper every day they commerce like this.

Your mind is usually “in the best way”

When are “reflexive and reflective” mind techniques aren’t in stability available in the market, we are inclined to make errors like regularly making an attempt to choose the highest of an uptrend, the underside of a downtrend, or getting into simply because the market is about to reverse…these are emotional buying and selling errors. The explanation folks do issues like this within the markets is primarily as a result of they’re utilizing an excessive amount of “intestine really feel” of their buying and selling, or moderately, they’re letting the motion of the market affect their emotion an excessive amount of.

Conversely, merchants who use their “reflective” brains an excessive amount of would possibly over-analyze the markets an excessive amount of, assume an excessive amount of and develop into fearful about buying and selling, inflicting them to overlook out on completely good commerce setups. Once more, we have to discover a stability between these opposing forces in our mind…

Once you begin to really feel excited in regards to the prospect of choosing a precise turning level in a trending market or about getting into right into a runaway “sure-thing” trending market after it’s prolonged….it is advisable to decelerate and let your “reflective” mind system kick in and do some goal evaluation to see if what you feel stacks up in opposition to goal logical reasoning. Equally, if you end up studying the Wall Avenue Journal, watching CNBC and taking a look at each chart time-frame accessible in your charts, it is advisable to cease pondering and analyzing a lot and easily attempt to get “in-tune” extra with the ebb and move of the value motion on the chart. Then, after utilizing each the “reflexive” and “reflective” areas of your mind it is best to be capable to make one of the best determination.

Chart examples:

The fact of buying and selling is that dropping and struggling merchants are sometimes late on tendencies and early on pattern adjustments. Which means, they enter when a pattern is already prolonged as a result of that’s when it appears to be like and “feels” protected, they usually attempt to choose the precise turning level primarily based on intestine really feel alone, moderately than ready for a value motion buying and selling technique to align with their intestine really feel.

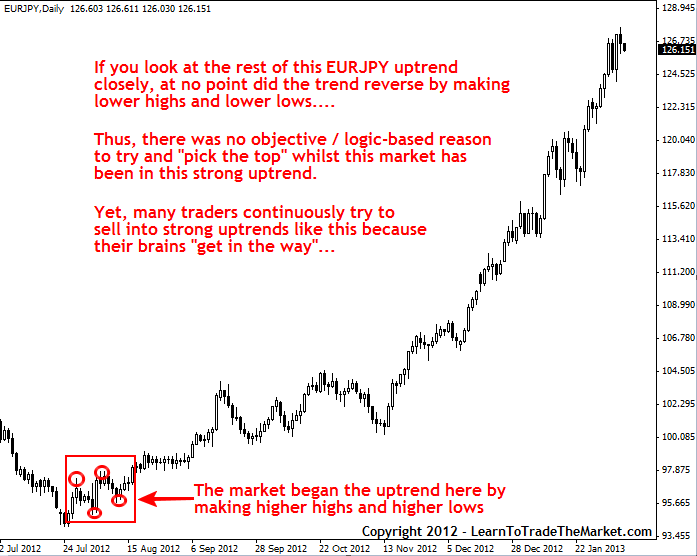

Selecting tops (or bottoms): Within the picture under, we see the present uptrend within the EURJPY. Despite the fact that there was no logic or value action-based cause to promote into this robust pattern, many merchants little question tried anyhow…as a result of they saved pondering issues like “it may possibly’t probably go a lot increased…”, and many others:

As markets pattern, they ebb and move, this simply signifies that after they push ahead or decrease, they’ll then rotate again to “worth” (worth means help and resistance areas). Many starting and struggling merchants have a tendency to purchase close to the highs in an uptrend and promote close to the lows in a downtrend. In different phrases, they’re shopping for an uptrend (or promoting a downtrend) solely as a result of it feels “protected”, not as a result of there’s a value action-based cause to enter.

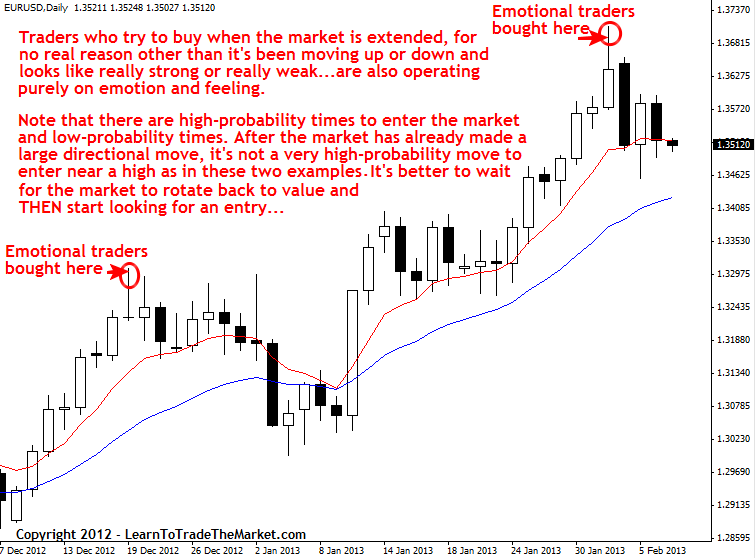

Coming into a pattern too late: Within the picture under, we will see the present EURUSD chart and an instance of how merchants purchase on the prime of strikes, simply because it feels good or “protected”:

Sadly, in buying and selling, we frequently must do the other of what “feels” proper…we have to promote when the market is excessive and purchase when the market is low…this appears easy sufficient however in actuality it’s troublesome for most individuals to disregard the urge to purchase solely as a result of the market is screaming increased or promote solely as a result of it’s falling decrease…as a substitute, we have to anticipate a value motion sign to “affirm” our entry.

Our pure tendency is to assume the market will maintain going if it appears to be like actually robust or weak, however in actuality when the market appears to be like and “feels” its strongest or weakest, it’s normally about able to rotate again to worth. So, it’s the value motion alerts from or close to “worth” that we wish to search for, that’s if we’re buying and selling with the pattern. Counter-trend buying and selling will be completed from extremes when the market is prolonged, nevertheless it’s riskier and will solely be tried after you’re skilled buying and selling with the pattern.

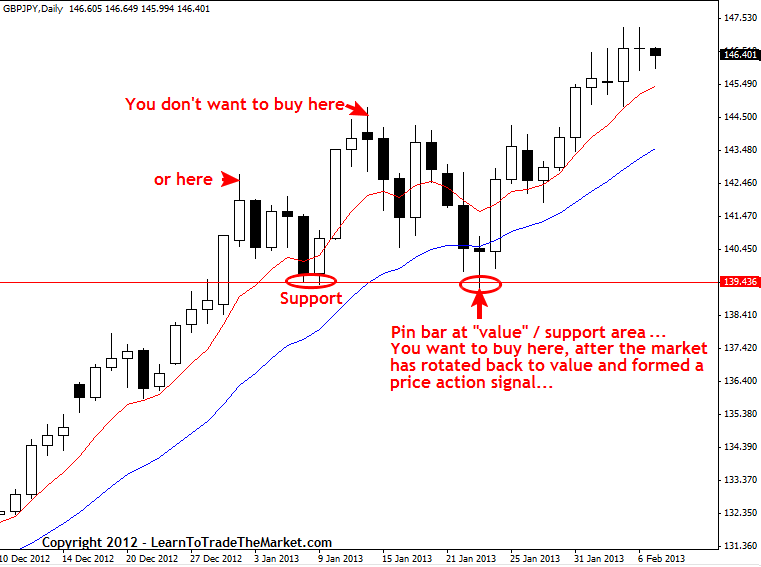

Within the picture under, we’re taking a look at an instance of utilizing your mind “correctly” to commerce the market. We wait till the market rotates again to a high-probability stage or space after which varieties a value motion entry set off to “affirm” our entry:

The best way to get your mind “out of the best way”

While there is no such thing as a tablet you’ll be able to swallow that may optimize your mind for buying and selling success, you should utilize what about how the mind works to your benefit. For instance, we mentioned earlier how the mind is sort of a muscle and can get higher and extra environment friendly at something it does repetitively. Thus, it is advisable to first work out HOW you have to be buying and selling if you happen to don’t already know, after which begin buying and selling that method with the intention to make it a behavior. Many merchants understand how they need to commerce however they merely don’t do it as a result of being disciplined is more durable than not being disciplined. Equally, most individuals know the right way to eat wholesome and train…however as a result of it feels higher to eat a Massive Mac now moderately than a wholesome salad…most individuals rationalize to themselves one thing like “I’ll eat wholesome later, however now I would like this”. Sadly, “later” tends to by no means come and most of the people regularly give in to their short-term temptations on the sacrifice of a a lot better longer-term profit that appears out of contact or distant when they’re “within the second”.

Primarily, what is required to “overcome your individual mind” within the markets, is the self-discipline to stick to a an efficient buying and selling technique and buying and selling plan over an extended sufficient time period so that you simply begin to see optimistic outcomes. These optimistic outcomes will then reinforce the optimistic buying and selling habits that it took to provide them…and earlier than it you’re a dealer with optimistic habits moderately than one with unfavourable account-destroying habits.

There are mainly two conditions that merchants finds themselves in on any given day available in the market; they’re both in a commerce or about to be in a single / trying and ready for one to kind.

What it is advisable to perceive is that in each of those eventualities, there’s loads of room in your mind to “get in the best way” and sabotage your buying and selling. In the event you’re already in a commerce, your mind will most likely over-analyze the market situations by arising with a thousand various things that “may occur”. In the event you’re flat the market and in search of a commerce, you need to be very cautious in opposition to getting into ONLY since you really feel a sure method from what the market is doing. Intestine buying and selling really feel and instinct is necessary and it performs a giant position in value motion buying and selling and in how I personally commerce….however you need to maintain it in-check. You can’t commerce purely off intestine really feel or purely off inflexible analytical pondering, you’ve acquired to stability out your pondering with a wholesome mixture of each.

Discovering and sustaining the best mixture of instinct or “intestine” buying and selling really feel and goal market evaluation & determination making, is actually the way you develop into a profitable dealer. Studying the buying and selling methods and strategies that I educate in my value motion buying and selling course will enable you to develop each your “intestine” buying and selling really feel in addition to your analytical interested by the markets.

Good buying and selling – Nial Fuller

Sources: http://www.amazon.com/Your-Cash-Mind-Science-Neuroeconomics/dp/074327668X