Cash administration is just like the “elephant within the room” that almost all merchants don’t wish to speak about. It may be boring, embarrassing, and even emotionally painful for some merchants to speak about threat and capital administration, as a result of they know they aren’t doing it proper.

Cash administration is just like the “elephant within the room” that almost all merchants don’t wish to speak about. It may be boring, embarrassing, and even emotionally painful for some merchants to speak about threat and capital administration, as a result of they know they aren’t doing it proper.

Nevertheless, as with something in life, speaking in regards to the “elephant within the room” is often the most effective factor you are able to do to enhance your Foreign currency trading. This implies, being trustworthy with your self and specializing in the “hardest” or most boring issues first and as usually as needed. For those who ignore this stuff they may usually develop into large issues which you can not management.

In at present’s lesson, I’m going that can assist you perceive a number of the extra necessary features of managing your threat and capital as you commerce the markets. This lesson will reply many questions I get from merchants asking about breakeven stops, trailing cease losses, and extra. So let’s get began…

Preserve threat constant

The primary “secret” I’m going to let you know about is to maintain your threat constant. As Marty Schwartz stated within the the market wizards article that I quoted him in, “Additionally, don’t enhance your place dimension till you could have doubled or tripled your capital. Most individuals make the error of accelerating their bets as quickly as they begin being profitable. That may be a fast option to get worn out.”

Why do I contemplate this a “secret”? Properly, since most merchants generally tend to extend their threat dimension after a successful commerce or after a sequence of winners, that is usually one thing you wish to keep away from. Mainly, doing the alternative of no matter “most merchants” do could be thought-about a “secret” of buying and selling…and with regards to cash administration there are fairly a number of of those “secrets and techniques”.

I’m a powerful proponent of maintaining threat constant not solely as a result of it’s how different skilled merchants function, however due to classes realized from my very own private expertise as nicely. Earlier in my profession, I used to be the man cranking up my threat after a winner…and eventually after realizing that this was not the precise factor to do, I finished. Additionally, from my observations of merchants that I assist, I do know that many merchants enhance threat after a winner, and it is a huge cause they lose…

After you win a number of trades you generally tend to develop into over-confident…and I ought to stress that there’s nothing inherently unsuitable with you when you do that or have executed it; it’s really human nature to develop into much less threat averse after successful a commerce or a number of trades. Nevertheless, it’s one thing you’ll have to put an finish to if you wish to earn a living buying and selling the markets. For those who’ve learn my article in regards to the one factor it’s worthwhile to learn about buying and selling, you’d know that even when you’re following your buying and selling technique to the T, your winners and losers are nonetheless randomly distributed. This implies, after a successful commerce there isn’t any logic-based cause to assume the subsequent commerce may also be a winner….thus no cause to extend your threat dimension. However, as people, we wish to gamble….and it may be actually exhausting to disregard the sentiments of euphoria and confidence after hitting a pleasant winner…however you HAVE TO if you wish to handle your cash successfully and make a residing available in the market.

Withdraw income

As we mentioned above, maintaining your threat constant or “mounted” is likely one of the keys to profitable Foreign exchange cash administration. Skilled merchants don’t jack up their threat exponentially after each winner…this isn’t a logical or real-world option to handle your threat. Skilled merchants who make their residing within the markets withdraw cash from their accounts every month and most will maintain their accounts funded to across the identical stage every month. For those who’re withdrawing income each month then you wouldn’t maintain growing your threat quantity over time.

What it’s worthwhile to do is construct your account as much as a stage your snug with, after which you can begin withdrawing revenue every month to dwell off of…thus the quantity you threat on every commerce wouldn’t maintain growing as a result of ultimately your buying and selling capital will attain an “equilibrium” stage.

Shifting a cease loss to ‘breakeven’ can kill your account

The massive secret concerning breakeven cease losses is that you shouldn’t transfer your cease loss to breakeven except there’s an actual price-action primarily based, logical cause to take action. Shifting your cease loss to the identical stage that you just simply entered at doesn’t make sense if there’s no cause to take action. Shifting to breakeven arbitrarily or as a result of you could have some pre-decided “rule” to take action is just not an efficient option to handle your trades. What number of instances have you ever moved to breakeven solely to see the market come again and cease you out after which transfer on in your favor? You need to give your trades “room to breathe”, and if there’s no cause to tighten your cease or transfer to breakeven, then don’t.

What you may not understand, is that messing round along with your cease loss or manually closing trades out earlier than they’ve had an opportunity to maneuver, is voluntarily decreasing the flexibility of your buying and selling edge to work in your favor. In brief, when you don’t have a logic-based cause to maneuver to breakeven, then you definitely’re transferring to breakeven primarily based on emotion; primarily concern. It’s essential to overcome your concern of shedding cash, as a result of shedding is a part of being a profitable dealer, and till you discover ways to let a commerce breathe and transfer with out your fixed interference, you’ll not earn a living.

Now, I’m not saying that it is best to by no means transfer to breakeven, as a result of there definitely are instances when it is best to. Under are some logical causes to maneuver your cease loss to breakeven:

• If an opposing sign causes warning and adjustments market circumstances you possibly can take that as a logic-based cause to maneuver to breakeven.

• If the market approaches a key chart stage after which begins to point out indicators of reversing, it is best to take that as a sign that the market would possibly certainly reverse after which path your cease to breakeven.

• For those who’ve been in a commerce over a number of days and nothing is occurring, you would possibly exit the commerce or transfer to breakeven…this is called a “time cease”, or utilizing the factor of time to handle your trades. Typically talking, the most effective trades do are inclined to work out in your favor quickly after you enter.

• If a giant information announcement like Non-Farm Payrolls is popping out and also you’re up a pleasant revenue, you would possibly wish to transfer to breakeven or monitor the commerce. Unstable information bulletins like this could usually change market circumstances.

Don’t be grasping: don’t purpose for giant targets on a regular basis

One other “secret” of cash administration is that it’s important to really take income. This would possibly not likely look like a “secret” to you, however I contemplate it a secret since most merchants merely don’t take income as usually as they need to…and lots of merchants virtually by no means take income. Why do you could have hassle with taking income? It’s easy actually; it’s exhausting to take a revenue when a commerce is in your favor as a result of your pure tendency is to wish to go away a commerce open that’s in your favor. While it is very important “let your winners run”…it’s important to decide and select while you do that; you definitely mustn’t attempt to let each successful dealer run. The market ebbs and flows, and the vast majority of the time it’s not going to make a extremely robust directional transfer with out retracing a whole lot of it. Thus, it makes far more sense as a short-term swing dealer to take a stable 2 to 1 or 3 to 1 revenue when the market is providing it to you…fairly than ready till the market retraces in opposition to your place and strikes all the way in which again in the direction of your entry level or past, at which level you’ll in all probability exit emotionally because you’re mad you let all that open revenue go.

Particularly for merchants with smaller accounts, it’s important to be completely happy taking “bread and butter” rewards of 1 to 1 or 2 to 1 usually….there’s nothing unsuitable with hitting these “singles” and “doubles” to construct your buying and selling account in addition to your confidence. You need to keep away from the temptation of attempting to hit a “house run” on each commerce.

Figuring out when to let a revenue run

From time to time the market will probably be simply ripe for a ten bagger….a home-run commerce. While these trades are uncommon, they do certainly happen, nevertheless it’s important to keep away from the error that many merchants usually make; aiming for a “home-run” on each commerce. More often than not, the market is barely going to maneuver a sure vary every week and month. For instance, the typical weekly vary on the EURUSD is round 250 pips.

Figuring out when to attempt to let a commerce run and when to take the extra sure 1 to 1, 2 to 1 or 3 to 1 reward is basically the place your discretionary value motion buying and selling ability comes into play. I’ll be trustworthy right here as a result of I do get a whole lot of emails asking about when to let trades run versus taking a set threat reward ratio, there’s no “concrete” rule I can provide you besides to say that coaching, display screen time, and “intestine” really feel for studying the charts are issues that you just want as a way to enhance your ability at exiting trades.

I can nevertheless provide you with some easy filters that you need to use to evaluate trades on a case by case foundation to assist decide whether or not or not they’re good candidates to attempt to run into a much bigger winner:

1. Robust breakout patterns – When the market has spent some time consolidating it’ll usually result in a powerful breakout up or down. These robust breakouts can usually be good candidates for “home-run” trades. Nevertheless, not each breakout is equal; some are weaker than others and generally the market makes a false break earlier than the actual breakout happens. So, we have to train warning when buying and selling breakouts, the most secure methods to enter a breakout are the next two situations:

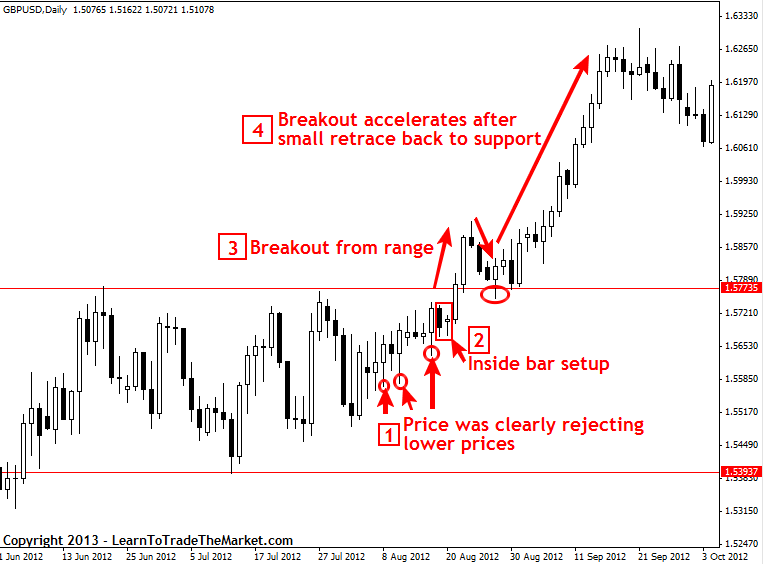

The chart picture under reveals us an instance of getting into the market on a value motion setup in “anticipation” of a breakout. This can be a extra superior option to enter a breakout however it might present a decent cease and a really massive threat reward potential on the commerce. There are often value motion “clues” simply earlier than this sort of breakout; word the bullish tails on the bars that preceded the within bar setup within the chart under. This indicated that momentum was constructing slightly below resistance for a possible upside breakout, then we bought the little inside bar setup slightly below the breakout stage that offered a pleasant “anticipation” entry into the market.

The chart picture under reveals an “anticipation” entry on a value motion sign simply earlier than the breakout:

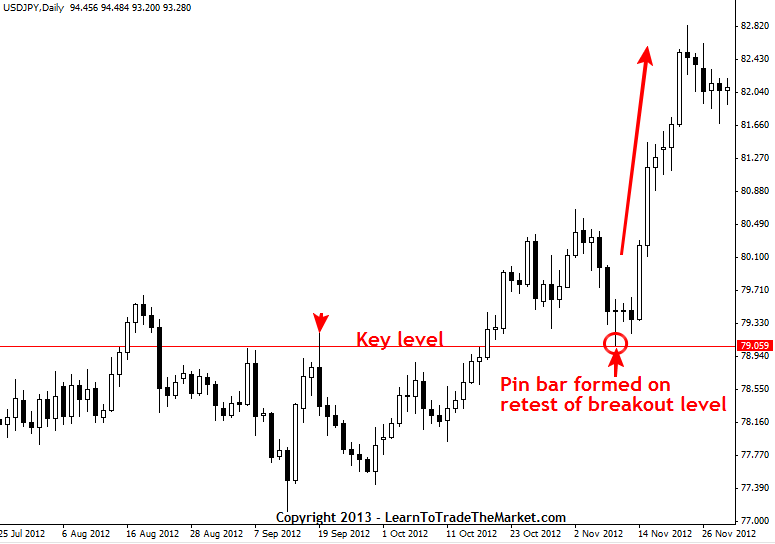

The subsequent option to enter a breakout that might result in the kind of commerce which you can let run into a much bigger winner, is to attend for the market to “verify” the breakout after a retrace again to resistance or assist. As soon as value breaks above or under a key stage it’ll usually come again and retest it earlier than pushing off once more within the route of the breakout. These kind of “confirmed” breakouts from key ranges can be superb alternatives to attempt to path your cease to let the commerce run.

The chart picture under reveals a value motion sign that shaped on a retrace again to the breakout stage:

2. Apparent pattern continuation indicators

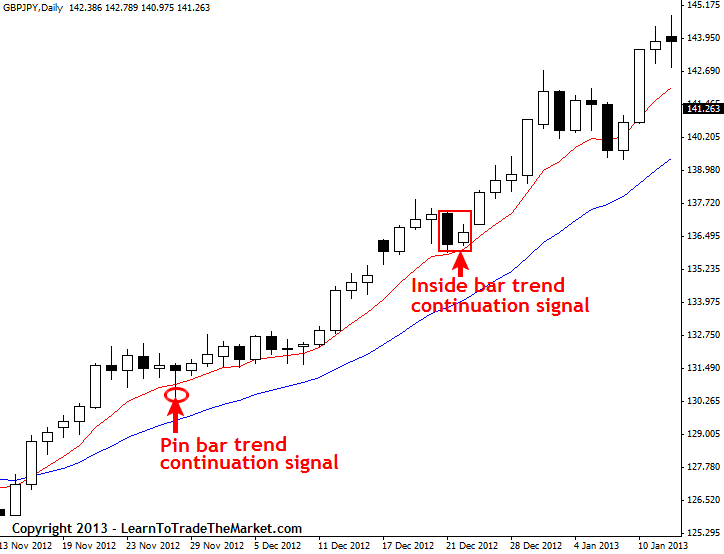

Robust trending markets can clearly be good candidates to attempt to let your commerce run into a giant winner. We generally see very massive potential winners in robust tendencies just like the GBPJPY chart under reveals. Notice, on this instance under, the pattern was clearly up and so any value motion sign that shaped on this robust pattern would have been a superb candidate for a bigger achieve, we will see the pin bar sign and inside bar setup within the chart under might have been very massive winners for anybody who traded them.

The chart picture under reveals a superb instance of buying and selling value motion trend-continuation indicators which could be good candidates for trailing your cease to let the commerce develop into a much bigger winner:

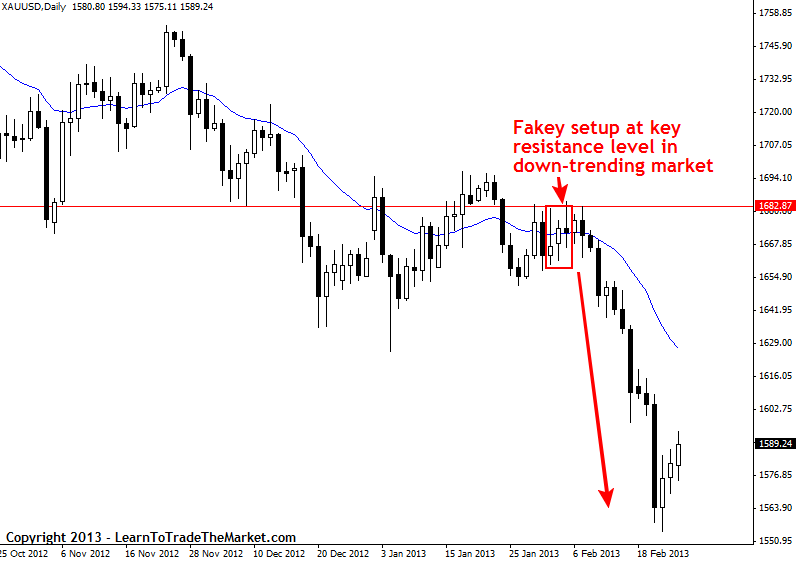

3. Value motion sign at a key stage in robust trending market

One other good situation to search for potential “home-run” trades is after the market retraces to a key stage inside a trending market. Within the chart under we will see a transparent instance of this when a fakey setup shaped just lately within the spot Gold market throughout the construction of the downtrend. We really mentioned this fakey in our February 5th commentary and we will see the market fell considerably decrease after forming that sign from resistance. When a market is clearly trending after which it retraces again to a key stage and varieties an apparent value motion sign in-line with the underlying pattern, it might usually be a superb alternative to look for a bigger than common winner.

The chart picture under reveals a fakey sign that shaped after the market had retraced again to a key resistance stage throughout the down-trending market:

The above situations could be good for letting your revenue run. You’ll wish to start the trailing course of by transferring your cease to breakeven as soon as the market clearly reveals you that the pattern is taking off in your favor. I like to attend till I’m up at the very least 1 instances my threat earlier than transferring my cease to breakeven. After that, the way you path your cease and exit the commerce is one thing you’ll have to use discretion to resolve; there are numerous totally different trailing methods however none of them are “excellent”. Over time and thru coaching and apply, you’ll develop a greater sense for figuring out whether or not or to not path a cease and tips on how to do it.

Last word

The technique we commerce with is clearly necessary, however in actuality, that shouldn’t be the “be all and finish all” of your buying and selling plan. The way in which that you just handle your threat and your general capital is the true “secret” to buying and selling. Most of you studying this already know you aren’t paying sufficient consideration to how you consider capital preservation and threat administration, you’re not taking it severely as a result of it’s the extra boring a part of the sport. It’s time to get up and face the fact; not taking note of threat administration and capital preservation will lead you to a path of economic ache and private stress. Managing your threat correctly whereas buying and selling with a easy but efficient buying and selling technique is the idea of what I educate in my buying and selling course and members’ space. When you mix these two vital items of the buying and selling puzzle, you’ll be prepared to start out making constant cash within the markets.