Truth: If you happen to take three merchants with the very same skills and buying and selling expertise and pit them towards one another, on common solely one of many merchants will survive. It doesn’t matter if a man is enjoying poker together with his mates or they’re buying and selling collectively at a espresso store, the last-man standing will ALWAYS be the man who managed his financial institution roll correctly.

Truth: If you happen to take three merchants with the very same skills and buying and selling expertise and pit them towards one another, on common solely one of many merchants will survive. It doesn’t matter if a man is enjoying poker together with his mates or they’re buying and selling collectively at a espresso store, the last-man standing will ALWAYS be the man who managed his financial institution roll correctly.

This text goes to indicate you find out how to not solely be the “final man standing”, however to be a disciplined winner and hopefully come away with a bigger financial institution roll than you began with. Immediately, we’re going to discuss in regards to the capital administration “secrets and techniques” that offers you the sting over some other dealer within the room or your mates on the poker desk, so pack your cigars, as a result of in case you handle your capital correctly you would possibly simply stroll away a winner subsequent week 🙂

The perfect offense is an efficient protection

As a dealer, in case you actually need to have an opportunity at long-term success, it is advisable be taught VERY rapidly that your psychological vitality have to be targeted on the buying and selling variables that you just CAN management. Clearly, we can’t management the market or make it do what we wish (though definitely some merchants act as if they will), however we will genuinely management most different facets of buying and selling; 1. Commerce entries, 2. Capital preservation and cash administration, and three. Our exits…these are all issues we DO have management over.

The KEY level there’s capital preservation and cash administration; correctly controlling the amount of cash you threat per commerce (your leverage and publicity to the market) is the first factor that may make or break you as a dealer; actually, it’s going to determine the destiny of your total buying and selling profession. Any skilled dealer is aware of that capital preservation is a very powerful a part of their each day routine as a market skilled, this will also be referred to as “enjoying protection” available in the market.

Nice merchants and fund managers take into consideration how a lot they may lose earlier than interested by how a lot they will win; that is basically the OPPOSITE of a gambler’s mentality. Gamblers undergo from an uncontrollable psychological illness whereby they focus nearly totally on how a lot cash they may win with nearly no regard for losses, that is borderline psychopathic habits. Sadly, this habits can also be quite common for a lot of starting and struggling merchants.

Why among the finest merchants and market analysts find yourself as “nobodies”

I’m positive you’ve heard of among the enormous hedge fund blow-ups which have occurred lately. The 2 major causes for these have been fraud and extra leverage. Extreme leverage will also be referred to as “irresponsible use of threat capital”, aka NOT training correct capital preservation.

As Scott C. Johnston factors out in his well-liked weblog “The Bare Greenback”, many distinguished hedge fund managers and merchants have blown-up hundred-million-dollar portfolios as a result of they didn’t handle their capital correctly. It solely takes one hot-head “young-gun” dealer to assume he’s “positive” of one thing to blow-up an enormous fund by taking an especially over-leveraged guess on some firm or some information occasion.

As I alluded to within the opening paragraph, you’ll be able to take two merchants or buyers with the identical quantity of talent and buying and selling information and one will obtain long-term success whereas the opposite constantly loses cash and blows up buying and selling accounts. The distinction between the 2 merchants is that solely considered one of them could have the psychological skills to handle threat, plan for losses, handle trades and execute capital administration accurately and persistently (that means with self-discipline over time). Thus, a superb dealer is actually outlined by his or her capacity to handle threat and management their publicity to the market…not by their capacity to search out trades or analyze the markets, opposite to well-liked perception.

SOME OF THE BEST TRADERS WITH THE BEST TALENT WILL ALWAYS BE NOBODIES, they’ll at all times be losers, and they’re going to by no means make the headlines, as a result of they fully lack psychological self-discipline or expertise with capital/portfolio administration, and that’s the place it counts. So heed this recommendation and hear up…it’s one factor to discover a good technique, it’s one other to remain within the recreation lengthy sufficient to see the fruits of the buying and selling methodology; in case your capital administration and threat management sucks, you’re going to be a loser, it’s pure math, plain and easy.

Capital preservation IS thrilling…you simply aren’t interested by it proper

I do know why many merchants don’t focus sufficient on capital preservation and threat administration: as a result of they mistakenly assume it’s not “enjoyable” or “thrilling”, however that’s solely as a result of they aren’t interested by it proper or they don’t absolutely perceive how highly effective it’s.

You see, the KEY to getting cash over the long-term within the markets is solely staying within the recreation. You want to protect your capital ok so that you just keep within the recreation lengthy sufficient to see your buying and selling technique play out and reward you.

The one solution to make constant cash as a dealer is to have small losses (as a result of you’ll have losses so higher to maintain them small) and some large winners in between. It appears easy, however in case you can’t try this, you’ll be able to’t generate profits. Now, the laborious half in all of that is having the psychological frame of mind to handle capital correctly on a per-trade foundation, one should take into account {dollars} risked on the commerce and in addition the leverage used, one should additionally calculate if this threat is justified however not get too emotional about it. It is best to at all times have a max greenback loss per commerce pre-planned, however it’s possible you’ll threat lower than that quantity clearly, all of it is determined by how assured you might be within the setup. In essence, it is advisable have a psychological “obsession” with capital preservation, and drop your obsession about rewards and income. Satirically, if you are able to do this, you’ll then begin to see the rewards that you just had been so obsessive about earlier than.

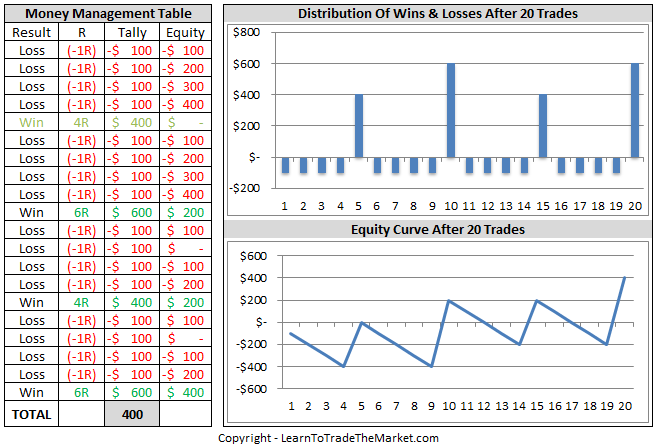

Visible Instance : Within the instance beneath, let’s take a look at how correct capital preservation and threat administration can can help you keep within the recreation lengthy sufficient to see your fairness curve enhance persistently over time. Discover how this dealer has made ‘a number of very small losses’ and people losses are ‘persistently the identical worth’. We are able to additionally word this dealer has the ‘occasional large winner’. It’s laborious to consider this dealer has achieved a revenue with a really low strike charge of simply over 20%. It’s simple to see that over time, this dealer is more likely to generate profits or on the very least break even. Let this instance function get up name to these of you who don’t observe disciplined capital preservation. Examine these examples beneath and exit and begin training it in the actual world.

The important thing factors to remove from the above graphs are that you must have a max greenback quantity you’ll let your self lose on anyone commerce, and you will need to not deviate from that threshold. Don’t underneath ANY circumstances over-leverage or threat an excessive amount of per commerce; the market will ALWAYS be there tomorrow, so ignore the temptation to “go all in”.

Nevertheless, that mentioned, some trades you’ll be able to go in a bit of tougher on than others, however the hot button is that you just keep underneath your total per-trade greenback threat quantity. So, if as within the instance above, your per-trade threat threshold is $100, then you’ll be able to threat any quantity on a commerce from 1 to 100 {dollars}. Some trades it’s possible you’ll determine to threat lower than $100 on, some you would possibly need to use the total $100…that is the place discretion and your capacity to investigate and gauge the market comes into play, however the hot button is that you just DO have that “lower off” level the place you KNOW you’ll by no means lose greater than a sure greenback quantity. That is actually the “key” take away level of this entire article.

The perfect merchants lower their losses they usually get the hell out once they know they’re mistaken, they usually NEVER put their portfolio, their main property or their shareholder’s property at main threat in the event that they get a commerce mistaken. They plan forward obsessively they usually at all times know the “worst case situation” for any commerce or funding. These are the merchants, buyers and fund managers that stand the take a look at of time and expertise success whereas the others blow-up accounts and fall to the best way aspect.

So far as HOW you really protect your capital, it primarily includes figuring out how a lot you might be emotionally OK with dropping PER TRADE and understanding place sizing and threat reward. I gained’t get into that at present as a result of I’ve written different articles on it you can take a look at. See my article on threat reward and place sizing for extra.

Conclusion…

While sound capital and threat administration is definitely the “key” to success within the markets, combining these cash administration expertise with an efficient buying and selling technique offers you an especially potent edge available in the market. Combining my value motion methods with sound capital preservation and threat administration expertise has enabled me to remain within the recreation for 12 years. Of all of the merchants I do know and have met, the one factor they at all times describe as their “secret weapon” and the explanation for his or her success, is specializing in capital preservation; preserve losses persistently beneath a sure greenback threshold and safe income and allow them to run when you’ll be able to. Capital preservation and threat administration is your most definable edge available in the market, and it’s an edge you’ve full management over, so don’t take it as a right or abuse it. Your different real edge must be an efficient buying and selling technique like value motion. To be taught extra about how I’ve integrated cash administration and value motion entry indicators to develop my account over the long run, checkout my Value Motion Buying and selling Course and Members Space for extra.