It’s time to file your tax return. And cybercriminals are lurking to make an already irritating interval much more edgy.

10 Feb 2026

•

,

5 min. learn

To misquote Benjamin Franklin, nothing is definite on this world apart from loss of life, taxes and scammers. Sadly, with tax submitting season now in full swing, the fraudsters are additionally out in drive, doing their greatest to money in. The chance of unwittingly sharing private and monetary info, enabling third events to hijack your tax refunds, and even being tricked into committing fraud your self, has grown immeasurably over latest years.

To remain on the best aspect of the regulation, and maintain the scammers at bay, learn on.

How you can spot the scams

Tax and IRS scams normally comprise lots of the identical warning indicators you must affiliate with different digital fraud sorts. Scammers could impersonate the IRS or tax preparers through cellphone/e-mail/textual content, utilizing official logos or spoofing caller ID/sender domains. They might even demand cash or fines. Or they might trick you into submitting fraudulent returns. Regardless of the pretext, likelihood is that the fraudsters might additionally leverage AI to supercharge their schemes.

Simply bear in mind the next warning indicators:

- An unsolicited e-mail/textual content/name from the IRS. The tax-collection company will at all times make contact initially through an official letter by means of the mail, not a textual content message.

- The IRS calls for fast cost to keep away from arrest or additional penalties. The IRS will at all times present taxpayers time to enchantment or question excellent sums.

- Scammers will ask for cost by uncommon means, corresponding to present card or cryptocurrency, which the IRS doesn’t settle for.

- You might be ordered to share private and/or monetary info like bank card numbers and banking logins. The IRS won’t ever name, textual content or e-mail asking for such particulars.

- With the rise of AI-aided scams, your eyes and ears can not be trusted as major authentication mechanisms. Do not forget that the IRS won’t ever provoke unsolicited contact through e-mail, textual content, or social media to ask to your private or monetary info.

The commonest IRS scams

With the above in thoughts, look out for the next most typical IRS and tax return scams:

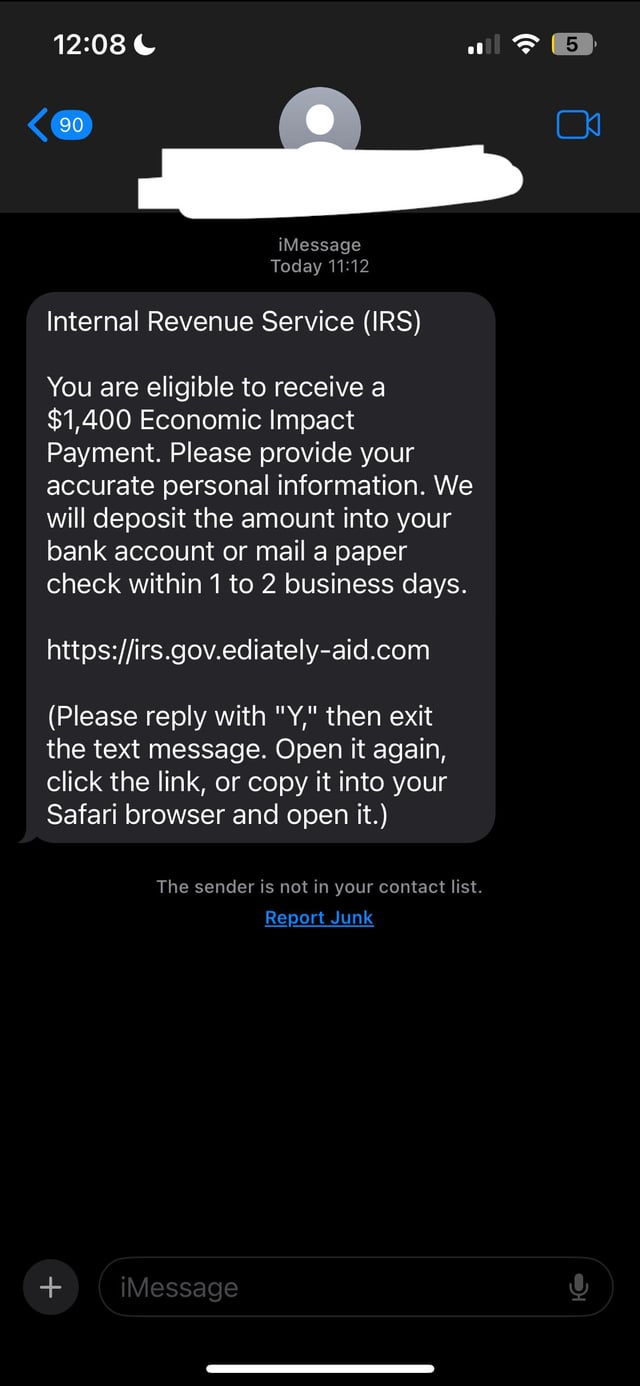

Phishing/smishing/vishing

Emails, texts and even cellphone calls purporting to return from tax authorities (e.g., IRS, state tax businesses and tax software program corporations). The tip purpose is to trick you into handing over money, delicate private/monetary info, or putting in malware in your gadget. The scammers could use a pretext corresponding to an sudden tax refund. Or they might go down a distinct route and declare your account has been suspended and/or you’ll face critical repercussions until you atone for ‘unpaid taxes’.

Regardless of the lure, they’ll often ask you to supply extra info, ship them cash, and/or click on on a malicious hyperlink.

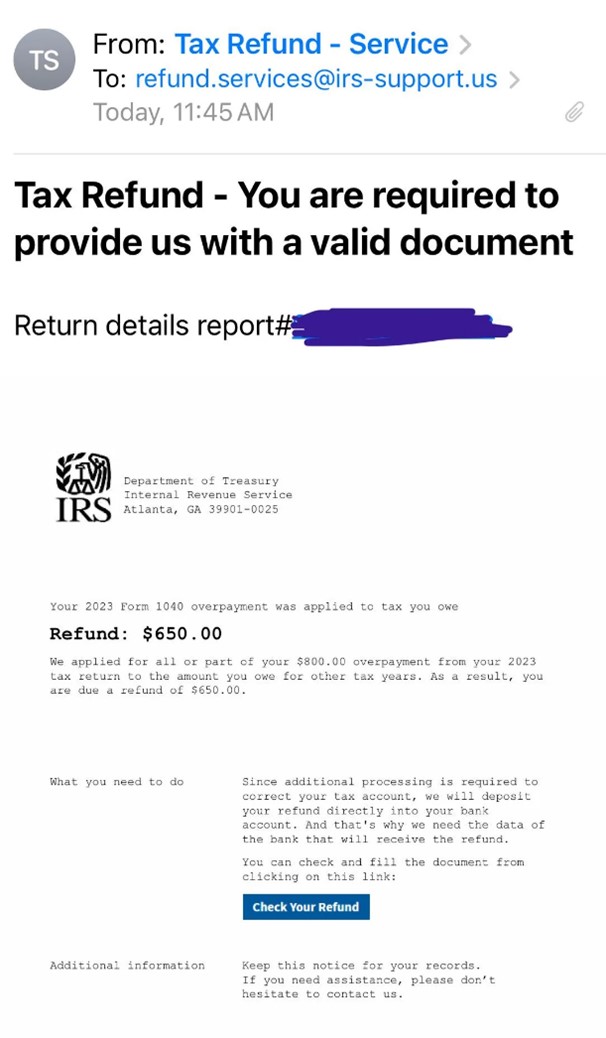

Tax refunds

The IRS tax refund system affords a number of alternatives for scammers to make straightforward cash. All they want is your private info (together with Social Safety particulars, identify and date of delivery) to file, and deposit the refund in a checking account underneath their management. The primary you would possibly discover out is when your authentic submitting is rejected as a result of a return has already been despatched in underneath your identify.

Alternatively, scammers impersonating the IRS would possibly ship you an unsolicited e-mail/textual content claiming you’re owed a giant rebate or refund. They’ll ask you to go to a phishing web site mirroring the IRS one to ‘confirm your account’ particulars.

W-2 type scams

A social media influencer advertises a ‘secret trick’ which you should utilize to sport the tax system and get a big refund. All it’s important to do is create a faux W-2 type, report inflated earnings and huge tax payments, and pay them a price. By doing this, you’re committing fraud and will face main monetary penalties from the IRS, or perhaps a prison investigation. Even worse, in addition to paying the scammer, you’ve gotten additionally shared your private and tax particulars, which they will use in follow-on fraud.

Self-employment tax credit score

Additionally circulating on social media are claims made by scammers a few non-existent “Self-Employment Tax Credit score.” In keeping with the IRS, they declare self-employed individuals and gig employees can get huge COVID-19 funds by filling in the best kinds. As soon as once more, they achieve this to get their palms in your money and private info.

Dishonest tax preparers

It’s additionally clever to be looking out for unscrupulous “tax professionals” who could substitute their checking account info to your personal in an effort to divert tax refunds. They may put together a tax return however then cost a price based mostly on the dimensions of the refund. Be suspicious of any that refuse to signal or embrace their IRS Preparer Tax Identification Quantity (PTIN).

What occurs subsequent?

In the event you suspect an IRS rip-off, the very best factor to do is to halt all communications. Which means hanging up the cellphone, and deleting any phishing e-mail and/or textual content. In the event you’re speaking to somebody and aren’t certain in the event that they’re the true deal or not, ask for his or her identify and name again quantity and examine the small print on-line. Rip-off emails may be despatched to phishing@irs.gov earlier than deletion, whilst you can submit an official fraud report back to the IRS right here.

Staying protected from IRS scams

To keep away from changing into one other sufferer of scams like those listed above, keep looking out for the warning indicators we’ve included for you. Unsolicited contact, guarantees of enormous refunds, and threats of fines or arrest ought to be fast purple flags. Report the tried rip-off and cling up or delete. It additionally pays to be cautious about any “tax tips” or ideas you would possibly see on social media, particularly in the event that they contain paying charges to a 3rd celebration or handing over any of your private/monetary info.

For added safety and peace of thoughts, swap on multifactor authentication (MFA) for any account used to entry tax and monetary info. This could maintain them protected even when risk actors pay money for your logins. An IRS Id Safety PIN (IP PIN) may be a good suggestion, to make sure no third celebration can file a return utilizing your Social Safety quantity (SSN) or particular person taxpayer identification quantity (ITIN).

Lastly, take into account submitting your returns early – as quickly as you obtain your W-2 type. That means, scammers gained’t be capable to beat you to a potential refund. None of those are assured to cease the scammers. However mixed, they may ship a transparent message.