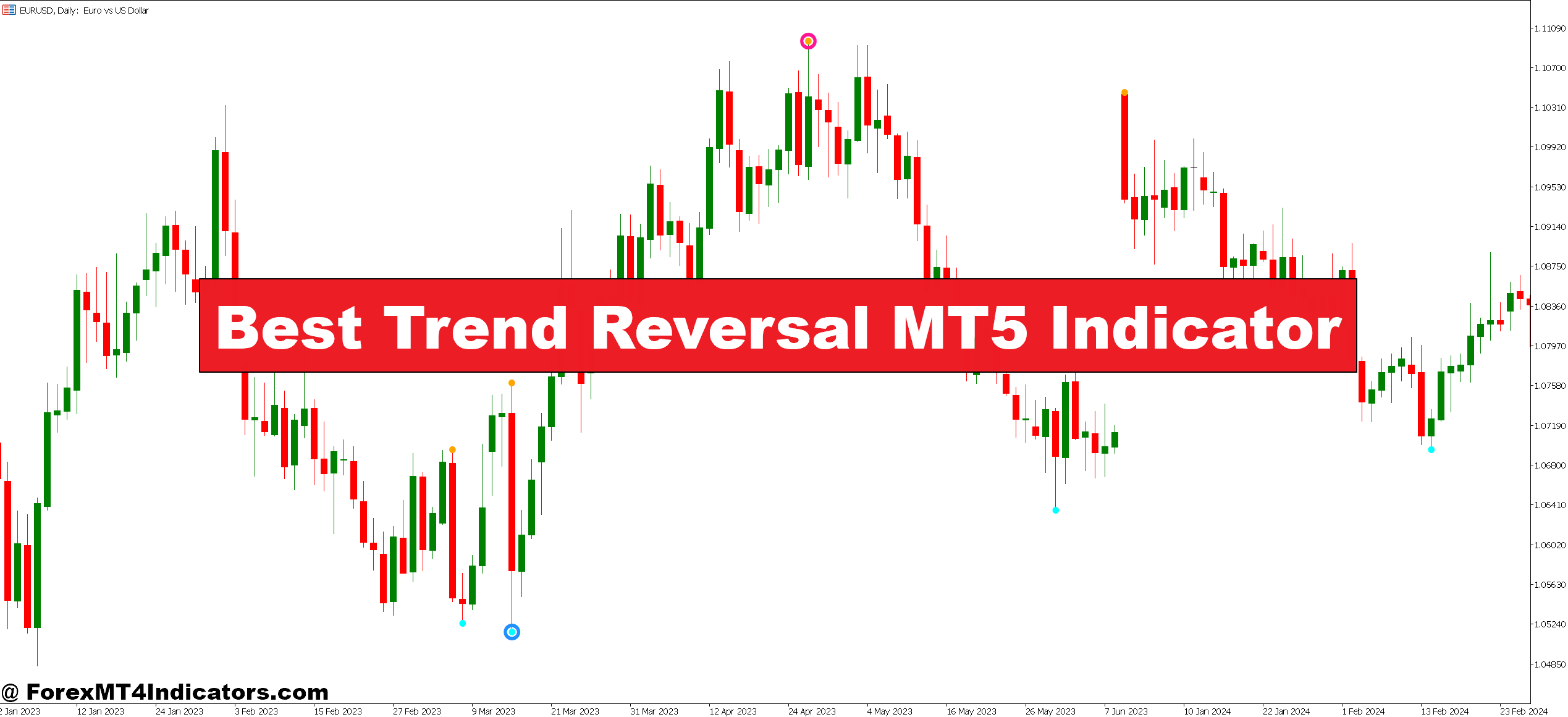

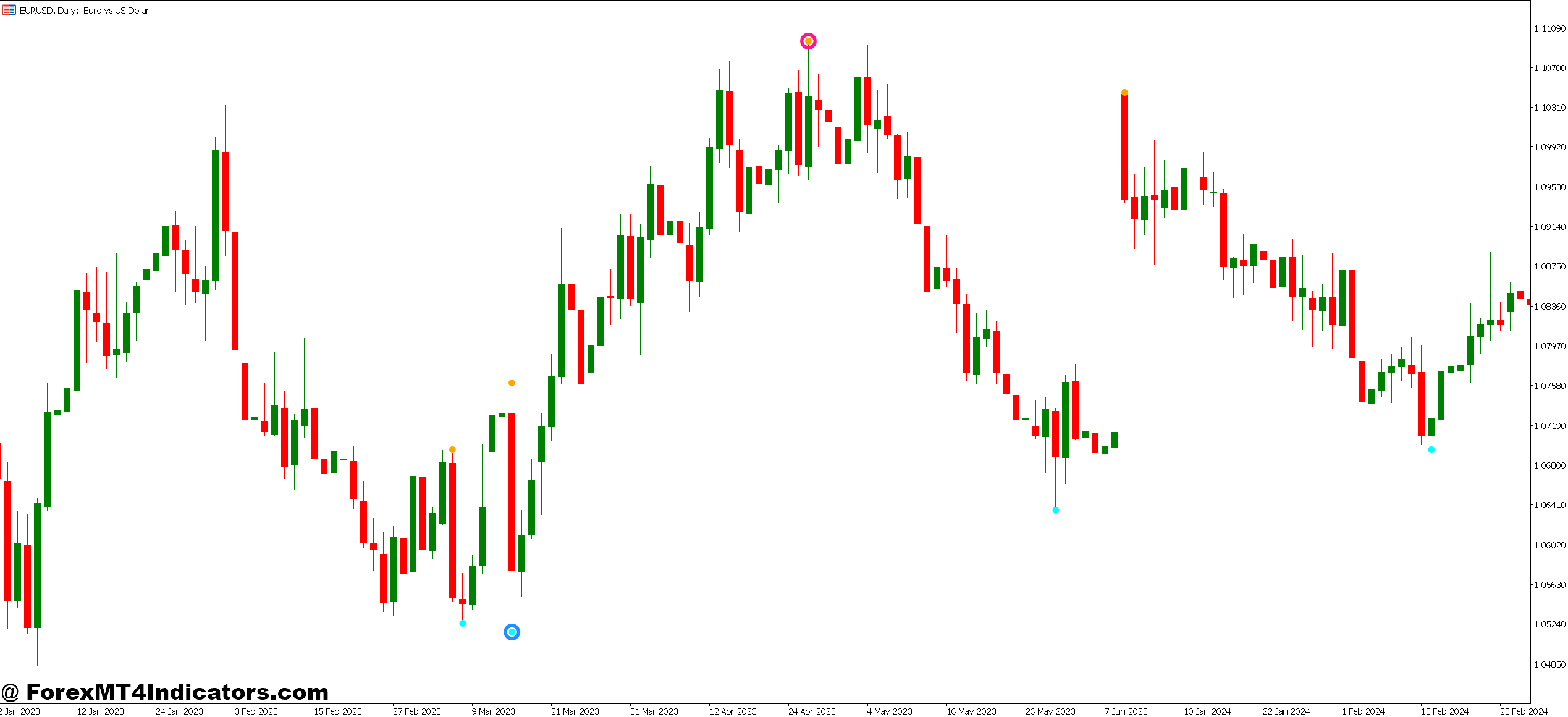

The finest development reversal MT5 indicator addresses this downside by combining a number of affirmation alerts into one visible instrument. As an alternative of juggling 5 completely different indicators throughout your charts, you get clear reversal alerts backed by worth motion, momentum, and quantity evaluation. This text breaks down how these indicators work, after they’re handiest, and what limitations it’s good to perceive earlier than risking actual capital.

Understanding Pattern Reversal Indicators

A development reversal indicator identifies potential turning factors the place an current development loses momentum and reverses course. In contrast to trend-following instruments that work finest throughout sustained strikes, reversal indicators excel at catching exhaustion factors—these moments when bulls or bears lastly run out of steam.

The mechanics range by indicator kind. Some use transferring common crossovers, the place short-term averages minimize by way of longer ones to sign momentum shifts. Others monitor momentum oscillators like RSI or Stochastic, looking forward to divergences between worth and indicator readings. The extra subtle instruments mix a number of alerts: a 50-period transferring common crossover may want affirmation from declining quantity and an overbought RSI studying earlier than triggering an alert.

What separates efficient reversal indicators from noise mills? Three issues: they filter out minor pullbacks that don’t change into actual reversals, they supply alerts early sufficient to seize significant revenue, and so they work throughout completely different timeframes with out fixed recalibration.

How High MT5 Reversal Indicators Work

{Most professional}-grade reversal indicators use a multi-layered strategy. Right here’s what occurs below the hood:

The indicator calculates worth momentum by evaluating latest closes to a transferring common baseline. When the EUR/USD 4-hour chart reveals worth touching the higher Bollinger Band whereas RSI exceeds 70, the indicator notes potential exhaustion. However it doesn’t set off but.

Subsequent, it checks for divergence. If worth makes the next excessive however the momentum oscillator makes a decrease excessive, that’s a basic bearish divergence—the rally is weakening. The indicator assigns a likelihood rating to this setup.

Lastly, it seems at quantity patterns. Declining quantity throughout an uptrend suggests patrons are dropping curiosity. When all three alerts align—overextension, divergence, and quantity affirmation—the indicator fires a reversal alert.

The calculation usually makes use of a weighted algorithm. Value motion may carry 40% weight, momentum 35%, and quantity 25%. This prevents any single issue from triggering false alerts throughout uneven markets.

Actual-World Software: Buying and selling USD/JPY Reversals

Let’s stroll by way of a selected commerce setup. USD/JPY had been climbing for six classes on the every day chart, gaining roughly 280 pips from 148.50 to 151.30. The reversal indicator began flashing warning alerts:

The value tagged the 20-day Bollinger Band higher restrict three consecutive days—basic overextension. In the meantime, the RSI momentum studying hit 76, deep in overbought territory. Right here’s the place divergence appeared: whereas worth pushed to 151.30 (a brand new excessive), the RSI peaked at 76 versus a earlier studying of 79. Value was making increased highs, however momentum was making decrease highs.

The indicator fired a reversal sign at 151.15. A conservative dealer entered a brief place there, inserting a stop-loss 40 pips above at 151.55. The danger appeared justified as a result of quantity evaluation confirmed shopping for stress dropping by 30% in comparison with the earlier three days.

The reversal performed out over the subsequent 48 hours. USD/JPY dropped to 149.80, delivering a 135-pip acquire. That’s a 3.3:1 risk-reward ratio on a single setup.

However not each sign works this cleanly. Two weeks later, the identical indicator triggered a bullish reversal sign on EUR/GBP at 0.8520. The setup appeared equivalent: oversold circumstances, bullish divergence, declining quantity throughout the downtrend. The pair rallied 25 pips earlier than resuming its downtrend, stopping out the place for a 35-pip loss.

For this reason threat administration issues greater than the indicator itself.

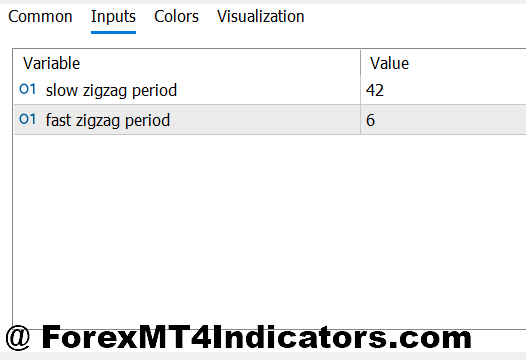

Customizing Settings for Completely different Buying and selling Types

MT5 reversal indicators usually supply adjustable parameters. The important thing settings embrace lookback durations, sensitivity ranges, and affirmation necessities.

For scalpers working 5-minute charts, decreasing the lookback interval from 50 bars to twenty bars creates extra alerts. The tradeoff? Extra false positives throughout ranging markets. Day merchants on 15-minute or 1-hour charts usually hold default settings—these timeframes supply a candy spot between sign frequency and accuracy.

Swing merchants working on 4-hour or every day charts may improve the affirmation threshold. As an alternative of accepting two aligned alerts (momentum plus divergence), they look ahead to all three elements, together with quantity. This filters out noise however means fewer buying and selling alternatives.

Sensitivity adjustment modifications how aggressively the indicator identifies reversals. Excessive sensitivity catches each potential flip, helpful throughout risky classes just like the London open. Low sensitivity waits for extra substantial proof, higher fitted to Asian session tradin,g the place false breakouts are frequent.

One often-overlooked setting: alert kind. Some merchants choose on-chart arrows, others need cellular push notifications. Testing each helps you catch alerts with out being chained to your display screen.

Strengths and Limitations You Must Know

Reversal indicators shine in trending markets that periodically exhaust themselves. The GBP/JPY pair, identified for robust traits punctuated by sharp reversals, works fantastically with these instruments. You’ll see clear alerts at main turning factors, usually at psychological worth ranges or earlier help/resistance zones.

In addition they excel throughout scheduled information occasions. When NFP employment information drops and a foreign money pair whipsaws violently, reversal indicators assist establish when the mud settles and a brand new development begins. That’s data value its weight in gold.

However the limitations are actual and price understanding earlier than you threat a dime.

Ranging markets produce nightmare situations for reversal indicators. When EUR/USD bounces between 1.0850 and 1.0950 for 3 weeks, you’ll get reversal alerts at each boundaries—however these aren’t development reversals, they’re vary boundaries. The indicator can’t distinguish between a reversal and a bounce inside consolidation.

Sudden information occasions additionally create issues. An sudden central financial institution assertion can invalidate each technical sign in seconds. Your indicator may present an ideal bearish reversal setup, but when the Fed declares emergency price cuts, all that technical evaluation turns into irrelevant.

False alerts throughout low-volatility durations are one other headache. The AUD/USD pair throughout Asian session usually triggers reversal alerts that go nowhere, producing small losses that add up over time.

And right here’s the factor: no indicator predicts the longer term. They analyze historic worth motion to establish possibilities. A reversal indicator displaying a 70% accuracy price nonetheless means three out of each ten alerts lose cash. Your place sizing and threat administration decide profitability, not the indicator itself.

How one can Commerce with Greatest Pattern Reversal MT5 Indicator

Purchase Entry

- Look ahead to bullish divergence – Value makes a decrease low however your indicator reveals the next low, signaling weakening downward momentum on 4-hour or every day charts.

- Affirm oversold circumstances – RSI drops under 30 and worth touches the decrease Bollinger Band; this works finest on EUR/USD and GBP/USD throughout trending markets.

- Examine quantity spike – Search for rising quantity on the reversal candle in comparison with the earlier 5 bars; declining quantity means weak conviction.

- Place stop-loss 20-30 pips under the swing low – By no means threat greater than 2% of your account; if EUR/USD reversal triggers at 1.0850, your cease goes at 1.0820.

- Keep away from purchase alerts throughout main downtrends – If the 200-period MA on the 1-hour chart is sloping down steeply, skip the sign; you’re preventing the larger development.

- Goal earlier resistance ranges – Goal for 50-80 pips on 1-hour setups or 150-200 pips on every day reversals; these are life like revenue zones.

- Don’t commerce throughout low-volatility Asian session – Reversal alerts between 22:00-02:00 GMT usually fail; look ahead to London or New York open.

- Require two timeframe affirmation – If the 1-hour reveals a purchase sign, verify the 4-hour chart helps it; single timeframe alerts fail 60% of the time.

Promote Entry

- Determine bearish divergence first – worth hits the next excessive whereas the indicator makes a decrease excessive; this means that the bulls are exhausted on the 4-hour or every day timeframe.

- Affirm overbought readings – an RSI above 70, mixed with a worth on the higher Bollinger Band, provides you the inexperienced mild; GBP/JPY gives the cleanest alerts right here.

- Look ahead to rejection wicks – A 30+ pip higher wick on the reversal candle reveals sellers rejecting increased costs; this provides 20% to sign accuracy.

- Set stop-loss 25-40 pips above the swing excessive – On GBP/USD, in case your promote sign fires at 1.2750, place your cease at 1.2790 most.

- Skip alerts throughout robust uptrends – If worth sits 100+ pips above the 200-period MA in your buying and selling timeframe, the reversal will doubtless fail.

- Goal help zones for exits – Earlier help ranges or psychological numbers (1.0800, 1.1000) make preferrred targets; plan for 60-100 pip positive factors on 1-hour charts.

- Keep away from Friday afternoon reversals – Alerts after 14:00 GMT on Fridays have 40% decrease success charges attributable to weekend place squaring.

- Don’t commerce half-hour earlier than main information – NFP, central financial institution choices, and inflation information will blow by way of any reversal sign; verify your financial calendar each morning.

Making It Work in Your Buying and selling System

One of the best strategy treats reversal indicators as affirmation instruments, not standalone techniques. Mix them with worth motion evaluation—are you seeing rejection wicks at key ranges? Examine market construction—is that this the next timeframe help zone?

Testing earlier than buying and selling is non-negotiable. Run the indicator on a demo account for at the very least 50 alerts. Monitor your outcomes actually: win price, common acquire, common loss, most drawdown. These numbers reveal whether or not the indicator matches your persona and schedule.

Threat administration trumps every little thing else. Even essentially the most correct reversal indicator received’t save an account risking 10% per commerce. Skilled merchants threat 1-2% per place, utilizing place sizing calculators to find out actual lot sizes based mostly on stop-loss distance.

Buying and selling foreign exchange carries substantial threat of loss. No indicator ensures earnings, and previous efficiency doesn’t predict future outcomes. Most retail merchants lose cash, no matter which indicators they use. Perceive this actuality earlier than placing actual capital in danger.

The important thing takeaway? Pattern reversal indicators work finest as a part of an entire buying and selling system. They establish high-probability setups the place technical elements align. Mix them with correct threat administration, life like expectations, and steady enchancment. The indicator gives the sign; your self-discipline determines the end result. Begin with a demo account, show the system works along with your fashion, then scale up regularly as consistency develops.

Advisable MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Further Unique Bonuses All through The Yr

- Unique 90% VIP Money Rebates for all Trades!

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Accomplice Code: VIP90