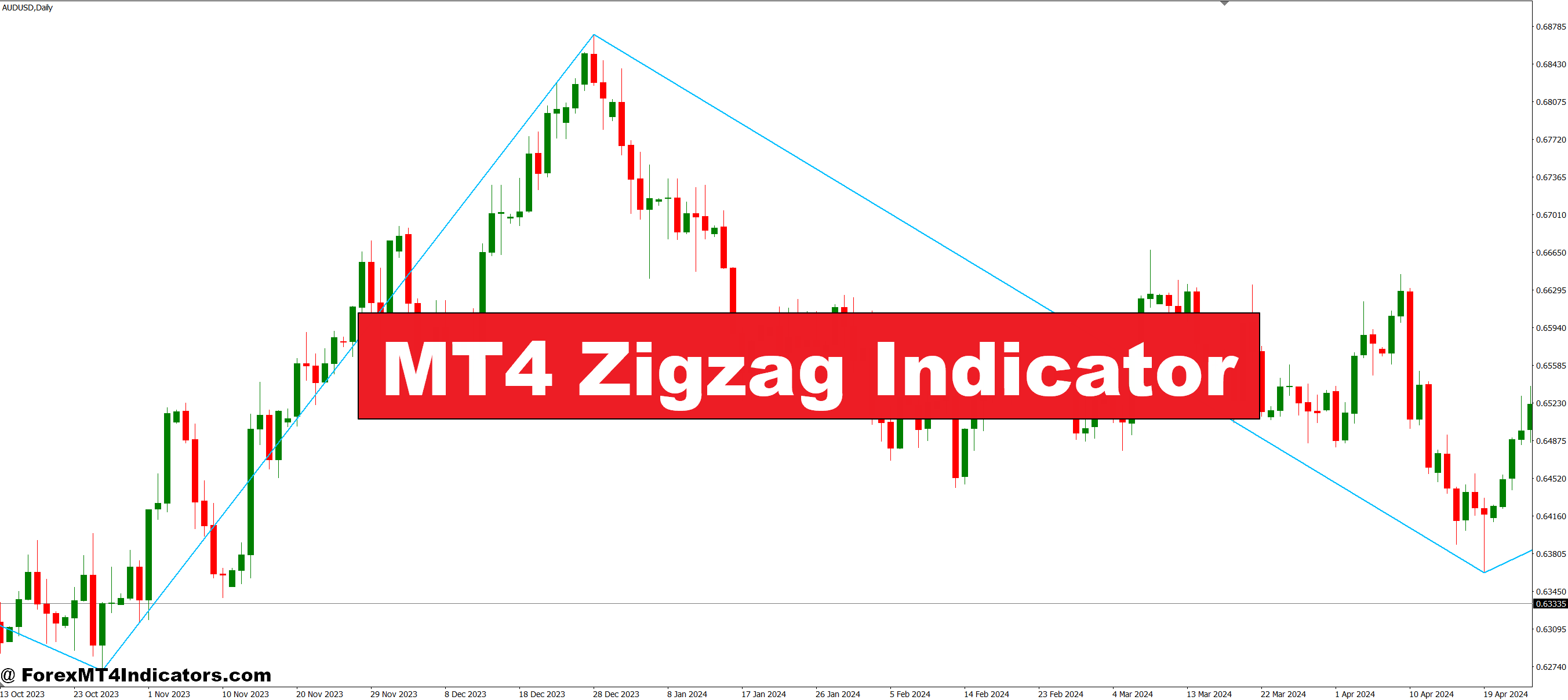

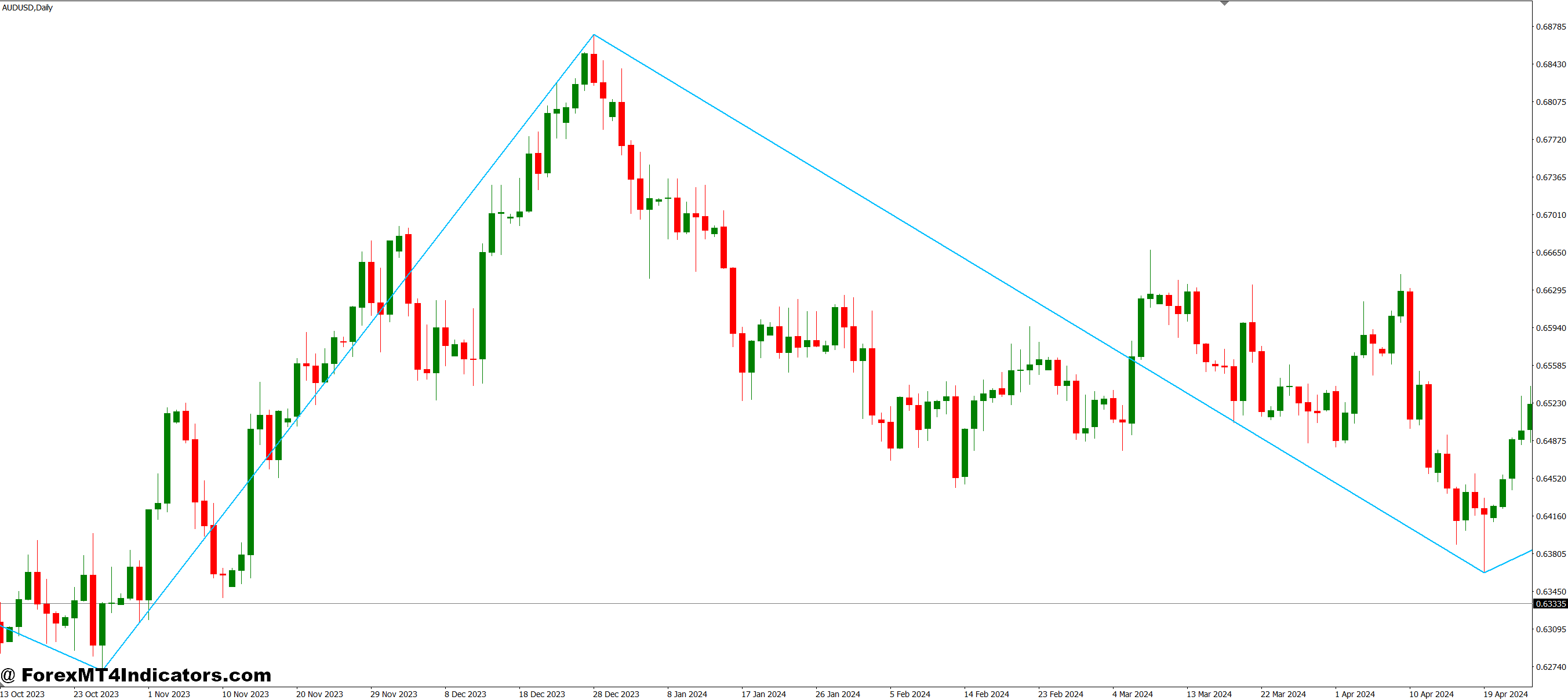

The Zigzag indicator plots traces connecting swing highs and swing lows primarily based on a share or pip threshold you set. Consider it as a highlighter for important value actions. If the worth strikes lower than your threshold, the indicator ignores it. As soon as value swings past that threshold, it attracts a line from the earlier pivot level.

This isn’t a predictive software—it gained’t inform you the place the worth is headed subsequent. What it does is present readability on the place value has been, filtering out the minor retracements and fake-outs that plague shorter timeframes. For merchants doing technical evaluation, it’s like cleansing a unclean windshield. Immediately, you’ll be able to see the street.

The indicator works on any timeframe, from 1-minute scalping charts to month-to-month place buying and selling setups. However right here’s the catch: it repaints. That final pivot level shifts as new information is available in, which makes it ineffective for automated buying and selling programs. For handbook chart evaluation, although? Strong.

How the Calculation Works

The MT4 Zigzag makes use of a depth-deviation-backstep system. Sounds difficult, however persist with me.

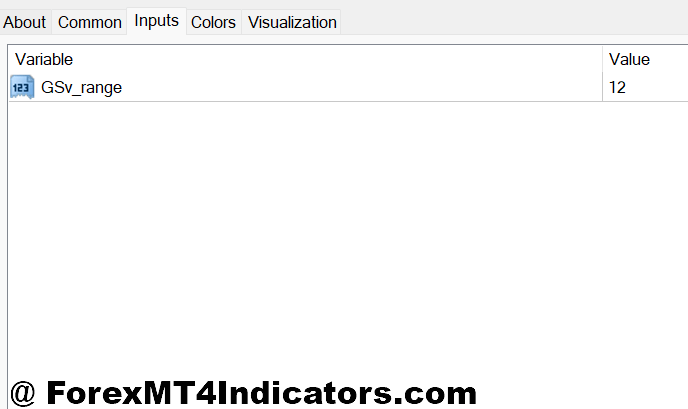

- Depth units what number of bars again the indicator appears to be like for prime/low pivots. A setting of 12 means it checks the previous 12 candles for the best excessive or lowest low.

- Deviation defines the minimal value motion (in share phrases) required to attract a brand new zigzag line. Set it to five%, and the worth should transfer 5% from the final pivot earlier than the indicator registers a brand new swing.

- Backstep prevents the indicator from drawing two pivots too shut collectively. In the event you set backstep to three, the indicator gained’t place one other pivot level inside 3 bars of the earlier one.

Most merchants persist with default settings (12, 5, 3), however these will be tweaked. Testing the indicator on GBP/JPY with a ten% deviation setting throughout the 2022 volatility confirmed cleaner swings than the default 5%—fewer traces, greater strikes highlighted.

Actual Buying and selling Purposes

Let’s get sensible. The Zigzag shines in three particular eventualities.

Sample Recognition: Elliott Wave merchants love this factor. When analyzing a possible impulse wave on the USD/CAD each day charts, the Zigzag connects the five-wave construction clearly. As an alternative of counting each micro-move, you see waves 1, 3, and 5 as distinct upswings, with waves 2 and 4 because the corrections. Harmonic sample merchants use it equally—recognizing ABCD patterns or Gartley setups turns into simple when the noise disappears.

Help and Resistance Mapping: Take a current instance from the AUD/USD 4-hour chart. The Zigzag linked three swing highs across the 0.6450 stage over two weeks. Every time the worth approached that zone and reversed, merchants watching had a transparent resistance stage marked. No confusion about which excessive mattered—the Zigzag did that work.

Pattern Affirmation: Right here’s the place it will get fascinating. If Zigzag traces preserve making larger highs and better lows, you’re in an uptrend. Sounds apparent, however whenever you’re within the thick of buying and selling, these decrease timeframe wiggles mess along with your head. The indicator on a 1-hour GBP/USD chart throughout a trending week will present a transparent staircase sample—every swing low larger than the final. That visible affirmation retains you from combating the development.

However don’t use it for entry indicators. A dealer ready for a Zigzag line to type earlier than coming into will at all times be late—the transfer already occurred. As an alternative, use it for context. The place are the foremost swings? What’s the development construction? Then take entries primarily based on value motion at these ranges.

Customizing Settings for Totally different Markets

Default settings don’t match all conditions. Unstable pairs like GBP/JPY want completely different parameters than slower movers like EUR/CHF.

For prime-volatility pairs throughout main information occasions (suppose NFP releases or FOMC conferences), bump the deviation to 8-10%. In any other case, you’ll get zigzag traces drawn on each panic spike and reversal. The purpose is to seize the actual swings, not each knee-jerk response.

Scalpers working 5-minute charts may drop depth to eight and deviation to three%, catching smaller however nonetheless important swings. That mentioned, the decrease you go, the extra repainting turns into annoying. A swing that regarded confirmed two bars in the past may disappear if the worth reverses barely.

Place merchants on weekly or month-to-month charts can improve depth to twenty and deviation to 10-15%. You wish to see solely the huge structural pivots—the 2020 pandemic crash low, the 2021 restoration excessive, and main development reversals. The whole lot else is simply noise at that scale.

Take a look at your settings on historic information first. Pull up a chart from three months in the past, apply your Zigzag parameters, and see if it highlights the swings that mattered. If it’s drawing traces on each minor pullback, tighten it up.

Benefits and Trustworthy Limitations

What works: The Zigzag offers you perspective. While you’re caught in evaluation paralysis, watching a messy chart, it brings readability. Sample identification turns into simpler. Help and resistance ranges soar out. It’s a visible cleanup software that helps you suppose clearly about market construction.

What doesn’t work: The repainting kills any mechanical buying and selling strategy. You may’t code a method round it reliably as a result of that final line retains shifting. It’s additionally lagging by nature—it tells you what occurred, not what’s going to occur. Some merchants get annoyed ready for affirmation, watching the worth transfer 50 pips earlier than the Zigzag attracts the road.

And right here’s the factor no person mentions sufficient: it might make you complacent. Merchants begin counting on it an excessive amount of, ignoring the precise value motion that creates these swings. You continue to want to grasp why the worth reversed at that stage, what fundamentals drove the transfer, and the place different merchants are positioned. The Zigzag exhibits the bones of market construction, however you should add the muscle your self.

Evaluate it to a shifting common—that smooths the worth too, however a minimum of it doesn’t repaint. The tradeoff? Transferring averages lag even worse and don’t present you discrete swing factors. Pivot factors provide you with particular ranges however don’t adapt to present value motion as Zigzag does. Totally different instruments, completely different functions.

Learn how to Commerce with MT4 Zigzag Indicator

Purchase Entry

- Look ahead to larger swing low affirmation – Enter lengthy solely after Zigzag attracts a better low than the earlier one on 4-hour or each day charts, confirming uptrend construction.

- Purchase the bounce at Zigzag assist – When value returns to a earlier Zigzag low that held 2-3 instances (like EUR/USD testing 1.0800), enter on bullish candlestick affirmation with 20-30 pip cease beneath.

- Commerce the breakout above Zigzag resistance – As soon as value closes above a Zigzag excessive that capped earlier rallies, enter lengthy with cease 15-20 pips beneath breakout candle on 1-hour charts.

- Use 50% retracement ranges – Mark the midpoint between two Zigzag swings; purchase when value pulls again 50% throughout an uptrend on GBP/USD 4-hour and exhibits reversal indicators.

- Align with larger timeframe Zigzag – Solely take longs when each day Zigzag exhibits uptrend construction, even when buying and selling 1-hour setups; prevents combating the larger development.

- Keep away from shopping for throughout flat Zigzag patterns – Skip entries when the final 3-4 Zigzag swings type horizontal consolidation; await clear directional construction to emerge.

- Set revenue targets at subsequent Zigzag excessive – Challenge your take-profit to the earlier swing excessive marked by Zigzag, sometimes 60-100 pips on main pairs, guaranteeing minimal 2:1 reward-risk.

- Verify with quantity spike – Don’t enter if the Zigzag swing low shaped on weak quantity; real reversals present elevated participation at turning factors.

Promote Entry

- Look ahead to decrease swing excessive affirmation – Enter brief solely after Zigzag plots a decrease excessive than the earlier peak on 4-hour or each day timeframes, confirming downtrend.

- Promote the rejection at Zigzag resistance – When value assessments a earlier Zigzag excessive that rejected value 2-3 instances, enter brief on bearish rejection candle with 20-30 pip cease above.

- Commerce breakdown beneath Zigzag assist – After value closes beneath a Zigzag low that beforehand held, enter brief with cease 15-20 pips above the breakdown candle on 1-hour EUR/USD.

- Quick from 50% Zigzag retracement – Throughout downtrends, promote when value retraces midway up the earlier Zigzag decline and exhibits bearish reversal patterns on 4-hour charts.

- Match larger timeframe Zigzag path – Solely brief when each day Zigzag confirms downtrend construction; don’t fade 1-hour rallies towards the each day development path.

- Skip uneven sideways Zigzag motion – Keep away from sells when final 3-4 Zigzag pivots bounce between the identical highs and lows; await breakdown to renew trending circumstances.

- Goal earlier Zigzag lows – Place take-profit on the final main Zigzag swing low, sometimes 70-120 pips away on GBP/USD, sustaining a 2:1 minimal reward-risk ratio.

- By no means promote into sturdy Zigzag uptrends – If Zigzag exhibits 5+ consecutive larger highs and better lows, keep away from counter-trend shorts no matter minor pullbacks; development is simply too sturdy.

Conclusion

The MT4 Zigzag indicator gained’t revolutionize your buying and selling, but it surely’ll clear up your charts and sharpen your evaluation. It filters market noise, highlights important swings, and makes sample recognition much less of a guessing recreation. Merchants doing technical evaluation—particularly these working with Elliott Waves, harmonics, or structural assist and resistance—discover it genuinely helpful.

Simply bear in mind what it’s: a visible filter, not a crystal ball. It exhibits you the skeleton of value motion after the actual fact. You continue to want confluence from different indicators, strong threat administration, and an understanding of what strikes markets. Buying and selling foreign exchange carries substantial threat. No indicator ensures income, and the Zigzag’s repainting nature means you’ll be able to’t blindly belief that final line.

Use it for context. Map out the foremost swings, determine the development construction, and mark key ranges. Then take your entries primarily based on value motion at these spots. That’s when this software earns its place in your charts.

Advisable MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

- Unique 90% VIP Money Rebates for all Trades!

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Accomplice Code: VIP90