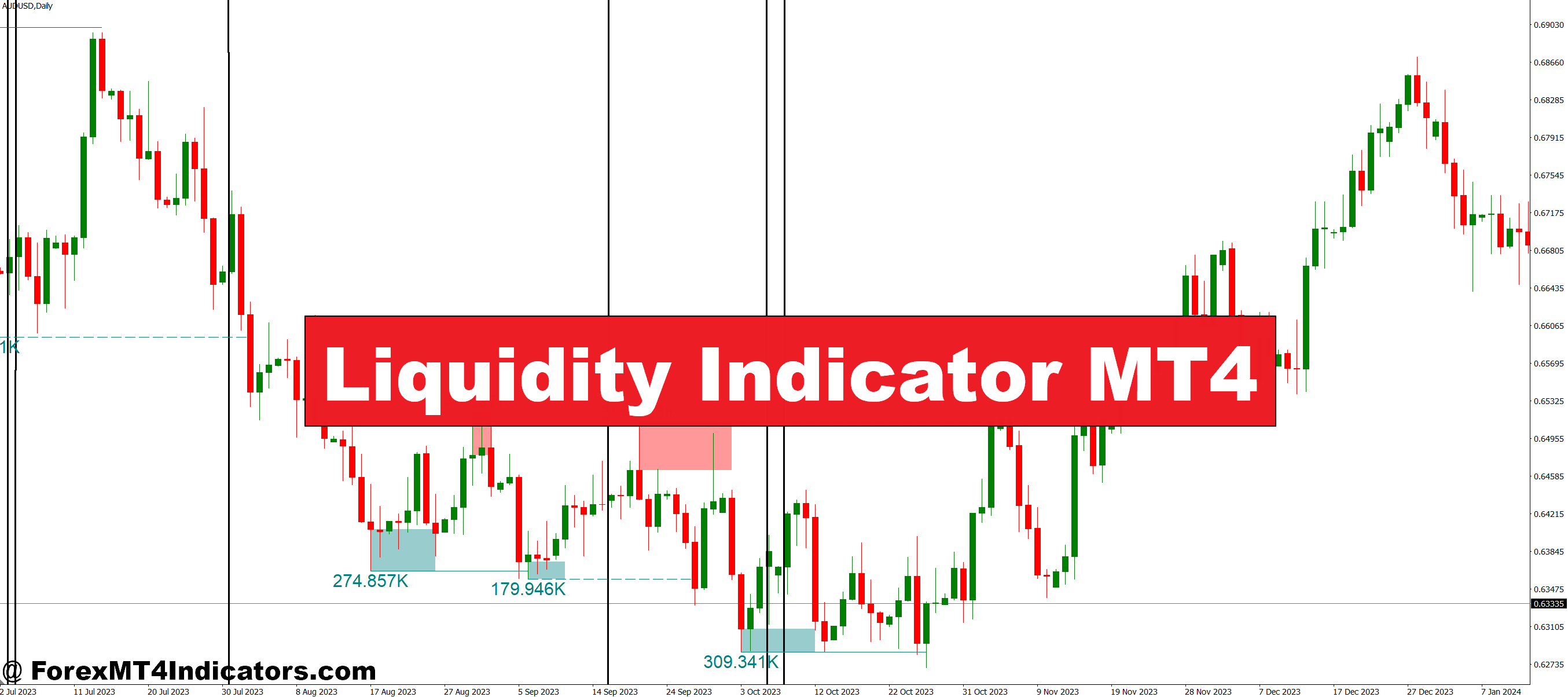

A liquidity indicator measures the focus of purchase and promote orders at numerous worth ranges. In contrast to conventional quantity indicators that present historic exercise, liquidity instruments try to visualise the place orders are stacking up proper now. For MT4 customers, these indicators sometimes analyze tick knowledge, order movement patterns, or calculate derived metrics from worth motion and quantity.

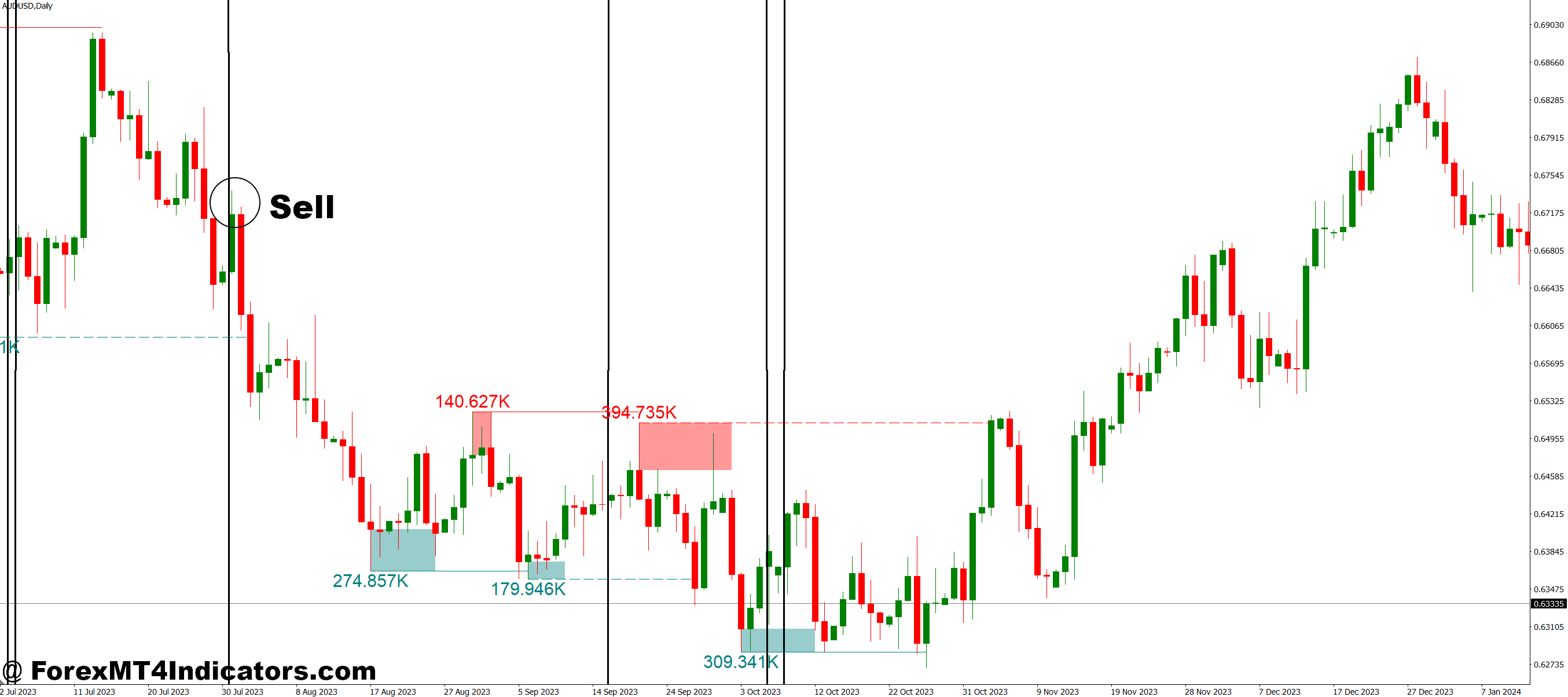

The core idea revolves round figuring out zones the place giant gamers—banks, establishments, hedge funds—have positioned important orders. These areas typically act as magnets or limitations for worth motion. When the market approaches high-liquidity zones, merchants can anticipate stronger assist or resistance. Conversely, low-liquidity areas are inclined to see speedy worth strikes as there’s much less opposition to directional motion.

The Mechanics Behind Liquidity Measurement

Most MT4 liquidity indicators work by means of one in every of three calculation strategies. The primary analyzes quantity clusters at particular worth ranges, constructing a histogram that reveals the place essentially the most buying and selling exercise occurred. Excessive quantity at a worth suggests liquidity focus—both as a result of giant orders absorbed incoming trades or as a result of that degree attracted important two-way movement.

The second technique tracks tick velocity and unfold fluctuations. When spreads tighten and tick exercise will increase, it indicators wholesome liquidity. The indicator marks these intervals in a different way from occasions when spreads balloon and ticks decelerate—a telltale signal of skinny markets. Scalpers significantly worth this info in the course of the London-New York overlap versus the Asian session’s quieter hours.

The third strategy makes use of delta quantity or order movement imbalance. It measures the distinction between market purchase orders and market promote orders executed on the bid versus the ask. Persistent imbalances reveal institutional positioning, displaying the place sensible cash may be constructing positions.

Actual-World Buying and selling Purposes

Right here’s the place idea meets apply. On a Wednesday morning, GBP/USD was grinding close to 1.2650 in the course of the London session. The liquidity indicator confirmed huge buy-side quantity stacked between 1.2620-1.2630. As a substitute of shorting the pair as momentum urged, merchants who observed this liquidity zone stayed affected person. Worth dipped to 1.2635, absorbed the sellers, and rallied 80 pips over the subsequent 4 hours.

That’s not luck—it’s studying the market’s precise construction. The liquidity indicator revealed the place institutional consumers had been ready, info not seen on commonplace candlestick charts.

For breakout merchants, liquidity mapping prevents the basic lure. Earlier than the Non-Farm Payroll launch final month, EUR/USD was consolidating between 1.0850 and 1.0880. The liquidity indicator confirmed paper-thin order books above 1.0880 however deep liquidity at 1.0900. Good merchants acknowledged {that a} break above 1.0880 would doubtless speed up to 1.0900 earlier than discovering resistance. That’s precisely what occurred—a 50-pip reward for these listening to liquidity construction.

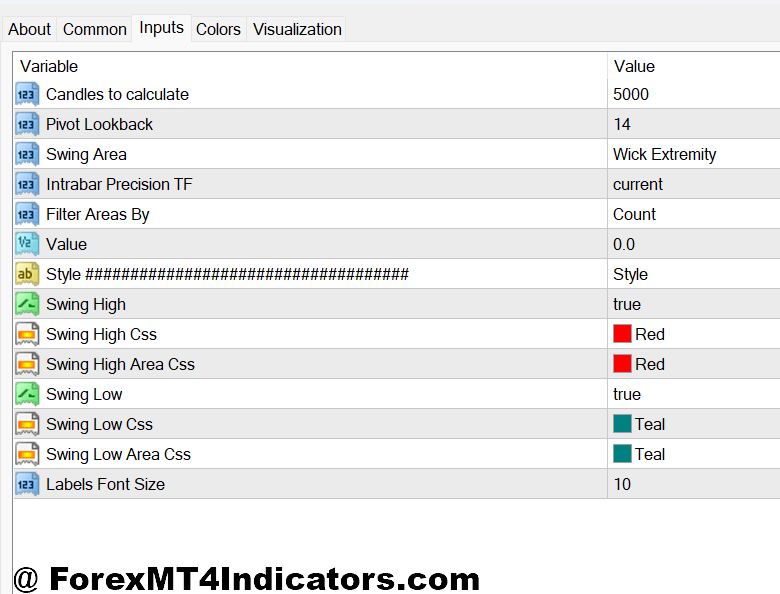

Customizing Your Liquidity Indicator Settings

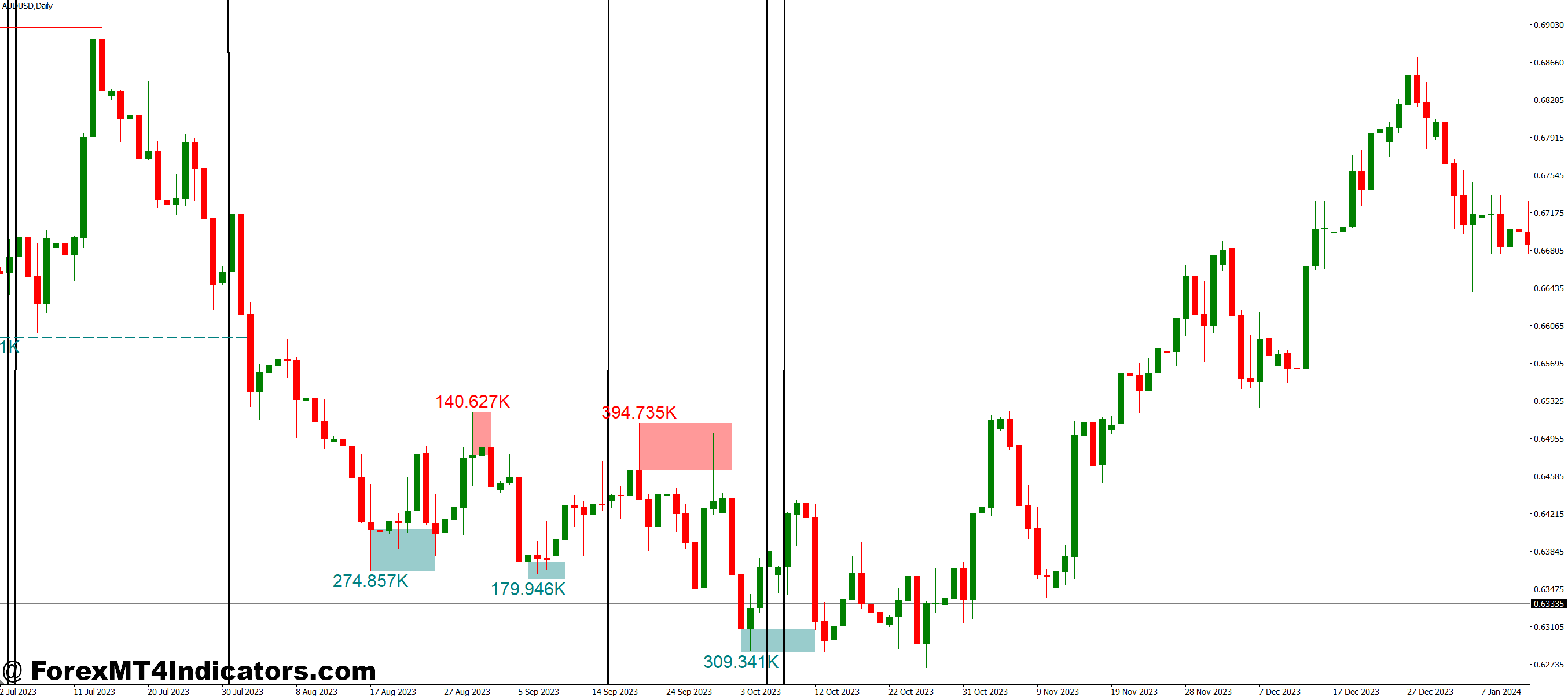

Default settings not often work for everybody. The lookback interval determines how a lot historic knowledge the indicator analyzes. Shorter intervals (20-50 bars) go well with scalpers buying and selling the 5-minute or 15-minute charts. They want present liquidity snapshots, not knowledge from yesterday’s session. Swing merchants on 4-hour or day by day charts ought to prolong the lookback to 100-200 bars to seize significant institutional positioning.

Threshold sensitivity controls which liquidity ranges show. Set it too low, and the chart turns into cluttered with minor zones. Set it too excessive, and also you would possibly miss essential ranges. For unstable pairs like GBP/JPY, a better threshold filters out noise. For steady pairs like EUR/CHF, decrease sensitivity captures the delicate liquidity shifts that matter in range-bound situations.

Shade coding helps visible processing. Some merchants use inexperienced for high-liquidity zones (potential assist/resistance) and pink for low-liquidity gaps (areas for fast strikes). Others desire warmth maps the place depth signifies order focus. The selection is private, however consistency issues greater than the precise scheme.

Benefits and Trustworthy Limitations

The first benefit is visibility. Commonplace MT4 offers merchants worth, quantity, and indicators derived from these—that’s it. A liquidity indicator provides a dimension most retail platforms don’t provide: market depth. This edge helps time entries, set sensible targets, and keep away from low-probability setups.

Danger administration improves, too. Understanding that liquidity vanishes above your stop-loss degree would possibly persuade you to tighten that cease or skip the commerce totally. On the flip facet, recognizing deep liquidity close to your entry gives confidence to carry by means of minor opposed strikes.

However right here’s the reality: these indicators aren’t good. MT4 doesn’t entry true market depth knowledge from interbank or ECN order books. Most liquidity indicators for MT4 derive their readings from broker-provided knowledge, which represents a fraction of the worldwide foreign exchange market. You’re seeing an approximation, not the whole image.

Latency creates one other problem. By the point liquidity knowledge reaches a retail MT4 terminal, processes by means of an indicator’s calculations, and shows on display, the market has moved. Excessive-frequency merchants already reacted. This doesn’t make the data ineffective, however it requires understanding the lag.

False indicators occur, particularly throughout information occasions, when order books can flip instantaneously. That deep liquidity zone you recognized would possibly evaporate in seconds if a central financial institution surprises the market. Buying and selling foreign exchange carries substantial threat. No indicator ensures earnings, and liquidity instruments aren’t any exception.

Comparability With Commonplace Quantity Indicators

Conventional quantity indicators on MT4 present tick quantity—the variety of worth adjustments per interval. That’s helpful however oblique. Excessive tick quantity means exercise, not essentially the place orders are sitting. A liquidity indicator makes an attempt to indicate order focus, which is forward-looking fairly than purely historic.

The Quantity Profile indicator comes closest to liquidity evaluation by displaying quantity distribution throughout worth ranges. Nevertheless, it’s nonetheless backward-looking. The liquidity indicator, when correctly coded, incorporates present order movement dynamics and unfold conduct to estimate the place orders exist now.

Order movement indicators from platforms like NinjaTrader or Sierra Chart provide superior knowledge high quality, however they require futures market entry and completely different software program. For MT4 merchants dedicated to their platform, liquidity indicators present one of the best out there different for understanding market depth.

Making Liquidity Evaluation Work

The liquidity indicator shines brightest when mixed with worth motion and conventional technical evaluation. Don’t commerce solely primarily based on liquidity zones. As a substitute, use them as affirmation. A bearish engulfing sample at a serious resistance degree turns into extra compelling if the liquidity indicator reveals skinny order books above and heavy promoting stress beneath.

Session consciousness issues. Liquidity concentrations in the course of the Tokyo session would possibly maintain when Asian merchants are energetic, however dissolve as soon as London opens and European establishments begin buying and selling. Context at all times trumps indicator indicators.

Begin with demo testing. Load the indicator on the EUR/USD and GBP/USD 1-hour charts. Observe how the value reacts round recognized liquidity zones over two weeks. Do high-liquidity areas persistently present assist or resistance? Do low-liquidity gaps see quicker worth motion? This empirical statement builds confidence and divulges the indicator’s quirks earlier than risking actual capital.

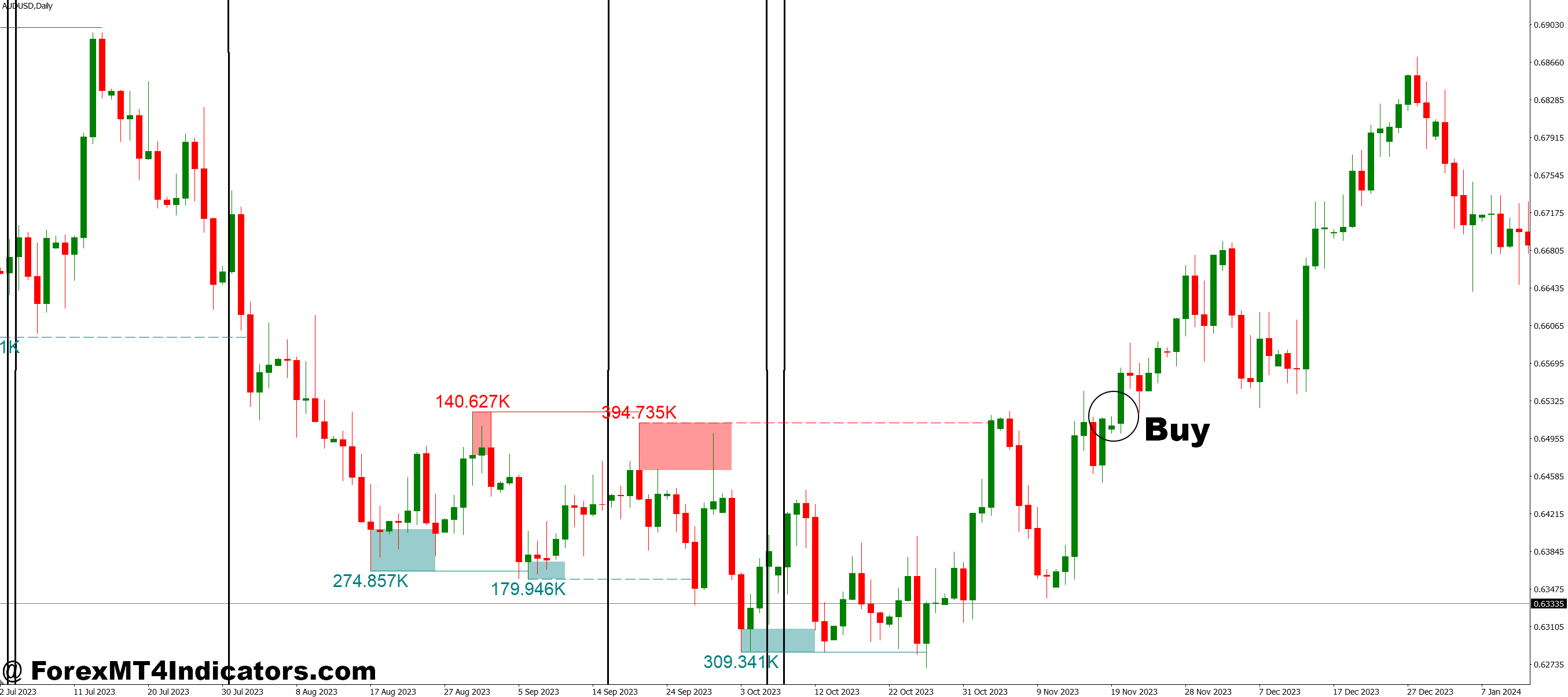

Easy methods to Commerce with Liquidity Indicator MT4

Purchase Entry

- Watch for worth to strategy high-liquidity assist zone – Enter lengthy when EUR/USD on the 1-hour chart reaches inside 5-10 pips of a serious liquidity cluster beneath the present worth, indicating institutional purchase orders are stacked.

- Verify with bullish rejection candle – Search for a powerful bullish engulfing or hammer sample on the liquidity zone; enter on the shut with a cease 15-20 pips beneath the zone.

- Verify unfold tightening – Solely take the commerce in case your liquidity indicator reveals spreads narrowing to 1-2 pips or much less on GBP/USD, confirming wholesome order movement and avoiding skinny market traps.

- Goal the subsequent liquidity void – Set your take revenue on the nearest low-liquidity hole proven on the indicator, sometimes 30-50 pips away on 4-hour charts the place worth tends to speed up.

- Keep away from shopping for into liquidity useless zones – Skip trades if the indicator reveals minimal orders between your entry and goal; these areas create whipsaw situations that cease you out.

- Use 1:2 minimal risk-reward – In case your cease is 20 pips beneath the liquidity assist, your goal must be a minimum of 40 pips on the subsequent resistance or liquidity barrier.

- Don’t chase after breakouts by means of skinny liquidity – If worth already shot 30+ pips above a low-liquidity space, the straightforward cash is gone; look forward to a pullback to the subsequent zone.

- Confirm session alignment – Take BUY indicators throughout London or New York classes when liquidity is deepest; keep away from Asian session entries on main pairs until you see distinctive quantity affirmation.

Promote Entry

- Enter at high-liquidity resistance clusters – Promote when GBP/USD on the 4-hour chart stalls inside 10 pips of a serious liquidity focus above worth, displaying institutional promote orders ready.

- Search for bearish rejection patterns – A taking pictures star or bearish engulfing on the liquidity zone offers your entry affirmation; place cease 20-25 pips above the excessive.

- Monitor unfold widening as a warning – If spreads balloon from 2 pips to five+ pips as worth approaches your zone, skip the commerce—liquidity is evaporating, and slippage will kill your edge.

- Goal high-liquidity assist beneath – Intention for the subsequent main liquidity cluster on the draw back, normally 40-60 pips away on the day by day chart,s the place institutional bids will doubtless soak up promoting stress.

- Keep away from promoting into liquidity vacuums blindly – Don’t quick simply because the indicator reveals low liquidity beneath; and not using a clear assist goal, worth can reverse earlier than reaching any significant degree.

- Danger not more than 1-2% per commerce – Even with good liquidity alignment, shield your account; a 30-pip cease on a regular lot ought to match your threat tolerance.

- Skip trades throughout main information occasions – NFP, central financial institution selections, and GDP releases can vaporize liquidity zones in seconds—your indicator knowledge turns into out of date immediately.

- Don’t promote at weak liquidity resistance – If the resistance zone reveals skinny orders on the EUR/USD 15-minute chart, the value will doubtless slice by means of it; look forward to a 1-hour or 4-hour affirmation of considerable order focus.

Conclusion

Liquidity indicators give MT4 merchants a window into market construction that commonplace instruments miss. They assist determine the place institutional orders cluster, the place skinny markets create threat, and the place worth is more likely to speed up or stall. When a serious assist degree aligns with a high-liquidity zone, the chance of that degree holding will increase. When your goal sits in a liquidity vacuum, anticipate fast strikes—or fast reversals.

That stated, these instruments work greatest as supporting proof, not major indicators. Mix liquidity evaluation with strong threat administration, technical evaluation, and consciousness of basic drivers. No single indicator, no matter how subtle, replaces complete market understanding. The merchants who revenue persistently are those that layer a number of analytical strategies and adapt to altering market situations.

Take a look at the liquidity indicator in your most popular pairs and timeframes. See if it aligns together with your buying and selling fashion. You would possibly uncover that avoiding trades into liquidity useless zones saves more cash than another single adjustment to your technique.

Beneficial MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

- Unique 90% VIP Money Rebates for all Trades!

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Companion Code: VIP90