The cell market app has a rising variety of customers, however not all of them are real. Be careful for these frequent scams.

04 Feb 2026

•

,

6 min. learn

OfferUp has been in enterprise for practically 15 years. Though little identified outdoors the US, {the marketplace} app competes for shopper hearts and minds with trade giants Craigslist, Fb Market and eBay. And like them, it has an issue with fraud. In case you’re seeking to purchase or promote on the platform and need to keep away from the scammers, learn on.

Prime 10 OfferUp scams

OfferUp claims to course of over 30 million transactions annually. That’s inevitably going to draw some customers with nefarious motives. Listed below are the commonest scams it’s possible you’ll encounter on the platform:

Counterfeit objects

Watch out for high-value objects that transform rip offs. The vendor will sometimes attempt to persuade you to pay by way of a third-party service (e.g., Zelle, Venmo) somewhat than by the app, as doing so means the merchandise received’t be coated by OfferUp’s Buy Safety.

Cost rip-off

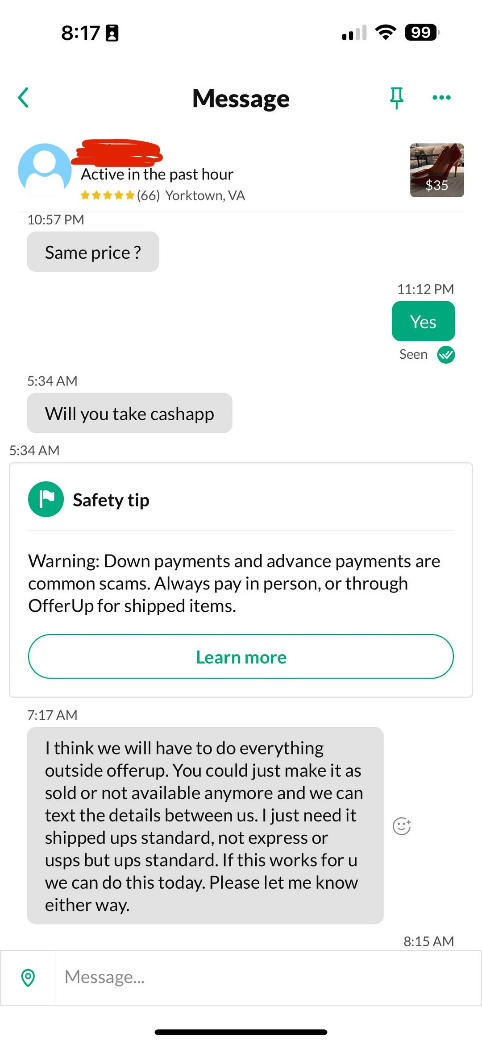

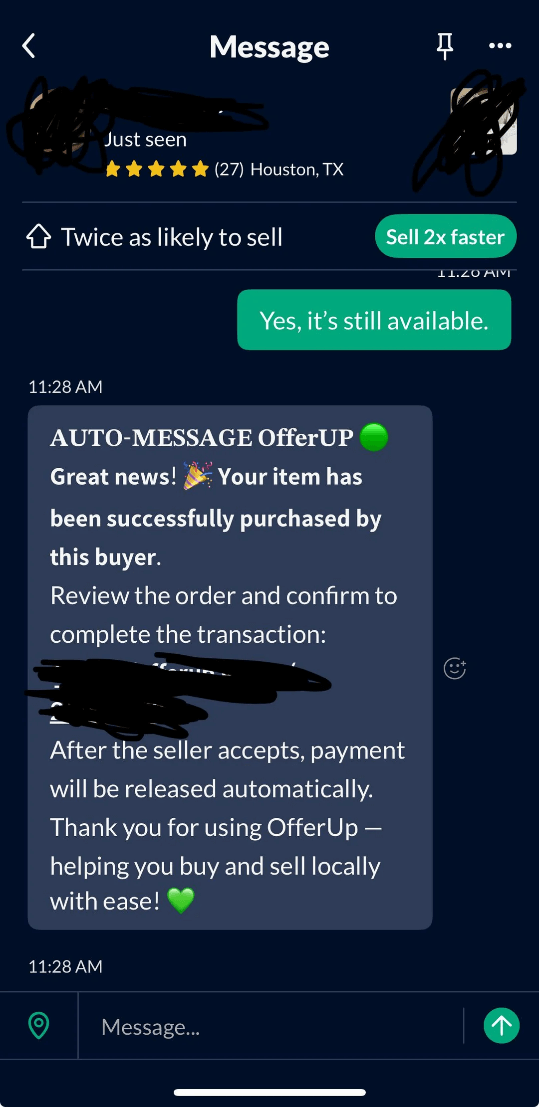

As above, scammers (whether or not purchaser or sellers) will usually attempt to trick you into transacting by way of third-party money app companies. They could:

- Promise to pay above the asking worth for a product you’re promoting, with a view to persuade you to comply with them utilizing a money app. They then overpay utilizing a stolen account or faux verify, and ask for a refund. In case you pay it, you’ll finally be down the refund, plus your merchandise, and could also be requested to repay the unique fraudulent sum

- Ask to pay by way of present playing cards, which transform faux or with zero worth

- Declare to be out-of-town sellers, requesting cash-app fee for objects they by no means find yourself transport

Account takeover

A purchaser asks you for a verification code with a view to ‘confirm’ your itemizing, for example by Google Voice. In reality, they’re normally attempting to log into your account and wish the two-factor authentication code despatched by OfferUp. In case you hand it over, they get management of your account, enabling them to entry your private data and doubtlessly use your account to rip-off others.

Empty field

Some sellers add disclaimers in a prolonged merchandise description saying they’re solely providing the field or a digital picture of the merchandise. So when it arrives, all you’ll obtain is an empty field.

Phishing hyperlinks

Rip-off consumers and sellers would possibly ship you a message saying one thing like “click on right here to receives a commission” or “click on to confirm your information”. Doing so will take you to a phishing website the place you’ll be requested to fill in your logins, fee particulars and/or different delicate private data.

E-mail phishing

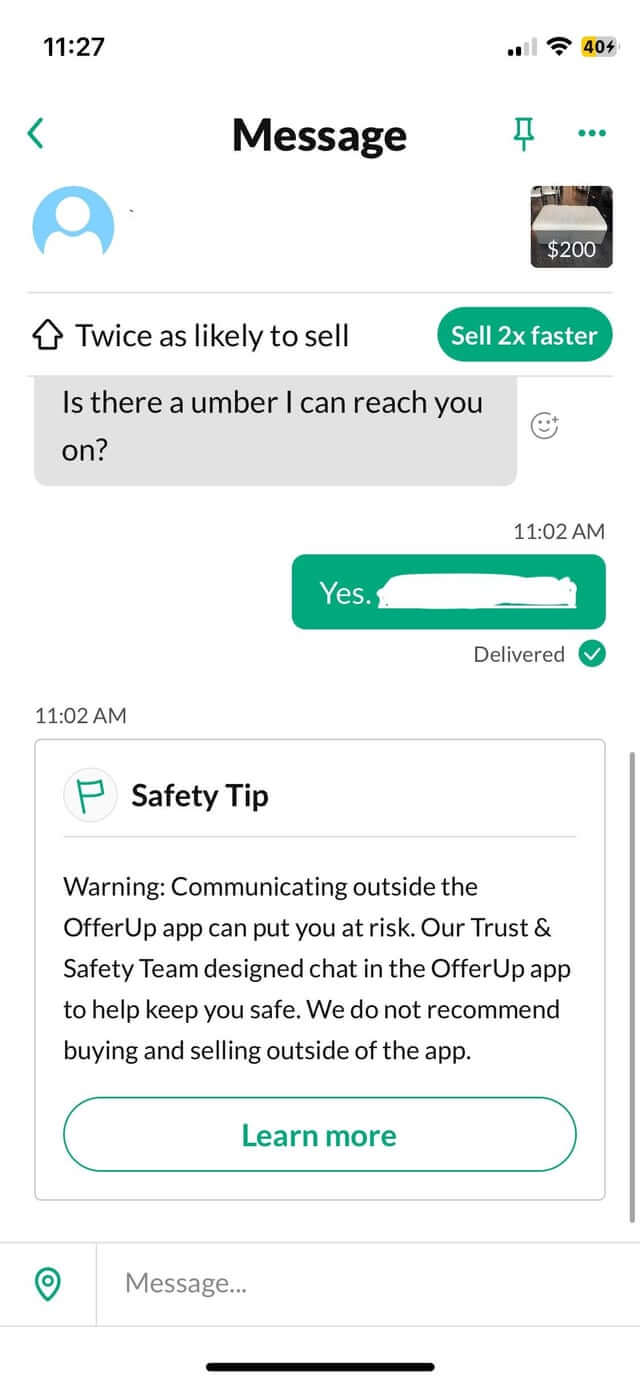

Some consumers or sellers would possibly ask on your electronic mail deal with or cellphone quantity through the transaction course of. They’ll use it to spam you with malicious hyperlinks designed to steal your data or set up malware in your system.

Deposit rip-off

A vendor posts a high-value merchandise, providing to ship it to you so long as you put a deposit down to safe it. It seems the merchandise doesn’t exist, and also you’ve misplaced the deposit.

Bouncing checks

A scammer pays for an merchandise you’re promoting by way of verify, which bounces a number of days later, leaving you with out the merchandise and no fee.

Funding alternative

A vendor posts an inventory about an “funding alternative” or comparable, however requires you to ship cash first.

Pretend jobs

Scammers might pose as employers that require upfront fee for ‘background checks’ or comparable. Alternatively, they might request you fill in your private and monetary particulars as a part of the ‘software course of,’ which they will use for identification fraud.

What OfferUp protects

OfferUp gives 2-day Buy Safety for consumers, that means that you’ve got 48 hours from supply to file a declare for objects:

- Considerably not as described

- Broken in transit

- Counterfeit

It’s also possible to file for objects not acquired and/or empty field scams.

Nevertheless, OfferUp is not going to supply safety for something bought off-app, or that violates its guidelines (e.g., present playing cards, alcohol), or that was paid for in money, in particular person.

What to look out for

While you’re searching the app, the next ought to all be purple flags:

- Offers which can be too good to be true, normally from fraudulent sellers who need you to place a deposit down, or rip-off consumers wanting to influence you into transacting off app.

- A purchaser profile with no historical past. This isn’t essentially a scammer, nevertheless it pays to be further cautious

- A instructed meetup level that’s not a Neighborhood Meetup Spot, as this might point out they need the transaction to not be noticed

- A purchaser/vendor asks for a verification code, which they really need to log into your account

- Consumers/sellers ship you messages containing hyperlinks to ‘confirm’ or comparable

- A vendor tries to make use of urgency to hurry you into making an unwise choice, like shopping for a counterfeit merchandise or placing a deposit down for a non-existent merchandise.

- Emotional manipulation, akin to scammers saying they cannot meet in particular person as a result of they’re within the navy or out of city on household emergency

- Phrases like “field solely,” “digital picture,” or “reproduction” hidden in a prolonged product description

- Requests to repay app

- Inventory pictures of things somewhat than ones they’ve taken themselves, indicating they don’t really personal the product

- Overpayment for an merchandise

Staying protected

To remain protected on the app, the recommendation could be very easy: don’t go away it and don’t click on on any doubtful hyperlinks. Meaning by no means leaving the app for messaging or funds, by no means handing over your private particulars, and never responding to messages with hyperlinks in them. In case you prepare an in-person sale, be sure it’s at a Neighborhood Meetup Spot. And if you wish to be extremely cautious, solely purchase from or promote to a person with a “TruYou” badge on their profile, indicating their identification has been verified.

I’ve been scammed, what subsequent?

If the worst-case situation involves cross, report the rip-off to OfferUp instantly, in case you’re coated by the agency’s 2-day Buy Safety. In Messages, faucet the dialog with the scammer and the three dots within the nook, then Report. Submit a Buy Safety declare within the OfferUp Assist Heart.

In case you’ve paid outdoors of the app, contact your financial institution to file a chargeback (if a card fee) or file a report with the money app you paid with. The latter is unlikely to get your a refund, however might assist get the scammer banned.

In case you’ve shared private data or a verification code with a scammer, change your app passwords, and do the identical for any websites you reuse the identical credential on. Monitor your financial institution accounts for uncommon exercise. And be cautious of any follow-up phishing makes an attempt that pop into your inbox/messages.

Lastly, take into account reporting the rip-off to the authorities, eg FTC, FBI or Report Fraud (UK). Earlier than you delete messages or block the person, take screenshots of the unique itemizing, the scammer’s profile, your chat historical past and any fee receipts.

OfferUp is nice method to choose up bargains in your space, or make a bit of more money from objects you not want. However keep in mind, not everyone seems to be appearing in good religion.