Bitcoin’s newest slide has pushed costs into territory not seen up to now this 12 months, with the market briefly buying and selling close to the low $75,000 space.

Associated Studying

Losses have piled up over current months, leaving the asset properly under its document peak and stirring contemporary debate about whether or not the broader uptrend has stalled.

The drop didn’t occur in isolation, although, and the timing factors to wider strain throughout threat property somewhat than a crypto-only shock.

Bids Cluster Beneath $73k

Order books present thicker purchase curiosity clustered in a variety that stretches from about $71,500 down towards $64,000. Based on market feeds, that demand is seen however tentative.

When many bids sit on change books they will gradual a fall, however they will additionally disappear shortly if sellers speed up.

Liquidations have amplified the slide: compelled closures of leveraged longs have been reported within the tens of millions and such occasions can create brief, violent drops even the place elementary demand stays.

This mannequin reveals present bitcoin worth motion continues to be sitting inside historic norms at $74,000.

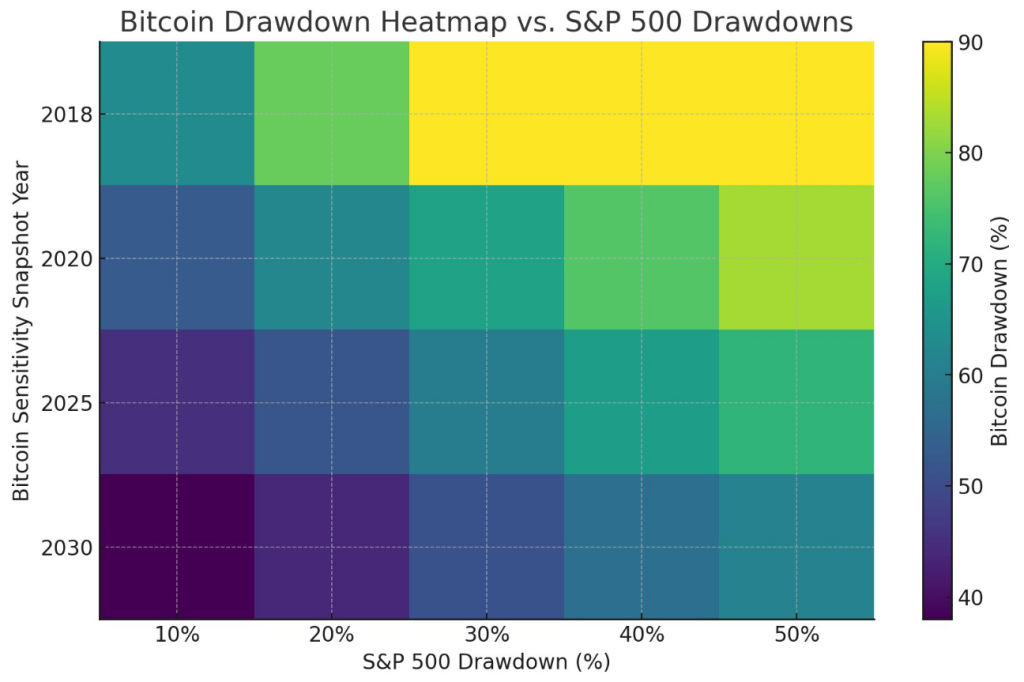

Bitcoin is down ~40% from its October excessive whereas U.S. equities stay close to all time highs, with the S&P 500 down lower than 10%. Below these circumstances, a attainable ~45% bitcoin… https://t.co/E8oiOKD3VE

— Joe Burnett, MSBA (@IIICapital) February 3, 2026

Nothing Out Of The Strange

Based on Joe Burnett, vp of Bitcoin technique at Attempt, the current downturn nonetheless matches inside patterns seen in prior market cycles.

Burnett stated Bitcoin hovering across the mid-$70,000 vary displays a drawdown measurement that has appeared earlier than during times of fast adoption and worth discovery.

He added that swings of this scale have a tendency to indicate up when an asset continues to be being priced by the market, somewhat than when it has settled right into a secure buying and selling vary.

Tech Shares Drag On Danger Urge for food

The pullback in US tech names, notably these tied to AI infrastructure, has been cited by a number of market watchers as a linked trigger.

NVIDIA and Microsoft have been among the many larger drags on main indices, and experiences observe that weak sentiment round earnings and high-cost AI build-outs has left buyers extra cautious.

When large progress shares wobble, buyers usually trim different dangerous positions too, and crypto has been swept up in that stream.

Associated Studying

Retail dip-buying was seen on some exchanges, and institutional spot purchases have been reported as properly.

Based on Burnett, a forty five% drawdown is near historic swings, which suggests volatility like this has precedents. That view doesn’t take away ache for merchants, however it does place the drop into an extended sample somewhat than labeling it terminal.

Featured picture from Unsplash, chart from TradingView