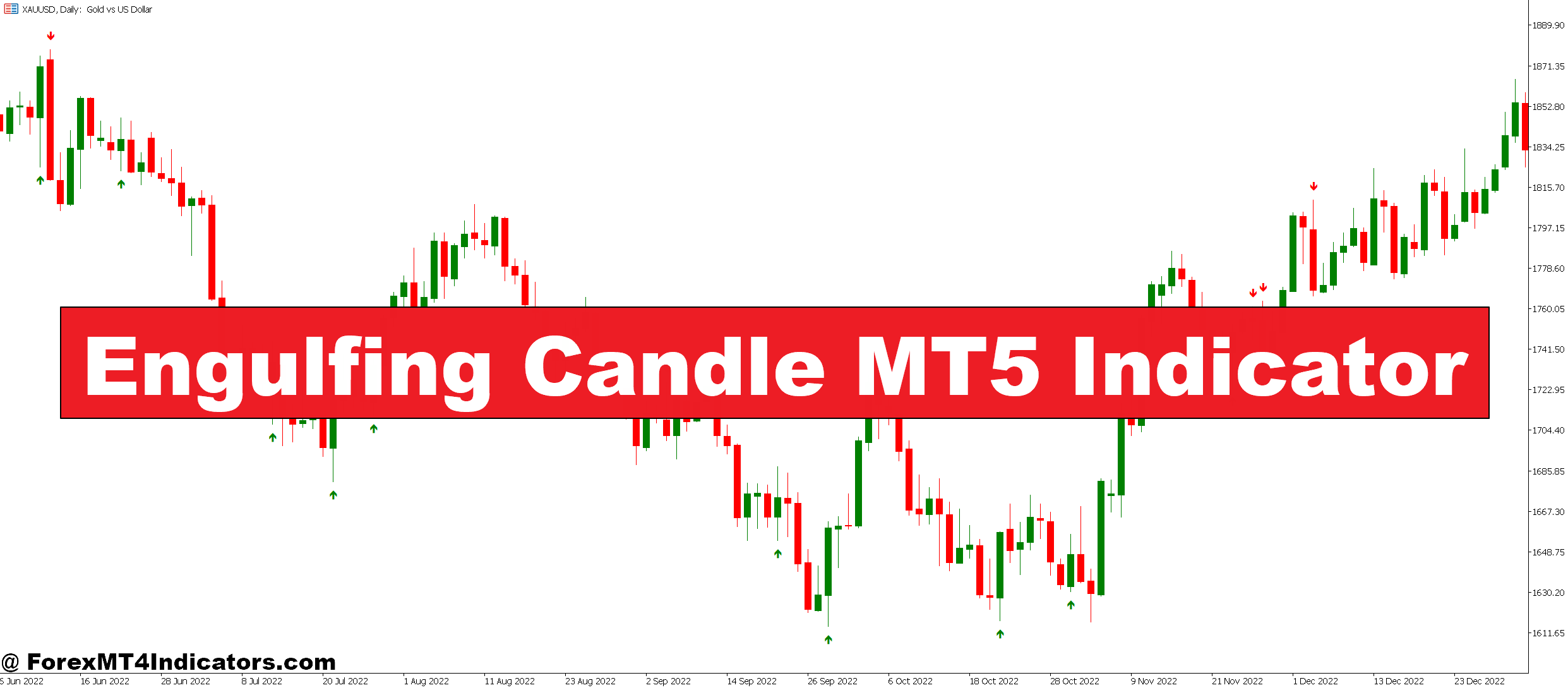

The Engulfing Candle MT5 Indicator solves this by routinely figuring out these highly effective reversal patterns in real-time, letting merchants give attention to execution relatively than candle-by-candle evaluation.

This instrument doesn’t simply spotlight engulfing candles—it filters them primarily based on customizable standards, serving to separate real reversal indicators from noise in uneven markets.

What Engulfing Patterns Truly Inform You

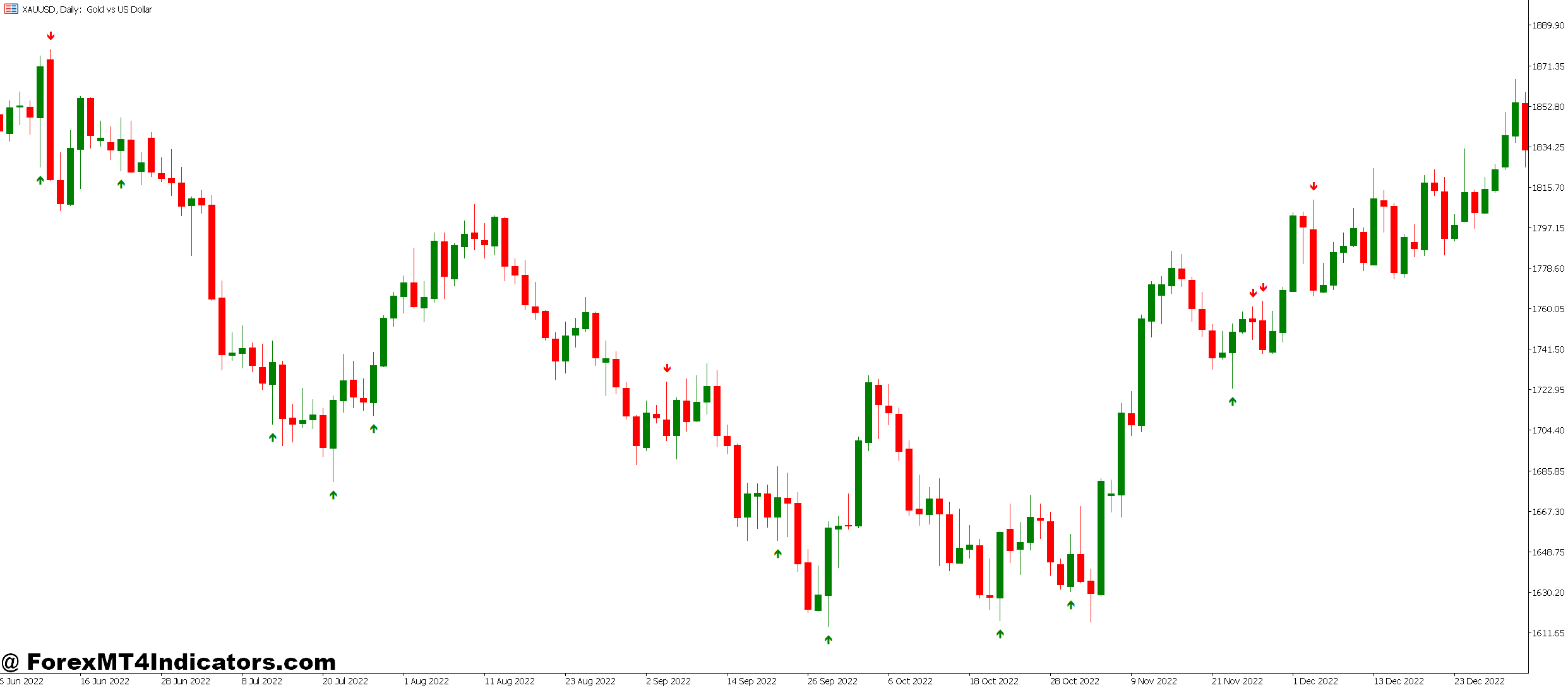

An engulfing candle kinds when the present candle’s physique utterly engulfs the earlier candle’s actual physique, no matter wick size. Bullish engulfing seems when a inexperienced candle swallows a crimson one, usually signaling patrons overpowering sellers. Bearish engulfing works in reverse—a crimson candle consuming a inexperienced one exhibits sellers taking management.

The psychology behind this sample is simple. When the second candle’s vary exceeds the primary solely, it demonstrates a shift in momentum. That earlier candle’s merchants? They’re now underwater, usually triggering stop-losses that gasoline the brand new path.

The MT5 indicator automates sample detection throughout timeframes. As an alternative of squinting at candlesticks throughout unstable Asian classes or NFP releases, the instrument marks legitimate engulfing formations with arrows or dots. Most variations let merchants set minimal physique measurement necessities, stopping tiny engulfing candles on ranging days from cluttering charts.

How the Indicator Processes Value Knowledge

The calculation logic compares the present candle’s open and shut in opposition to the earlier candle’s vary. For a bullish engulfing, the indicator verifies: present open beneath prior shut, present shut above prior open. Bearish engulfing requires the other: present open above prior shut, present shut beneath prior open.

Right here’s the place customization issues. Fundamental variations flag each engulfing sample, however that creates false indicators throughout sideways markets. Higher implementations embrace filters:

- Minimal physique measurement: Requires the engulfing candle to be at the very least X pips or a proportion bigger

- Development affirmation: Solely indicators engulfing patterns aligned with greater timeframe tendencies

- Quantity verification: Checks if quantity elevated throughout formation (when accessible)

When testing this on GBP/JPY’s 4-hour chart, including a 15-pip minimal physique filter lowered indicators by 40% however improved win fee considerably. The remaining setups occurred at real help and resistance zones relatively than mid-range noise.

Actual Buying and selling Eventualities and Setup Examples

The indicator shines when mixed with confluence components. A standalone engulfing candle at a random worth degree? Not notably helpful. However an engulfing sample at a key Fibonacci retracement or earlier swing excessive turns into price watching.

Take this EUR/USD instance from a typical buying and selling week: Value approached 1.0850 resistance after a robust rally. A bearish engulfing shaped on the 1-hour chart proper because the 4-hour timeframe confirmed an overbought RSI studying above 70. Merchants utilizing the indicator acquired an alert, entered brief with stops above the engulfing candle’s excessive, and caught a 60-pip transfer to the subsequent help zone.

What made that setup work? The confluence. The sample aligned with resistance, momentum divergence, and occurred in the course of the London session liquidity. The indicator didn’t trigger the commerce—it highlighted the sample so merchants might assess context rapidly.

On the flip aspect, the identical indicator flagged eight different engulfing patterns that week on EUR/USD. Three occurred mid-range with no close by construction, two reversed instantly (traditional fake-outs), and three required persistence as worth consolidated earlier than shifting. That’s actuality. No sample works in isolation.

Settings Price Adjusting for Completely different Markets

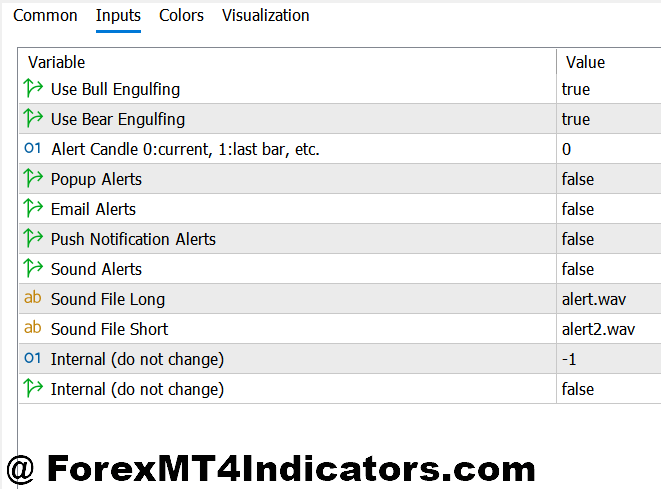

Default settings hardly ever go well with each buying and selling type or market situation. Most merchants modify these parameters:

- Minimal Candle Measurement: Scalpers on 5-minute charts would possibly use 5-10 pips, whereas swing merchants on every day charts might require 50+ pips. The purpose is to filter out insignificant patterns relative to regular worth motion.

- Alert Varieties: Visible arrows work for guide chart scanning, however cell push notifications assist when monitoring a number of pairs. Some variations provide e mail alerts—helpful for swing merchants checking positions a couple of occasions every day.

- Colour Schemes: Sounds trivial, however on darkish charts with a number of indicators, default arrow colours usually mix in. Brilliant contrasting colours stop lacking indicators throughout quick markets.

One underused setting is the “reverse candle most measurement” parameter. This ensures the candle being engulfed isn’t abnormally giant—a typical prevalence throughout information spikes that produces unreliable patterns.

Testing these changes on a demo account for 2 weeks earlier than going stay prevents expensive errors. What works on GBP/USD’s volatility would possibly overwhelm AUD/NZD’s slower tempo.

Strengths That Make It Helpful

The first benefit is time financial savings. Scanning six forex pairs throughout three timeframes manually takes critical display screen time. The indicator does this immediately, letting merchants analyze context relatively than hunt for patterns.

Sample consistency is one other profit. People get drained and miss formations throughout lengthy classes. The indicator applies the identical standards each time, eradicating emotional bias from sample identification.

It additionally serves newer merchants as an academic instrument. Watching how engulfing patterns kind in real-time builds sample recognition expertise quicker than finding out static chart examples. That information stays invaluable even when merchants finally choose guide evaluation.

Limitations Each Dealer Ought to Know

The indicator can’t assess market construction, which is essential for sample validation. It flags an engulfing candle at 3 AM throughout skinny liquidity, the identical manner it might in the course of the London-New York overlap. Context consciousness requires human judgment.

False indicators throughout ranging markets are inevitable. When worth chops between tight help and resistance, engulfing patterns seem often however hardly ever result in sustained strikes. The indicator doesn’t distinguish between trending and ranging circumstances with out further filters.

Buying and selling foreign exchange carries substantial threat. No indicator ensures income, and engulfing patterns fail usually when market circumstances change abruptly. Correct threat administration—stop-losses, place sizing, and capital preservation—issues greater than any single sample recognition instrument.

How It Compares to Pin Bar and Inside Bar Indicators

Pin bar indicators search for candles with lengthy wicks and small our bodies, signaling rejection at worth ranges. They’re usually extra dependable at excessive help and resistance however seem much less often than engulfing patterns.

Inside bar indicators mark consolidation—smaller candles contained inside the earlier candle’s vary. These sign potential breakouts relatively than rapid reversals like engulfing patterns counsel.

The engulfing indicator sits between these. It’s not as uncommon as sturdy pin bars however extra decisive than inside bars. Many merchants run all three indicators concurrently, in search of confluence when a number of patterns align.

That mentioned, working too many indicators creates evaluation paralysis. Skilled merchants usually select one sample sort that matches their type, then grasp its nuances relatively than chasing each sign throughout a number of instruments.

How one can Commerce with Engulfing Candle MT5 Indicator

Purchase Entry

- Affirm bullish engulfing at help – Look forward to a inexperienced candle to utterly engulf the earlier crimson candle at a key help degree on the EUR/USD 4-hour chart, then enter 2-3 pips above the engulfing candle’s excessive.

- Test greater timeframe alignment – Solely take the sign if the every day chart exhibits an uptrend; bullish engulfing patterns in opposition to the every day development fail 60-70% of the time.

- Set stop-loss beneath the low – Place your cease 5-10 pips beneath the engulfing candle’s lowest level to account for wicks and keep away from untimely stop-outs throughout regular volatility.

- Goal earlier resistance zones – Goal for the closest resistance degree or swing excessive, usually 40-80 pips away on GBP/USD 1-hour charts in the course of the London session.

- Confirm with quantity – Search for elevated quantity in the course of the engulfing candle formation; low quantity patterns at help usually reverse rapidly and lure late patrons.

- Keep away from throughout main information – Skip indicators that kind half-hour earlier than or after high-impact information releases like NFP or central financial institution selections—whipsaws destroy these setups.

- Threat most 1-2% per commerce – By no means threat greater than 2% of your account on a single engulfing sample, even when it seems excellent; three consecutive losses occur usually.

- Ignore patterns in tight ranges – Don’t enter if worth has been consolidating inside a 30-pip vary for six+ hours; anticipate a transparent breakout earlier than trusting engulfing indicators.

Promote Entry

- Establish bearish engulfing at resistance – Enter when a crimson candle totally engulfs the prior inexperienced candle at a examined resistance zone on the EUR/USD every day chart, putting entry 2-3 pips beneath the candle’s low.

- Affirm downtrend on greater timeframe – Confirm the 4-hour or every day chart exhibits decrease highs and decrease lows; bearish engulfing in uptrends usually turns into bullish continuation as an alternative.

- Place cease above the excessive – Set stop-loss 5-10 pips above the engulfing candle’s highest level to guard in opposition to false breakouts whereas giving the commerce respiratory room.

- Goal help or Fibonacci ranges – Take revenue on the subsequent help zone or 61.8% Fibonacci retracement, normally 50-100 pips down on GBP/USD 4-hour charts.

- Look ahead to RSI overbought affirmation – Bearish engulfing patterns work finest when RSI reads above 70, displaying exhaustion; patterns at RSI 50 lack momentum affirmation.

- Skip indicators throughout Asian session – Keep away from bearish engulfing patterns between 8 PM-3 AM EST when liquidity is skinny; these usually reverse throughout London open, inflicting pointless losses.

- Use a 2:1 minimal risk-reward ratio – In case your cease is 30 pips, goal at the very least 60 pips revenue; decrease ratios imply you want 60%+ win fee simply to interrupt even.

- By no means chase after huge strikes – If the bearish engulfing shaped after a 150+ pip drop in a single session, anticipate a pullback; late entries catch reversals as an alternative of continuations.

Conclusion

The Engulfing Candle MT5 Indicator works finest as a sample recognition assistant, not a standalone system. Merchants who mix it with correct help and resistance evaluation, development identification on greater timeframes, and stable threat administration discover worth in its automation.

Success comes from filtering indicators ruthlessly. Not each engulfing sample deserves a commerce. The most effective setups happen at important worth ranges, align with broader development path, and seem throughout liquid buying and selling classes. The indicator highlights prospects—merchants should consider likelihood.

Begin by testing on a demo account with conservative place sizing. Observe which filtered standards produce the very best outcomes in your most well-liked pairs and timeframes. That knowledge beats any default setting or theoretical suggestion.

Advisable MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Further Unique Bonuses All through The 12 months

- Unique 90% VIP Money Rebates for all Trades!

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Accomplice Code: VIP90