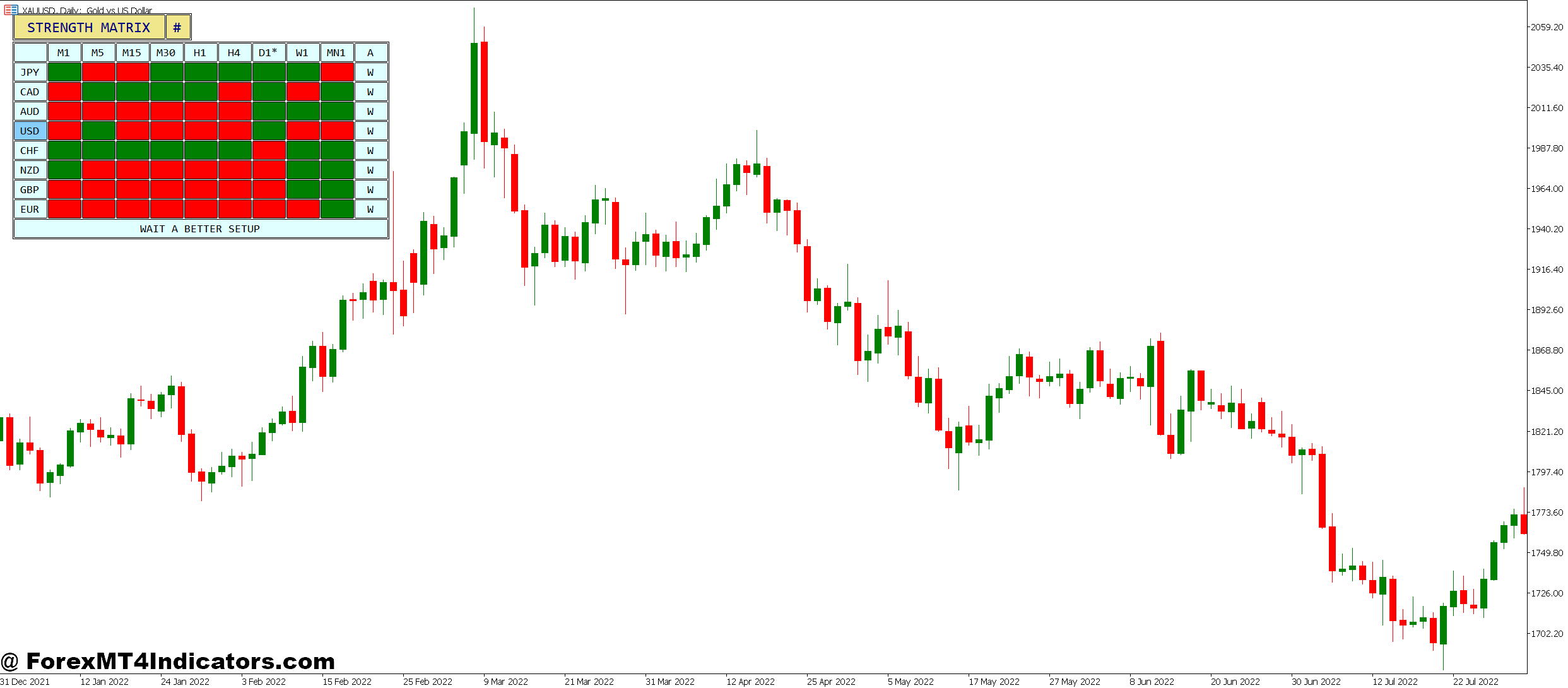

A forex power indicator measures the relative efficiency of particular person currencies towards a basket of others. In contrast to conventional indicators that analyze value motion on a single pair, these instruments break down the eight main currencies (USD, EUR, GBP, JPY, CHF, CAD, AUD, NZD) and rank their power independently.

Right here’s how this adjustments your perspective: While you take a look at GBP/USD in your chart, you’re seeing one information stream—the connection between two currencies. However a forex power indicator reveals you two separate information streams. The pound may be up 0.8% whereas the greenback is down 0.3%. That’s a really totally different situation than the pound being up 0.2% and the greenback being down 0.9%, though each might present GBP/USD rising.

The calculation usually includes evaluating every forex towards all others over a selected interval. When you’re utilizing a 24-hour calculation window, the indicator measures how a lot the euro gained or misplaced towards the greenback, pound, yen, and so forth, then averages these actions to provide a single power worth. Some variations normalize this to a scale of 0-100, whereas others use proportion adjustments.

How MT5 Foreign money Power Indicators Calculate Values

Most MT5 forex power indicators use one in every of two calculation strategies. The easier strategy takes the share change of every forex towards all others within the basket. For example, if EUR/USD is up 0.5%, EUR/JPY is up 0.8%, and EUR/GBP is down 0.2%, the indicator averages these actions to indicate the euro’s total power.

The extra subtle technique—and the one skilled merchants want—weights these calculations by buying and selling quantity or market share. Since EUR/USD represents roughly 24% of foreign exchange quantity whereas EUR/NZD may be lower than 1%, giving them equal weight distorts actuality. Quantity-weighted indicators present a extra correct image of precise forex power.

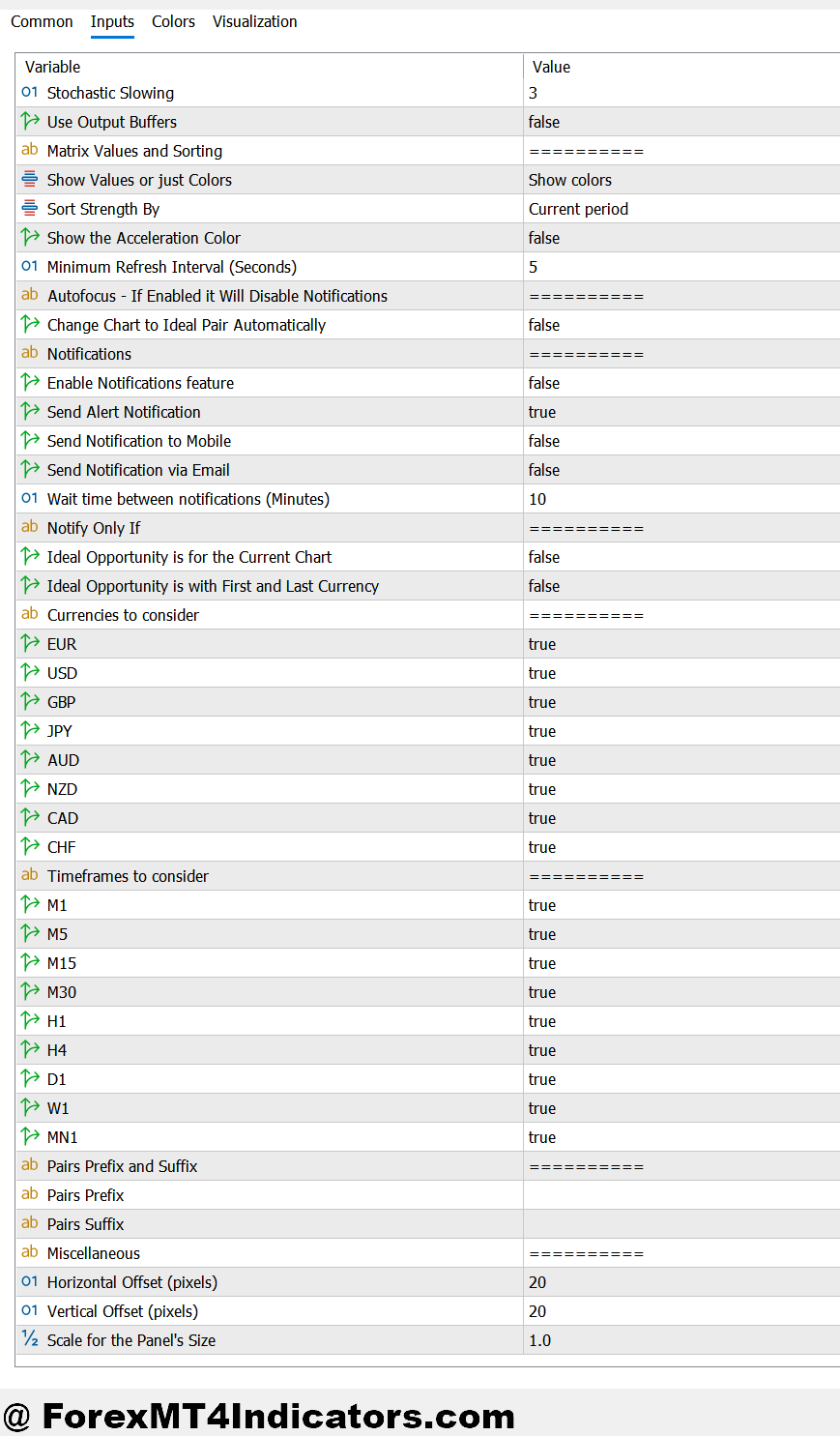

The refresh charge issues too. Some indicators recalculate with each tick, making a jittery, noise-filled line that’s powerful to learn. Others replace each 5 or quarter-hour, smoothing out the microstructure noise whereas staying responsive sufficient for day buying and selling. When testing the Foreign money Power 28 indicator on a 4-hour EUR/USD chart through the March 2024 Fed determination, the 15-minute refresh charge caught the greenback’s reversal inside half-hour, whereas the tick-by-tick model gave three false alerts in the identical window.

Buying and selling Purposes: Placing Power to Work

Essentially the most simple utility is pattern affirmation. Say you’re eyeing an extended place on AUD/JPY primarily based on a bullish flag sample. Earlier than coming into, examine the power indicator. If the Aussie greenback reveals sturdy momentum (above 70 on a 0-100 scale) whereas the yen sits weak (under 30), that’s affirmation. Your technical setup aligns with underlying forex dynamics.

However right here’s the place it will get attention-grabbing: divergence trades. On August 14th, 2024, EUR/GBP was grinding sideways between 0.8550 and 0.8580, wanting lifeless. The forex power indicator informed a special story. The euro was weakening steadily whereas the pound was strengthening. Although the pair hadn’t damaged out but, that divergence signaled the coil was winding tighter. When EUR/GBP lastly broke down by means of 0.8550, the power indicator had already given you a 4-hour heads up.

Pair choice turns into systematic quite than random. As an alternative of scrolling by means of 28 pairs hoping to identify a setup, you establish the strongest and weakest currencies, then commerce the pair that mixes them. If the CAD is displaying most power at 95 whereas the NZD is weakest at 15, you don’t want to attend for NZD/CAD to color an ideal chart sample—the power differential is your sign. Simply anticipate an inexpensive entry on any timeframe you commerce.

Danger administration improves too. While you’re holding EUR/USD lengthy and the euro’s power line begins rolling over whereas nonetheless in revenue, that’s your cue to tighten stops or take partial income. You’re not ready for value to reverse and provides again beneficial properties—the power indicator is displaying you the momentum shift earlier than it totally displays in value.

Customization and Settings for Completely different Buying and selling Types

The calculation interval is your main lever. Scalpers would possibly use a 1-hour or 4-hour lookback interval, making the indicator hyperresponsive to short-term shifts. This works nice on the 1-minute or 5-minute chart for catching fast intraday swings. Swing merchants usually want 24-hour or 48-hour calculations, filtering out noise and specializing in sustained power tendencies.

Smoothing settings matter greater than most merchants understand. A uncooked, unsmoothed power line jumps round with each information blip and random market fluctuation. Apply a easy shifting common—say, a 3-period or 5-period SMA—and all of the sudden the sign turns into readable. Check this your self: Load the indicator twice in your chart, one smoothed and one uncooked. The distinction is placing.

Foreign money basket composition might be adjusted too. The usual eight majors work wonderful for many buying and selling, however some indicators allow you to add or take away currencies. When you by no means commerce the Swiss franc or New Zealand greenback, eradicating them can sharpen the calculation for the currencies you really care about.

Visible settings shouldn’t be neglected. Some merchants want line-based shows displaying all eight currencies concurrently—it’s complete however can seem like a bowl of spaghetti. Others use bar charts or gauges displaying solely the present power values, which is cleaner however loses the historic context. Discover what your mind processes quickest, as a result of info you’ll be able to’t shortly interpret is ineffective throughout dwell buying and selling.

Strengths and Limitations: The Trustworthy Evaluation

The first benefit is readability. You cease guessing about forex dynamics and begin figuring out. When EUR/USD, EUR/JPY, and EUR/GBP are all shifting in a different way, the indicator tells you whether or not the euro is genuinely sturdy or simply benefiting from a weak greenback. That’s highly effective.

Correlation buying and selling turns into doable. As soon as you already know the pound is crushing it and the yen is weak, you’ll be able to search for GBP/JPY setups throughout a number of timeframes. Similar evaluation, a number of alternatives. This multiplies your edge with out multiplying your analysis time.

That mentioned, forex power indicators aren’t crystal balls. They’re lagging by nature—they measure what’s already occurred to calculate present power. Throughout flash crashes or main information occasions, the indicator would possibly present power constructing when the market is already pivoting. Don’t confuse measurement with prediction.

False alerts occur, particularly in ranging markets. If currencies are all bunched collectively in the course of the power scale, the indicator isn’t telling you a lot. Buying and selling primarily based on a 52 vs. 48 power differential is like flipping a coin. You want significant separation—no less than 20-30 factors on a 100-point scale—to have conviction.

The indicator additionally doesn’t account for basic drivers. The greenback would possibly present weakening power, but when the Fed is about to hike charges unexpectedly, technical power readings received’t prevent. Foreign money power indicators work finest when mixed with consciousness of the financial calendar and main market themes.

Evaluating Foreign money Power to Different Approaches

Conventional RSI or MACD indicators utilized to a single pair present you momentum for that relationship. Foreign money power indicators present you the parts of that relationship. They’re complementary, not aggressive. An RSI would possibly let you know EUR/USD is overbought whereas the power indicator reveals each currencies strengthening—which means the uptrend has gas left regardless of stretched technicals.

Relative power in comparison with correlation matrices presents related info however totally different usability. Correlation matrices are nice for understanding relationships between pairs, however they don’t let you know which particular person forex is driving these relationships. Foreign money power indicators lower by means of that complexity with a single, readable output.

Some merchants use index charts—just like the Greenback Index (DXY)—for related functions. These work, however they’re restricted to particular currencies and use weighted baskets which may not match your buying and selling focus. DXY weighs the euro at 57.6% however offers the yen solely 13.6%. When you’re buying and selling yen crosses primarily, that weighting skews your perspective.

The best way to Commerce with MT5 Indicator Foreign money Power

Purchase Entry

- Power divergence above 30 factors – Enter lengthy when your base forex reveals 65+ power whereas quote forex sits under 35 on the 0-100 scale (instance: purchase GBP/JPY when pound hits 70 and yen drops to 32).

- Verify with value motion breakout – Look forward to the pair to interrupt above a 4-hour resistance stage when power readings help the transfer; don’t purchase into resistance simply because power seems to be good.

- Rising power line for 3+ bars – Enter when your goal forex’s power line climbs for no less than three consecutive 15-minute or 1-hour candles, displaying sustained momentum, not only a spike.

- Danger 1-2% most per commerce – Even with excellent power readings, restrict place dimension so a 30-pip cease loss on EUR/USD equals not more than 2% of your account.

- Keep away from trades when each currencies strengthen – skip the setup if EUR/USD power reveals the euro at 68 and the greenback at 71; you’re buying and selling a coin flip, not a directional edge.

- Greatest throughout the London/New York overlap – Take purchase alerts between 8 AM and 12 PM EST when quantity is highest; power readings throughout Asian low-volume classes have a tendency to provide extra false alerts.

- Set stops under current swing low – Place your cease 5-10 pips under the final 1-hour or 4-hour swing level, not arbitrary numbers; let market construction defend you.

- Exit partial at 1.5R, path the remainder – Take 50% revenue whenever you’re up 45 pips on a 30-pip threat commerce, then transfer cease to breakeven and let power information the exit on remaining place.

Promote Entry

- Weak point divergence under -30 factors – Enter quick when your base forex drops under 35 power whereas quote forex rises above 65 (instance: promote AUD/USD when Aussie hits 28 and greenback reaches 73).

- Power line rolling over from peaks – Promote when base forex power tops out above 75 and begins declining for two+ consecutive bars in your buying and selling timeframe, signaling exhaustion.

- Pair at resistance with weak base – Quick EUR/GBP at every day resistance when euro power reveals 45 or under and pound power exceeds 60; technical and power align.

- Skip ranging markets completely – Don’t promote when all eight currencies cluster between 45-55 power; anticipate a transparent separation of no less than 25-30 factors between the strongest and weakest.

- Time entries after main information releases – Keep away from promoting quarter-hour earlier than and after NFP, Fed choices, or ECB conferences; power indicators lag throughout risky spikes, and also you’ll get slippage.

- Use tighter stops on decrease timeframes – If buying and selling 5-minute charts with power affirmation, maintain stops 15-20 pips max; longer timeframes like 4-hour can deal with 40-50 pip stops.

- Look ahead to power convergence as exit – Shut shorts when the weak forex’s power begins rising and approaches the sturdy forex’s declining power, even when the value hasn’t hit your goal.

- By no means commerce towards all-time power extremes – Don’t promote USD pairs when greenback power hits 90+ on the dimensions; anticipate a pullback to 75-80 or threat getting run over by the freight prepare.

Conclusion

Foreign money power indicators give merchants X-ray imaginative and prescient into the foreign exchange market’s skeleton, revealing which currencies are literally shifting the pairs in your charts. They received’t exchange strong technical evaluation or basic consciousness, however they add a layer of perception that almost all retail merchants fully miss.

Begin by including a forex power indicator to your MT5 platform and simply watch it for per week. Don’t commerce off it but—simply observe how power shifts earlier than value breaks out, or how ranging pairs usually present converging power readings. Discover which forex tends to guide strikes throughout your buying and selling session. That observational interval will train you greater than any article can.

The actual edge comes from combining power readings along with your current technique. Use it to filter trades, selecting setups the place the underlying currencies help your directional bias. Use it to handle exits, closing positions when the power begins deteriorating. And use it for pair choice, focusing your consideration the place the true alternatives are.

Buying and selling foreign exchange carries substantial threat. No indicator ensures income, and forex power instruments can produce false alerts throughout ranging markets or sudden information occasions. They’re one piece of data in your decision-making course of, not a standalone system. However for merchants keen so as to add this attitude to their evaluation, forex power indicators reveal patterns and alternatives that value charts alone maintain hidden.

Really helpful MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Further Unique Bonuses All through The Yr

- Unique 90% VIP Money Rebates for all Trades!

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Accomplice Code: VIP90