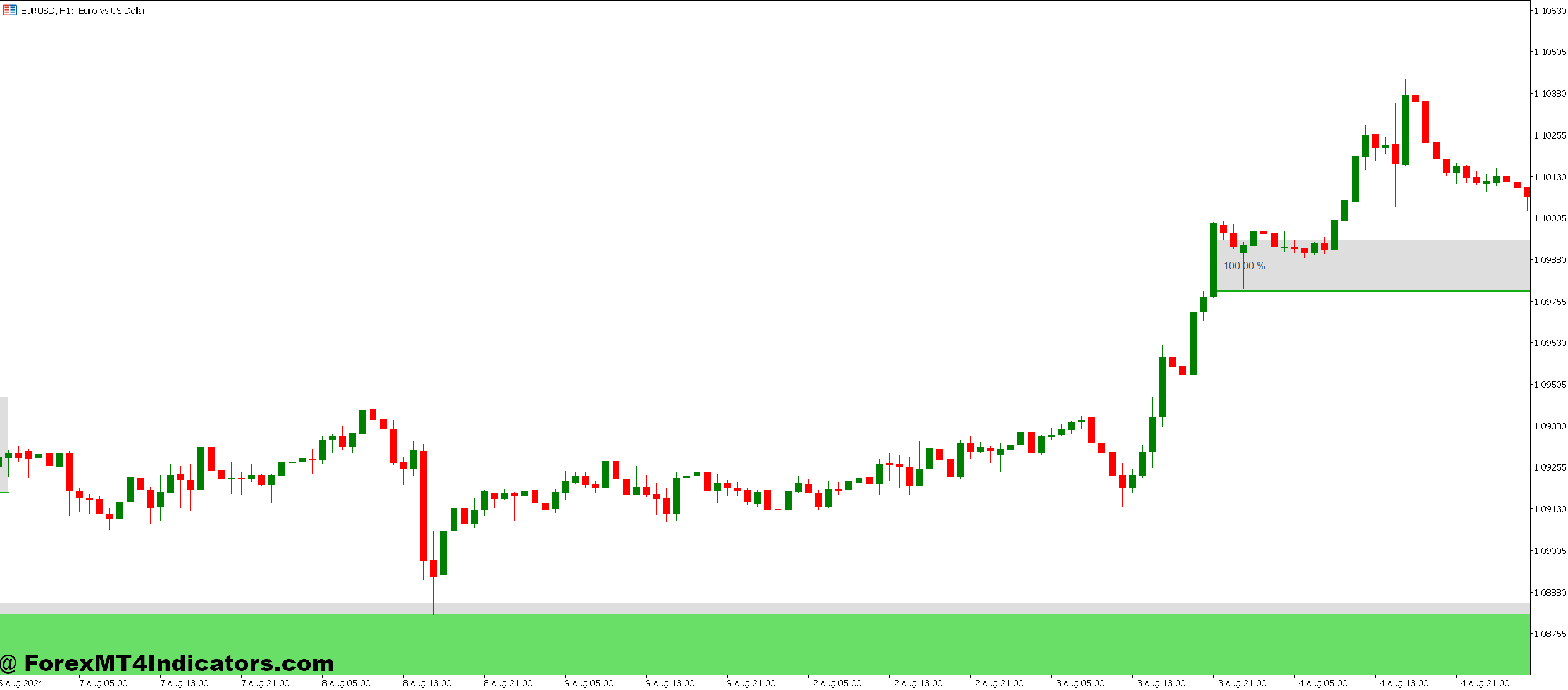

The Honest Worth Hole Indicator automates the detection of those worth imbalances on MetaTrader 5, highlighting zones the place institutional order movement created inefficiencies. As a substitute of manually scanning charts for three-candle patterns, merchants get visible alerts exhibiting potential reversal or continuation zones. Let’s break down how this software truly works and whether or not it deserves a spot in your buying and selling arsenal.

What Honest Worth Gaps Truly Signify

Honest worth gaps (FVGs) happen when worth strikes so aggressively that it skips over sure worth ranges, creating an imbalance. In technical phrases, this occurs when the excessive of candle one doesn’t overlap with the low of candle three. That center candle—the one driving the sharp transfer—leaves behind what some merchants name an “inefficiency” or “liquidity void.”

Right here’s the factor: markets hate inefficiencies. Worth gravitates again to those zones like a magnet, usually offering high-probability entries. When GBP/JPY gaps up throughout the London session, leaving an FVG between 185.20 and 185.50, there’s a robust probability it’ll retrace to “steadiness” that zone earlier than persevering with larger. The Honest Worth Hole Indicator MT5 routinely identifies these patterns and marks them as rectangular bins in your chart.

The idea comes from the ICT (Interior Circle Dealer) methodology and good cash ideas. Establishments don’t care about clear, orderly worth motion. When they should transfer measurement, they create gaps. Retail merchants utilizing conventional indicators miss these totally as a result of transferring averages and oscillators don’t account for structural imbalances.

How the Indicator Calculates and Shows FVGs

The calculation logic is easy however requires exact execution. The indicator scans for 3 consecutive candles the place a niche exists between candle one’s excessive and candle three’s excessive. For bullish FVGs, it identifies when candle one’s excessive is under candle three’s low, with candle two bridging the hole via aggressive shopping for.

Most MT5 variations of this indicator supply customization for:

- Minimal hole measurement: Filters out tiny imbalances that lack significance (sometimes set to 5-10 pips)

- Most gaps displayed: Prevents chart muddle by exhibiting solely current FVGs

- Coloration coding: Bullish gaps in a single shade, bearish in one other

- Alert settings: Pop-ups or cellular notifications when new gaps type

When testing this on AUD/USD throughout the Sydney session, the indicator flagged a bullish FVG at 0.6385-0.6395 after a pointy transfer off help. Worth rallied 60 pips, retraced into the hole, and launched one other 80-pip leg larger. With out the visible field, that reentry would’ve been straightforward to overlook.

The indicator doesn’t predict course—it marks zones. That’s a important distinction. The hole reveals the place an imbalance exists, however context determines whether or not it’s a reversal zone or a continuation setup.

Buying and selling Honest Worth Gaps in Stay Market Situations

Good merchants don’t blindly purchase each hole fill. Context issues. Throughout trending situations on the 1-hour EUR/USD chart, bullish FVGs act as continuation zones. When worth pulls again into a niche that fashioned throughout a robust uptrend, it usually bounces and extends the transfer. However in ranging situations, those self same gaps would possibly set off reversals.

Right here’s a sensible method: Anticipate the value to enter the FVG zone, then search for affirmation. That could possibly be a bullish engulfing candle, a rejected wick, or momentum divergence. On USD/CAD’s 4-hour chart, there was a bearish FVG between 1.3580 and 1.3610. Worth rallied into it, fashioned a capturing star, and dropped 120 pips. The hole offered the zone; the candlestick sample gave the entry sign.

Timeframe choice adjustments every little thing. The 15-minute chart produces tons of gaps, most meaningless. The each day chart reveals fewer however extra vital imbalances. Swing merchants desire 4-hour and each day FVGs, whereas scalpers would possibly use 5-minute gaps throughout high-volatility classes. Every timeframe requires totally different danger administration since smaller timeframes generate extra false alerts.

One mistake merchants make is anticipating rapid fills. Typically the value runs 200 pips earlier than returning to fill a niche. Endurance separates worthwhile FVG merchants from those that chase worth and sabotage their accounts.

Limitations Each Dealer Ought to Perceive

No indicator ensures earnings, and FVGs have clear weaknesses. First, they’re lagging by nature—the hole seems after the value already moved. You’re primarily buying and selling a retracement, not catching the preliminary impulse. Meaning you’ll miss the strongest a part of the transfer.

Second, not all gaps are crammed. Throughout robust tendencies, the value can go away a number of FVGs behind with out ever returning. If EUR/USD is in a 500-pip downtrend, that bullish hole from two days in the past would possibly by no means fill. The market doesn’t owe you a retracement simply because an imbalance exists.

Third, false alerts pop up continuously on decrease timeframes. The 1-minute chart creates FVGs that imply nothing within the larger image. Mix this indicator with larger timeframe evaluation and worth motion affirmation. Utilizing FVGs alone is like making an attempt to construct a home with only a hammer.

Danger administration stays non-negotiable. A niche on GBP/USD spanning 40 pips doesn’t imply you danger 40 pips. Place stops past the zone, account for unfold and slippage, and by no means danger greater than 1-2% per commerce. Buying and selling foreign exchange carries substantial danger, and even one of the best setups fail often.

How FVGs Examine to Conventional Provide and Demand Zones

Provide and demand zones mark areas the place institutional orders sat traditionally. Honest worth gaps determine inefficiencies created by aggressive order movement. Each ideas overlap, however FVGs supply extra exact zones since they’re mathematically outlined by three particular candles.

Assist and resistance ranges present the place the value reversed beforehand. FVGs present the place worth skipped ranges totally. On NZD/USD, you might need resistance at 0.6250, but when the value gaps via it, the FVG between 0.6245-0.6255 turns into the main focus, not the previous degree.

In comparison with Fibonacci retracements, FVGs present goal zones with out subjective swing level choice. Two merchants utilizing Fibs would possibly mark totally different ranges; two merchants utilizing the Honest Worth Hole Indicator MT5 see equivalent zones. That consistency helps when backtesting and journaling trades.

That stated, combining FVGs with help/resistance creates a robust confluence. When a bullish hole aligns with a earlier demand zone on the each day chart, the setup beneficial properties validity. USD/JPY confirmed this completely when a 4-hour FVG landed precisely on the 145.00 psychological degree—worth bounced 90 pips.

Making the Indicator Work for Your Buying and selling Fashion

Day merchants profit from 5-minute and 15-minute gaps throughout the London and New York classes. Volatility will increase throughout these home windows, creating cleaner imbalances. Set alerts so that you don’t miss new gaps forming in your watchlist. When EUR/GBP varieties a bullish FVG at 8:30 AM EST, you wish to know instantly.

Swing merchants ought to give attention to each day and 4-hour FVGs. These gaps have extra significance and supply higher risk-reward ratios. A each day chart hole spanning 50 pips on AUD/JPY gives room for a 2:1 or 3:1 goal, whereas 15-minute gaps barely supply 1:1.

Scalpers have to be selective. Sure, the 1-minute chart produces gaps, however most are noise. Filter by minimal hole measurement (no less than 10 pips on main pairs) and solely commerce throughout peak liquidity. Exterior London and New York overlap, these tiny gaps not often lead wherever.

The indicator shines when mixed with different instruments. Use it alongside RSI to identify oversold bounces inside bullish gaps. Add transferring averages to substantiate development course earlier than buying and selling hole fills. Layer FVGs with quantity evaluation to gauge whether or not good cash is accumulating or distributing. No single indicator tells the entire story.

The right way to Commerce with Honest Worth Hole Indicator MT5

Purchase Entry

- Anticipate worth to enter the bullish FVG zone – Don’t chase the preliminary transfer up; let worth retrace into the hole between 50-75% for optimum risk-reward on EUR/USD 4-hour charts.

- Affirm with bullish candlestick sample – Search for engulfing candles, hammer wicks, or morning stars forming contained in the hole on 1-hour timeframes earlier than coming into.

- Verify larger timeframe development alignment – Solely take bullish FVG entries when the each day chart reveals an uptrend; counter-trend hole fills fail 60% of the time.

- Set cease loss 5-10 pips under the FVG zone – On GBP/USD, if the hole spans 1.2650-1.2680, place stops at 1.2640 to account for unfold and keep away from untimely exits.

- Goal earlier excessive or subsequent FVG – Goal for two:1 minimal risk-reward; if risking 20 pips, goal no less than 40 pips towards the swing excessive that created the hole.

- Keep away from buying and selling gaps smaller than 15 pips – Tiny imbalances on main pairs lack institutional significance and sometimes produce whipsaw losses throughout uneven classes.

- Skip entries throughout main information releases – NFP, FOMC, or central financial institution bulletins create erratic worth motion that invalidates FVG setups inside seconds.

- Cut back place measurement if the hole is older than 10 candles – Stale gaps on the 15-minute chart lose relevance; reduce danger by 50% or look ahead to brisker setups.

Promote Entry

- Enter when worth rallies into bearish FVG – Anticipate retracement into the hole zone (sometimes 50-80% fill) on EUR/USD 1-hour charts earlier than promoting.

- Require bearish affirmation candle – Capturing star, bearish engulfing, or robust rejection wick contained in the hole validates the reversal on 4-hour timeframes.

- Confirm downtrend on larger timeframe – Solely quick bearish FVGs when the each day chart reveals a transparent downward construction; range-bound markets produce unreliable alerts.

- Place stops 5-10 pips above the FVG excessive – If GBP/USD bearish hole runs from 1.2750-1.2780, set cease at 1.2790 to outlive minor volatility spikes.

- Goal decrease swing low or help – Mission minimal 2:1 reward; risking 25 pips means concentrating on 50+ pips towards the demand zone that created the hole.

- Ignore gaps fashioned throughout Asian session lows – Low-volume durations on USD/JPY create false FVGs that usually fail when London opens with actual liquidity.

- Don’t promote into gaps close to main help – Bearish FVG at 1.0800 on EUR/USD (psychological degree) sometimes reverses; context beats sample each time.

- Exit instantly if worth closes above the hole – Failed bearish FVG means invalidation; don’t maintain dropping trades hoping worth returns—it received’t.

Ultimate Ideas on Honest Worth Hole Buying and selling

The Honest Worth Hole Indicator MT5 presents a scientific technique to spot worth inefficiencies that market makers ultimately fill. It excels at offering high-probability reentry zones throughout tendencies and potential reversal areas when gaps align with key ranges. Merchants who perceive market construction and order movement discover FVGs complement their technique naturally.

But it surely’s not magic. Gaps don’t assure fills, and fills don’t assure worthwhile trades. You’ll nonetheless want correct danger administration, affirmation alerts, and the self-discipline to skip mediocre setups. The indicator merely highlights zones value watching—what you do with that data determines outcomes.

Check it on a demo account first. Observe how usually gaps fill in your most popular pairs and timeframes. Discover which classes produce the cleanest setups. Construct guidelines round place sizing and cease placement. When you’ve received a course of that is sensible, then think about making use of it with actual capital.

The market will hold creating imbalances so long as establishments want to maneuver measurement. Studying to learn these gaps provides you a lens into the place good cash operated. Whether or not that edge interprets to constant earnings is determined by every little thing else you deliver to the desk.

Advisable MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The 12 months

- Unique 90% VIP Money Rebates for all Trades!

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Companion Code: VIP90