If I needed to boil down my Foreign currency trading technique into to at least one easy phrase, it will be this; buying and selling easy worth motion alerts from confluent ranges available in the market.

On this buying and selling coaching lesson, I’m going to elucidate tips on how to discover higher-probability commerce entries by searching for worth motion buying and selling alerts from confluent ranges or areas available in the market. So, let’s start by defining the 2 buying and selling instruments we shall be discussing as we speak:

On this buying and selling coaching lesson, I’m going to elucidate tips on how to discover higher-probability commerce entries by searching for worth motion buying and selling alerts from confluent ranges or areas available in the market. So, let’s start by defining the 2 buying and selling instruments we shall be discussing as we speak:

Value motion: Value motion is the motion of the value of a market over a selected time frame. By studying to learn the value motion of a market, we are able to decide a market’s directional bias in addition to commerce from reoccurring worth patterns or worth motion setups that mirror modifications or continuations in market sentiment.

Confluence: Some extent available in the market the place two or extra ranges intersect one another, thus forming a ‘scorching level’ or confluent level available in the market. Within the dictionary, confluence means ‘a coming collectively of individuals or issues; concourse’ (this the image to the precise displaying two rivers coming collectively). So, mainly, after we search for confluent areas available in the market we’re searching for areas the place two or extra ranges or evaluation instruments are intersecting.

A few of the components of confluence I search for on a chart:

• An uptrend or a down development; primarily a “development” is one issue of confluence in and of itself.

• Exponential transferring averages; I take advantage of the 8 and 21 day EMAs on the day by day charts to assist with development identification and dynamic assist and resistance identification. Each the 8 and 21 EMAs are components or ranges that may add confluence to a worth motion setup.

• Static (horizontal) assist and resistance ranges. These are the “traditional” horizontal assist and resistance ranges that usually join highs to highs or lows to lows. Right here’s a video on drawing assist and resistance ranges.

• Occasion areas. Occasion areas are ranges available in the market the place a major worth motion occasion occurred. This generally is a robust directional motion after a worth motion sign types, or it might merely be a rejection of a degree adopted by a robust directional motion…some vital “occasion” must have occurred at a sure level available in the market, we are able to then think about this an occasion space or degree. Learn extra on occasion areas right here.

• 50% retrace ranges. I personally watch the 50% to 61.8% retrace ranges for an additional issue of confluence. I don’t get into all the opposite Fibonacci extension ranges as I believe they’re too discretionary and haphazard to be of any use. It’s widespread data that the majority main strikes within the markets are inclined to retrace roughly 50% in some unspecified time in the future after they kind. However all the opposite Fibonacci ranges are merely a case of “when you put sufficient ranges in your charts a few of them are certain to get hit…”, in different phrases they’re extra messy and complicated than related or sensible.

The 5 components of confluence above are simply a few of the ranges that may intersect to kind a confluent space available in the market, there are additionally intra-day ranges and different components of confluence that we are able to look ahead to, which I focus on in my worth motion buying and selling course.

Combining ranges of confluence with worth motion alerts

When I’m analyzing the markets, I’m primarily searching for an apparent worth motion sample that has shaped at a confluent level available in the market. After all, studying what constitutes on “apparent” or high-probability worth motion setup and a confluent level available in the market is the outcome off schooling and display time, however they actually don’t take lengthy to be taught. As soon as you see a high-probability worth motion sign you’ll be able to then start to do some evaluation of the market construction and the context that the sign has shaped inside. Examine for the components of confluence listed above and see if two or extra of them line up with the value motion sign, in that case, you simply may need a commerce price risking your cash on.

Right here’s an instance of an apparent pin bar setup on the day by day chart EURUSD that had 4 components of confluence supporting it:

1. This pin bar had confluence with the dominant downtrend, because it shaped telling you to promote the market with the development.

2. The pin bar confirmed clear and forceful rejection of the day by day 8 / 21 EMA dynamic resistance layer.

3. The pin bar was additionally rejecting a horizontal degree of resistance.

4. The pin bar confirmed clear and forceful rejection of the 50% retrace of the final down transfer.

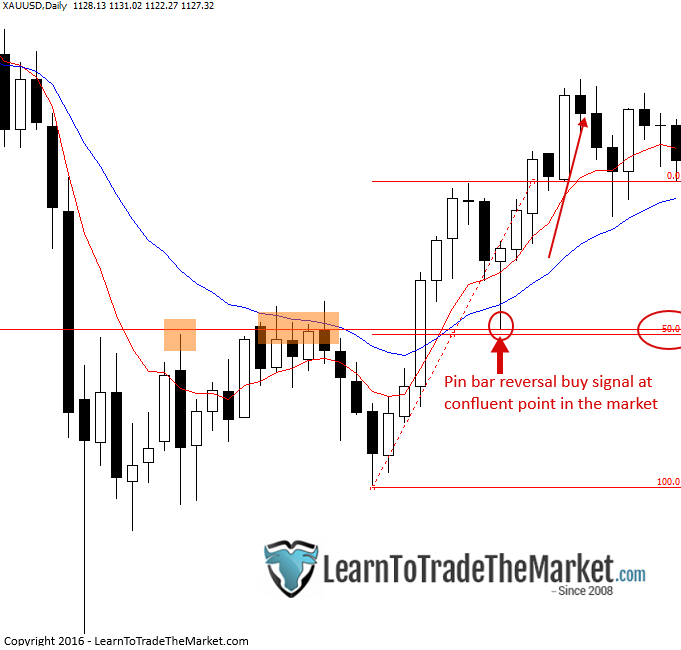

Within the subsequent instance, we are able to see a pin bar setup on the day by day spot Gold chart that had 4 of the components of confluence talked about above:

1. This pin bar had confluence with the just lately shaped uptrend, because it shaped telling you to purchase the market with the development.

2. The pin bar confirmed clear and forceful rejection of the day by day 8 / 21 EMA dynamic assist layer.

3. The pin bar was additionally rejecting a horizontal degree of assist.

4. The pin bar confirmed clear and forceful rejection of the 50% retrace of the final up transfer.

Within the subsequent instance, we are able to see an inside bar sample on the day by day GBPUSD chart that had 3 of the components of confluence talked about above:

1. This inside bar had confluence with the robust downtrend that was in place. Having the ‘weight’ and momentum of a development behind the sign you’re contemplating is an enormous piece of supporting proof for a commerce.

2. The within bar shaped after a small retrace as much as the day by day 8 / 21 EMA dynamic resistance layer.

3. The within bar shaped at a horizontal degree of assist.

Once we get a number of components of confluence coming collectively like this for a specific commerce setup, it’s an excellent signal and provides us a sort of ‘affirmation’ that the commerce is price taking…

Within the subsequent instance, we are able to see an fakey pin bar combo sample on the 4 hour GBPJPY chart that had 3 of the components of confluence talked about above:

1. This fakey sample had confluence with the robust downtrend that was in place. Having the ‘weight’ and momentum of a development behind the sign you’re contemplating is an enormous piece of supporting proof for a commerce. Additionally, the market was falling on the day by day chart on the time this 4 hour sign shaped, in order that provides extra weight or confluence to our setup.

2. The fakey shaped at a horizontal degree of assist.

Once we get a number of components of confluence coming collectively like this for a specific commerce setup, it’s an excellent signal and provides us a sort of ‘affirmation’ that the commerce is price taking…

Conclusion

From the examples above, you must have gained a fundamental data of what buying and selling worth motion from confluent ranges available in the market is all about. This lesson has given you slightly glimpse into my core buying and selling philosophy; searching for confluent ranges available in the market to commerce apparent worth motion alerts from. If you wish to be taught extra about how I commerce clear and efficient worth motion methods from confluent ranges available in the market, take a look at my worth motion buying and selling course right here.