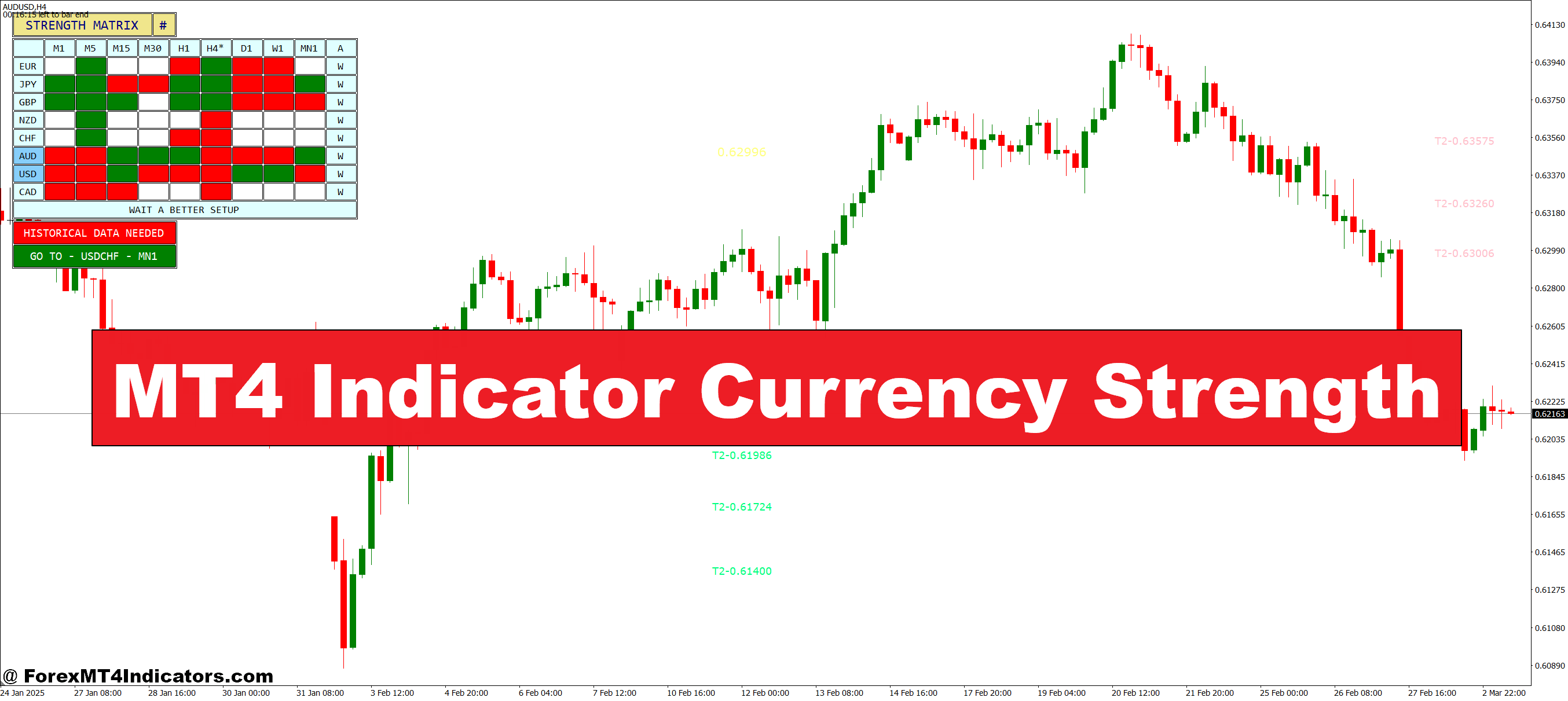

The MT4 indicator foreign money energy software solves this by measuring the relative efficiency of every main foreign money in real-time. As a substitute of guessing which pair has momentum, merchants can determine the strongest and weakest currencies, then commerce the pair that mixes them. This method transforms foreign exchange from a guessing sport right into a data-driven hunt for the trail of least resistance.

What Is the Foreign money Energy Indicator?

A foreign money energy indicator measures how every foreign money is performing in opposition to all others over a selected interval. In contrast to conventional indicators that analyze a single pair, this software calculates the composite energy of eight main currencies: USD, EUR, GBP, JPY, CHF, CAD, AUD, and NZD.

The indicator shows these currencies as separate strains on a chart, every exhibiting relative energy on a scale, usually starting from 0 to 10 or displayed as proportion values. When the EUR line is on the prime, and the JPY line is on the backside, the largest alternatives exist in pairs combining these two currencies.

Right here’s what makes it completely different: Customary oscillators like RSI or MACD inform you if a pair is overbought. Foreign money energy tells you why. If EUR/USD is falling, you’ll know instantly whether or not to brief it (if EUR is weak) or search for lengthy alternatives in different greenback pairs (if USD is powerful).

How the Foreign money Energy Calculation Works

Most MT4 foreign money energy indicators use one in every of two calculation strategies. The easier method measures every foreign money’s worth motion in opposition to all different majors over a set interval—normally the final 24 hours or a selected variety of candles. If the euro gained in opposition to six currencies and misplaced in opposition to one, it registers as robust.

The extra refined variations incorporate smoothing algorithms much like transferring averages. Some builders use relative energy calculations evaluating every foreign money’s efficiency to its common, whereas others monitor the cumulative pip motion throughout all pairs. As an illustration, if USD/JPY strikes up 50 pips and EUR/USD strikes down 30 pips in the identical timeframe, the indicator attributes energy to the greenback.

The precise system varies by developer, however the precept stays constant: combination efficiency throughout a number of pairs reveals true foreign money energy. Consider it like monitoring a basketball participant’s contribution to their staff—factors alone don’t inform the story, however assists, rebounds, and defensive stops create a whole image.

Sensible Buying and selling Purposes

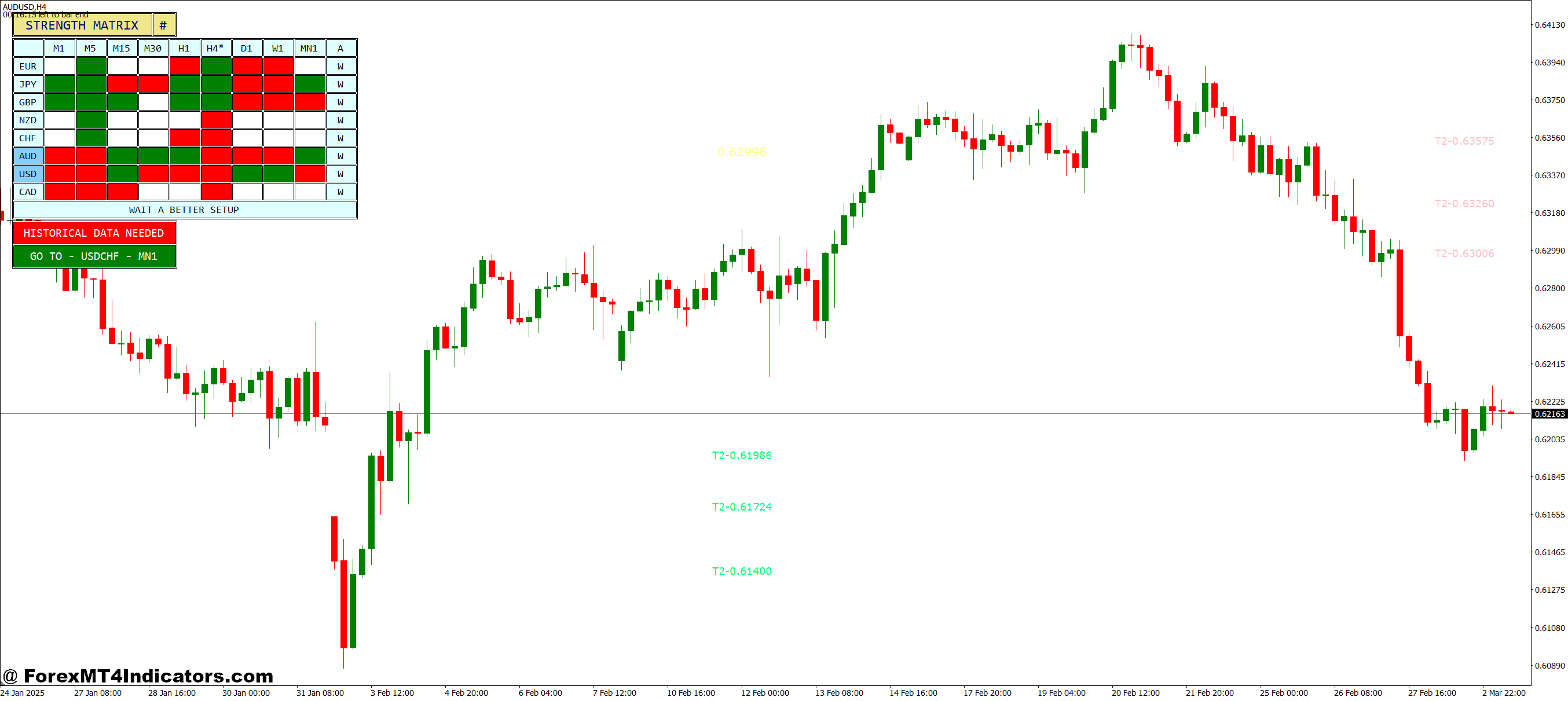

The fundamental technique is easy: commerce pairs combining the strongest and weakest currencies. When GBP reveals most energy, and JPY reveals most weak spot, GBP/JPY turns into the first goal.

However skilled merchants use foreign money energy extra strategically. Final month, through the Federal Reserve’s hawkish pivot, USD energy spiked whereas EUR, GBP, and AUD all weakened concurrently. As a substitute of spreading capital throughout EUR/USD, GBP/USD, and AUD/USD shorts, specializing in the one strongest setup—AUD/USD on this case, for the reason that Australian greenback was weakest—produced the cleanest transfer with the least whipsaw.

The indicator additionally prevents rookie errors. Say EUR/USD breaks resistance and appears bullish. Earlier than getting into, examine the foreign money energy. If each EUR and USD are strengthening collectively, that breakout is pushed by broader greenback weak spot affecting all pairs. The transfer lacks conviction. But when the EUR is genuinely robust whereas the USD is weak, the breakout has gasoline.

Divergence between pairs reveals hidden alternatives, too. When EUR/USD trades flat however the foreign money energy indicator reveals EUR climbing and USD falling, one thing’s about to offer. That compression usually precedes explosive strikes because the pair catches as much as the underlying foreign money dynamics.

One dealer I do know makes use of it completely on the 4-hour chart through the London open. He waits till two currencies present clear separation—one on the prime, one on the backside, each trending in the identical course for no less than three candles. Then he enters that pair with tight stops. His win price jumped from 52% to 67% after implementing this filter.

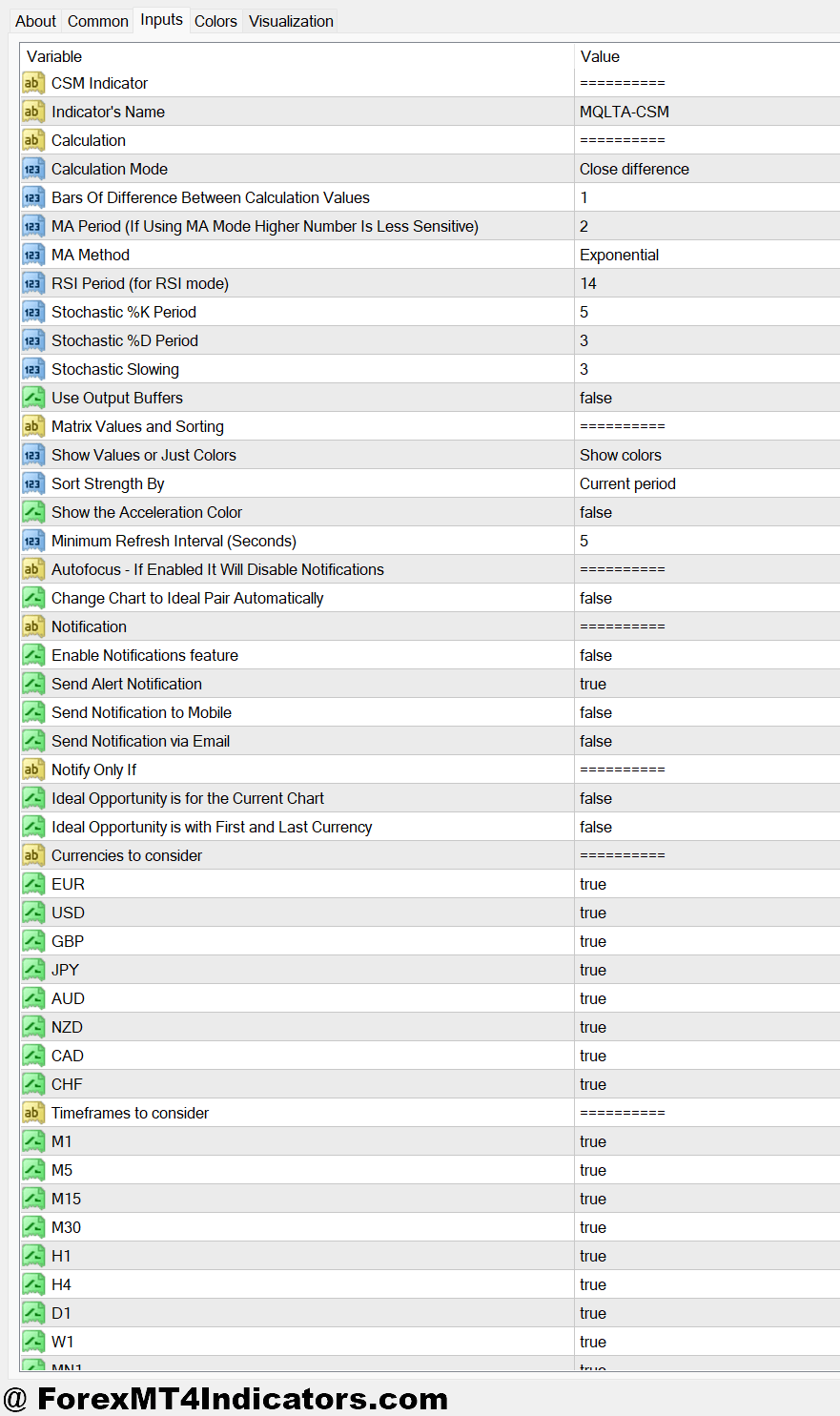

Settings and Customization Choices

The default interval setting on most foreign money energy indicators is 24 (24 intervals, usually 24 hours on the H1 chart). Day merchants usually cut back this to 12 and even 6 intervals to seize intraday momentum shifts. Swing merchants lengthen it to 48 or 96 intervals for a broader view.

Smoothing parameters matter too. Increased smoothing values (like 5 or 10) cut back noise however create lag. Decrease values (1 or 2) reply sooner however generate false indicators throughout uneven classes. For scalping through the New York open, minimal smoothing works. For place buying and selling, heavy smoothing filters out each day noise.

Some variations mean you can exclude sure currencies. If you happen to by no means commerce the Swiss franc, eradicating CHF declutters the show. Others embrace unique currencies, although liquidity issues make these much less sensible.

Shade schemes have an effect on usability greater than merchants understand. The default rainbow of colours will get complicated when eight strains overlap. Set your major currencies (USD, EUR, JPY) to daring, contrasting colours—crimson, blue, inexperienced—and make the remaining muted grays. Your eyes will monitor the vital strikes sooner.

Benefits and Sincere Limitations

The principle benefit is readability. When 5 indicators on EUR/USD give blended indicators, foreign money energy cuts by means of the noise. It’s both robust or it’s not. This software additionally reveals correlations immediately—when all greenback pairs transfer collectively, you recognize it’s in regards to the greenback, not particular person pair dynamics.

Foreign money energy excels at confirming commerce concepts. Obtained a setup on GBP/USD? Test if the pound energy and greenback weak spot align. In the event that they do, confidence will increase. In the event that they don’t, rethink.

That mentioned, foreign money energy isn’t a standalone technique. It received’t inform you the place to enter or when to exit. It identifies which pairs to give attention to—you continue to want worth motion, assist and resistance, or different indicators to time entries. Some merchants make the error of shopping for each pair with a powerful foreign money, ignoring that they’re already overextended.

The indicator additionally lags throughout sudden information occasions. A shock price resolution sends currencies spiking earlier than the indicator registers the transfer. By the point the sign seems, the simple cash is gone.

False indicators emerge throughout range-bound markets, too. When no foreign money reveals clear energy or weak spot, all of the strains bunch collectively within the center. Buying and selling these situations results in chop and fake-outs. The indicator works finest when currencies are literally trending—which, let’s be trustworthy, is possibly 30% of the time.

In comparison with correlation matrices, foreign money energy is extra intuitive however much less exact. Correlation coefficients provide you with precise readings; energy indicators provide you with approximate rankings. For fast decision-making, that’s normally sufficient. For institutional-level evaluation, uncooked correlation information may be higher.

Easy methods to Commerce with MT4 Indicator Foreign money Energy

Purchase Entry

- Sturdy foreign money at prime, weak at backside – Look forward to no less than a 2-point separation on a 0-10 scale between your two currencies earlier than getting into; if EUR is at 8.5 and USD is at 3.0 on the 4-hour chart, purchase EUR/USD.

- Three consecutive candles of energy – Enter solely after the robust foreign money holds the highest place for 3 full H1 candles (3 hours minimal) to keep away from false spikes throughout low-volume Asian classes.

- Rising energy line with 45-degree angle – Search for the foreign money line climbing steadily upward at roughly 45 levels over 6-12 candles; vertical spikes usually reverse shortly, whereas gradual climbs maintain longer strikes.

- Affirmation at main assist stage – Mix foreign money energy with worth motion by shopping for when EUR/USD assessments 1.0850 assist AND the euro line crosses above 6.0 whereas the greenback drops under 4.0.

- Threat 1% with 20-pip cease – On GBP/USD, place your cease 20 pips under the current swing low when pound energy exceeds 7.5; by no means commerce if the energy hole is lower than 1.5 factors—that’s uneven territory.

- Keep away from throughout foreign money line convergence – Don’t purchase if 4 or extra currencies cluster between 4.0-6.0 on the indicator; await clear separation, otherwise you’ll get whipsawed in ranging markets.

- Goal the weakest pair mixture – If GBP reads 8.2 (strongest) and JPY reads 2.1 (weakest), skip GBP/USD at 7.5 energy and commerce GBP/JPY as a substitute for optimum momentum on the each day chart.

- Exit when strains cross – Shut 50% of your EUR/USD lengthy when the euro energy line crosses under 6.5, or the greenback line crosses above 5.0, even when the worth hasn’t hit your goal.

Promote Entry

- Weak foreign money at backside, robust at prime – Promote when your base foreign money drops under 3.0 whereas the quote foreign money rises above 7.0; for instance, brief AUD/USD when Aussie hits 2.5 and greenback hits 8.0 on H4.

- Downward energy angle for 4+ hours – Look forward to the foreign money line to say no steadily for no less than 4 1-hour candles earlier than shorting; sudden drops usually bounce as quick as they fell.

- Weak point confirmed at resistance rejection – Quick GBP/USD at 1.2950 resistance provided that the pound line falls under 4.0 whereas greenback energy exceeds 6.5; worth rejection alone isn’t sufficient affirmation.

- Most 2% danger with 30-pip cease – On EUR/JPY shorts, place stops 30 pips above current swing excessive when yen energy climbs previous 7.0; if separation is lower than 2 factors, skip the commerce totally.

- Don’t brief throughout information spikes – Keep away from promoting when foreign money energy strains transfer vertically inside 1-2 candles (normally NFP or price selections); wait 2-3 hours for strains to stabilize earlier than getting into.

- Divergence between energy and worth – Quick when USD/JPY makes greater highs however greenback energy makes decrease highs over 8-12 H1 candles; this divergence indicators exhaustion and impending reversal.

- Commerce the acute pair solely – If USD is strongest at 8.7 and JPY is weakest at 1.9, brief USD/JPY moderately than USD/CAD; all the time match the 2 excessive currencies for cleanest directional strikes.

- Exit at energy line compression – Shut your EUR/USD brief when the hole between euro and greenback narrows to lower than 2 factors or when three different currencies enter the identical vary on the 4-hour chart.

Making Foreign money Energy Work for You

The MT4 indicator foreign money energy works finest as a filter, not a sign generator. Use it to slim down the universe of 28 main pairs to the 2 or three price watching. Then apply your precise technique, whether or not that’s breakouts, reversals, or development following, to these particular pairs.

Begin by observing how the currencies behave throughout completely different market classes. The Japanese yen usually strengthens throughout Tokyo hours. The pound strikes duringthe London open. These patterns develop into apparent if you’re monitoring particular person currencies moderately than pairs.

However right here’s the factor: no indicator eliminates danger. Buying and selling foreign exchange carries substantial danger, and foreign money energy instruments don’t assure earnings. They enable you make knowledgeable selections, however losses are nonetheless a part of the sport. Place sizing and danger administration matter greater than any indicator—foreign money energy included.

The actual worth comes from understanding why pairs transfer, not simply that they’re transferring. When you begin considering when it comes to particular person currencies moderately than pairs, market construction turns into clearer. You’ll cease chasing random setups and begin searching real imbalances between robust and weak currencies. That shift in perspective? That’s the place constant profitability lives.

Really useful MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Further Unique Bonuses All through The Yr

- Unique 90% VIP Money Rebates for all Trades!

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Associate Code: VIP90