Most merchants fail not as a result of they lack entries,

however as a result of they misinterpret context.

Markets don’t transfer randomly.

They transfer inside ranges, timeframe hierarchy, and liquidity goals.

Candle Vary Idea (CRT) and Greater-Timeframe (HTF) fractals usually are not entry fashions.

They’re context and validation instruments.

When mixed accurately, they assist merchants reply three essential questions:

The place is higher-timeframe liquidity situated?

Has liquidity been taken or is it nonetheless forming?

Is value reacting with intent or simply increasing quickly?

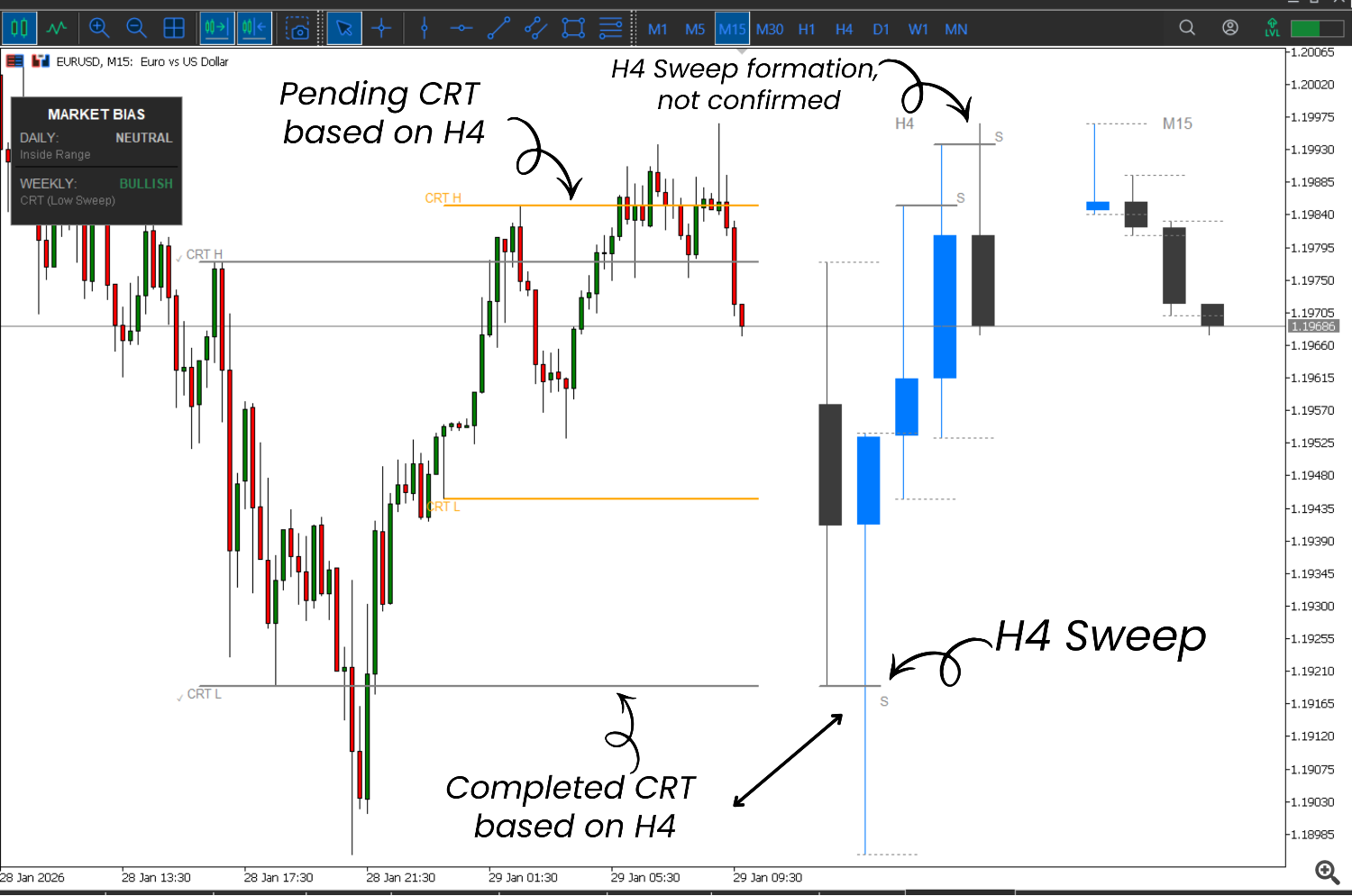

This text explains how CRT and HTF Fractal logic work collectively on stay charts, utilizing actual market construction moderately than hindsight markings.

Understanding CRT: Pending vs Accomplished

CRT is constructed on a easy however highly effective remark:

Value typically sweeps a previous candle’s vary earlier than committing to route.

Nevertheless, not all CRT ranges carry the identical which means.

Pending CRT

A CRT stage is taken into account pending when:

Value has interacted with a previous vary

The sweep is forming, however not but confirmed

The upper-timeframe candle has not closed with validation

Pending CRT gives context, not route.

It tells us:

Liquidity is being examined

Vary boundaries are energetic

Route continues to be undecided

That is the place many merchants make errors — treating pending CRT as an entry sign.

Accomplished CRT

A CRT stage turns into accomplished solely when:

Accomplished CRT represents validation, not anticipation.

This distinction is essential:

With out this separation, CRT turns into subjective and inconsistent.

Making use of CRT + Greater-Timeframe Fractal Logic on a Dwell Chart

(Sensible Workflow)

This part explains how one can interpret the constructions proven within the charts above in actual time, with out prediction or hindsight.

Step 1: Begin From the Greater Timeframe Context

Start by figuring out the higher-timeframe construction that controls value supply.

Observe the HTF ghost candles (for instance, H4 on an M15 chart)

Observe the present HTF vary (excessive and low)

Verify whether or not value is working inside vary or interacting with vary boundaries

At this stage, there isn’t a commerce bias — solely context.

Step 2: Determine a Pending CRT Zone

A Pending CRT kinds when value sweeps a previous higher-timeframe excessive or low however has not but closed with affirmation.

Traits of a Pending CRT:

Value quickly trades past a previous vary stage

The candle has not but closed again contained in the vary

Liquidity should still be forming

This part represents context, not validation.

Reacting right here is anticipation, not affirmation.

Step 3: Anticipate Accomplished CRT Affirmation

A Accomplished CRT happens solely after candle shut confirms that:

This can be a structural occasion, not a sign.

Accomplished CRT defines:

The place liquidity was taken

The place imbalance might now exist

The place reactions develop into doable, not assured

Step 4: Consider Greater-Timeframe Sweep Standing

Not all sweeps are equal.

Use HTF fractal logic to distinguish between:

Sweep forming (noise)

Sweep confirmed (intent)

Key distinction:

Solely confirmed HTF sweeps ought to affect directional expectations.

Step 5: Align Decrease-Timeframe Execution With HTF Intent

As soon as the next situations align:

You now have validated context.

Decrease-timeframe execution (entries, danger placement, administration) ought to happen solely after this alignment, utilizing the dealer’s personal execution mannequin.

CRT and HTF fractals don’t inform you when to enter —

they inform you when the market has revealed intent.

Step 6: When To not Commerce

Equally essential is figuring out when not to behave.

Keep away from engagement when:

In these situations, value motion is informational, not actionable.

Key Precept to Keep in mind

Pending CRT is context.

Accomplished CRT is validation.

HTF sweep forming is noise.

HTF sweep confirmed is intent.

When you cease chasing candles and begin studying construction,

the market turns into quieter — and choices develop into clearer.

Why This Workflow Issues

This method:

Reduces overtrading

Removes emotional decision-making

Forces endurance till affirmation

Aligns execution with higher-timeframe intent

CRT and HTF fractals usually are not entry programs.

They’re filters that inform you when the market is value participating.

Greater-Timeframe Fractals: Noise vs Intent

Greater-timeframe fractals assist establish liquidity occasions, however solely when interpreted accurately.

HTF Sweep Forming

A sweep is forming when:

Value extends past a previous HTF excessive or low

The candle has not but closed

Liquidity interplay continues to be in progress

Forming sweeps are noise.

They’re widespread and infrequently deceptive.

HTF Sweep Confirmed

A sweep is confirmed solely when:

The upper-timeframe candle closes

The sweep is validated utilizing close-based logic

Liquidity has clearly been taken

Confirmed HTF sweeps characterize intent.

They sign that:

Why CRT and HTF Fractals Should Be Learn Collectively

Individually, CRT and HTF fractals present partial info.

Collectively, they kind a full validation framework:

For instance:

This alignment removes guesswork and emotional decision-making.

Decrease-Timeframe Execution with Greater-Timeframe Context

Most execution occurs on decrease timeframes (M5–M15).

Most errors occur when higher-timeframe context is ignored.

By projecting HTF construction onto decrease timeframes:

This method doesn’t predict value.

It filters low-quality choices.

Frequent Misconceptions

“CRT is an entry mannequin.”

No. CRT is a spread validation framework.

“Each sweep means reversal.”

No. Solely confirmed sweeps matter.

“Decrease timeframes are noisy.”

They’re noisy solely when higher-timeframe context is lacking.

Sensible Takeaways

Pending CRT = context, not motion

Accomplished CRT = validation

HTF sweep forming = noise

HTF sweep confirmed = intent

Affirmation at all times comes from candle shut

Construction issues greater than velocity

When merchants cease chasing candles and begin studying construction,

the market turns into quieter, clearer, and extra disciplined.

Remaining Ideas

CRT and Greater-Timeframe Fractal logic usually are not shortcuts.

They’re self-discipline frameworks.

They assist merchants:

Respect market hierarchy

Perceive liquidity conduct

Commerce much less, however with increased readability

The objective will not be extra trades.

The objective is higher choices.

Disclaimer

This text is for academic and analytical functions solely.

It doesn’t represent monetary recommendation or buying and selling indicators.

All buying and selling includes danger, and discretion is required.