In the present day’s article is predicated on my private buying and selling expertise over the past 14 years, and over the course of my buying and selling profession I’ve arrived on the conclusion that ‘information buying and selling’ and elementary evaluation are utterly pointless. Avoiding information and financial indicators is clearly a controversial matter within the buying and selling world; some folks swear by solely elementary evaluation, some by a mixture of technical and fundamentals, and a few commerce purely on technical evaluation.

In the present day’s article is predicated on my private buying and selling expertise over the past 14 years, and over the course of my buying and selling profession I’ve arrived on the conclusion that ‘information buying and selling’ and elementary evaluation are utterly pointless. Avoiding information and financial indicators is clearly a controversial matter within the buying and selling world; some folks swear by solely elementary evaluation, some by a mixture of technical and fundamentals, and a few commerce purely on technical evaluation.

I’m about as far into the technical (worth motion) evaluation camp as you could be, I imagine very strongly that the value motion of a market displays every thing we have to learn about it. I personally don’t commerce the information or use elementary evaluation in my buying and selling, and I truthfully really feel it’s a massive a part of why I’ve been profitable in buying and selling. This weblog is about my expertise and what I’ve seen over the past 14 years analyzing and buying and selling markets, for these of you who take my concepts significantly, this text goes that can assist you take away at the very least half of the complicated muddle that’s most likely negatively affecting your buying and selling day-after-day…

Are you a technical or elementary dealer?

In the event you’re a starting dealer you most likely are feeling a bit overwhelmed with the entire “technical evaluation or fundamentals debate” and every thing that goes together with it. Nonetheless, you’re going to have decide on the matter sooner quite than later, as a result of there merely are simply WAY too many variables scattered throughout the spectrum of technical and elementary evaluation, and also you don’t have the pinnacle area, time or capacity to make sense of all of them….however maybe extra importantly, it’s utterly pointless and even counter-productive to your buying and selling success to take action!

It’s my hope, after studying this text and a few of my different classes on information buying and selling and fundamentals, that you’ll give an extended exhausting assume into what actually is sensible to you and what doesn’t.

I firmly imagine that merchants want to decide on between technical evaluation and elementary evaluation. I additionally don’t imagine in combining them. Buying and selling, maybe greater than every other career on the earth, is a particularly straightforward factor to over-complicate. It’s this over-complication and over-thinking that causes merchants to constantly make ‘silly buying and selling selections’ (I’m certain you understand what I’m speaking about right here).

It’s my perception, that by reducing out all information and elementary evaluation you may rapidly and completely remove half of the muddle out of your thoughts that’s inflicting you to over-think and over-complicate buying and selling. It will assist you to take a a lot clearer and cleaner strategy to the market, which is able to naturally scale back the quantity of ‘silly’ buying and selling errors you make in addition to reduce the temptation to over-trade. On the finish of the day, every thing that occurs on the earth that impacts a market is mirrored through worth motion available on the market’s worth chart. Thus, all you need to do is settle for this reality, which you’ll show to your self just by observing worth motion for some time and seeing the way it usually leads the information or acts independently of it…

Value motion is a number one indicator

There’s quite a lot of discuss within the buying and selling world concerning the “Massive boys” who commerce actually massive lot sizes or who commerce for banks / giant companies, and so forth. Effectively, a few of it’s simply fantasy and paranoia, however the one key facet concerning the “Massive boys” that’s true is that they’re, shall I say, extra effectively ‘linked’ than smaller on a regular basis retail merchants. They’ve the flexibility to affect worth motion and make the market transfer and typically they will discover out what’s going on on the earth earlier than the remainder of us and act on this info earlier than the mainstream information media retailers have it.

There’s quite a lot of discuss within the buying and selling world concerning the “Massive boys” who commerce actually massive lot sizes or who commerce for banks / giant companies, and so forth. Effectively, a few of it’s simply fantasy and paranoia, however the one key facet concerning the “Massive boys” that’s true is that they’re, shall I say, extra effectively ‘linked’ than smaller on a regular basis retail merchants. They’ve the flexibility to affect worth motion and make the market transfer and typically they will discover out what’s going on on the earth earlier than the remainder of us and act on this info earlier than the mainstream information media retailers have it.

In the long run, it doesn’t matter if the “Massive boys” get the information earlier than you or on the similar time or after you, as a result of they’re buying and selling such massive measurement that the market strikes after they enter it. It’s your job as a smaller retail dealer to study to commerce primarily based on what the “Massive boys” are doing and meaning studying to commerce from worth motion.

At Study To Commerce The Market, we subscribe to the assumption that worth motion is one of the best ways to outline the market, analyze it and discover commerce setups. Due to this fact, we imagine that the underlying worth present and worth dynamics are what decide what a market will do subsequent, not for instance, the Russians shifting troops into the Ukraine as we noticed not too long ago.

Monetary media retailers need you to imagine in any other case, that’s why the mainstream consensus is that there’s all the time a elementary motive behind worth motion. There’s a complete business that relies on making you imagine financial information reviews and world information is what strikes the markets and is what you need to take note of. So, their livelihoods rely on spreading this fantasy and misinformation, however they haven’t any understanding of worth motion, which is clear by the shortage of consideration it will get on main monetary information retailers like CNBC, Bloomberg and others.

The massive information occasions are priced in, the ‘Massive boys’ who’re in-the-know have already priced within the massive occasions…or quite their expectations of them, which is all that basically issues in any case. You see, the important thing motive why the information merely doesn’t matter and why I’ll by no means commerce primarily based on it, is as a result of what actually issues is what market individuals THINK about how the information will have an effect on the market. Folks commerce their views on a market, which are sometimes contradictory to the information and what it implies. All that issues is the combination of what market participates assume a market is price, and that is mirrored through the value motion, not the information. Folks are likely to commerce their expectations of a specific information occasion, as I simply talked about, so when the information comes out it’s basically ‘previous information’ already and doesn’t actually matter anymore. That is the place the previous Wall Road saying “Purchase the rumor, promote the actual fact” got here from.

“The proof is within the pudding”…

Speak is reasonable, as they are saying, so let’s check out some current examples that present why information is irrelevant in addition to how worth is a number one indicator…

It’s vital to notice that the examples under of Oil and Gold occurred over concerning the final two months. In each instances, the value motion was clearly main the information as a result of we had apparent uptrends in each markets. One good instance is the current geopolitical unrest within the Ukraine, with Russia threatening army pressure there to take the Crimea peninsula. Sometimes, commodities like Oil and Gold will rally throughout threats of battle, particularly in nations wealthy with pure sources like Russia. Clearly, each markets had been already crusing larger effectively earlier than this stress between Ukraine and Russia actually took middle stage within the media because it has not too long ago.

One other instance is Non-Farm payrolls (NFP) from January of this yr. They had been forecast at 185k however got here in at simply 113k, effectively under expectations. The Dow and different indexes have pushed considerably larger since these numbers had been launched, however a decrease NFP result’s usually seen as ‘dangerous’ for shares and riskier currencies as effectively…simply one other instance of why the information actually doesn’t matter in any respect.

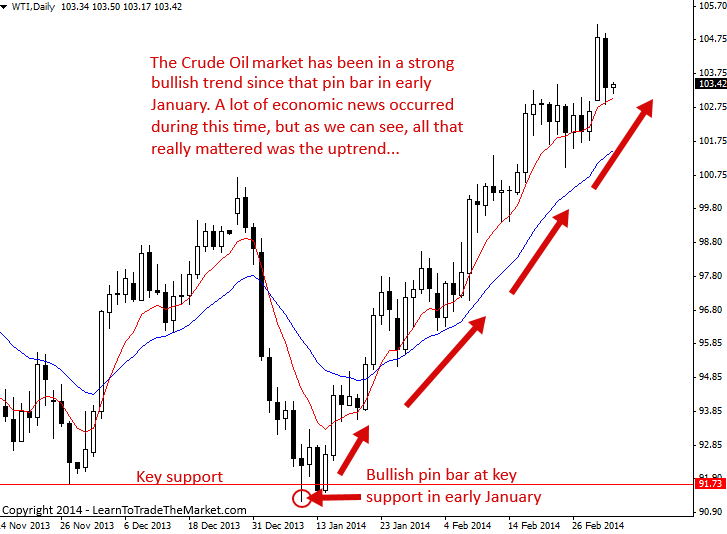

Crude oil – Bullish pattern stays intact regardless of world information and financial occasions…

Within the chart under, we will see that Crude Oil has been in a powerful uptrend since concerning the center of January. A whole lot of information has come out throughout the course of this uptrend, each good and dangerous, however all that mattered to a worth motion dealer like me, was that the market was clearly in a powerful bullish pattern. While you commerce with the pattern, you’ll do your self a HUGE favor by utterly ignoring the information, as a result of the information is just going to contradict what you see on the chart generally and trigger you to second-guess a powerful pattern like this one…

Gold – Gold surges larger regardless of information and ‘analysts’ views

One other glorious instance of why the information doesn’t matter has been the Gold market. We will clearly see within the chart under that since December 31st 2013, gold has been surging larger and in a really agency bullish pattern. In the event you look again at financial reviews and ‘analysts’ views over the past 2 months, you’ll little doubt discover many who had been bearish on Gold and financial reviews that implied Gold ought to go decrease. However, it doesn’t matter. What issues is what market individuals (primarily the ‘massive boys’) imagine Gold is price, and over the past two months they clearly felt Gold was ‘low cost’, thus it’s been in an uptrend…

Ignore the information to remove two widespread buying and selling errors

There are two HUGE errors that taking a look at information and fundamentals tends to trigger merchants to make:

1) While you’re in an open place taking a look at information, it would affect you in a roundabout way, whether or not you assume it would or not, it would. information when you’re in an open place could make you modify your thoughts concerning the commerce, even when the value motion and the technical image haven’t modified in any respect. It’s a ridiculous factor to imagine that since you learn one thing contradictory to the commerce you’re in, the market will one way or the other flip in opposition to you. There are actually 1000’s of variables affecting a market at any given time, the few information gadgets you’ve got time to soak up usually are not going to matter.

You have to do not forget that it is advisable keep on with your buying and selling methodology and your buying and selling plan, as a result of in case you don’t, you’ll by no means know in case your methodology works since you received’t give it an opportunity to play out. Intervening in trades due to some information report is nearly all the time a nasty thought, and within the odd probability it really works out in your favor, you’re simply reinforcing dangerous buying and selling habits. The one motive to ever intervene in a commerce is that if the underlying worth motion dynamics change, you may learn extra on this in my article on find out how to exit trades.

2) The subsequent massive mistake that wanting on the information may cause you to make is that it may possibly persuade you to remain in a nasty commerce. Folks tend to need to discover information and ‘different supporting’ elements to persuade themselves {that a} commerce there in will not be failing, even when it clearly is. This causes them to do every kind of issues like transfer their cease losses additional away and even delete all of them collectively as a result of they’re ‘certain’ the commerce will ‘come again’. It will possibly additionally trigger merchants to try to add extra positions as worth strikes in opposition to them as a result of they’re ‘satisfied’ the market will transfer again of their favor from that ‘knowledgeable’ report they only learn. In actuality, what usually finally ends up occurring is that you find yourself having to swallow a MUCH greater loss than had you simply ignored the information all collectively. Losses are a part of buying and selling, you can not keep away from them, however taking a look at information to try to discover methods to ‘verify’ your commerce usually means you’re attempting to keep away from an inevitable loss, which sarcastically leads to a a lot, a lot bigger loss than you ever anticipated.

In abstract, in case you simply take away the information completely, it would remove the potential of constructing both of those errors. Simply put in your buying and selling plan that it is advisable take away the information out of your buying and selling, make ignoring the information a routine a part of your buying and selling routine and one thing you consciously do, in any other case you’ll most likely discover {that a} ‘sneak peak’ of CNBC turns right into a full-blown information habit you may’t management…the monetary information is nearly in all places as of late.

Conclusion…

A few of you studying this may have skilled quite a lot of the issues on this article, however you should still not be satisfied even after studying my views and your individual expertise. Nonetheless, typically in buying and selling, simply as in different areas of life, it is advisable decide even in case you aren’t completely ‘satisfied’. Profitable merchants share a similarity with people who find themselves devoted to getting and staying in form; sticking to a food regimen and train plan and being disciplined with it means reducing sure issues out (too many beers, McDonald’s, being lazy, and so forth). Profitable buying and selling additionally requires you to chop out the stuff you don’t want; in case you attempt absorbing and utilizing every thing you see on the information, you’ll rapidly blow out your buying and selling account.

A few of you studying this may have skilled quite a lot of the issues on this article, however you should still not be satisfied even after studying my views and your individual expertise. Nonetheless, typically in buying and selling, simply as in different areas of life, it is advisable decide even in case you aren’t completely ‘satisfied’. Profitable merchants share a similarity with people who find themselves devoted to getting and staying in form; sticking to a food regimen and train plan and being disciplined with it means reducing sure issues out (too many beers, McDonald’s, being lazy, and so forth). Profitable buying and selling additionally requires you to chop out the stuff you don’t want; in case you attempt absorbing and utilizing every thing you see on the information, you’ll rapidly blow out your buying and selling account.

On the finish of the day it’s possible you’ll not 100% imagine what I’m saying right here, however you need to subscribe to a perception system and also you can’t simply subscribe to every thing. It’s important to determine the way you’re gonna reside your life as a dealer.

A whole lot of the concepts offered in the present day will deeply resonate with new and skilled merchants alike, primarily based on my expertise out there, I’m 100% assured that following each information and technicals, will ultimately result in monetary catastrophe. It’s additionally my agency perception that one ought to comply with technical evaluation (worth motion) as a substitute of fundamentals and information. My experiences taught me {that a} dealer actually ought to comply with a restricted quantity of knowledge to kind selections versus letting every thing she or he is uncovered to create their opinions of the market.

It’s my hope that in the present day I’ve helped you determine that you simply now must go ahead and determine to effectively and really change the best way you assume. I can assure you that by following simply worth, you’re going to completely clear your head area and take away quite a lot of the psychological confusion and muddle out of your buying and selling. It received’t be straightforward, however subsequent time you stroll right into a room and see monetary TV on or see monetary magazines, maintain again, don’t get sucked into the pointless world of stories and elementary evaluation. To discover ways to commerce solely with worth motion and ignore the information, checkout my worth motion course for extra info.