How a lot do you worth your time? I’m prepared to guess rather a lot, the truth is most of us worth ‘free time’ greater than anything on this planet, as a result of as everyone knows, our time is proscribed to at least one comparatively brief lifetime on this planet. But when we worth time a lot, why is it that so many merchants are seemingly unaware of the energy and worth of time with reference to the way it can considerably have an effect on their buying and selling efficiency?

How a lot do you worth your time? I’m prepared to guess rather a lot, the truth is most of us worth ‘free time’ greater than anything on this planet, as a result of as everyone knows, our time is proscribed to at least one comparatively brief lifetime on this planet. But when we worth time a lot, why is it that so many merchants are seemingly unaware of the energy and worth of time with reference to the way it can considerably have an effect on their buying and selling efficiency?

In at the moment’s article, I’m going to debate the significance of time in buying and selling and the way using it correctly is usually the distinction between success and failure available in the market. The facility and financial worth of merely not buying and selling, is vastly underestimated by most merchants and till you perceive why it is best to consider time as a particularly precious commodity, you’ll proceed to battle available in the market.

Time = Cash. Actually.

I would like you to begin pondering of time as a ‘foreign money’ that’s a part of your buying and selling account stability. The extra time you’ve got the extra worth you’ve got, we are able to all agree on that. In buying and selling, it’s actually true that point is the same as cash, for those who make the most of your time correctly. Let me clarify…

First off, the one manner you’ll be able to lose cash available in the market is by having a dropping commerce (“sensible level Nial” you’re pondering, learn on it will get higher, I promise). Give it some thought like this, if you find yourself sitting on the sidelines available in the market (not buying and selling), you’ll be able to’t lose cash are you able to? Avoiding dropping trades, in addition to not giving again earnings you made on profitable trades are the 2 principal ways in which time spent not buying and selling can assist you develop your buying and selling account sooner.

It’s counter-intuitive for many people, as a result of as people we are likely to assume ‘extra time’ is healthier in something; our job, faculty, sports activities, you title it…extra time spent doing one thing is sort of all the time part of the trail to success. Nonetheless, buying and selling is a unique beast all collectively as a result of spending extra time out and in of trades is often not what equals success. Buying and selling success is discovered by choosing your entries very rigorously and ready patiently for the obvious commerce setups to ‘come to you’, which generally entails a lot bigger stretches of time spent not buying and selling in between trades than what most merchants are used to.

Most merchants fail, everybody is aware of that, we’ve all heard the 90% failure fee factor, and sadly it’s in all probability fairly correct. Are most merchants affected person and disciplined? No. Thus, if most merchants usually are not affected person or disciplined and most merchants are failing available in the market, then the logical inference to make is that it is advisable be extra affected person and disciplined as you commerce. This principally means it is advisable commerce much less steadily and provides extra worth to the time you spend not buying and selling than you at present are.

The approximate 10% of merchants who turn out to be very profitable available in the market have the SAME quantity of hours of their day as you do in yours. Nonetheless, what they’ve realized is that by sitting out on low-probability trades and mastering their buying and selling technique to the purpose the place they know when to commerce and when to not, they’re able to use time to their benefit available in the market.

The day-trader vs. the time-savvy swing dealer

The mindsets of a day dealer and a affected person swing dealer are going to range fairly drastically. The day dealer is sort of consistently competing with time as a result of she or he feels compelled to all the time be available in the market. This compulsion to commerce naturally means the day dealer can have extra dropping trades consuming into his worthwhile ones; he basically is just not utilizing time to select and select his entries as discreetly because the time-savvy swing dealer is. The top results of day buying and selling is often a full-blown buying and selling dependancy the place time spent not buying and selling actually creates a panic and intense cognitive dissonance because the dealer finally figures out that they’re spending an excessive amount of time available in the market however can’t appear to cease buying and selling. It’s fairly exhausting to constantly take high-probability trades while you’re all the time available in the market.

The mindsets of a day dealer and a affected person swing dealer are going to range fairly drastically. The day dealer is sort of consistently competing with time as a result of she or he feels compelled to all the time be available in the market. This compulsion to commerce naturally means the day dealer can have extra dropping trades consuming into his worthwhile ones; he basically is just not utilizing time to select and select his entries as discreetly because the time-savvy swing dealer is. The top results of day buying and selling is often a full-blown buying and selling dependancy the place time spent not buying and selling actually creates a panic and intense cognitive dissonance because the dealer finally figures out that they’re spending an excessive amount of time available in the market however can’t appear to cease buying and selling. It’s fairly exhausting to constantly take high-probability trades while you’re all the time available in the market.

A buying and selling ‘edge’ means you’ve got some kind of high-probability entry technique that actually provides you an ‘edge’ over a purely random entry, however when a dealer spends an excessive amount of time buying and selling they naturally negate their edge because the edge is clearly not current as typically as they’re buying and selling. The very nature of buying and selling edge / buying and selling technique is that it gained’t be current very steadily…you need to turn out to be a grasp of studying when it’s and isn’t current, that’s the way you turn out to be a talented dealer and separate your self from the legions of losers.

The expert, time-savvy swing dealer, is aware of that the extra they commerce the extra their cash is in danger available in the market. They know {that a} dealer’s first objective is to reduce threat and the second objective is to maximise reward, that is reverse to how dropping merchants behave, which is that they focus much more on potential rewards and earnings than they do on managing threat correctly. The profitable dealer basically practices good ‘protection’ as a result of he is aware of protection will result in the ‘offense’ taking good care of itself, so to talk. In different phrases, for those who handle your threat capital correctly and use time to your benefit by ready patiently for high-probability commerce setups, the earnings will begin to accumulate in your buying and selling account.

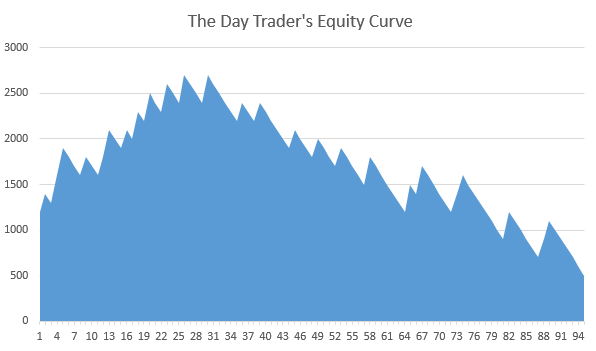

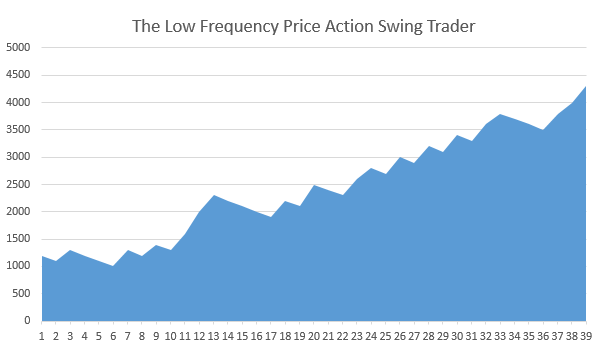

Let’s take a look at a hypothetical instance of the fairness curves of a day-trader / scalper and a low-frequency time-savvy swing dealer:

The day dealer’s fairness curve under exhibits a rise at first, however then slowly however certainly as time goes by the curve begins to lower. Low-probability trades (over-trading) and dropping earnings made on profitable trades (over-trading) finally flattens out the fairness curve and finally causes both a quick or sluggish depletion of buying and selling account funds.

The time-savvy, expert swing dealer takes a a lot calmer and lower-frequency buying and selling method. This method is obvious within the sluggish however constant enhance in his fairness curve. Observe that he nonetheless has dropping trades, however as a result of he’s utilizing time to his benefit by choosing his trades very rigorously, he all the time has one other winner across the nook that makes up for his losers. He’s additionally not giving again earnings that he made on his winners, which is a large purpose his fairness curve has a pleasant constant upward development to it whereas the day dealer’s doesn’t.

Don’t marginalize the importance of time to your buying and selling success

As I deliver at the moment’s lesson to an in depth, I wish to first make it clear that you shouldn’t assume you’ll be able to keep away from having dropping trades, that’s not the purpose I’m conveying on this lesson. Even a affected person, time-savvy swing dealer can have dropping trades, and the very best merchants on the market nonetheless lose round 50% of the time. There are two various kinds of losses, there are losses which might be a pure a part of any buying and selling technique and which might be unavoidable, after which there are losses which might be avoidable, these are the losses that end result from spending an excessive amount of time in trades / over-trading.

Thus, for those who take away just one factor from at the moment’s lesson, let it’s this: With the ability to choose and select your commerce entries in a affected person method is how you can also make probably the most out of your time available in the market. If you wish to know the right way to choose and select your entries correctly, you can begin by studying the high-probability worth motion buying and selling strategies I educate in my Worth Motion Buying and selling Course. Upon getting the information and talent to seek out high-probability commerce setups available in the market, you solely have to remind your self that the time you might be spending being affected person and ready for the obvious setups is actually serving to you develop your buying and selling account since you’re not giving again your earnings or dropping cash on ‘silly’ trades.