As we speak’s lesson goes to be about altering how you consider buying and selling. As a substitute of performing in your first impulse out there, I would like you to cease and take into consideration what’s REALLY occurring…

As we speak’s lesson goes to be about altering how you consider buying and selling. As a substitute of performing in your first impulse out there, I would like you to cease and take into consideration what’s REALLY occurring…

I would like you to take a look at buying and selling as two dimensional; someone wins and someone loses. When a market is shifting a method, most retail merchants bounce on board someplace within the center or close to the top of that transfer when it feels and appears the ‘most secure’. Nonetheless, usually when it’s at these occasions when it appears ‘protected’ to enter, that the market is about able to reverse. Do you ever cease to suppose “Who’s taking the opposite facet of my trades?”

It’s the skilled dealer who takes on the chance of the retail dealer (the opposite facet of your trades), in any case, someone has to promote you one thing or purchase one thing from you once you wish to place a commerce. The skilled due to this fact wants the market to maneuver in the other way to what you need it to maneuver in, as a way to revenue. Thus, in the event you can study to anticipate and suppose like an expert dealer, you’ll be able to start bettering your buying and selling outcomes…

Taking over market danger

Who’s taking up the chance once you place a commerce? The one that desires you to lose, that’s who, as a result of in the event you lose, they win. Due to this fact, they’re your opponent, and for the reason that majority of retail merchants lose, meaning the particular person taking their danger and turning into revenue, are the skilled merchants.

You clearly wish to transfer your self from the struggling / dropping dealer camp into the profitable / skilled dealer camp. Thus, you want to begin considering like an expert dealer and cease considering and behaving like an beginner once you commerce.

Once more, this two dimensionally: someone goes to win and someone goes to lose on this recreation.

The buying and selling technique of the skilled, irrespective of how complicated one desires to make it, is just to tackle the retail dealer and to tackle different professionals (opponents). They make massive sums of cash when the bets / speculative positions of the others merchants go fallacious and people merchants in the end find yourself dropping as costs reverse in the other way

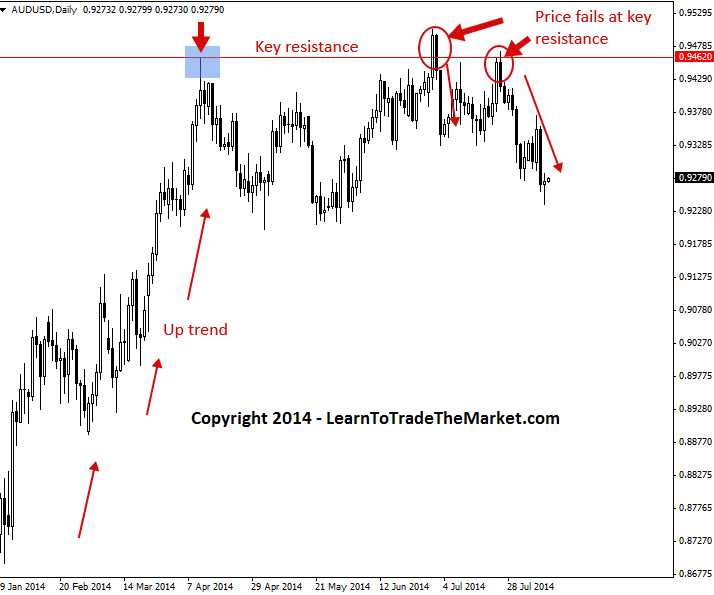

The AUDUSD chart instance beneath exhibits us a transparent instance of pros taking up the chance of the amateurs. The uptrend was intact for fairly some time earlier than establishing a key resistance degree / horizontal degree up close to 0.9450. Because the market got here again up and re-tested that key resistance close to 0.9450 and tried to push above it, it was largely a ‘desperation transfer’ by all of the amateurs who had been getting into close to the highest of the transfer and hoping for a breakout…though the development had already run increased for months.

Should you look intently, you’ll see the uptrend was already fairly stale because it ran from about mid-January to mid-April. The skilled merchants had been already on-board and had already made their cash by the point worth began reversing up close to 0.9450. We will then see worth did not push again above key resistance on two events. This was attributable to beginner merchants considering the uptrend would proceed and a breakout was imminent. The professionals might sense that the up transfer was coming to an finish and so they gladly took on the chance of the extra emotion-fueled, impulsive beginner merchants….

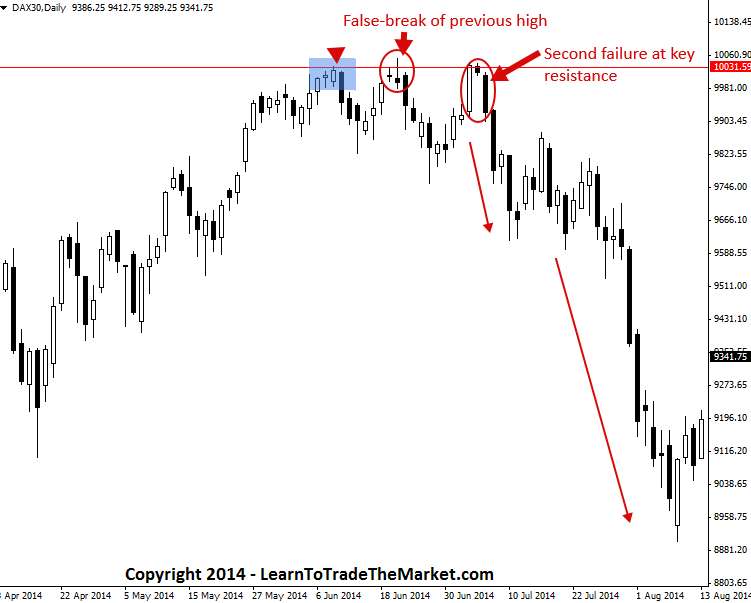

The subsequent instance is the DAX30 – German Inventory Index day by day chart. Be aware the false break of the latest excessive in June, adopted by one other check and failure at that degree, then the market simply sold-off onerous. That is one other away from instance of watching key ranges intently for doable worth motion reversals, because it’s at these key ranges that the professionals are normally stepping in to tackle the amateurs…

Right here’s one other good instance of buying and selling like an expert…

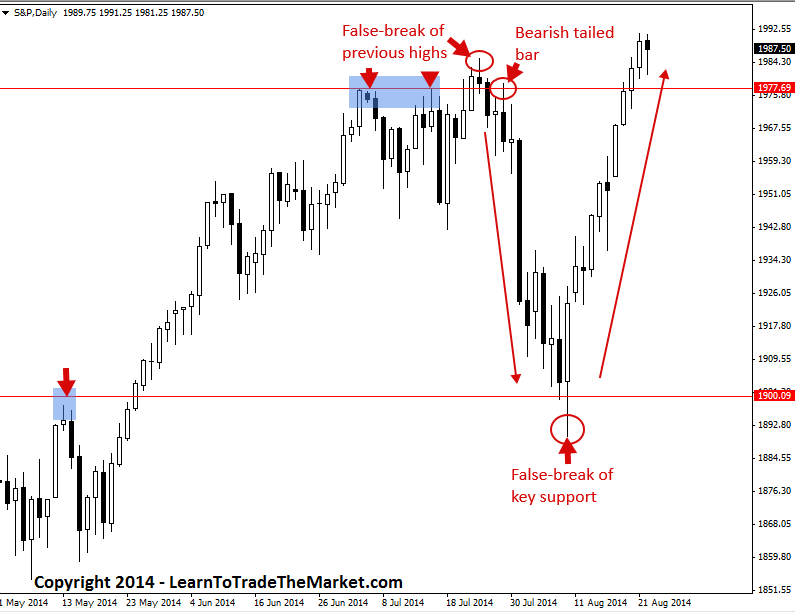

The S&P 500 had a false-break / failure at key resistance up close to 1977.50 again in late July of this yr. The market then fell away dramatically, netting anybody who shorted a major acquire. Once more, awaiting false-breaks of key ranges like this is essential as they usually result in enormous strikes within the different course, which suggests fast earnings to you, if you understand how to identify the strikes earlier than they occur.

The S&P 500 then created a false-break of key help down close to 1900.00 following the massive sell-off. As an ideal real-world instance, checkout our name on the S&P in our July thirty first market commentary, we had been clearly anticipating a possible purchase entry down close to 1900.00 key help. Profitable merchants know that buying and selling is a recreation of anticipation.

The technique is contrarian, it could be with or towards the development, it could be inside a buying and selling vary, it could possibly tackle many types. The hot button is that you just perceive the idea clearly. That idea could possibly be merely mentioned as ‘professionals doing the alternative to what the herd is doing’.

That doesn’t imply that each time markets go up, the professionals are promoting, and it doesn’t imply each time the market goes down, the professionals are shopping for, it doesn’t recommend that in any respect. As soon as once more, the idea I’m making an attempt to clarify is a state of affairs the place one dealer is taking up the chance of one other dealer, i.e. taking up his opponent.

suppose like an expert dealer

Skilled merchants are all the time considering one thing alongside the strains of, “What are the amateurs doing?” or “What’s the most blatant commerce {that a} dropping dealer who’s working on emotion as a substitute of logic and planning would take?”

Asking your self easy questions like these, earlier than getting into a commerce, can considerably improve your possibilities of success out there. In any case, everyone knows about 90% of merchants lose cash within the long-run, so it solely make sense to attempt to do the alternative of what they’re doing.

If a development has already run for months, likelihood is the professionals have already made their cash on it or not less than have plenty of revenue locked in. Thus, if a market has been trending for months and is nearing a key help degree or resistance degree, you want to ask your self if “getting into here’s what the professionals are doing or what the amateurs are doing?”

Equally, if a contemporary development has just lately begun, and the market pulls again somewhat bit to a help or resistance degree, the professionals are in all probability searching for an entry with that contemporary / near-term momentum.

Newbie merchants usually ignore altering market dynamics till it’s too late and the transfer is already over. Skilled merchants get on new developments early, they don’t wait till the development is nearly over, as amateurs do.

commerce like an expert dealer

A method is all the time the underlying reasoning behind the savvy skilled’s entry out there, he is not only getting into randomly, in no way. He (or she) is calculated, he’s studying the chart and he’s studying the emotion of all market contributors in that chart (worth motion), he sees and feels the clues being printed daily. He pounces with precision, putting his prey (the herd) with ice in his veins.

You’re in all probability questioning what methods one can make use of to commerce on this method.

Among the best merchants have mentioned you solely want a easy horizontal line to commerce the market efficiently.

I take that one step additional and add worth motion affirmation alerts, e.g., pin bars, false breaks, fakeys and so forth, that happen at these horizontal strains.

By buying and selling at and round these key chart ranges, we will additionally apply stricter danger management. It’s usually so simple as saying, if beneath this degree, we count on it to fall, or if above this degree we count on it to bounce. As may be seen, key horizontal ranges enable for best danger administration. It’s usually why markets reverse on a dime on these ranges and spherical numbers and so forth. Attempt drawing them in in your charts every day and week and you will note their effectiveness for your self.

Whenever you mix worth motion with key ranges, you’re now beginning to see the market like an expert and also you’re gaining the ‘unfair edge’ over your competitors out there.

Conclusion

Should you consider the market as a sea of opponents, and inside this sea of opponents is a college of merchants very like a college of fish. They’ll stick collectively, observe one another in a consolation zone, most don’t know who’s main who. Should you can think about every short-term day by day swing out there as a college of misplaced fish following each other, you’ll be able to form the truth in your favor. “What are most individuals doing immediately?” If they’re more likely to be fallacious (as a rule), then I have to suppose logically and contemplate doing the alternative / being a contrarian. How can I take advantage of worth motion alerts and key market ranges to information me in taking up my opponents and taking an opposing view to the herd, the varsity, and the plenty?

Should you begin using this logic sometimes, taking a step again and looking out on the market from the alternative facet of the fence (the professionals facet) you might not solely discover some nice buying and selling alternatives, you might begin avoiding some unhealthy trades as properly. To study extra about buying and selling like an expert through the use of easy worth motion methods and key chart ranges, checkout my buying and selling course.

To your success – Nial Fuller