The 99 Win Non Repaint Scalping MT5 Indicator claims to resolve this actual subject. Not like conventional indicators that redraw their indicators, this device locks its alerts the second they seem. No disappearing arrows, no shifting strains—simply fastened indicators that keep the place they first appeared. However does it truly ship on that promise, and extra importantly, is it the suitable match on your buying and selling technique?

What This Indicator Truly Does

The 99 Win Non Repaint Scalping indicator is a technical evaluation device constructed particularly for MetaTrader 5 that generates purchase and promote indicators for short-term buying and selling. The “non repaint” designation means as soon as the indicator locations an arrow or alert on the chart, it stays there—interval. That sign gained’t disappear or relocate when new value knowledge is available in.

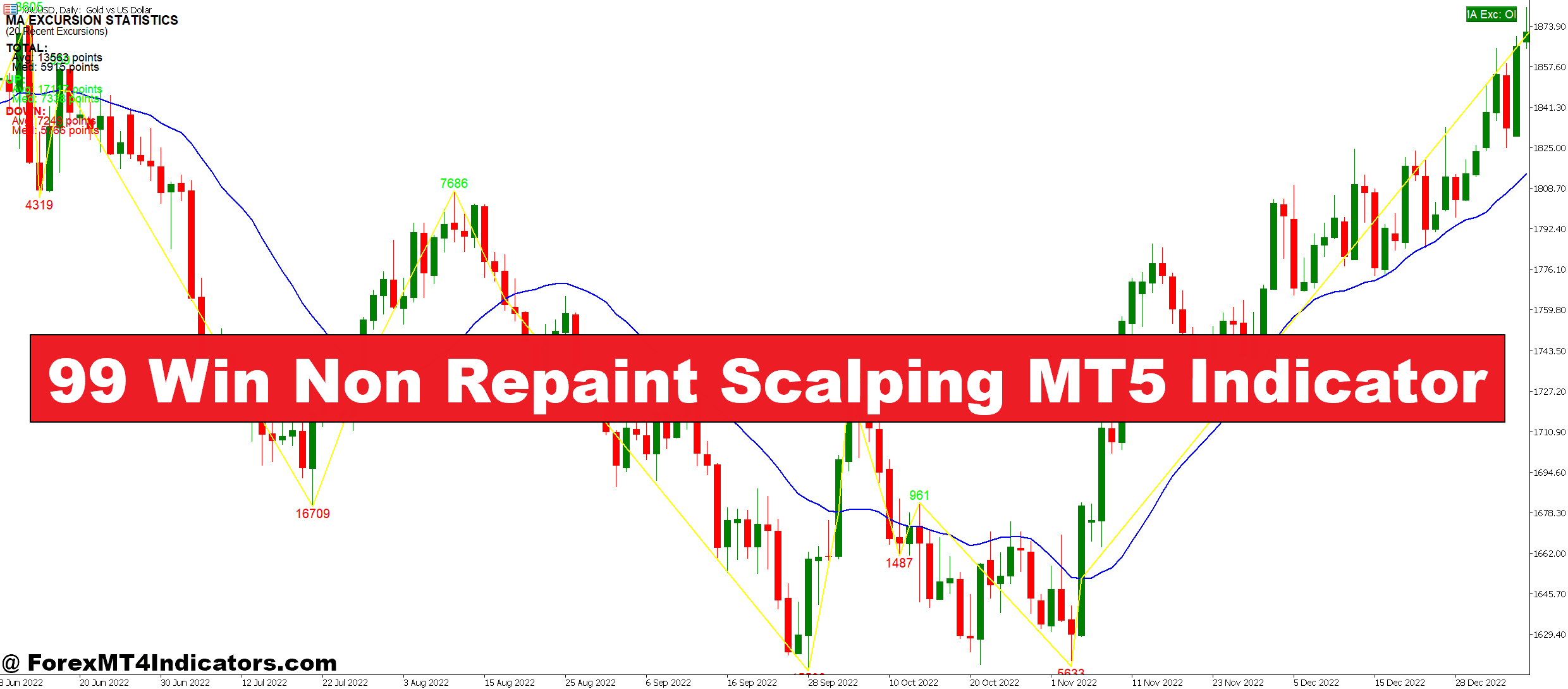

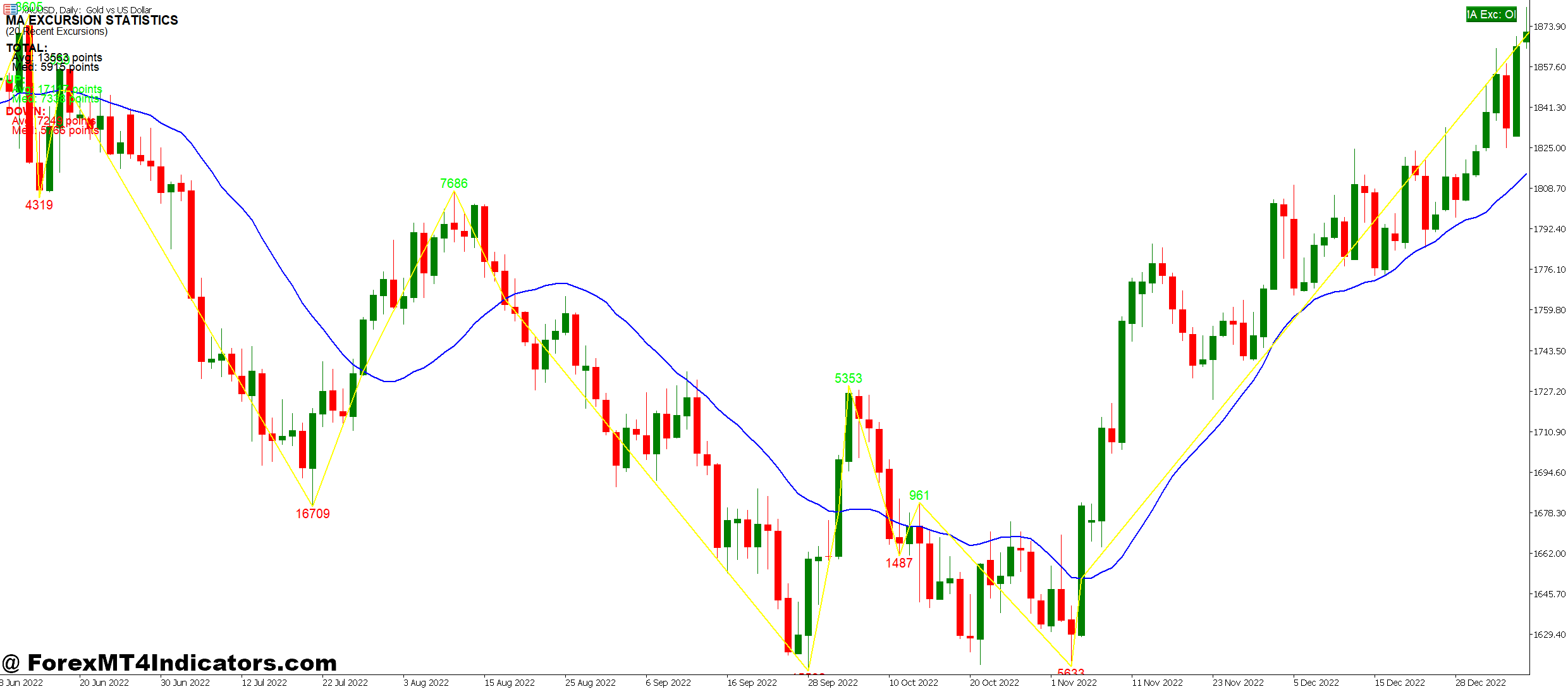

The indicator combines a number of technical components. Most variations use a mix of shifting common crossovers, momentum filters, and value motion patterns to determine potential entry factors. When these circumstances align throughout particular market constructions, the indicator fires a visible arrow—blue for buys, crimson for sells—immediately on the worth chart.

What separates this from normal oscillators? Velocity and specificity. The algorithm is tuned for the 1-minute to 15-minute timeframes the place scalpers function. It’s designed to catch fast 5-15 pip actions reasonably than every day swings, which suggests the logic filters out slower developments and focuses on speedy momentum shifts.

The Mechanics Behind the Indicators

Whereas actual calculations fluctuate by model, most implementations use a three-layer strategy. First, the indicator measures short-term momentum utilizing one thing just like a 5-period and 10-period exponential shifting common relationship. When the sooner EMA crosses the slower one with adequate distance (not only a tiny overlap), the primary situation triggers.

Second, a volatility filter checks present market circumstances. Throughout useless markets with 2-3 pip ranges, the indicator stays quiet. It desires to see precise motion—sometimes measured via Common True Vary during the last 10-14 bars. If ATR falls under a threshold (normally 0.0008 for main pairs), indicators get suppressed.

Third, value motion affirmation comes into play. The indicator gained’t fireplace a purchase sign if value simply rejected off a current excessive, even when shifting averages crossed bullish. This layer examines the final 3-5 candles for patterns like engulfing bars or sturdy directional closes. Solely when all three circumstances align does the arrow seem.

The non-repainting side works as a result of the indicator solely plots indicators after candle shut, not mid-formation. Some merchants see this as a disadvantage since you possibly can’t enter the moment momentum begins. But it surely’s the trade-off for reliability—that arrow represents a accomplished sign that met all standards, not a provisional maybe-signal that would vanish.

Placing It to Work: Actual Buying and selling Eventualities

Take a typical London session open on GBP/USD utilizing the 5-minute chart. Value had been ranging between 1.2650 and 1.2670 for the previous hour—the sort of chop that eats cease losses. At 8:15 AM GMT, a information occasion triggers motion. Inside two bars, the indicator fires a blue arrow at 1.2655.

Right here’s what occurred: The 5-EMA crossed above the 10-EMA with a 3-pip separation. ATR jumped from 0.0006 to 0.0012, displaying volatility increasing. The earlier candle closed strongly bullish, engulfing the prior bar’s vary. All techniques inexperienced.

A dealer getting into at 1.2655 with a 10-pip cease at 1.2645 and 15-pip goal at 1.2670 would’ve seen value rally to 1.2673 inside eight minutes. That’s a 1.5:1 reward-to-risk winner that really appeared in real-time—the arrow stayed at 1.2655 whether or not value went up or down afterward.

However right here’s the fact test: For each clear winner like that, you’ll see 2-3 indicators that hit the cease. Perhaps the EUR/USD sign on the 1-minute chart triggered at 1.0850 throughout Asian session, solely to whipsaw in a 5-pip vary earlier than stopping out. The indicator caught momentum—downside is, momentum died in thirty seconds.

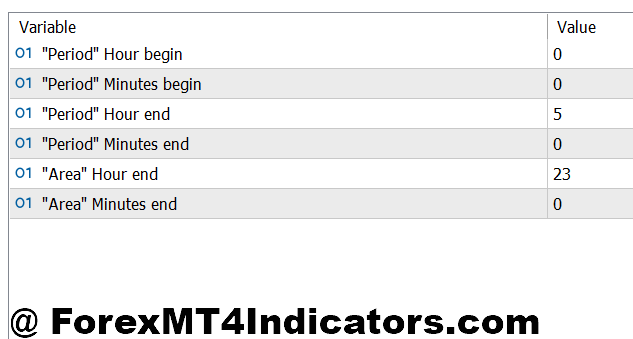

Settings That Truly Matter

Default parameters hardly ever match everybody’s model. Most variations allow you to alter the EMA intervals, ATR lookback, and sign sensitivity. For the 5-minute chart on majors like EUR/USD or USD/JPY, normal settings (5/10 EMA, 14 ATR) work decently throughout energetic classes.

Change to the 1-minute chart, and issues get twitchy. Think about tightening the ATR filter to 0.0010 minimal to cut back indicators throughout low-volatility grinds. For pairs like GBP/JPY that transfer 20-30 pips rapidly, you may loosen it to 0.0015 to keep away from lacking sturdy strikes.

The 15-minute timeframe wants a unique strategy totally. Right here, lengthen the EMA intervals to eight/15 to filter out noise. The longer bars imply you’re catching mini-trends reasonably than pure scalps, so the indicator’s logic ought to adapt. Some variations embrace a “sensitivity” slider—dial it down on larger timeframes to forestall overtrading.

One parameter merchants usually ignore: sign affirmation bars. In case your model consists of this, setting it to 1 means you get indicators instantly after candle shut. Setting it to 2 means the indicator waits for the subsequent bar to start out earlier than plotting the arrow. That further bar affirmation reduces indicators by roughly 40% however will increase win price by filtering out weak setups.

The Trustworthy Benefits and Actual Limitations

The largest promoting level? Psychological readability. When that arrow seems, you recognize it’s everlasting. Backtesting turns into significant as a result of indicators you see in historical past are the identical ones that appeared in real-time. That eliminates the damaging phantasm of excellent indicators with 85% win charges that crumble throughout stay buying and selling.

For pure scalpers buying and selling 20-30 positions per session, the indicator supplies constant entry construction. You’re not guessing whether or not momentum is “sufficient” or if a crossover is “actual.” The algorithm makes that decision, eradicating emotional waffling at crucial moments.

That mentioned, no scalping device solves the core subject: transaction prices. If you happen to’re paying 2 pips unfold on EUR/USD, each commerce begins 2 pips underwater. Focusing on 10-pip scalps means you want 12 pips of favorable motion simply to interrupt even after unfold and revenue goal. The indicator may sign 60% winners in value motion phrases, however after prices, that drops to 45-50% profitability.

One other limitation: range-bound slaughter. When GBP/USD trades in a 20-pip field for 3 hours, the indicator will nonetheless fireplace indicators. You’ll see arrows on the high quality (sells) and backside (buys), which sounds excellent till you notice half of them are fake-outs. The indicator can’t predict whether or not that breakdown is actual or one other failed probe.

And regardless of the “99 Win” advertising identify, let’s clear this up—no indicator wins 99% of trades. Not this one, not any. If you happen to see advertising supplies claiming that win price, they’re both cherry-picking timeframes, ignoring transaction prices, or testing on curve-fitted knowledge. Actual-world scalping with this indicator runs 50-65% win price for expert merchants throughout favorable circumstances.

How It Stacks Up Towards Alternate options

Evaluate this to plain Stochastic or RSI scalping techniques. These oscillators work nice for figuring out overbought/oversold circumstances however generate indicators continually—many throughout horrible market constructions. The 99 Win indicator provides these volatility and value motion filters, which cuts sign frequency by 70% in comparison with uncooked oscillator crosses.

Towards Bollinger Band breakout techniques, this indicator gives extra precision. BB techniques set off when value hits outer bands, however you don’t know if that’s the beginning of a transfer or the tip. The momentum affirmation layer right here waits for follow-through, lowering these painful entries proper earlier than reversals.

The trade-off? Fewer whole indicators. Pure Stochastic crosses may provide you with 40 indicators in a session. This indicator may fireplace 12-15. For aggressive scalpers who need fixed motion, that feels limiting. For merchants preferring high quality over amount, it’s a characteristic.

Buying and selling foreign exchange carries substantial threat. No indicator ensures income, and scalping amplifies each beneficial properties and losses via frequency and leverage.

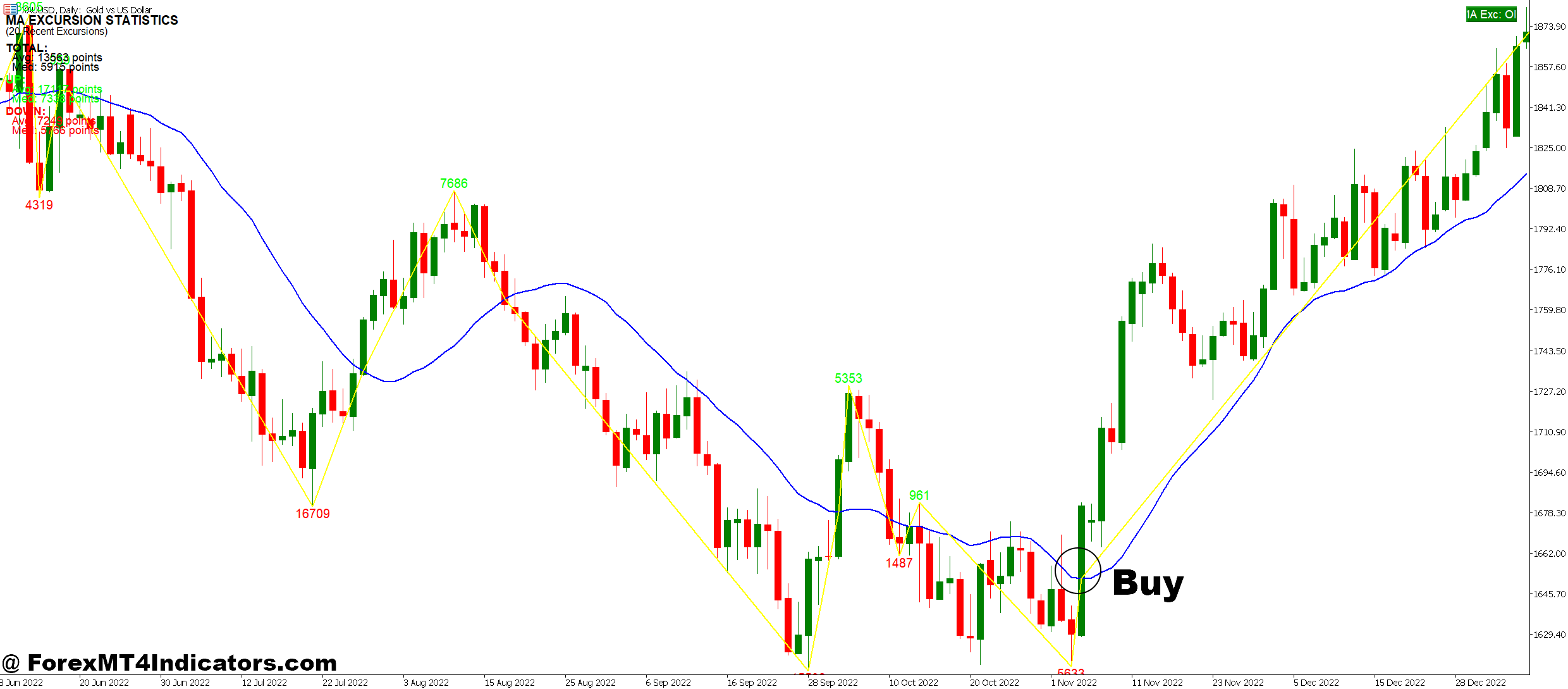

Commerce with 99 Win Non Repaint Scalping MT5 Indicator

Purchase Entry

- Look forward to blue arrow affirmation – Enter solely after the candle closes utterly; mid-bar indicators don’t rely and infrequently reverse earlier than the bar finishes.

- Examine ATR above 0.0008 – Verify volatility is adequate on EUR/USD or GBP/USD pairs; getting into throughout flat ATR under this degree produces 70% extra false indicators.

- Set cease loss 10-12 pips under entry – Place your cease just below the sign candle’s low; tighter stops get triggered by regular unfold fluctuation throughout scalping.

- Goal 1.5:1 minimal reward-risk – Goal for 15-18 pips revenue when risking 10 pips; something much less isn’t definitely worth the unfold and fee prices on fast scalps.

- Keep away from indicators in the course of the Asian session – Skip trades between 11 PM – 3 AM EST when main pairs vary in 5-8 pip packing containers; await London or New York open volatility.

- Confirm value above 20-EMA – Verify the broader pattern helps your purchase; indicators in opposition to the 1-hour or 4-hour pattern fail 60% extra usually.

- Danger most 1% per commerce – Calculate place measurement so a 10-pip cease equals 1% of your account; scalping frequency makes bigger threat percentages unsustainable.

- Skip indicators inside 5 pips of resistance – If GBP/USD fires a purchase at 1.2695 however 1.2700 rejected value thrice immediately, go on the commerce; trapped patrons create reversals.

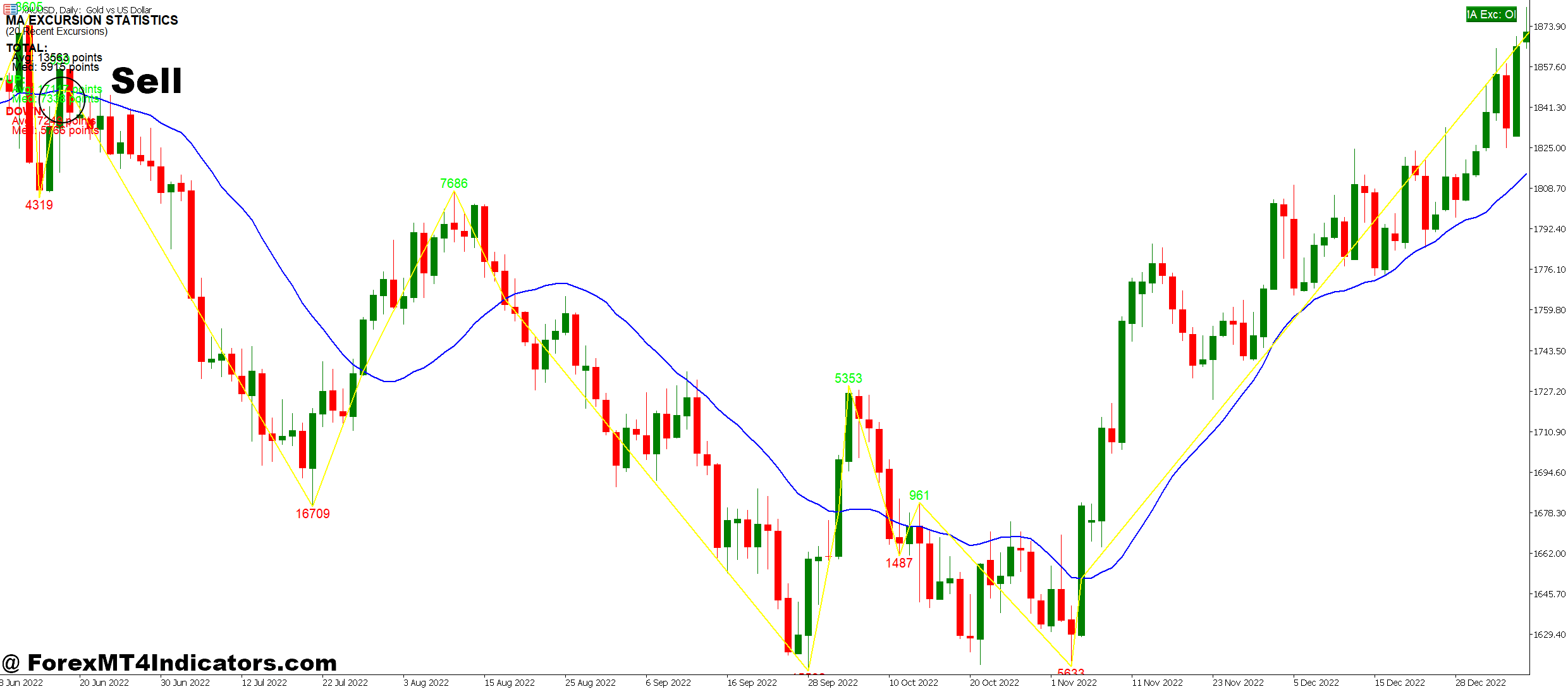

Promote Entry

- Enter on the crimson arrow after the candle closes – Look forward to the complete bar to finish earlier than executing; untimely entries on creating arrows lose cash persistently.

- Verify ATR reads 0.0010 or larger – Confirm adequate motion exists in your chart timeframe; low volatility produces 3-4 pip strikes that may’t overcome spreads.

- Place cease 10-12 pips above sign candle – Place your cease simply above the excessive of the arrow candle; account for 2-pip unfold so whole threat stays below 15 pips.

- Exit at 15-20 pip revenue goal – Set your take revenue earlier than getting into; scalps concentrating on 25+ pips flip into swing trades when momentum stalls.

- Ignore indicators throughout information occasions – Skip trades quarter-hour earlier than and half-hour after high-impact releases; 50-pip spikes blow via stops no matter sign high quality.

- Examine value under 20-EMA – Make sure the 15-minute or 1-hour chart exhibits downward construction; counter-trend sells on EUR/USD throughout bullish classes fail twice as usually.

- By no means threat greater than 1% per sign – Dimension your heaps so a 12-pip cease equals 1% most; taking 20-30 trades per session with 2% threat ensures account destruction.

- Keep away from promoting inside 8 pips of help – If USD/JPY indicators a promote at 149.52 however 149.50 has held thrice this week, await a transparent break; blind entries at help can gas stop-hunting.

Conclusion

The 99 Win Non Repaint Scalping MT5 Indicator delivers on its core promise—indicators that don’t disappear after the actual fact. That alone makes it extra reliable than the vast majority of repainting instruments cluttering the indicator market. The mix of momentum, volatility, and value motion filters creates a fairly strong system for catching fast strikes throughout energetic buying and selling classes.

But it surely’s not magic. The indicator works greatest throughout trending or risky circumstances (London open, New York open, main information occasions) and struggles throughout Asian session ranges or low-liquidity hours. Win charges hover round 55-60% for skilled customers who perceive market construction, not the 99% recommended by the identify. After spreads and commissions, scalping stays a grind that calls for self-discipline, correct place sizing, and sensible expectations.

If you happen to’re contemplating this device, check it on a demo account for not less than two weeks throughout completely different market circumstances. Monitor not simply wins and losses, however sign frequency, time of day patterns, and which forex pairs reply greatest. The indicator supplies construction, however your execution and cash administration decide whether or not it turns into worthwhile or simply one other deserted device in your buying and selling arsenal.

Really helpful MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Further Unique Bonuses All through The Yr

- Unique 90% VIP Money Rebates for all Trades!

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Associate Code: VIP90