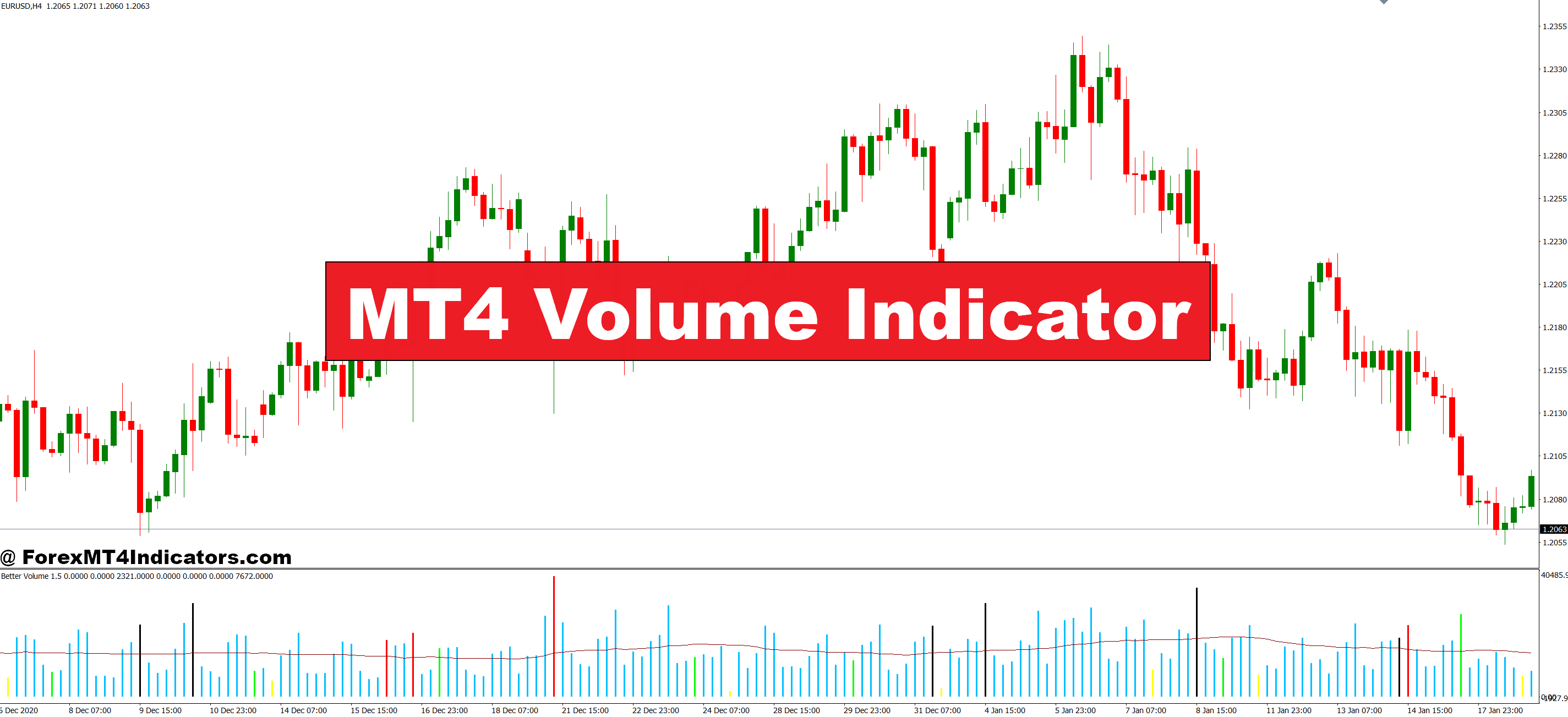

The quantity indicator in MetaTrader 4 shows tick quantity—the variety of value adjustments that occurred throughout every time interval. Right here’s the factor: MT4 doesn’t have entry to precise traded quantity such as you’d see on futures exchanges. As a substitute, it counts what number of occasions the value ticked up or down inside every candle.

A inexperienced or crimson histogram seems under your chart, with every bar representing one candle’s exercise. Taller bars imply extra value fluctuations occurred throughout that interval. Shorter bars point out quieter value motion with fewer ticks.

This tick quantity correlates strongly with precise buying and selling quantity, particularly on main pairs like EUR/USD or GBP/JPY. When institutional gamers are lively, costs tick extra incessantly. Throughout Asian session doldrums on a random Tuesday? You’ll see these quantity bars shrink significantly.

The Math Behind the Indicator

The calculation is simple. MT4 counts each bid or ask value change through the candle’s formation. If EUR/USD ticks from 1.0850 to 1.0851, that’s one rely. If it ticks again to 1.0850, that’s one other. Sum all these actions, and also you’ve acquired your quantity studying for that candle.

Merchants usually misunderstand this. They assume quantity means one thing sophisticated, but it surely’s only a tally of value exercise. That simplicity makes it dependable. You’re not coping with complicated formulation that repaints or lag behind value motion.

The indicator updates in real-time as the present candle develops. Watch a reside chart throughout London open, and also you’ll see that quantity bar climbing as European merchants pile in. Against this, Sunday night often exhibits anemic quantity bars as merchants look forward to Monday’s liquidity.

Placing Quantity to Work in Actual Trades

Quantity shines brightest when confirming breakouts. Let’s say USD/JPY consolidates between 149.50 and 150.00 for 3 hours on the 15-minute chart. Value lastly breaks above 150.00. However is it actual?

Verify the quantity bar for that breakout candle. If it’s considerably taller than the earlier 10-20 candles—perhaps double or triple the common—that means real momentum. Merchants are actively collaborating within the transfer. That’s your affirmation to enter lengthy with extra confidence.

However what if that breakout candle exhibits weak quantity, barely increased than the consolidation candles? That’s a crimson flag. The break is likely to be a fake-out pushed by skinny liquidity or stop-hunting. Sensible merchants look forward to the following candle or skip the commerce fully.

Quantity additionally helps determine exhaustion. Image EUR/USD grinding increased for 2 hours, making regular progress on first rate quantity. Then you definitely get an enormous bullish candle that shoots value up 30 pips in 5 minutes. The quantity bar completely explodes—3 times taller than something you’ve seen all session.

That excessive quantity spike usually marks a climax. Everybody who needed to purchase simply purchased. The gas runs out, and value stalls or reverses. Skilled merchants acknowledge this sample and look to take income and even fade the transfer.

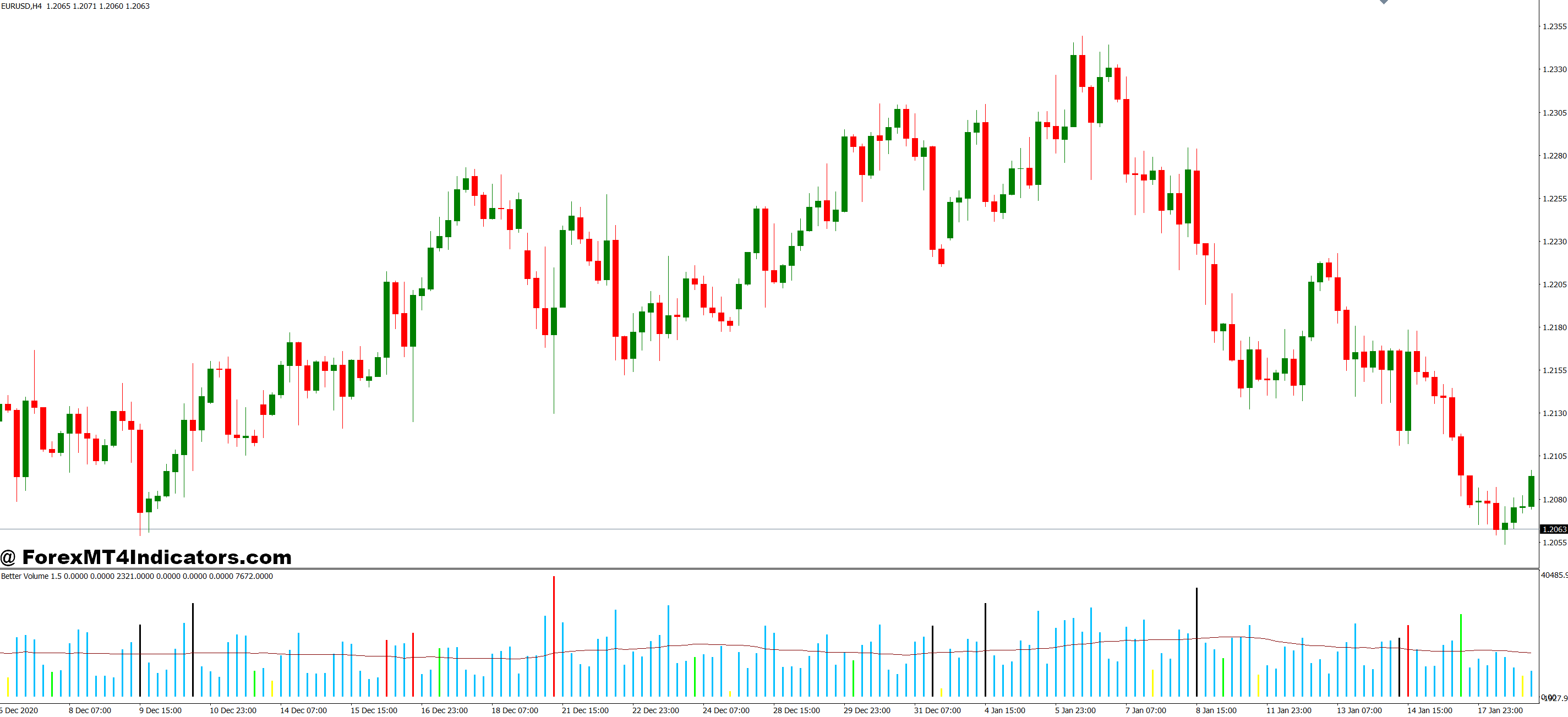

Customizing Quantity Settings for Completely different Eventualities

The default MT4 quantity indicator works wonderful proper out of the field, however you’ll be able to modify the visible show. Proper-click the indicator, choose “Properties,” and also you’ll discover choices to vary colours or line thickness.

Some merchants favor setting bullish quantity bars (up-close candles) to inexperienced and bearish bars (down-close candles) to crimson. This colour coding helps spot divergences sooner. When value makes increased highs however quantity bars are declining, that’s bearish divergence suggesting weakening momentum.

For scalpers working 1-minute or 5-minute charts, evaluating quantity bars between timeframes provides context. A spike on the 5-minute chart carries extra weight than one on the 1-minute. The upper timeframe quantity confirms broader market participation, not simply fleeting tick noise.

Day merchants usually mix quantity with help and resistance zones. Excessive quantity at a key degree—say, the 1.1000 deal with on EUR/USD—suggests sturdy curiosity. If value bounces off that degree with elevated quantity, the extent holds extra significance than a low-volume contact.

Strengths and Limitations You Have to Know

The MT4 quantity indicator’s largest power is availability and ease. It’s constructed into each MT4 platform, requires zero setup, and updates immediately. You don’t want costly knowledge feeds or sophisticated subscriptions.

Quantity divergence detection represents one other benefit. When value tendencies strongly however quantity retains declining, you’re seeing participation dry up. That divergence usually precedes reversals. Recognizing these patterns early offers you an edge in timing exits or reversals.

That mentioned, tick quantity has limitations. It’s not precise traded contracts or {dollars} altering arms. A single massive establishment can transfer value considerably with out producing huge tick quantity in the event that they’re inserting restrict orders rigorously. You gained’t at all times see their footprint.

One other disadvantage: MT4 solely exhibits quantity out of your dealer’s liquidity pool. Dealer A would possibly show totally different quantity readings than Dealer B for a similar forex pair and timeframe. This inconsistency means you’ll be able to’t depend on absolute quantity numbers—solely relative adjustments matter.

The indicator additionally lacks sophistication in comparison with skilled quantity instruments. You gained’t get quantity profile, delta evaluation, or cumulative quantity delta. For many retail spot foreign exchange merchants, although? These superior instruments don’t matter a lot anyway. Tick quantity offers sufficient sign for sensible buying and selling choices.

How Quantity Stacks Up In opposition to Different Affirmation Instruments

Evaluating quantity to RSI or MACD reveals totally different strengths. RSI tells you when value is stretched (overbought/oversold), but it surely doesn’t present conviction. You would possibly see RSI at 75 indicating overbought circumstances, but if quantity retains climbing, the development might run a lot additional.

MACD histogram exhibits momentum shifts via shifting common crossovers. That’s helpful, but it surely lags behind value. Quantity doesn’t lag—it displays present market exercise because it occurs. When MACD exhibits bullish momentum AND quantity confirms with sturdy bars, you’ve acquired a high-probability setup.

Some merchants use the On-Stability Quantity (OBV) indicator in its place. OBV provides quantity on up days and subtracts it on down days, making a cumulative line. It’s extra refined but additionally extra complicated. The straightforward MT4 quantity histogram offers you 80% of the profit with 20% of the psychological overhead.

Ichimoku Cloud customers usually ignore quantity fully, relying as an alternative on cloud construction and value place. However including quantity to Ichimoku setups improves outcomes. When value breaks out of the cloud with excessive quantity, that breakout deserves extra respect than a quiet, low-volume break.

Easy methods to Commerce with MT4 Quantity Indicator

Purchase Entry

- Quantity spike on help bounce – Enter lengthy when EUR/USD touches a key help degree (like 1.0800) and the quantity bar is 2x the 20-candle common, confirming consumers are defending the zone.

- Breakout affirmation above resistance – Take the purchase when value breaks a 4-hour resistance degree with quantity exceeding 150% of latest common; keep away from if quantity is weak because it indicators a fake-out.

- Bullish divergence with rising quantity – Purchase when value makes decrease lows however quantity bars present increased lows on the 1-hour chart, indicating accumulation earlier than a reversal.

- Quantity growth throughout uptrend – Add to longs when GBP/USD tendencies increased and every rally candle exhibits progressively bigger quantity bars, confirming sturdy momentum continuation.

- Low-volume pullback entry – Enter on retracements that present 50% much less quantity than the preliminary breakout transfer, signaling the pullback lacks conviction and the uptrend will resume.

- Morning breakout with London quantity – Go lengthy on EUR/USD breakouts between 8:00-10:00 GMT when quantity doubles from Asian session ranges, capturing institutional participation.

- Skip uneven, erratic quantity – Don’t purchase when quantity bars fluctuate wildly with out sample on the 15-minute chart; this means confused market circumstances with excessive whipsaw threat.

- Danger 1% most per sign – By no means threat greater than 1% of your account on volume-based indicators; place stops 10-15 pips under the help degree that triggered your entry.

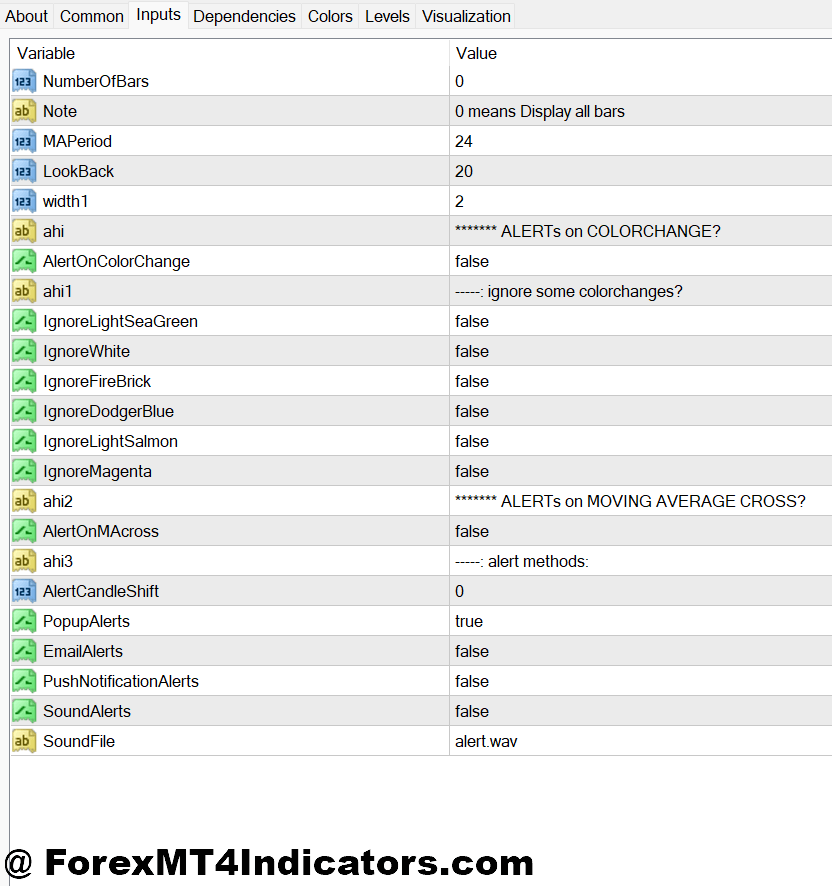

Promote Entry

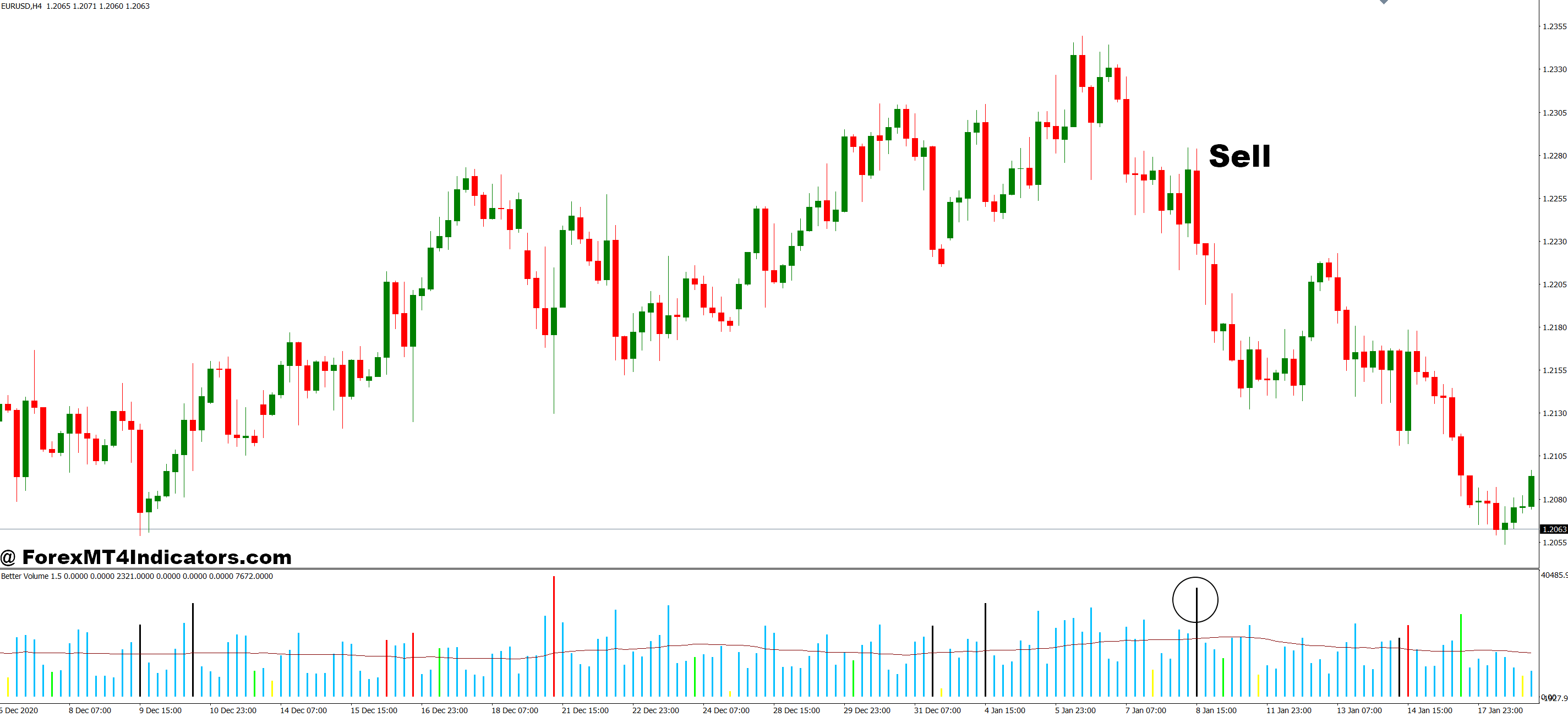

- Quantity climax at resistance – Quick when value hits resistance (like GBP/USD at 1.2700) with quantity 3x the common, indicating exhaustion and possible reversal inside 2-4 candles.

- Breakdown with increasing quantity – Promote when value breaks every day help with quantity bars 50-100 pips bigger than consolidation common, confirming sellers are in management.

- Bearish divergence sample – Enter shorts when EUR/USD makes increased highs however quantity steadily declines over 6+ candles on the 4-hour chart, exhibiting weakening shopping for strain.

- Quantity spike rejection – Go brief when value pushes to new highs, quantity explodes, then the candle closes within the decrease 30% of its vary, indicating trapped consumers.

- Declining quantity uptrend – Fade rallies when every increased excessive exhibits progressively smaller quantity bars over 8+ hours, signaling the transfer is working out of gas.

- Submit-news fade with quantity drop – Quick 15-Half-hour after information spikes if the follow-through candles present 60% much less quantity than the preliminary response candle.

- Keep away from low-volume Asian breakdowns – Skip sells throughout 22:00-6:00 GMT when quantity is skinny; breakdowns usually reverse when London opens with actual liquidity.

- Use 2:1 minimal reward-risk – Solely take volume-confirmed sells focusing on a minimum of 40 pips when risking 20 pips; exit instantly if quantity spikes in opposition to your place inside 3 candles.

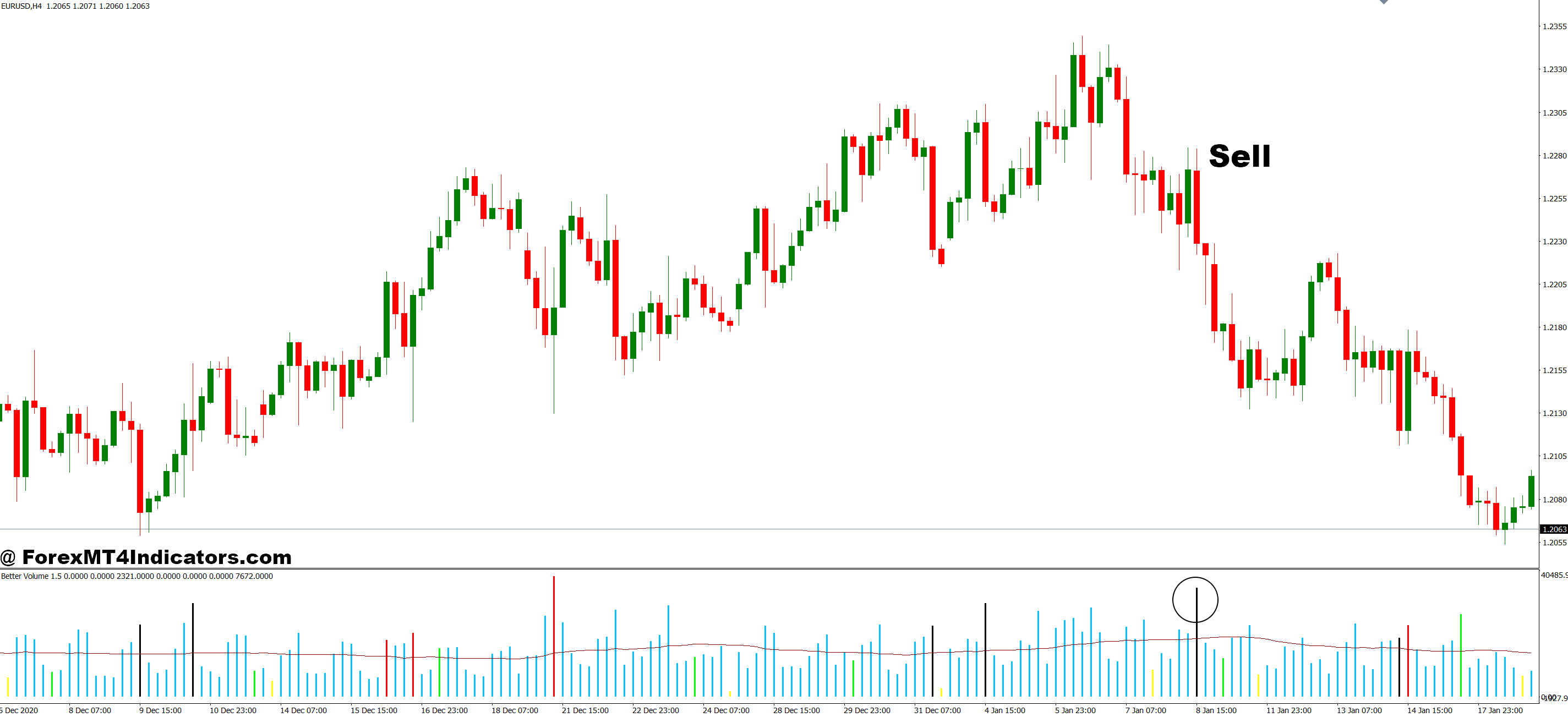

Making Quantity A part of Your Buying and selling System

Quantity works greatest as a affirmation filter, not a standalone sign generator. Construct your setups round value motion, help and resistance, or your most popular indicators. Then use quantity to substantiate whether or not the setup deserves a commerce.

Right here’s a sensible workflow: Spot a setup (double backside, trendline break, no matter you commerce). Earlier than getting into, look on the quantity bars. Does the confirming candle present above-average quantity? If sure, take the commerce. If quantity’s weak or declining, cross or look forward to higher affirmation.

Buying and selling foreign exchange carries substantial threat. No indicator ensures income, and quantity can’t stop losses from poor threat administration or overtrading. However used appropriately, the MT4 quantity indicator helps you keep away from low-conviction trades and will increase your confidence in high-probability setups. That’s definitely worth the two seconds it takes to verify these histogram bars earlier than clicking the purchase or promote button.

Beneficial MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

- Unique 90% VIP Money Rebates for all Trades!

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Companion Code: VIP90