If 2025 taught Canadian dividend buyers something, it’s that top dividend yields include low dividend security. There’s a commerce off, and a steadiness someplace. However there are exceptions, too.

We watched telecom giants pause dividend development (I’m watching you, TELUS), and a 56% dividend lower at BCE. We noticed an entire dividend suspension at PetroTal in November, and a 40% dividend lower at Northland Energy was essential to sustainably finance its huge offshore wind vitality growth pipeline.

Principally, yields near or above the 7% scream danger! Nevertheless, additional due diligence can add confidence when choosing the right high-yield dividend shares to purchase for the long run. Probably the most useful asset in a dividend portfolio isn’t simply present passive earnings — it’s future money movement visibility.

That’s why, regardless of the noise within the broader market, with its 6.1% payout, Enbridge (TSX:ENB) stays the high-yield inventory I’m most comfy holding for the following decade, and at the very least for the following 5 years.

The consolation in Enbridge inventory’s capital funding backlog

The first cause I’m comfy with Enbridge is that its future isn’t based mostly on guessing oil costs; it’s based mostly on contracted “take-or-pay” pipelines money flows and an expanded building schedule.

Enbridge presently sits on a secured capital program of roughly $35 billion coming into service by 2030. This isn’t “deliberate” or “aspirational” spending. The funding is allotted to initiatives which can be commercially secured, and “utility-like” investments that can diversify its income, earnings and money movement profile.

Administration has confirmed roughly $8 billion of those initiatives will enter service in 2026.

These initiatives ought to generate dependable money movement instantly upon completion, immediately supporting the 6.1% dividend.

Once you purchase Enbridge inventory as we speak, you’re shopping for the present pipeline community, a rising pure gasoline utility, and a renewable vitality inventory with a pre-funded, non-dilutive development pipeline that extends nicely into the following decade.

A boring, but stunning passive-income development engine

Enbridge’s medium-term monetary steerage guarantees respectable working earnings development charges and stronger distributable money movement profile. Whereas different high-yielders are struggling to take care of their payouts, Enbridge has reaffirmed a gradual development trajectory that earnings buyers ought to love.

Administration targets 7-9% development in earnings earlier than curiosity, taxes, depreciation, and amortization (EBITDA) in 2026, with EBITDA and distributable money movement (DCF) development normalizing at 5% by 2030.

This creates a compelling mathematical flooring to your complete returns. In case you purchase the inventory as we speak at a 6.1% yield and the corporate grows money movement by 5% yearly, you’re looking at a possible complete return of about 11% per 12 months, with out requiring any valuation a number of enlargement or hype.

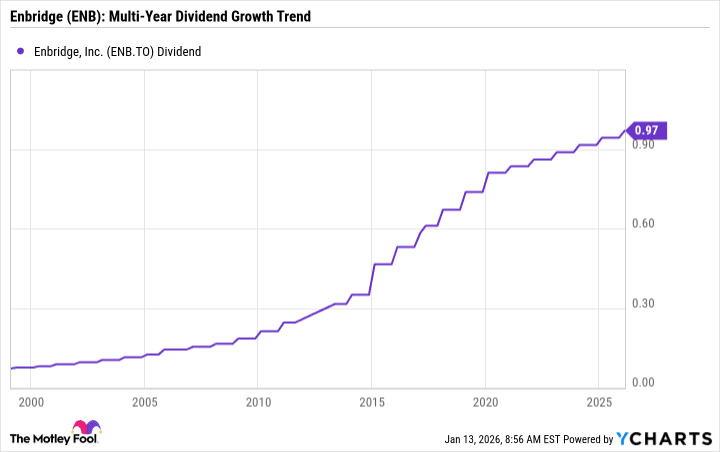

The ENB inventory dividend: A 31-year development streak

ENB Dividend information by YCharts

There’s useful consolation in understanding that administration prioritizes rising Enbridge inventory’s dividend payout.

Only in the near past, Enbridge introduced a 3% dividend improve for 2026, marking its thirty first consecutive 12 months of raises. Whereas 3% would possibly sound modest in comparison with the hikes of a decade in the past, it seems sustainable. If the corporate manages a 5% development charge goal for DCF, and maybe, the dividend, buyers who purchase ENB inventory as we speak may see yields develop to 7.5% by 2030.

Enbridge’s money movement payout ratio stays wholesome below 70%, and with the corporate projecting $5.70 to $6.10 in DCF per share for 2026, the dividend ($3.88 annualized) is well-covered. Administration is successfully retaining sufficient money to self-fund that huge $35 billion backlog we talked about, lowering the necessity to situation fairness or load up on harmful quantities of debt.

The Silly backside line

A 6.1% yield normally comes with a catch. In Enbridge inventory’s case, the “catch” is that you must settle for boring, single-digit development charges moderately than explosive tech-sector positive factors, and Bay Avenue may add execution dangers on new low-carbon initiatives to the corporate’s fairness danger profile.

However trying on the insiders’ latest information, the $35 billion backlog, the locked-in regulated charges, and the 5% medium-term development goal, I see an organization that has already constructed the “dividend” bridge to 2030. For a long-term passive-income portfolio, that’s the form of consolation I’m in search of.