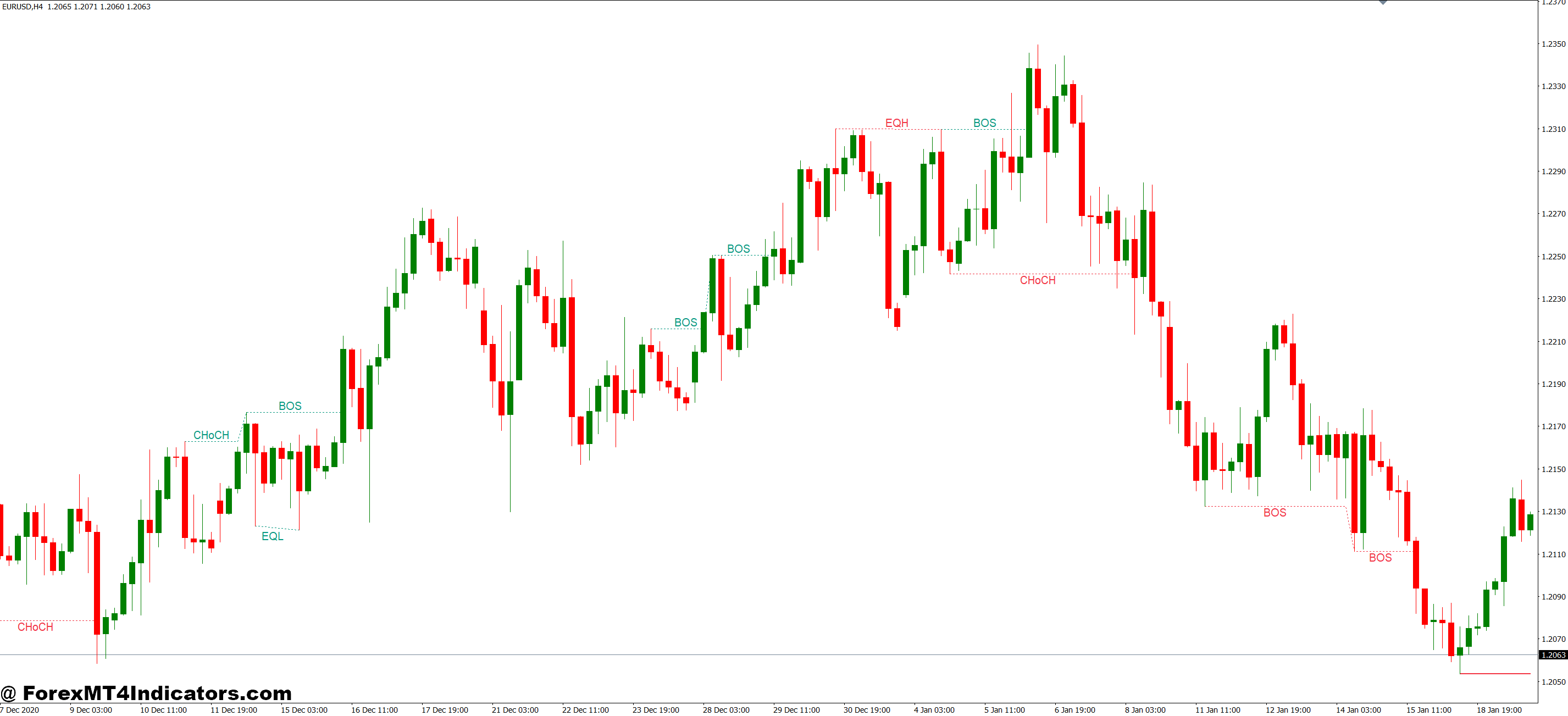

The Sensible Cash Ideas indicator builds on value motion ideas that institutional merchants have used for many years. At its core, SMC identifies three key parts: order blocks, truthful worth gaps, and liquidity sweeps.

Order blocks symbolize the final opposing candle earlier than a robust directional transfer. When GBP/USD consolidates for hours then abruptly drops 80 pips, that last bullish candle earlier than the drop marks an order block. Establishments doubtless positioned massive promote orders there, creating provide that overwhelms retail demand. The indicator robotically highlights these zones, which frequently act as future resistance.

Truthful worth gaps seem when value strikes so aggressively that it leaves inefficiencies—areas the place no precise buying and selling occurred at sure value ranges. On a 15-minute USD/JPY chart, if value jumps from 149.20 to 149.50 in a single candle with the following candle opening above the primary candle’s excessive, that hole between them represents unfilled orders. Value ceaselessly returns to fill these gaps, providing high-probability reversal setups.

Liquidity zones mark areas the place cease losses cluster. Retail merchants sometimes place stops slightly below swing lows or above swing highs. The indicator identifies these zones as a result of establishments intentionally push value into them, triggering stops to build up positions at higher costs earlier than the actual transfer begins.

Sensible Buying and selling Purposes

The true worth emerges when combining these parts in precise market situations. Right here’s a situation that performed out repeatedly throughout September 2024’s EUR/USD volatility.

Value was trending down on the every day chart however had created a bullish order block at 1.0920 on the 1-hour timeframe. Sensible cash merchants waited for value to retrace into this zone. When it did, the indicator confirmed confluence: the order block aligned with a good worth hole from the earlier week. Merchants entered lengthy positions at 1.0925 with stops beneath 1.0900. Value revered the zone, bouncing 60 pips inside twelve hours.

However the indicator doesn’t assure each setup works. Two days later, value returned to the identical zone and sliced via it, hitting stops earlier than reversing increased. That’s the character of foreign exchange—even institutional ranges fail when bigger market forces dominate.

The indicator works finest when figuring out high-timeframe construction breaks. On AUD/USD’s 4-hour chart, merchants look ahead to liquidity sweeps above every day highs. When value shortly spikes above a excessive then reverses, leaving a good worth hole, that’s typically a manipulation transfer. The indicator marks each the swept liquidity and the hole, making a high-probability quick setup as value fills the inefficiency.

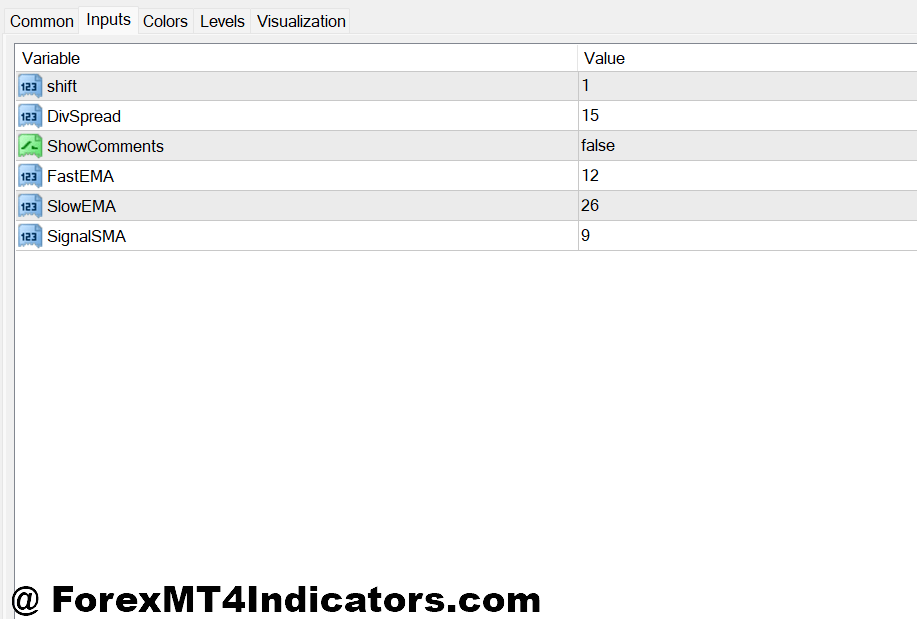

Customizing Settings for Buying and selling

MT4’s model gives flexibility that scalpers and swing merchants each respect. The order block sensitivity parameter adjusts what number of blocks seem on charts. Setting it to “Excessive” on a 5-minute chart floods the show with zones—helpful for scalpers looking fast reversals however overwhelming for place merchants.

Swing merchants sometimes dial sensitivity to “Medium” or “Low” on 4-hour or every day charts. This filters noise, displaying solely essentially the most important institutional zones. A day dealer working EUR/JPY may use “Excessive” sensitivity on the 15-minute chart, catching smaller order blocks throughout London session volatility.

The truthful worth hole minimal dimension setting prevents tiny inefficiencies from cluttering charts. On unstable pairs like GBP/JPY, setting the minimal to twenty pips filters out noise whereas catching significant gaps. Calmer pairs like EUR/CHF may use 10-pip minimums since gaps seem much less ceaselessly.

Shade customization issues greater than merchants anticipate. Marking bullish order blocks in inexperienced and bearish blocks in pink creates fast visible recognition throughout quick markets. Some merchants want refined grays and blues to scale back chart litter whereas sustaining readability.

Evaluating SMC to Conventional Indicators

Conventional help and resistance indicators mark horizontal strains based mostly on swing highs and lows. The Sensible Cash Ideas indicator differs essentially—it identifies the place establishments doubtless positioned orders, not simply the place value traditionally reversed.

A regular pivot level indicator may present resistance at 1.1000 on EUR/USD as a result of value touched that degree twice. The SMC indicator reveals resistance there provided that an order block fashioned—which means establishments demonstrated precise promoting curiosity via value motion. This distinction issues. Value can blow via technical ranges that lack institutional backing.

In comparison with provide and demand zone indicators, SMC provides the liquidity element. A requirement zone indicator marks an space the place shopping for occurred. The SMC indicator goes additional, displaying not simply the place shopping for occurred but in addition the place retail stops cluster above that zone. This reveals potential manipulation situations that conventional zone indicators miss.

Fibonacci retracement instruments work nicely alongside SMC. When a 61.8% retracement degree aligns with an order block and truthful worth hole, confluence strengthens the setup. The SMC indicator doesn’t exchange Fibonacci—it enhances it by including the institutional perspective.

Actual Limitations Each Dealer Ought to Know

Buying and selling foreign exchange carries substantial threat. No indicator ensures income, and the Sensible Cash Ideas indicator actually has weaknesses merchants should perceive.

Order blocks fail throughout elementary occasions. When the Federal Reserve publicizes an surprising fee hike, even the strongest every day order block on USD/CAD will get obliterated. The indicator can’t predict news-driven volatility that overrides technical construction.

False alerts seem recurrently in ranging markets. Throughout consolidation durations, value creates a number of order blocks that don’t result in important strikes. A dealer may enter 5 consecutive setups based mostly on order blocks, with 4 stopping out earlier than the fifth lastly works. This assessments persistence and bankroll administration.

The indicator additionally reveals historic zones—it could actually’t predict which of them stay related. That bullish order block from three weeks in the past may not maintain institutional curiosity, however it nonetheless seems on the chart. Merchants should mix SMC with market context, not blindly commerce each marked zone.

Subjectivity creeps in regardless of automation. Two merchants utilizing equivalent settings may interpret liquidity sweeps otherwise. One sees manipulation above a excessive; one other sees a sound breakout. The indicator marks the degrees, however commerce choices nonetheless require judgment.

Learn how to Commerce with Sensible Cash Ideas Indicator MT4

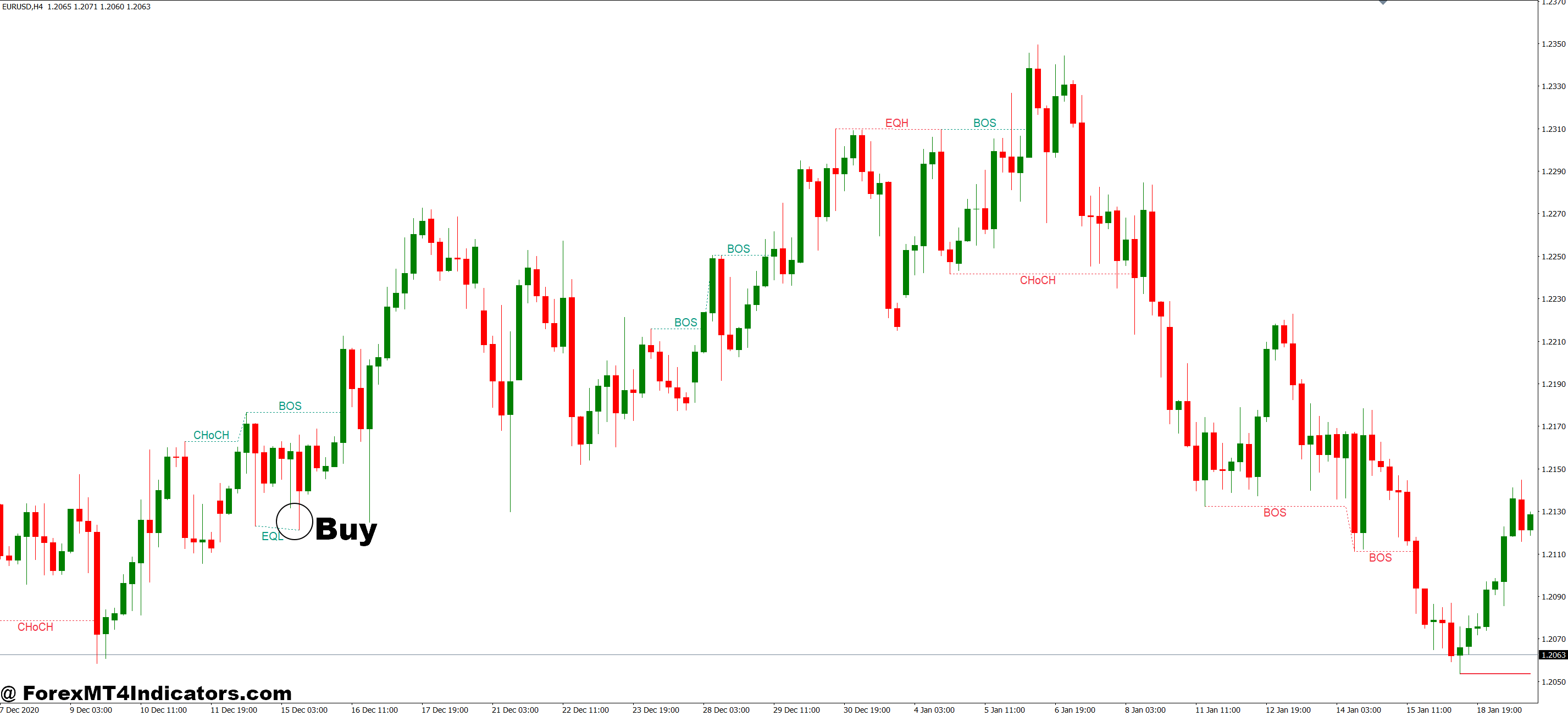

Purchase Entry

- Bullish order block retest – Enter lengthy when value returns to a bullish order block on the 1-hour or 4-hour chart with a rejection wick of not less than 10-15 pips; place cease loss 5-10 pips beneath the block.

- Truthful worth hole fill from beneath – Purchase when value drops into an unfilled truthful worth hole on EUR/USD or GBP/USD; goal the hole’s higher boundary for fast 20-30 pip scalps on 15-minute charts.

- Liquidity sweep beneath help – Go lengthy instantly after value spikes beneath a swing low (sweeping retail stops) then closes again above it inside 1-2 candles; this alerts institutional accumulation.

- Increased timeframe alignment – Solely take purchase alerts when the every day chart reveals bullish construction and the 4-hour order block aligns with the pattern; keep away from countertrend longs that battle institutional circulation.

- Danger 1-2% most – By no means threat greater than 2% of your account on any single SMC setup, even when confluence appears excellent; order blocks fail throughout high-impact information occasions.

- Verify with value motion – Anticipate a bullish engulfing candle or pin bar rejection on the order block earlier than getting into; don’t purchase simply because value touched the zone.

- Keep away from throughout ranging markets – Skip purchase setups when the 4-hour chart reveals sideways consolidation; SMC alerts produce extra false breakouts in uneven situations with out clear directional bias.

- Goal premium zones – Set take revenue on the subsequent bearish order block or truthful worth hole overhead, sometimes 40-80 pips away on main pairs throughout trending situations.

Promote Entry

- Bearish order block rejection – Enter quick when value rallies right into a bearish order block on the 4-hour chart and kinds a rejection candle; place stops 10-15 pips above the block’s excessive.

- Truthful worth hole fill from above – Promote when value spikes into an unfilled hole on GBP/USD 1-hour charts; these typically present 25-40 pip reversals as establishments fill the inefficiency.

- Liquidity seize above resistance – Go quick after value briefly breaks above a swing excessive (triggering retail purchase stops) then reverses again beneath inside 1-3 candles; confirms manipulation.

- Each day pattern affirmation – Solely take promote alerts when the every day chart is bearish and the decrease timeframe order block sits close to every day resistance; don’t quick into robust uptrends.

- Tighten stops on volatility – Cut back place dimension by 50% and use tighter 20-pip stops throughout main information releases (NFP, FOMC); SMC ranges typically get violated throughout high-impact occasions.

- Anticipate displacement – Don’t promote till you see a robust bearish impulse candle (30+ pips on EUR/USD 1-hour) breaking beneath the order block; this confirms institutional promoting stress.

- Skip weak setups – Keep away from promoting if a number of order blocks exist inside 20-30 pips of one another; overlapping zones create confusion and scale back chance of unpolluted reversals.

- Exit at low cost zones – Take income when value reaches the following bullish order block or truthful worth hole beneath, normally 50-100 pips away on 4-hour timeframes throughout robust traits.

Making SMC Work in Your Technique

Sensible cash ideas shine brightest when merchants deal with them as confluence components somewhat than standalone alerts. A bullish order block on the 1-hour chart positive factors energy when the 4-hour pattern aligns, value reveals bullish divergence on RSI, and a good worth hole sits simply above.

Danger administration determines success greater than indicator accuracy. Even with excellent order block identification, overleveraging destroys accounts. Risking 1-2% per commerce whereas focusing on 2:1 or 3:1 reward-to-risk ratios permits merchants to outlive the inevitable shedding streaks that include any technique.

The indicator works throughout all pairs, however sure markets reply higher to good cash ideas. Main pairs like EUR/USD and GBP/USD present clearer institutional conduct than unique crosses the place liquidity is skinny and value motion extra erratic.

Begin by marking increased timeframe construction on every day and 4-hour charts, then drop to 1-hour or 15-minute charts for entries. This multi-timeframe method prevents merchants from taking countertrend setups in opposition to bigger institutional circulation. When the every day chart reveals a bearish order block overhead and the 1-hour chart provides a brief sign close to that zone, confluence improves dramatically.

The Sensible Cash Ideas Indicator MT4 gained’t flip shedding merchants into winners in a single day. But it surely does present a framework for understanding how institutional gamers function—and that perspective can shift a dealer’s complete method from chasing retail breakouts to patiently ready for institutional ranges. That shift, mixed with stable threat administration and life like expectations, creates a basis for long-term consistency within the foreign exchange market.

Advisable MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The 12 months

- Unique 90% VIP Money Rebates for all Trades!

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Associate Code: VIP90