XRP could possibly be approaching an inflection level as a carefully watched chart sample tightens into its apex and broader “risk-on” indicators in equities flash inexperienced, in keeping with XRPL developer Chicken (@Bird_XRPL).

In a sequence of posts on X, Chicken, the developer behind XRPL meme coin DROP, pointed to XRP’s hourly construction as establishing for a decisive transfer “earlier than the top of the week,” arguing {that a} technical breakout might speed up shortly towards a close-by upside goal.

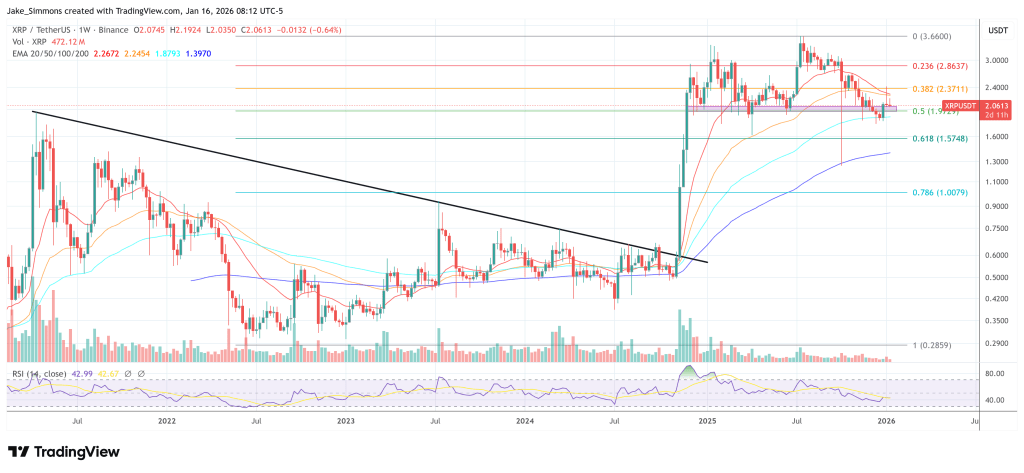

“Check out XRP on the hourly. A transfer is about to occur earlier than the top of the week,” Chicken wrote alongside a chart exhibiting a contracting triangle with value compressing into the tip. “A measured transfer if we ship upwards might push us straight to that $2.69 mark which lastly will get us into ‘bull run’ mode.”

Russell 2000 Breakout Places XRP on Alert

Past the short-term sample, Chicken anchored his thesis to US small caps, arguing that the Russell 2000’s conduct has traditionally mattered for XRP and the broader altcoin complicated.

Associated Studying

“The Russell 2000 is about to shut its highest weekly shut in historical past. That issues ALOT for XRP,” Chicken stated. “Traditionally, XRP and altcoins have all the time tracked the Russell 2000 extraordinarily carefully. It’s the true threat on index for mid caps (not mega caps just like the S&P or MAG7 the place most capital has been parked).”

Chicken’s argument is that XRP nonetheless trades extra like a mid-cap threat asset than a mega-cap “retailer of worth” proxy, making the Russell’s breakout a helpful macro inform for when speculative capital rotates again into increased beta exposures. He described the present backdrop as “capital rotating” and “threat … again on,” suggesting that the market could also be getting into a window the place positioning can change shortly if narratives align.

In an extended follow-up thread, Chicken described XRP’s prolonged consolidation as more and more out of sync with what he views as constructive macro circumstances throughout threat belongings.

“We’re at a genuinely scientific second for XRP. We’ve gone sideways for over a yr, but the Russell 2000 is now in full value discovery, different inventory markets have been in any respect time highs for a very long time, metals are elevated, and Bitcoin dominance is chopping at ranges that traditionally dumps at,” he wrote.

Associated Studying

Chicken additionally pointed to a previous episode as a reference level: “In November ’24, the Russell turned inexperienced and XRP went parabolic roughly 10 days later,” he stated, arguing that this time the Russell has gone additional by reclaiming highs and holding energy throughout timeframes. In his view, the remaining constraint is rotation, not essentially a pointy drawdown in metals or different belongings, however merely a pause that enables threat urge for food to re-price.

On XRP and Ripple particular context, Chicken stated “acquisitions achieved, partnerships rolling out, NDAs lifting, authorized readability forming,” and argued that the market is nearing some extent the place “a single narrative, catalyst, or push can ignite XRP quick.”

The important thing near-term check is whether or not the tightening technical construction resolves upward as Chicken expects and whether or not cross-asset threat urge for food continues to assist alt beta. If each align, Chicken’s framework suggests merchants will probably be looking ahead to a momentum break that would carry XRP towards the $2.69 goal and, in his view, doubtlessly open the door to a sooner path towards contemporary cycle highs.

At press time, XRP traded at $2.06.

Featured picture created with DALL.E, chart from TradingView.com