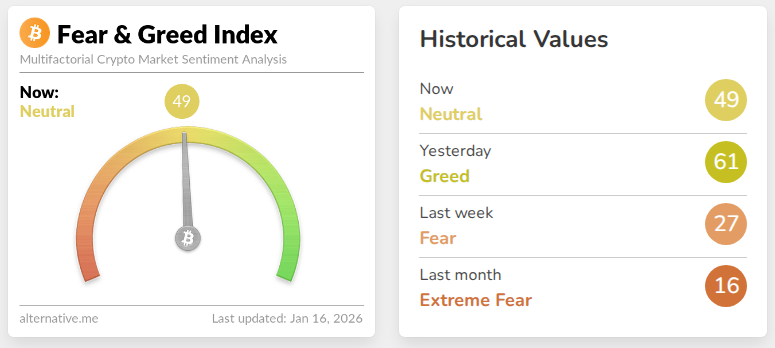

The market temper in crypto cooled sharply after a fast spike in optimism. In accordance with the Crypto Worry & Greed Index, the studying fell by 12 factors on Friday, dropping from 61 to 49.

Associated Studying

That swing moved the gauge from “greed” right into a “impartial” zone in a single session. Bitcoin had jumped about 4.5% earlier within the week to roughly $97,700, which helped push sentiment larger, however the focus shifted towards politics and lawmaking in Washington.

Regulatory Issues Shake Markets

Primarily based on experiences, the primary set off was debate over a Senate model of a long-awaited crypto market construction invoice. The measure would set out how US regulators oversee digital belongings and consists of language that might tighten guidelines round stablecoin yields.

A number of lobbyists and executives raised alarms about these provisions. Brian Armstrong, the CEO of Coinbase, withdrew his backing, saying the proposal could be worse than the present setup and {that a} unhealthy regulation could be dangerous.

After the backlash, the Senate Banking Committee cancelled its deliberate markup and the Senate Agriculture Committee moved its session to late January whereas lawmakers search extra help.

Social Media Sentiment Shifts As Merchants React

In accordance with crypto analytics agency Santiment, the market exercise had two completely different tendencies directly: bigger holders have been constructing positions whereas smaller, retail merchants have been promoting.

Social chatter started to replicate fear after the regulatory information, whilst on-chain knowledge confirmed accumulation by extra skilled wallets.

The index’s peak earlier within the week was the best because it reached 64 on October 10, the identical day a market crash triggered over $19 billion in liquidations. These previous losses nonetheless dangle in traders’ recollections.

Sensible Cash Buys Whereas Retail Sells

Studies have disclosed that sensible cash accumulation can help costs, however headlines form short-term moods. Bitcoin was buying and selling at about $95,642 on the time of publication, down round 0.02% over the previous 24 hours, in keeping with CoinGecko.

That small transfer reveals market resilience, but the sentiment measure’s drop demonstrates how fragile confidence might be when coverage doubts emerge. Many merchants watch Washington intently, typically much more intently than charts.

Associated Studying

Delay Seen As Likelihood By Some Business Gamers

A phase of the business learn the postponements as constructive.

David Sacks, who advises on crypto issues on the White Home, mentioned the pause may assist shut gaps between stakeholders and produce the invoice nearer to one thing workable.

Brad Garlinghouse, CEO of Ripple, saved partaking with lawmakers and described the delay as a gap to enhance the textual content.

These views distinction with extra alarmed voices and assist clarify the combined market response.

Featured picture from The Drive, chart from TradingView