The Order Circulate Indicator MT4 bridges this hole by displaying real-time shopping for and promoting strain straight in your MetaTrader 4 charts. As an alternative of guessing the place good cash is positioned, merchants can observe precise transaction knowledge because it occurs, recognizing accumulation and distribution patterns that precede main strikes.

What the Order Circulate Indicator Really Exhibits

Order move evaluation tracks the precise transactions occurring available in the market—who’s shopping for, who’s promoting, and at what depth. The MT4 model interprets this tick-level knowledge into visible representations that present quantity at particular value ranges. In contrast to lagging indicators that depend on previous closes, order move reveals present market participation.

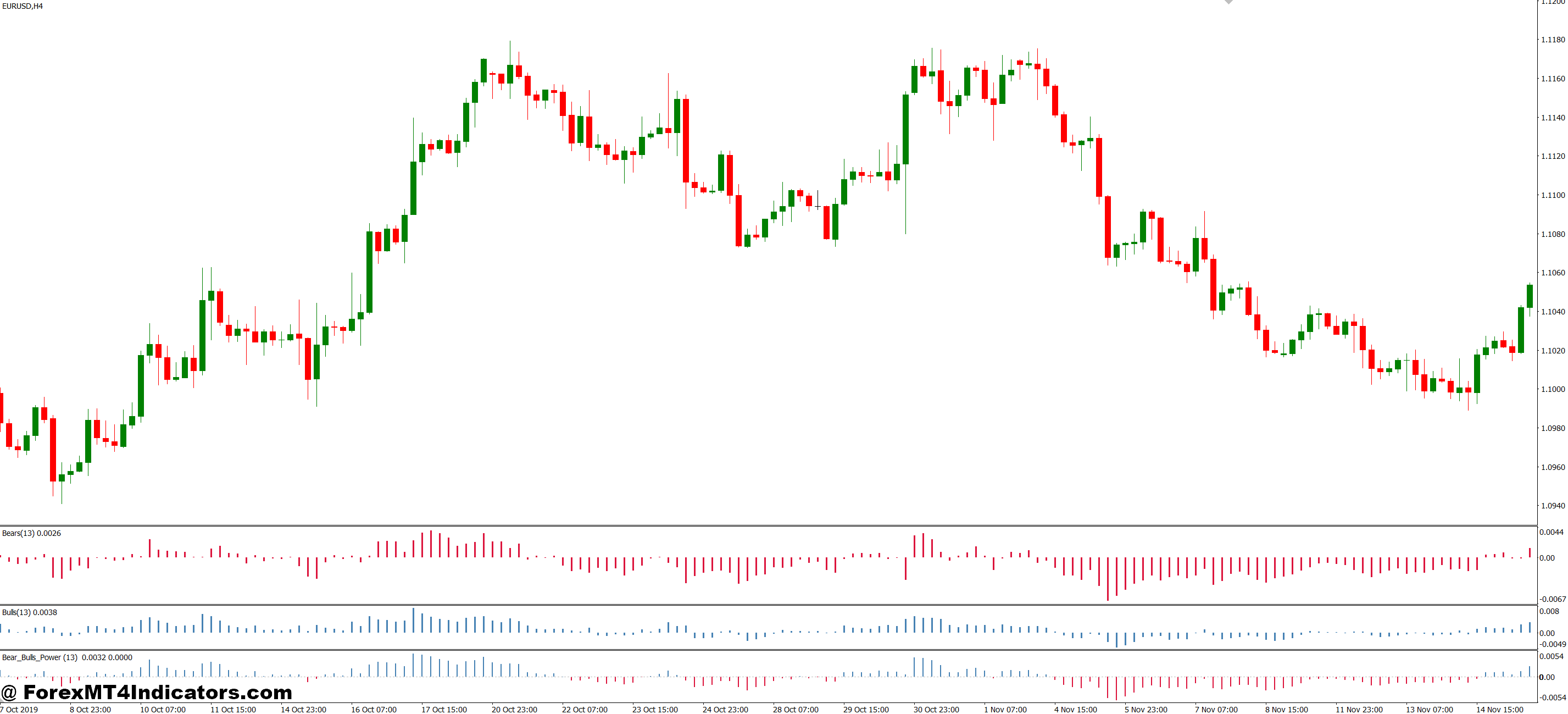

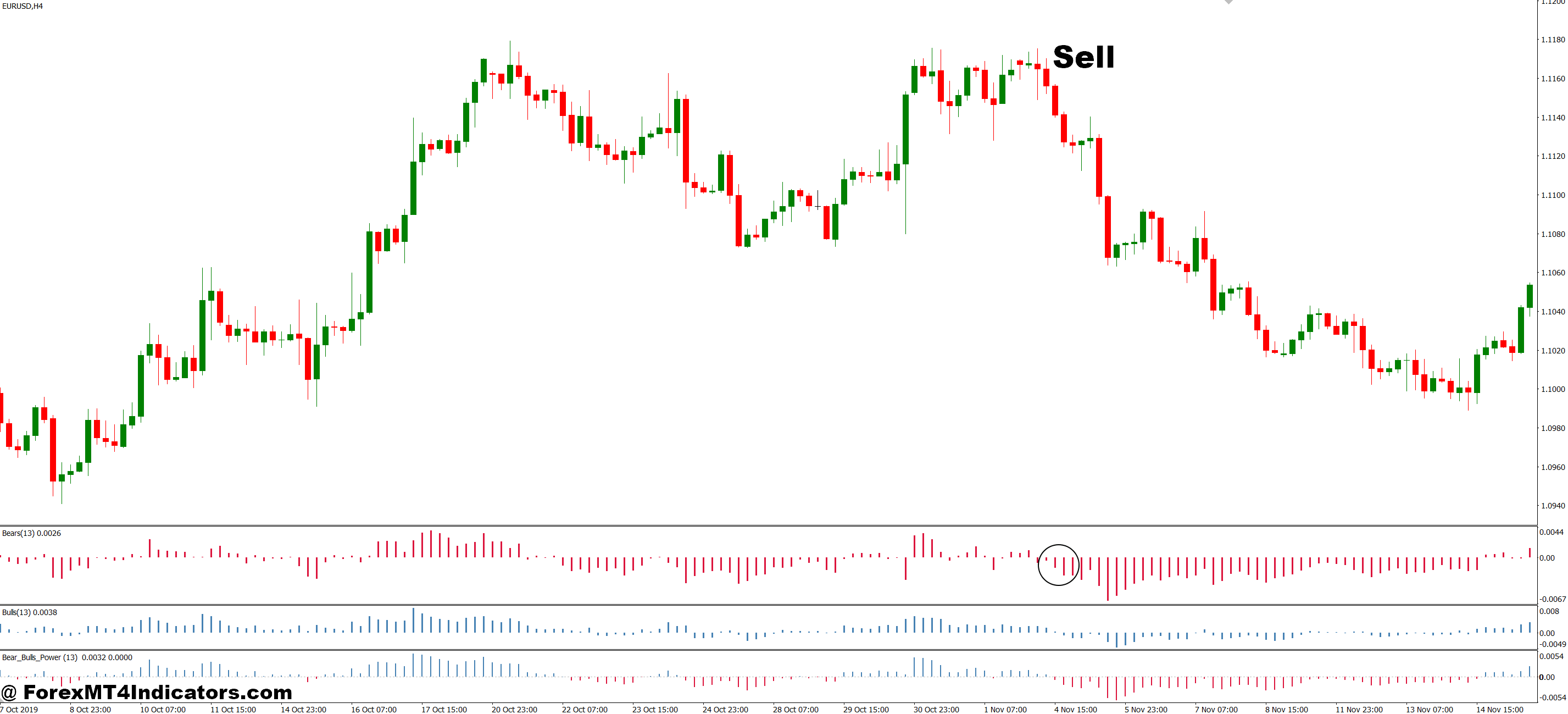

The indicator shows quantity profiles and delta calculations (purchase quantity minus promote quantity) in histogram format alongside your value chart. While you see heavy shopping for at a value stage that retains getting examined, that’s institutional gamers constructing positions. When promoting strain dominates throughout an uptrend, good cash is distributing to late patrons.

Right here’s what makes it totally different out of your commonplace quantity indicator: Customary quantity exhibits complete transactions with out distinguishing path. Order move separates aggressive patrons (market orders hitting the ask) from aggressive sellers (market orders hitting the bid). That distinction issues as a result of market orders reveal urgency—somebody prepared to pay the unfold to get crammed instantly.

How Actual Merchants Use Order Circulate Information

Let’s get sensible. GBP/USD is grinding greater on the 15-minute chart, making greater highs. Your momentum indicators present continuation potential. However the order move indicator reveals one thing else: promoting quantity is spiking at every new excessive whereas shopping for strain weakens. This divergence warned of the 80-pip reversal that caught lengthy merchants off-guard through the London session final Tuesday.

The indicator works greatest when mixed with value motion context. Throughout uneven periods—the sort that whipsaw vary merchants mercilessly—order move helps distinguish actual breakouts from false ones. A breakout accompanied by surging buy-side quantity and rising delta has legs. A breakout with declining quantity and impartial delta? That’s a entice ready to spring.

Scalpers depend on order move for exact entries. When scalping EUR/JPY on the 5-minute chart, looking ahead to quantity spikes at key ranges offers entry affirmation that shaves seconds off response time. These seconds translate to higher fills and diminished slippage on fast-moving pairs.

However there’s a studying curve. New customers usually misread short-term quantity spikes as pattern indicators after they’re simply noise. The 1-minute chart will present fixed quantity fluctuations that imply nothing for place trades. Context issues—a quantity spike issues extra when it happens at a examined assist stage than in the midst of nowhere.

Customizing Settings

The default settings work for intraday buying and selling on main pairs, however they’re not one-size-fits-all. Day merchants sometimes set the lookback interval to 20-50 bars on 15-minute or 1-hour charts. This captures sufficient knowledge to identify institutional exercise with out cluttering the show with noise.

Swing merchants want wider parameters. Setting the lookback to 100-200 bars on 4-hour or day by day charts reveals longer-term accumulation patterns that develop over days or even weeks. When order move confirms a multi-day base forming on USD/CAD, that’s the place place merchants discover high-probability entries with favorable risk-reward ratios.

The colour scheme issues greater than you’d assume. Most merchants use inexperienced for buy-side dominance and pink for sell-side, however adjusting transparency helps distinguish between latest and historic quantity. Setting latest bars to full opacity whereas fading older knowledge retains the give attention to present market sentiment.

Quantity threshold filters separate sign from noise. On risky pairs like GBP/JPY, setting minimal quantity thresholds filters out small transactions that don’t symbolize institutional move. Throughout Asian periods with lighter quantity, reducing these thresholds prevents lacking respectable indicators.

Evaluating Order Circulate to Conventional Indicators

Customary indicators like RSI or MACD react to cost modifications that already occurred. Order move exhibits you why these value modifications occurred. When RSI hits oversold and value bounces, order move reveals whether or not that bounce got here from real shopping for curiosity or simply brief overlaying—essential data that RSI alone can’t present.

Quantity indicators like OBV (On-Steadiness Quantity) accumulate complete quantity however deal with a tiny uptick the identical as a powerful surge. Order move’s delta calculation weights the depth of shopping for versus promoting, offering nuance that complete quantity metrics miss. Throughout trending markets, OBV confirms path, but it surely doesn’t warn when distribution begins. Order move catches that shift in real-time.

The draw back? Order move requires extra display screen time and lively monitoring than set-and-forget indicators. It’s additionally much less helpful throughout low-liquidity intervals when retail order move dominates and institutional participation drops off. Asian session merchants usually discover order move much less dependable than throughout London or New York hours when main gamers are lively.

The place It Helps and The place It Doesn’t

Order move excels at confirming high-probability setups and filtering false indicators on liquid pairs throughout lively periods. Merchants who beforehand struggled with untimely entries discover that ready for order move affirmation improves win charges measurably. The indicator prevents chasing strikes that lack institutional assist—a mistake that accounts for vital losses in retail accounts.

That mentioned, order move received’t make dangerous trades good. It’s a affirmation device, not a crystal ball. Even excellent order move indicators fail when fundamentals shift unexpectedly or when algorithmic buying and selling creates non permanent distortions. The indicator additionally performs poorly on unique pairs the place skinny liquidity makes quantity knowledge unreliable.

Set up requires tick knowledge, which some brokers don’t present with enough granularity. With out high quality knowledge, the indicator’s calculations turn into questionable. Merchants must confirm their dealer streams real tick knowledge relatively than interpolated minutes-based data.

Methods to Commerce with Order Circulate Indicator MT4

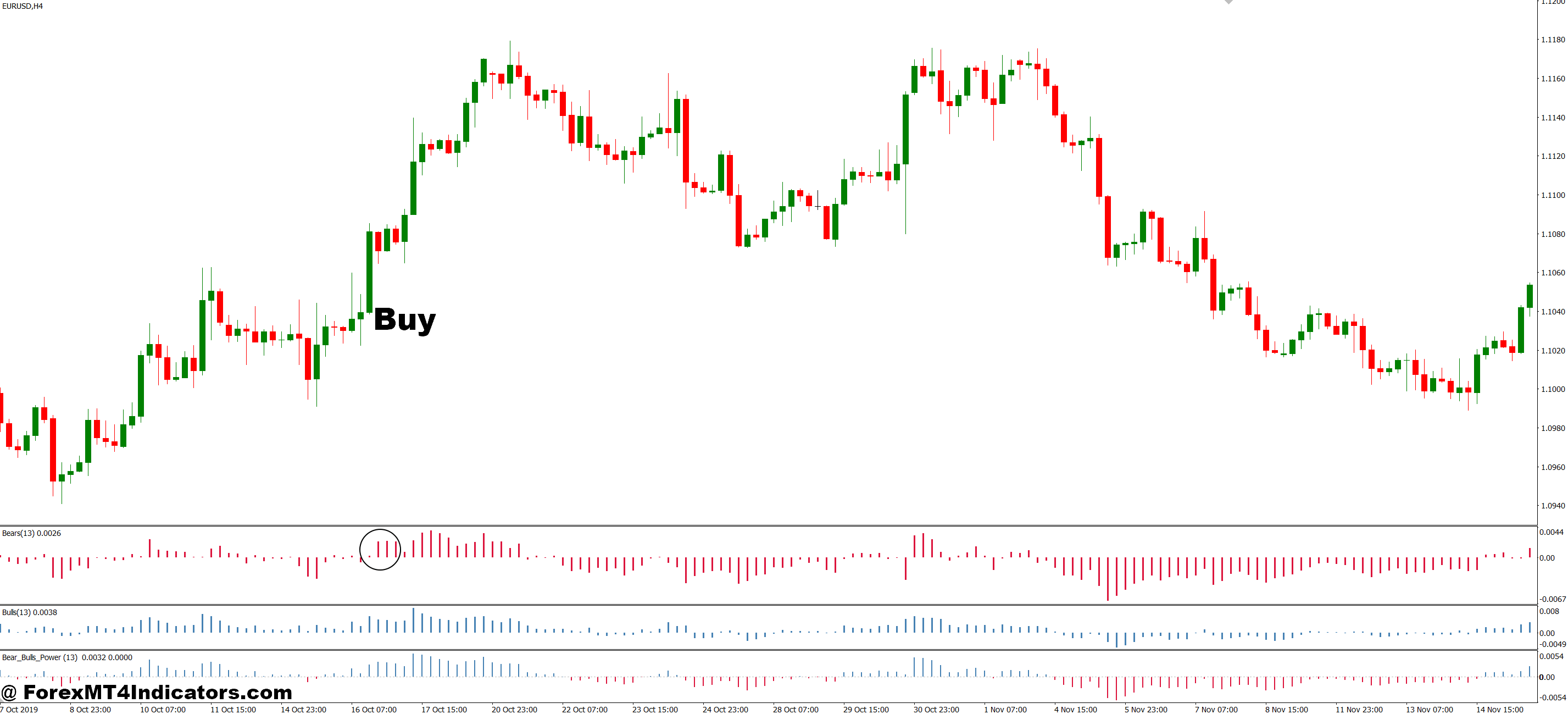

Purchase Entry

- Delta turns constructive at assist – Look ahead to purchase quantity to exceed promote quantity by not less than 60% when EUR/USD exams a key assist stage on the 1-hour chart earlier than getting into lengthy.

- Quantity spike on breakout – Enter lengthy solely when order move exhibits 2-3x common quantity throughout an upside breakout; false breakouts sometimes present declining quantity inside quarter-hour.

- Accumulation at lows – Look ahead to sustained shopping for strain (3+ consecutive inexperienced bars on indicator) throughout sideways value motion close to session lows on GBP/USD 4-hour charts.

- Divergence affirmation – Go lengthy when value makes decrease lows however order move delta exhibits greater lows, indicating hidden shopping for—set cease 20-30 pips under the swing low.

- Institutional shopping for clusters – Enter whenever you spot giant purchase orders (quantity bars 150%+ above common) stacking at entire numbers like 1.1000 on EUR/USD throughout London open.

- Rejection of promoting strain – Take longs when heavy promote quantity fails to push value decrease and buy-side instantly absorbs it—frequent reversal sample at day by day assist zones.

- Skip Asian session indicators – Keep away from purchase indicators throughout low-liquidity Asian hours (00:00-06:00 GMT) when retail move dominates and institutional participation drops under 30%.

- Danger 1-2% most – By no means danger greater than 2% of account fairness on order move indicators alone; mix with value motion affirmation for entries exceeding 1% danger.

Promote Entry

- Delta turns destructive at resistance – Enter brief when promote quantity dominates by 60%+ as value exams resistance on the 15-minute or 1-hour chart—frequent at spherical numbers.

- Distribution throughout rallies – Go brief when order move exhibits constant promoting (pink bars) whereas value makes greater highs on GBP/USD—signifies good cash exiting into retail shopping for.

- Quantity dies on breakout makes an attempt – Promote when upside breakouts present declining quantity and impartial delta inside 10-20 pips of resistance; actual breakouts maintain heavy shopping for.

- Bearish divergence sample – Brief when value hits new highs however order move delta weakens or turns destructive—place cease 15-25 pips above the swing excessive.

- Heavy promoting at key ranges – Enter brief when quantity spikes 200%+ above common with dominant sell-side strain at earlier swing highs on 4-hour EUR/USD charts.

- Failed purchaser absorption – Take shorts when purchase makes an attempt can’t soak up persistent promoting strain at resistance—value stalls regardless of aggressive shopping for for 30+ minutes.

- Keep away from information releases – By no means commerce order move indicators quarter-hour earlier than or half-hour after main information (NFP, FOMC, CPI)—erratic quantity distorts institutional footprints.

- Verify with value motion – Don’t brief primarily based solely on order move; look forward to bearish candlestick rejection or break of minor assist to substantiate—reduces false indicators by 40%.

Shifting Ahead with Order Circulate

Order move evaluation provides a dimension to buying and selling that price-based indicators merely can’t match—the flexibility to see transaction-level market dynamics as they unfold. For merchants uninterested in being on the flawed aspect of sudden reversals, the perception into shopping for and promoting strain offers an edge value growing. The indicator received’t eradicate losses or change sound danger administration, but it surely does supply visibility into market mechanics that separate knowledgeable merchants from the group reacting to what already occurred.

Begin by paper buying and selling with order move on main pairs throughout peak quantity hours. Watch how quantity patterns develop round key ranges, and be aware when order move diverges from value motion. These divergences, after they align with stable technical setups, level to alternatives the place institutional exercise contradicts retail positioning. That’s the place the true edge lives—seeing what others miss as a result of they’re watching the flawed knowledge.

Advisable MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The 12 months

- Unique 90% VIP Money Rebates for all Trades!

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Companion Code: VIP90