Breakouts are tempting, the truth is, most individuals commerce in-line with the path value is presently shifting with out a lot thought; they’re reactive with a ‘herd’ mentality. Now, one may say pattern following or buying and selling with the herd / sheep is the right technique and in principle it typically is, however in relation to the precise commerce execution there’s at all times the next chance space and decrease chance space to enter, and buying and selling on the break-down to new lows or on the break-up to new current highs is usually a significant entice, particularly for novice merchants.

Breakouts are tempting, the truth is, most individuals commerce in-line with the path value is presently shifting with out a lot thought; they’re reactive with a ‘herd’ mentality. Now, one may say pattern following or buying and selling with the herd / sheep is the right technique and in principle it typically is, however in relation to the precise commerce execution there’s at all times the next chance space and decrease chance space to enter, and buying and selling on the break-down to new lows or on the break-up to new current highs is usually a significant entice, particularly for novice merchants.

While I’m an enormous advocate and fan of buying and selling with momentum and the trail of ‘least resistance’, even when I’m attempting to get on board an current pattern, I hardly ever commerce breakouts, as a substitute, I watch for value to pullback to worth (assist / resistance space) the place I’ll get extra elements of confluence lining up.

Examples of why buying and selling breakouts will be harmful.

In the present day, I wished to indicate you some current actual world “BOMB” breakout trades that completely sucked the market in in the end to revert again in the wrong way.

Tens of millions of {dollars} had been made and misplaced in these strikes and I’m sure a few of you bought caught in these. While it’s unimaginable to know when and the place these ‘traps’ will happen, we are able to have a look at the carnage that resulted and study some vital classes…

In current months, you could have seen what number of fake-outs and ‘suck-out’ traps / false breakouts have occurred.

Listed below are some examples of current breakouts that sucked merchants in and spit them out like used chewing gum…

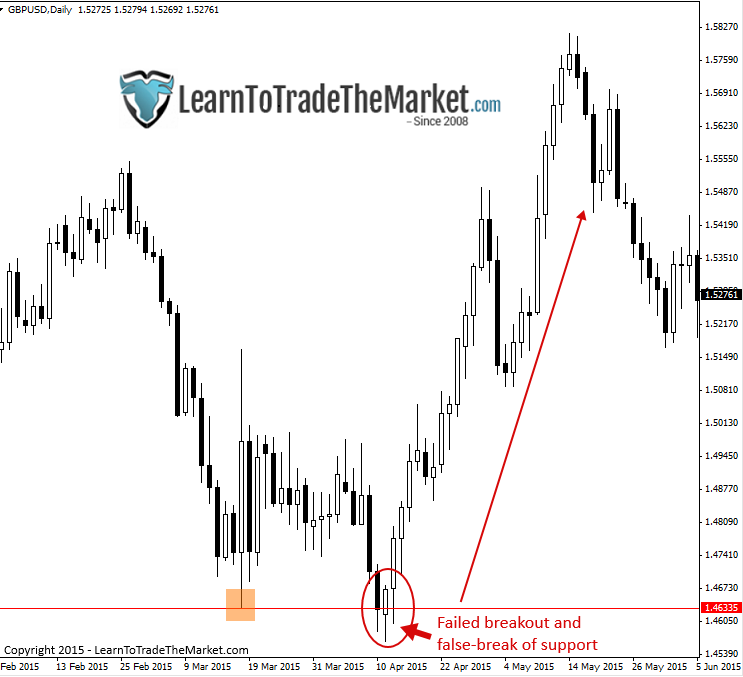

The primary chart we’re taking a look at is a ‘basic’ instance of a failed breakout and false-break of a key assist stage within the GBPUSD. Discover how value broke just under the important thing stage after which rapidly reversed, shifting considerably greater and sucking out everybody who offered on the lows / as the extent broke…

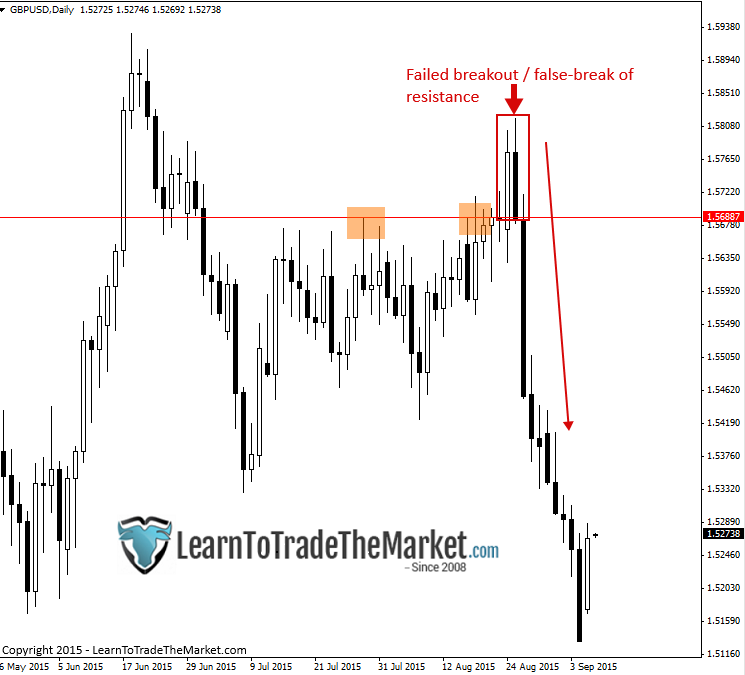

The chart beneath reveals us a current breakout that failed within the GBPUSD. Discover how value was wanting prefer it wished to interrupt up above that resistance at 1.5688 for a while. These kinds of breakouts appear to be probably the most harmful; those that ‘appear’ very apparent…as a result of they’ve attracted all of the beginner gamers and after they offer in to the breakout the professionals step in and flush all of them out by sending value the opposite path…

Within the subsequent instance, we see a transparent false-breakout above a key resistance stage within the EURUSD not too long ago. Be aware that this market was (and nonetheless is as of this writing) in a buying and selling vary. False breakouts are frequent in massive buying and selling ranges like this one…

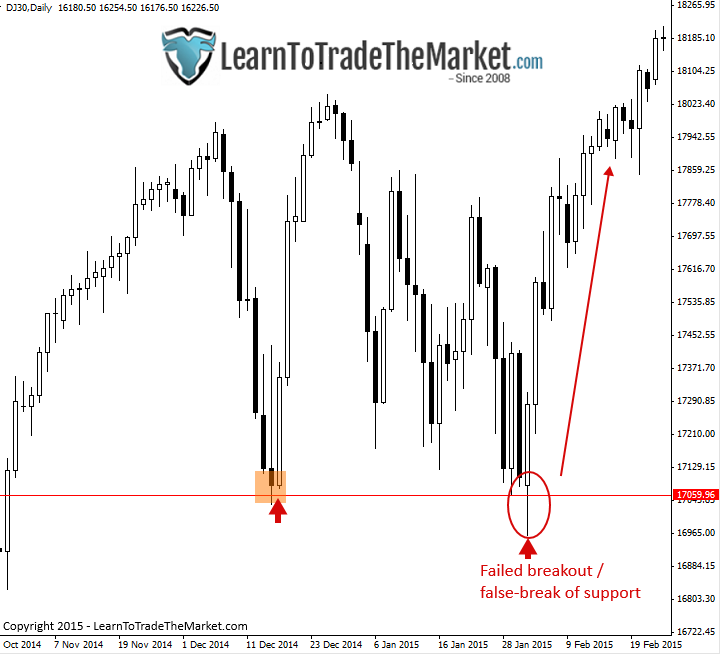

Within the subsequent chart, we see a transparent failed breakout within the Dow30 as value made a basic false-break of key assist close to 17060 early this 12 months earlier than surging again greater, in-line with the longer-term uptrend. Key ranges like this are sometimes prime targets for failed breakouts to happen and shake out all of the individuals who thought the transfer would hold going past the extent…

Right here’s one other clear failed breakout / false-break of key assist. As value comes again down to check the extent, the ‘apparent’ play is to commerce the breakout…everybody thinks the market will proceed decrease. However, it’s at that time that there’s nobody else left to promote and the professionals are available and cease everybody out and push the market greater…

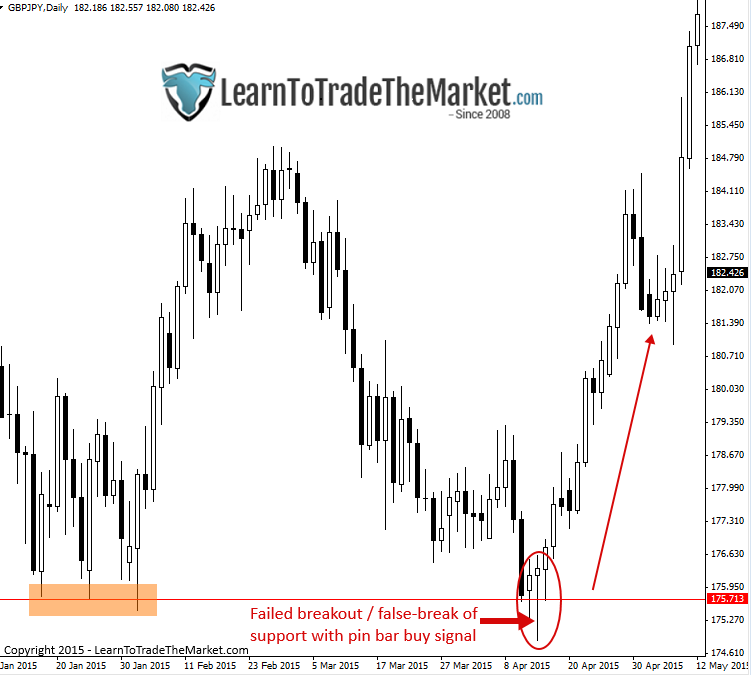

Usually instances, failed breakouts will be good buying and selling alternatives to fade or commerce the wrong way of the breakout. Within the chart beneath, we see a transparent instance of a failed breakdown of assist within the GBPUSD that was accompanied by a pleasant pin bar purchase sign which led to a considerable transfer the opposite path…

Options to breakout buying and selling…

Now, let’s have a look at what I might name a extra textual content e-book entry, buying and selling with the bias of the market after a retracement…

Within the chart beneath, discover how value rotated as much as the 21 day EMA resistance stage or ‘worth’ after which shaped a pin bar promote sign in-line with the downtrend. This was a confluent pin bar sign that had a excessive probability of figuring out because it was with the every day chart pattern and shaped after a pullback. Buying and selling like this largely eliminates the potential to get caught in false-breakouts…

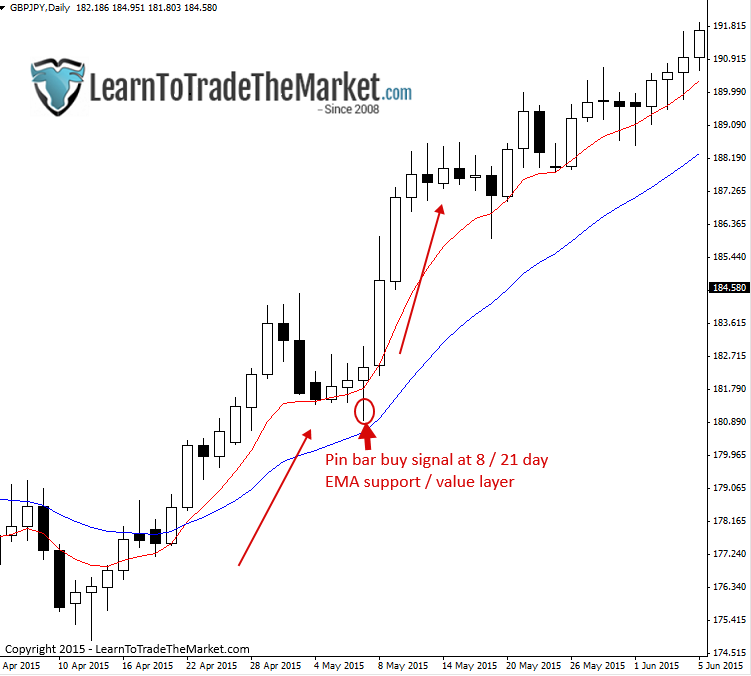

Right here’s one other instance of ready for a pullback to worth to get in with the pattern from an optimum entry level. Be aware the uptrend that already existed, then value pulled again to the 8 / 21 day EMA assist layer (worth) and shaped a pin bar, at that time we had every thing lining up for a high-probability entry into the pattern…

Let’s have a look at one other instance of ready for a pullback and searching for a sign with the pattern that has confluence. Discover within the Hong Kong Index chart beneath, value was in a transparent downtrend earlier than it rotated / pulled again as much as a resistance stage, shortly thereafter it shaped a pin bar promote sign in-line with the pattern from the 8 / 21 day EMA layer.

Let’s additionally take a look at how a dealer can play each side of the market in additional sideways to impartial bias situations, these are sometimes probably the most harmful durations the place main shake-outs on the extremes of the vary happen…

Discover within the EURUSD chart beneath that it was in an outlined buying and selling vary, and nonetheless is as of this writing. In these conditions, shake-outs / false-breaks on the extremities of the vary, are quite common. Figuring out this, skilled merchants will fade these ranges, that means when value will get to them, commerce again towards the alternative stage…till value clearly and at last breaks out of the vary. This can be a good strategy to reap the benefits of range-bound / non-trending market situations. It may be achieved with a value motion sign or with out, on a ‘blind entry’.

Key takeaways…

- Considering opposite to the ‘herd’ is a ability you will need to develop by way of coaching and display time. Contrarian market thinkers normally win out in the long run.

- You’ll be able to nonetheless commerce with the pattern however assume contrarian, e.g., the examples above of searching for pullbacks / retraces to worth and confluent ranges in trending markets. Breakouts are NOT the one strategy to commerce with a pattern, and in reality aren’t the best strategy to commerce developments.

- Ready for value to rotate again to apparent ranges after which searching for value motion alerts at these ranges

- When markets are in buying and selling ranges you may look to commerce or ‘fade’ the buying and selling vary boundaries as value approaches them (commerce again towards reverse finish of vary).

- Failed breakouts / false-breaks are good buying and selling alternatives, search for alerts on the failed breakout or shortly thereafter (see GBPUSD false-break with pin bar instance above).

- Don’t promote right into a key assist stage or purchase right into a key resistance stage. In the event you actually need to commerce in that path, watch for value to shut exterior of the important thing stage for not less than a number of days and THEN search for a an entry on a retrace / pullback to worth.

In abstract, breakouts can result in shedding trades, particularly probably the most ‘apparent’ ones which are inclined to ‘idiot’ all of the beginner merchants.

This doesn’t imply you must ‘by no means’ commerce breakouts, it simply means you must strategy them extra thoughtfully and search for different, extra contrarian entries into the market, as we mentioned within the examples above.

It’s human nature to need to purchase or promote a market as its shifting within the path you need to commerce, however this alone just isn’t a high-probability buying and selling technique. Markets ebb and circulate and also you want a buying and selling technique that enables you reap the benefits of this, somewhat than getting taken benefit by it. To find out how my value motion methods may also help you develop this contrarian view and buying and selling strategy, take a look at my course right here.