Macroeconomic information revealed within the US final week didn’t sign any sharp deterioration in financial situations. ISM PMI indicators and labour market information, together with the ADP report, weekly jobless claims, and the December non-farm payrolls, confirmed steady situations within the US labour market. Within the eurozone, inflation information got here near forecasts and didn’t change expectations relating to ECB coverage. Taken collectively, these components elevated investor warning and supported the US greenback.

💶 EUR/USD

EUR/USD ended the week at 1.1633, persevering with its corrective decline from the December highs. The pair stays extremely delicate to US macroeconomic information and adjustments in rate of interest expectations. On the identical time, cautious market sentiment continues to restrict the euro’s means to regain upward momentum. An try to rise in direction of the 1.1700-1.1720 resistance space can’t be dominated out. Failure to consolidate above this zone might result in renewed promoting strain, with a transfer in direction of 1.1575-1.1615. If bearish momentum strengthens, a deeper decline in direction of 1.1540 and additional to 1.1470-1.1510 is feasible. A assured breakout and consolidation above 1.1720 would cancel the bearish situation and open the way in which in direction of 1.1780-1.1820, with a possible extension to 1.1900.

₿ BTC/USD

Bitcoin continues to disregard the stronger US greenback, buying and selling close to the 90,000 pivot level inside a consolidation vary of 83,800-94,500. One other try to interrupt above the higher boundary of this vary failed, and BTC/USD ended Friday’s session at 90,430. If bitcoin reacts to the stronger greenback and decrease threat urge for food, a decline in direction of the 86,600 help stage might comply with, with an additional transfer in direction of the decrease boundary of the vary at 83,800-85,100. A break beneath 83,800 would open the way in which to the following bearish goal at 80,540. A breakout above 95,000 would sign renewed bullish momentum and open the way in which in direction of 98,000-100,000.

🛢️ Brent

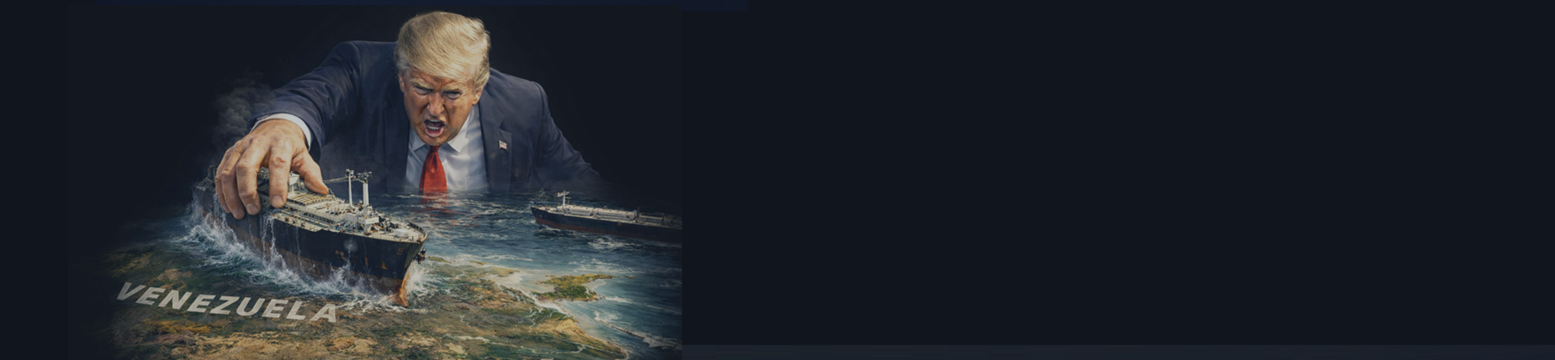

Brent crude oil closed the week at 62.71 USD per barrel, reaching a weekly excessive close to the higher boundary of the descending channel at 63.60. Costs had been supported by geopolitical tensions, together with the scenario round Venezuelan President Nicolas Maduro and the maritime blockade of the nation. Extra help got here from stories of arrests of Russian oil tankers by the USA. On the identical time, many analysts level to a major oil surplus anticipated this yr, which may push costs all the way down to 50–52 USD and probably even to 30–40 USD per barrel. Within the new buying and selling week, Brent might check the 63.90–65.00 resistance space, which might open the way in which in direction of 66.80–68.00. If bullish momentum weakens, a decline in direction of 60.10–61.00 and additional to 59.60 can’t be dominated out.

🥇 XAU/USD

Gold ended Friday at 4,509, returning to historic highs and persevering with to profit from robust safe-haven demand. The closest upside goal for patrons is 4,550. A breakout above this stage would open the way in which in direction of 4,600-4,680. On the identical time, a brief correction in direction of the 4,400-4,450 space can’t be excluded. The subsequent help ranges are situated at 4,350 and 4,300-4,250.

🧭 Conclusion

Within the coming week, the important thing occasion would be the publication of US inflation information. On Tuesday, the Shopper Worth Index (CPI) for December will likely be launched. On Wednesday, Producer Worth Index (PPI) information will comply with. On Thursday, market consideration will deal with US retail gross sales and labour market statistics.

Baseline eventualities: EUR/USD – impartial to bearish whereas the pair stays beneath 1.1720, with draw back dangers growing if 1.1575 is damaged. BTC/USD – impartial. Brent – impartial to bullish whereas costs stay above 61.80, with key resistance at 63.90-65.00. XAU/USD – bullish, with buy-on-dips technique whereas gold stays above 4,450.

P.S. Consideration merchants: do you need to get extra cash from each commerce – even shedding ones? Commerce as common and obtain cashback. There are not any limits on withdrawals.

Particulars right here:

https://www.globalfinance.professional