How I Handle Threat and Diversify Throughout A number of Prop-Agency Accounts

One of the vital widespread errors I see amongst prop-firm merchants is concentrating an excessive amount of danger in a single technique or a single account. Even worthwhile methods can undergo troublesome intervals, and when every little thing is stacked collectively, one unhealthy section can wipe out months of labor.

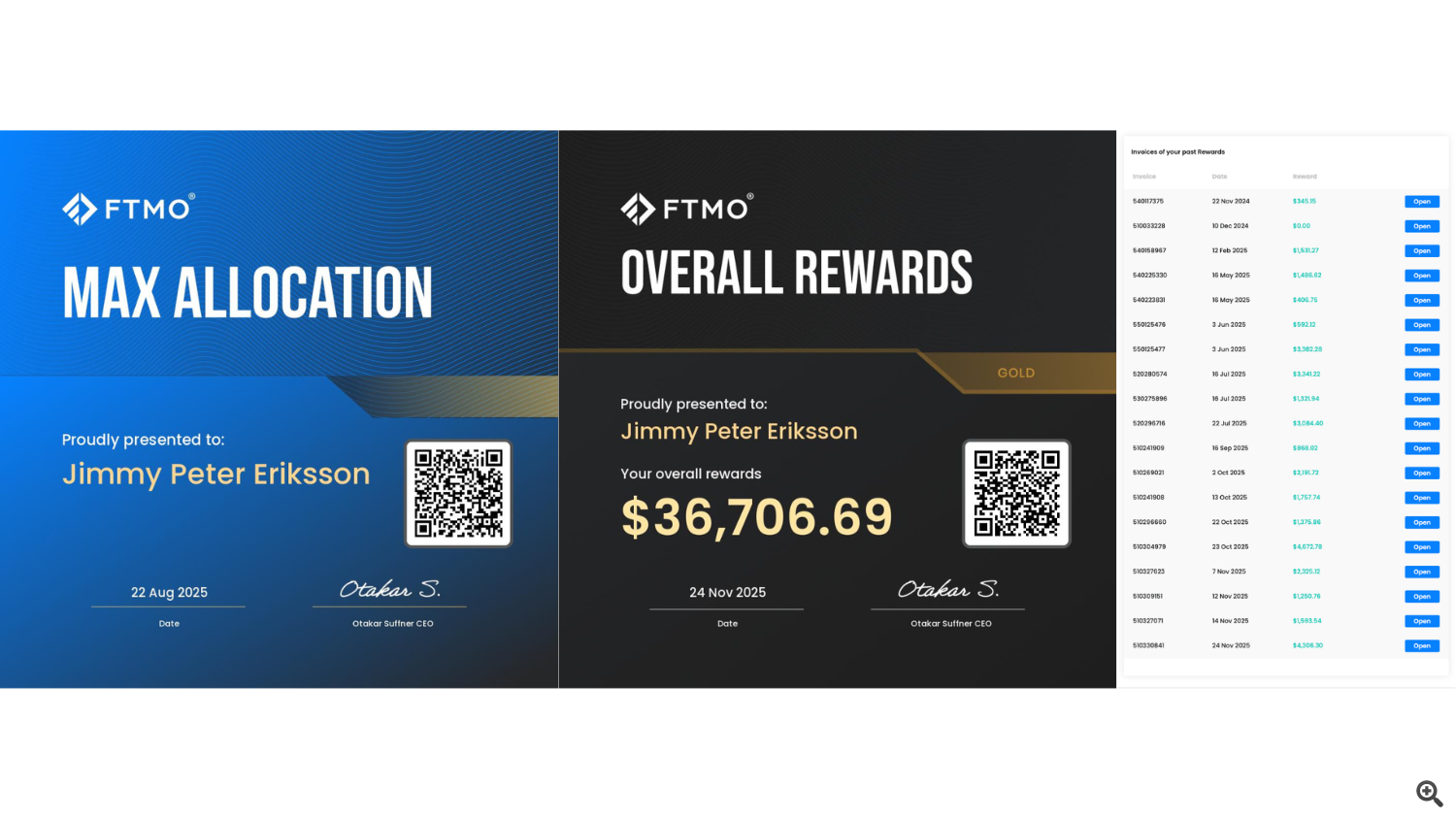

Over time, I’ve constructed a construction that focuses on danger separation, diversification, and longevity, slightly than chasing short-term returns. This method has allowed me to generate constant payouts for over a 12 months, with greater than 20 payouts and over $36,000 USD withdrawn from FTMO-style accounts, whereas managing roughly $400,000 in funded capital.

This text explains precisely how I construction my accounts and why I do it this fashion.

Core Precept: Methods Fail Briefly, Buildings Ought to Not

I don’t depend on a single “excellent” technique. As an alternative, I commerce a number of uncorrelated Professional Advisors, every based mostly on totally different market behaviors:

Any particular person system can underperform for weeks or months. The aim is to not keep away from drawdowns totally, however to make sure that no single drawdown can damage the whole operation.

My Setup: 8 Uncorrelated Professional Advisors

Let’s assume I’m working 8 uncorrelated EAs and 4 × $100,000 prop-firm accounts.

Slightly than cloning the identical setup in every single place, I deliberately assign totally different roles to every account.

Account 1: Extremely-Protected, Lengthy-Time period Earnings Core

Objective: Stability and longevity

Threat: Very low

Purpose: ~1–2% monthly

This account shouldn’t be thrilling — and that’s the purpose.

It acts as a base revenue account, meant to remain funded long-term and produce regular payouts. If every little thing else fails, this account is designed to maintain going.

Account 2: Diversified however Greater Threat

Objective: Managed development

Threat: ~2× the ultra-safe account

Purpose: Greater month-to-month returns

All 8 EAs are nonetheless working collectively

Similar diversification advantages

Barely elevated danger per commerce

Right here, I settle for extra volatility. I’m snug shedding this account if it generates robust payouts first. Even one good cycle can produce a number of thousand {dollars}, which already offsets the danger.

This account balances diversification with efficiency.

Accounts 3 & 4: Cut up Methods, Cut up Threat

Objective: Threat separation and redundancy

As an alternative of working all methods collectively, I cut up them:

Why do that?

If a particular group of methods hits a foul interval, it solely impacts one account

The opposite account could stay secure or worthwhile

Totally different system combos behave in another way, even in the identical market

This dramatically reduces the possibility of a number of accounts failing on the similar time.

Why This Works Higher Than a Single “Excessive-Threat” Account

Many merchants attempt to push one account onerous to succeed in targets quicker. That method normally ends in:

My construction accepts that:

Some accounts could also be misplaced

Others are designed particularly not to be misplaced

Total capital and payouts keep constant

It’s a portfolio mindset, not a single-bet mindset.

The Large Benefit: Psychological and Statistical Stability

This construction offers two main advantages:

1. Psychological Stability

When one account is down, others are sometimes up. This removes the urge to intrude with methods or enhance danger emotionally.

2. Statistical Robustness

Uncorrelated methods + separate accounts = fewer excessive outcomes. You’re not betting every little thing on one market regime.

Last Ideas

This method shouldn’t be about maximizing returns in a single month. It’s about:

Staying funded

Producing constant payouts

Surviving unhealthy market intervals

Treating prop-firm buying and selling like a enterprise, not a raffle

If you happen to commerce a number of methods, I strongly suggest pondering not solely about how they commerce — however the place and the way they’re allotted.