Does the next buying and selling situation sound acquainted to you?…

Does the next buying and selling situation sound acquainted to you?…

A market has damaged up via a stage and begins trending aggressively, beginning to acquire plenty of momentum. Then abruptly, you see the market rotate again to a superb stable stage after which a pleasant value motion sign kinds at that stage and in-line with development. Nonetheless, somewhat than taking fast motion and organising the commerce, you simply stare at it blankly, like a ‘deer caught within the headlights’, unable to take motion. You suppose to your self one thing like: “I’ll let the market run its course as a result of I don’t suppose it may probably preserve going with how far it’s already moved, I’m not going to get in right here” and so forth.

Not lengthy after this ‘deer within the headlights’ second, the market continues on its means with out you on board. You’re feeling anger, frustration and customarily such as you need to punch your laptop display right into a thousand items.

Let me inform you, the above situation is one thing many merchants expertise and as we speak I need to discuss some related situations you would possibly end up in and provide the answer to keep away from them sooner or later…

The ‘deer in headlights’ buying and selling downside…

Many starting and even some skilled merchants are typically confronted with worry of pulling the set off on trades. What are you able to do to beat this worry and transfer ahead in your buying and selling?

First, let’s focus on what tends to occur to merchants who face this downside…

Buying and selling might be troublesome as a result of every commerce and market situation goes to be distinctive. Certainly, because the late nice Mark Douglas stated in Buying and selling within the Zone: “No two moments available in the market are ever precisely the identical”. Because of this, merchants usually hesitate or are confused as as to whether or not “this sign” is one price buying and selling or not.

We are inclined to suppose ourselves proper out of completely good trades typically…

How usually have you ever seen a lifeless apparent commerce sign and also you simply stared at it as an alternative of coming into it after which it comes off in your favor as you proceed to stare in disbelief that you simply didn’t enter it??

Trending markets are sometimes so blatantly apparent that we will’t consider the market will proceed. Certainly, one of many greatest issues individuals have is that they suppose one thing like “Oh this market has fallen (or risen) thus far on this quick area of time it may’t probably go any additional”, I’ve even been responsible of pondering like this up to now. Primarily, we’re offered with stunning proof that it can go additional, within the type of a powerful trending transfer, however we persuade ourselves that it may’t. That is basic over-thinking / over-analysis / analysis-paralysis, name it what you need.

I’ve even just lately been noticing that in aggressively transferring markets, pullbacks / retraces are inclined to not be very deep or vital. When the market is transferring, we have to discover an entry level to reap the benefits of these massive market strikes, we don’t need to be continually ready for a pullback that by no means comes. After all, this entails growing your buying and selling talent and intestine really feel so that you could know when a market is trending aggressively and when it’s not.

One other widespread situation of the ‘deer in headlights’ syndrome is once we see a stage holding firmly as value checks it however we start believing it received’t maintain once we are about to commerce. We predict “Oh watch, now it received’t maintain for my commerce” and so forth. So, we sit out after which in fact the market activates a dime at that stage we deliberate to commerce at, with out us on board once more. Irritating, to say the least.

It’s after going via these numerous situations that the hindsight commerce mentality then takes over. We get assured primarily based on these trades we analyzed however didn’t take after which the following time round we do take the same commerce but when it’s a commerce that loses, we then destroy ourselves mentally. You may see how this turns into a vicious psychological circle the place you see a commerce work out that you simply hesitated on, then take the same commerce and it fails, then you definately begin getting mad / over-trading and so forth.

The important thing right here is that if we had traded each setups (the one we hesitated on that will have been a winner and the following one which failed), we’d now be within the cash if we had a 2 to 1 winner after which the one loser.

Right here’s a basic instance of a current transfer that many merchants most likely hesitated on…

Discover within the AUDUSD day by day chart beneath that the market had been in an uptrend earlier than reversing and pulling again almost 300 pips on the finish of April. Individuals didn’t need to consider that the development had turned, they thought “oh it may’t fall any additional, it’s fallen 300 pips in a reasonably quick time…”. Then, what occurred? The market promptly fell one other 300 pips, with none of these individuals on board…

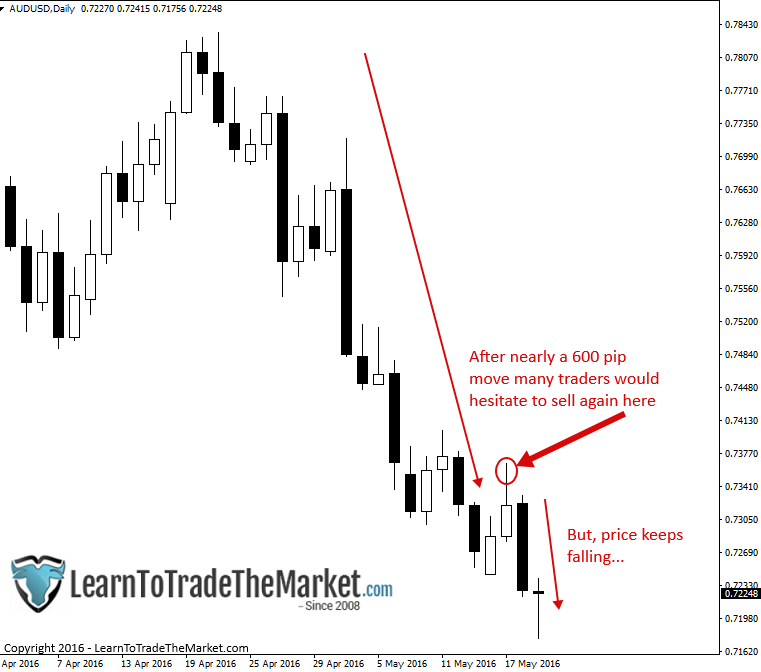

Right here’s one other commerce from the identical transfer within the AUDUSD, this one I truly traded myself…

After almost a 600 pip transfer to the draw back, most individuals have been attempting to select the underside, they figured it may’t fall anymore. Why was this fallacious? Nicely, it’s easy; the value motion proof on the chart was nonetheless very bearish and there was loads of room for value to maintain falling. These are the forms of trades individuals take a look at it and suppose “it may’t go any additional”, however then it does…

The options to the pricey within the headlights downside…

- Perceive buying and selling is a sport of chances – It’s essential take each occasion of your buying and selling edge and never hesitate. In case you hesitate on a wonderfully good sign, it should throw off your entire buying and selling mindset and rhythm as a result of in case you then take a commerce that loses you’ll begin to doubt your self and your technique. It’s essential at all times keep in mind that we’re buying and selling chances, not certainties and that any single commerce has primarily a random expectation, it’s the general technique when traded constantly over time that offers you a high-probability edge.

- Subsequent time you see one thing, act on it – Fairly easy. To not be crude, however it’s a must to have ‘balls’ if you wish to be a dealer. In case you’re going to hesitate and be afraid to take completely good setups, don’t attempt to be a dealer. Reducing your threat to a greenback quantity that you’re OK with dropping may also enable you to to have much less worry of a commerce dropping, which ought to enable you to remove the hesitation / worry issue.

- Markets usually transfer additional than we predict – Keep in mind, markets usually transfer additional than you suppose they’ll. So, don’t over-think the state of affairs; in case you see a powerful development, assume it should preserve going till it exhibits you in any other case…. as an alternative of assuming it should finish on a regular basis with no proof that it’s going to. Don’t persuade your self of issues with out price-based proof.

- Examine, know what to search for – After all, in case you haven’t realized easy methods to commerce correctly and also you don’t know what you’re buying and selling edge or entry sign(s) is, you’re going to hesitate and be fearful merely since you don’t actually know what you’re doing. Take my buying and selling course, discover ways to commerce correctly, don’t let worry rule you; the one answer to worry is data. Individuals are afraid of what they don’t perceive.

Conclusion

Regarding the two commerce examples above, most of these trades might take just a few days or much more to work out. Don’t sit there checking all of them day at work or college or residence or wherever. Let the market run its course and don’t micro-manage or over-manage your trades by decrease time frames than the one you entered on, and so forth.

This mentality of being disciplined in each when you must commerce and whenever you shouldn’t, in addition to having self-discipline to not micro-manage your trades, is the precise mentality that led to my profitable a buying and selling competitors just lately. I noticed the alerts, I believed in my technique and I used to be aggressive. Had I sat round like a ‘deer in headlights’, fearful about whether or not “this transfer will proceed or not”, I wouldn’t have received. I merely needed to have self-discipline, belief my edge and again myself, and that my pals, is the ‘formulation’ for fulfillment as a dealer.