Explains NPS MSF Framework, eligibility, migration guidelines, fund choice, dangers, and whether or not long-term traders ought to select 100% fairness underneath NPS.

One among my weblog readers not too long ago commented as beneath after studying one in all my weblog submit associated to NPS. Therefore, thought to jot down an in depth submit on this.

“Expensive Basavaraj,

Thanks for the great weblog on newest NPS exit adjustments. Might you please write a weblog on technical and elementary evaluation on selecting Pension Funds on MSF framework. Few questions:

1. Is that this the fitting time to decide on funds from this framework or anticipate someday?

2. If the time horizon is 15+ years, is it good to go for 100% fairness from my present 75%?”

The Pension Fund Regulatory and Growth Authority (PFRDA) has launched a structural enhancement to NPS known as the Multi Scheme Framework (MSF). Whereas many discussions give attention to returns and fund decisions, the true worth of MSF lies in the way it adjustments the interior structure of NPS, who can use it, and the way responsibly it needs to be used.

This text explains the MSF framework in easy language utilizing solely official PFRDA and CRA guidelines, and solutions the commonest investor questions.

NPS MSF Framework – That means, Guidelines, Advantages and Utilization

What’s the NPS MSF Framework?

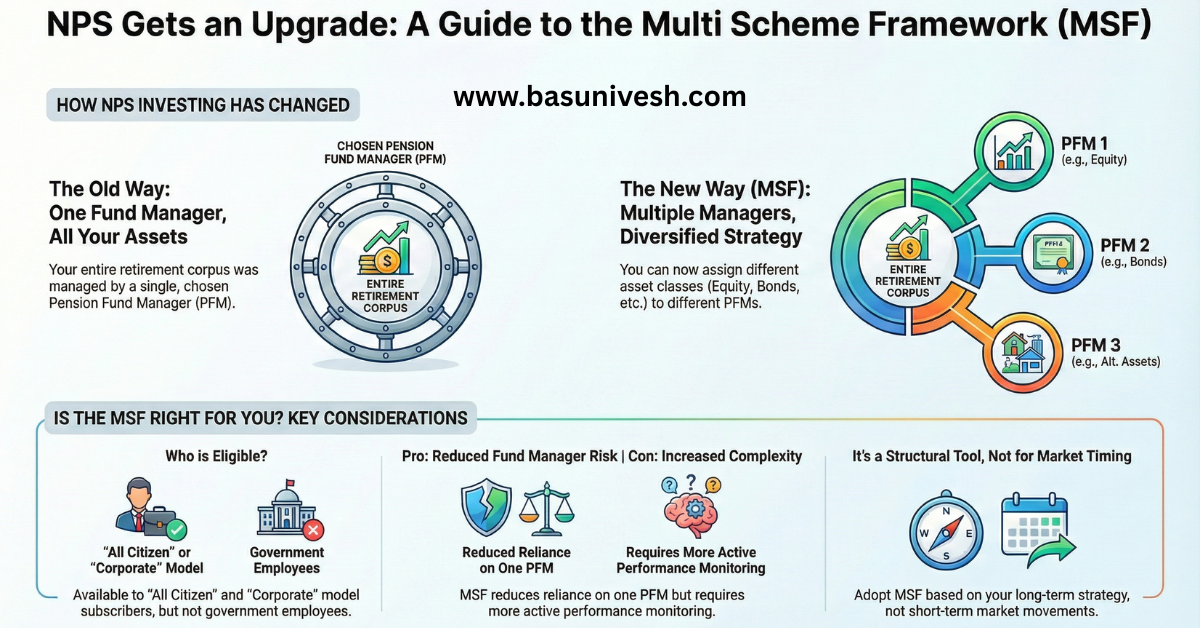

Earlier, an NPS investor may choose just one Pension Fund Supervisor (PFM) for a PRAN and allocate investments amongst 4 asset lessons — fairness (E), company bonds (C), authorities securities (G) and different property (A). If that fund supervisor underperformed, your entire retirement corpus suffered.

The MSF framework permits a subscriber to decide on a number of PFMs concurrently and assign totally different asset lessons to totally different fund managers. This implies you possibly can diversify not solely throughout property but additionally throughout fund administration types and threat processes.

MSF doesn’t introduce new asset lessons, doesn’t change taxation, exit guidelines, or withdrawal situations. It solely adjustments how PFMs may be mixed.

Is MSF obtainable to all NPS subscribers?

MSF is on the market solely to subscribers underneath the All Citizen Mannequin and Company Mannequin of NPS. Central and State Authorities staff aren’t presently eligible as a result of their NPS is ruled by service guidelines.

Present eligible subscribers can migrate to MSF via the CRA system. This isn’t automated and should be initiated by the investor. Migration is handled as a structural change and shouldn’t be carried out casually or steadily.

How is MSF totally different from the prevailing construction?

Earlier, the investor bore your entire threat of 1 fund supervisor. Beneath MSF, this threat is distributed.

Nevertheless, this additionally will increase complexity. MSF is subsequently appropriate for traders who perceive markets and are snug monitoring efficiency periodically. For traders who worth simplicity, the prevailing construction stays sufficient.

Understanding asset lessons underneath NPS

The 4 asset lessons stay unchanged. Fairness (E) invests in listed shares and supplies development however excessive volatility. Company bonds (C) put money into high-quality debt devices and supply stability. Authorities securities (G) put money into sovereign bonds and provide security with average returns. Different property (A) embrace REITs and InvITs and are capped at a small share.

MSF doesn’t change these dangers — it solely permits you to select who manages them.

How ought to one select PFMs underneath MSF? Technical vs elementary method

A technical method focuses on rolling returns, consistency throughout cycles, volatility and drawdowns. A elementary method focuses on portfolio high quality, expense ratio, fund supervisor tenure, and threat administration self-discipline.

A smart investor makes use of each. Rolling return consistency with affordable volatility is extra significant than short-term prime efficiency.

Is that this the fitting time to undertake MSF or ought to one wait?

MSF is a structural possibility, not a market timing resolution. There isn’t a “proper” or “improper” time from a valuation perspective. The choice is dependent upon the investor’s capability to handle complexity.

In case you are glad along with your present fund supervisor and don’t need lively involvement, there is no such thing as a urgency to alter.

For a 15+ 12 months horizon, ought to one transfer from 75% fairness to 100% fairness?

Fairness supplies inflation-beating returns however comes with extreme interim declines. A 100% fairness portfolio can fall by 40–50% in dangerous markets.

Solely traders who’re emotionally able to seeing such declines with out panic ought to contemplate 100% fairness (Such traders are rarest of uncommon on this earth 🙂 ). For many traders, 60–70% fairness supplies a greater steadiness.

Benefits and limitations of MSF

MSF reduces fund supervisor threat and improves diversification. It will increase flexibility and accountability.

Nevertheless, it will increase complexity, behavioural threat, and the temptation to chase returns. Over-switching can destroy long-term returns.

Closing conclusion

MSF is a constructive structural enchancment however not a return-enhancing shortcut. It’s obtainable solely to voluntary and company subscribers, not authorities staff. Present eligible subscribers can migrate however ought to achieve this thoughtfully.MSF rewards self-discipline, not exercise.

The perfect NPS portfolio isn’t the one with the best return, however the one you possibly can maintain via each market cycle.