The three M’s of buying and selling: Thoughts, Cash and Methodology, possibly you might have heard of them, possibly not. Both method, in at present’s lesson you’re going to be taught what they imply and why profitable buying and selling requires them.

The three M’s of buying and selling: Thoughts, Cash and Methodology, possibly you might have heard of them, possibly not. Both method, in at present’s lesson you’re going to be taught what they imply and why profitable buying and selling requires them.

Word: The three M’s was not my thought, somewhat it got here from a e-book known as Come into My Buying and selling Room by Alexander Elder. Nonetheless, I wish to present you the way I exploit the three M’s and the way it applies to my private buying and selling strategy.

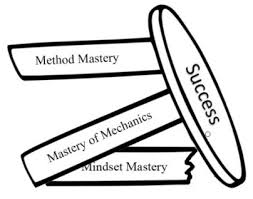

All three of the M’s are equally necessary, and you may consider them because the three pillars of buying and selling and the spine of your buying and selling marketing strategy. With out certainly one of them, your buying and selling basis is not going to maintain, and you’ll not succeed. You want all three of them working collectively to earn money as dealer…

Thoughts

The Thoughts a part of the three M’s basically means creating psychological ‘guidelines’ that may hold you calm amidst the noise and fixed temptation of the markets. The whole lot begins (or ends) along with your buying and selling mindset.

You can not earn money over a interval of consecutive months if you’re not within the correct buying and selling mindset. There are lots of issues that go into attaining the correct buying and selling mindset and I’ve written about this matter extensively. Nonetheless, if there may be one over-arching theme that it’s essential to perceive in regard to your buying and selling mindset, it’s self-control.

Most of buying and selling may be boiled right down to your potential or incapacity to manage your self within the face of the close to fixed temptation to commerce, as a result of more often than not, doing so means you’ll inflict hurt on your self.

As a dealer, speculating within the markets, an endeavor that’s clearly very dangerous, it’s as much as you to manage your self, and this potential begins with the psychological understanding of what you might be doing, what is feasible and what you might be risking.

My suggestion is that you simply assume extra about the truth that it’s very simple to lose cash buying and selling, somewhat than the truth that you MIGHT hit a giant winner on any given commerce. It’s about understanding and accepting threat after which behaving in-line with this acceptance. Which implies principally that you simply shouldn’t be buying and selling so much as a result of high-probability buying and selling alternatives are usually not almost as widespread as many merchants assume they’re (or commerce as if they’re).

Cash

The Cash a part of the three M’s refers to cash administration, in fact. This encompasses each threat and reward; how do you handle threat and the way do you handle your income / rewards?

Getting your cash administration down is closely depending on having the correct buying and selling mindset, in addition to having a agency understanding of what cash administration truly means. Here’s what it means in a nutshell:

- You at all times take into consideration threat earlier than reward.

- You recognize what your per commerce threat quantity is and also you by no means exceed that quantity. This ought to be a greenback mount that you’re mentally and financially in a position to safely lose on any given commerce.

- You perceive the best way to place cease losses correctly and the best way to handle your place sizes.

- You’ve gotten a transparent understanding of the best way to place revenue targets and an total technique for exiting trades.

- You perceive the best way to calculate the threat reward on a commerce and this additionally means generally a commerce gained’t be value taking if the danger reward doesn’t make sense.

Cash administration may be considered the ‘glue’ the three M’s, as a result of it actually holds all the things collectively. In case you wouldn’t have correctly cash administration, your mindset goes to rapidly get out of whack. Additionally, your technique will turn out to be irrelevant virtually, if you don’t handle your cash accurately. So, if you wish to make all the things a lot, a lot simpler on your self, concentrate on managing your cash, particularly your threat, essentially the most. Perceive that capital preservation is basically the important thing to cash administration. Capital preservation means managing your buying and selling capital so that you’re not utilizing an excessive amount of of it on anybody commerce and that you’re not utilizing it too incessantly. Primarily, you wish to solely use your buying and selling capital when a really apparent / high-probability commerce comes alongside, as a result of then you might have extra capital to make use of on higher trades. Don’t blow your buying and selling capital by over-trading.

Methodology

The Methodology a part of the three M’s is the way you commerce the market. What’s your strategy or technique to analyzing costs and making selections about when to commerce and when to not? You will need to have an efficient buying and selling technique, however what’s an “efficient buying and selling technique” and the way have you learnt if yours is or not?

The only method to choose whether or not or not your buying and selling technique is efficient, is to demo commerce it for a few months and see what sort of outcomes you might be getting. One caveat right here nonetheless; ensure you are ACTUALLY following the tactic because it was taught to you and never over-trading (buying and selling when no sign is current).

Now, there are a lot of completely different buying and selling methods and strategies on the market. Finally, it’s a must to discover one that’s A) efficient and that B) you personally take pleasure in and that works properly along with your character and schedule.

Personally, I’m an enormous proponent (duh) of value motion buying and selling. My buying and selling technique is value motion and it’s the solely technique I commerce and train to my college students. You probably have been following my weblog for any size of time, it is best to know a bit bit about how I commerce with value motion, in case you don’t, click on right here. I’ve written many articles on why I choose value motion over another technique, however in case you missed them, are just a few so that you can take a look at:

Learners Information To Worth Motion Buying and selling

Studying Worth Motion Is The Key To Buying and selling Success

Why Worth Motion Buying and selling Will Enhance Your Buying and selling

4 Information About Worth Motion Buying and selling You Want To Know

The final word useful resource on how I commerce value motion is my superior value motion buying and selling course. Inside in my buying and selling course, you’ll not solely study my Methodology, however additionally, you will learn the way I handle the Thoughts and Cash facets which can be so crucial to a dealer as properly. You’ll discover ways to construct your personal buying and selling plan with the constructing blocks being the three M’s, to get began, click on right here.

Don’t hesitate to e-mail me with any questions or considerations you might have, and bear in mind to depart a remark under.