What’s the single largest motive why most merchants find yourself dropping cash out there? It’s easy: They do an excessive amount of – they suppose an excessive amount of, they have a look at charts an excessive amount of, they commerce an excessive amount of, they threat an excessive amount of and on and on.

What’s the single largest motive why most merchants find yourself dropping cash out there? It’s easy: They do an excessive amount of – they suppose an excessive amount of, they have a look at charts an excessive amount of, they commerce an excessive amount of, they threat an excessive amount of and on and on.

Essentially the most profitable merchants and buyers of our time spend 99% of their time ready for alternatives and learning the markets, reasonably than buying and selling them. Roughly 1% of their buying and selling effort is spent executing trades and managing positions. In different phrases, more often than not they’re doing NOTHING. Are you able to say the identical? Or, are you spending 99% of your time coming into and managing trades and just one% of your time ready patiently?

If in case you have ever learn my articles on What Crocodiles Can Educate us about Buying and selling or The Sniper Buying and selling Method, it’s apparent that my buying and selling model is a low-frequency, high-conviction method. So, why do you have to undertake the same method together with your buying and selling? Learn on to seek out out…

The ‘hunt’ includes A LOT of ready.

Simply as a Crocodile spends most of its time stalking its prey, a worthwhile dealer spends most of his or her time stalking good trades. You wish to commerce like a predator, not the prey out there, what I imply by that’s, you wish to be the dealer who’s ready patiently within the ‘bushes’ for the ‘straightforward kills’. You don’t want to be the lots of prey (beginner merchants) who get ‘eaten’ by the skilled merchants each week.

How do you accomplish being the predator and never the prey? It’s easy actually, ready, ready and extra ready.

I prefer to say I’m in “hurry up and wait” mode for the correct market circumstances to current themselves. What this implies is, I’m truly excited to attend, as a result of I do know ready means I’m exercising self-control and being affected person and disciplined, and I do know that is the way you generate income within the markets. I’ve no downside ready for the correct setup to kind with the proper market confluence, typically for weeks and even months.

The reason being easy, as a result of I do know for a undeniable fact that buying and selling with excessive frequency is the way you lose cash out there and buying and selling with low frequency is the way you turn into a worthwhile dealer. Each dealer finally learns this truth given sufficient time and expertise out there.

Warren Buffet is a grasp of doing ‘nothing’

My favourite idea and metaphor for instructing folks how I commerce is that of a sniper. The sniper buying and selling method as outlined in my article on this matter, is mainly that I wait patiently like a sniper for my predefined commerce standards to align, reasonably than buying and selling or ‘capturing’ at every little thing like a machine-gunner.

Maybe not surprisingly, that is additionally how the ‘best investor ever’ manages himself and his exercise out there. I’m speaking about none aside from the good Warren Buffet, after all. Take into consideration how he manages billions of {dollars} – it isn’t by coming into the market day-after-day, that’s for certain! All you should do is learn a e-book about him or watch the latest documentary on him, “Turning into Warren Buffet”, and you will notice he’s a particularly affected person and exact investor.

Not solely is Buffet affected person and exact in regards to the transactions he makes out there, when he’s prepared he dives in, boots and all. Typically, he even buys the complete firm! You’d name Mr. Buffet a low-frequency and high-conviction investor. As merchants, we are able to be taught an incredible deal from Mr. Buffet. While we’re doing one thing a bit of completely different than long-term investing or ‘purchase and maintain’, we must always certainly mannequin our swing buying and selling method after Mr. Buffet.

Right here is an efficient quote from commodity buying and selling extraordinaire, Mr. Jim Rogers from The Market Wizards

I simply wait till there’s cash mendacity within the nook, and all I’ve to do is go over there and choose it up. I do nothing within the meantime. Even individuals who lose cash out there say, “I simply misplaced my cash, now I’ve to do one thing to make it again.” No, you don’t. You must sit there till you discover one thing.

You see? The purpose right here is that more often than not, worthwhile buyers and merchants are doing ‘nothing’ and by nothing, I imply they don’t seem to be coming into trades or managing trades. They might certainly be learning or analyzing the market within the meantime, however this could rely as ‘stalking’ their prey.

Change how you concentrate on doing ‘nothing’

It’s innate for us people to need a ‘fast thrill’ in all that we do. Consistently checking social media on our telephones has been confirmed to extend the quantity of dopamine (the feel-good chemical) in our mind, for instance. We’re a society hooked on doing what feels good extra typically than doing what IS good. We’re born with a gamblers or speculators mind, searching for prompt rewards and thrills in life and with cash.

On the subject of buying and selling, the ramifications for such habits could be extreme.

It could actually result in treating your buying and selling account as if it’s a slot machine. Many merchants find yourself coming into trades, one after one other, as if they’re pulling the arm of a slot machine time and again in a on line casino. After all, the distinction is, we usually anticipate to lose at a on line casino, so most of us don’t take cash that we’d like. In buying and selling, many individuals imagine they are going to be worthwhile due to some ‘innate means’ they’ve and they also typically threat greater than they need to or commerce with cash they actually can’t afford to lose. After all, as soon as they begin buying and selling and get the dopamine repair, it turns into an habit that results in blowing out their buying and selling accounts.

How do you modify this toxic buying and selling mentality?

Probably the greatest guidelines anyone can study investing is to do nothing, completely nothing, until there’s something to do. Most individuals – not that I’m higher than most individuals – all the time need to be enjoying; they all the time need to be doing one thing. They make a giant play and say, “Boy, am I sensible, I simply tripled my cash.” Then they rush out and need to do one thing else with that cash. They will’t simply sit there and look forward to one thing new to develop. – Jim Rogers

The best way that we circumnavigate our personal flawed buying and selling mindsets, is to easily perceive, settle for after which embrace the concept of doing nothing. Embrace what you think about ‘boring’ and mediate on it. Ultimately, after a couple of huge buying and selling wins that resulted from you ready patiently for extremely confluent trades, you’ll begin to re-align your thought processes and the dopamine rush you used to get from coming into trades and messing round with them whereas they had been stay, will shift to the intervals of time you’re ready and stalking the market. Once you really feel such as you’re not doing sufficient, you’re in the correct zone, you could grasp with the ability to do nothing and you are able to do this by discovering one thing else to exchange that ‘void’.

When you understand that being affected person and learning the market or just not even wanting on the market in any respect, will make you extra money within the long-run than the alternative, your mind chemistry will start to ‘flip’, and shortly you’ll be wanting ahead to the ‘hunt’, even when it means ready two weeks between trades.

Conclusion

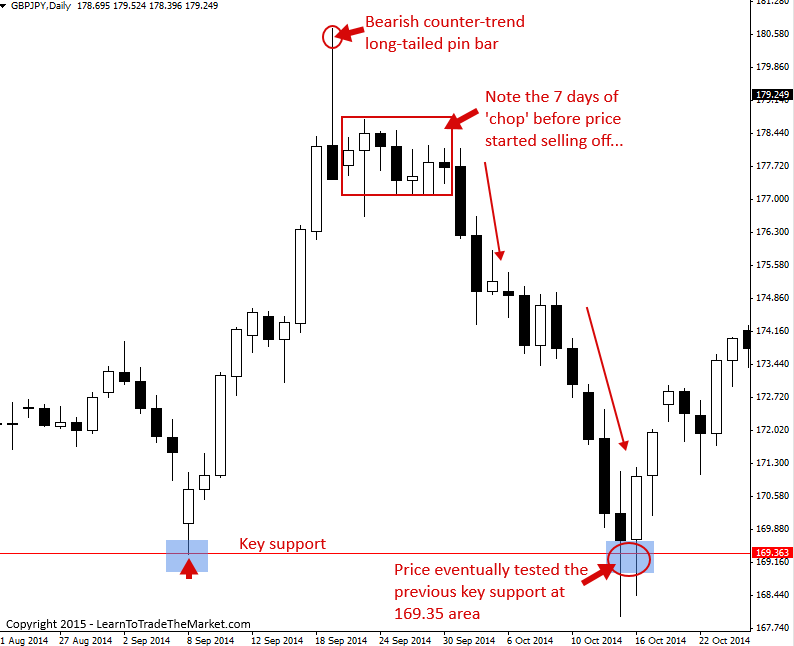

The Market is slower than we think about, and trades can take a very long time to play out. Take the chart under for instance: It reveals that persistence is required to seize the massive strikes, and we should ignore the short-term ‘shake outs’ that trigger most merchants to over-think and exit prematurely…

The worth motion setups that I commerce don’t seem extraordinarily typically, and once we apply my TLS filtering rule and look forward to that confluence, the buying and selling alternatives are diminished much more. My buying and selling programs can share my buying and selling technique however they will’t drive you to be affected person and wait it out for the correct alternative to reach. It’s one factor to be assured in recognizing trades, however are you assured in your means to not over-trade even within the face of fixed temptation by the charts? If you realize that is your weak point (and I assume it’s for many studying this), spend MORE time getting that facet of your buying and selling proper, and I assure you that your account steadiness will thanks.

I WOULD LOVE TO HEAR YOUR THOUGHTS, PLEASE LEAVE A COMMENT BELOW 🙂

ANY QUESTIONS ? – CONTACT ME HERE